The relationship between insurance premiums and deductibles is a fundamental concept often misunderstood. Higher deductibles, while seemingly counterintuitive, often translate to lower monthly payments. This exploration delves into the mechanics behind this dynamic, examining how risk-sharing, insurer profitability, and policyholder behavior all contribute to this cost-saving strategy. We’ll unravel the complexities, providing clarity on how choosing a higher deductible can impact your overall insurance costs.

Understanding this interplay requires a look at the insurance industry’s risk assessment models. Insurance companies, by their very nature, are in the business of managing risk. A higher deductible signifies a greater willingness on the part of the policyholder to absorb the initial cost of a claim. This shift in responsibility allows insurers to reduce their overall payout risk, consequently lowering the premiums they charge.

Risk and Responsibility

Choosing a higher deductible directly impacts the balance of risk and responsibility between the policyholder and the insurance company. A higher deductible signifies a greater willingness on the part of the insured to absorb the initial costs of a claim. This, in turn, reduces the risk borne by the insurer.

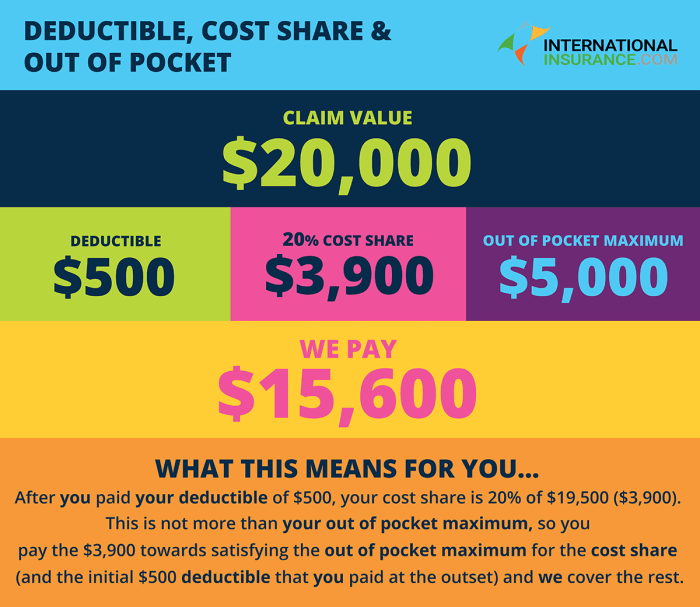

The relationship between deductible and risk is fundamentally one of cost-sharing. A higher deductible shifts a larger portion of the financial responsibility for smaller claims onto the policyholder. The insurance company, therefore, assumes less risk because they are less likely to pay out on smaller incidents. Conversely, a lower deductible means the insurer shoulders more of the financial burden, increasing their risk exposure.

Deductible Impact on Risk and Financial Responsibility

A higher deductible means you, the policyholder, take on more financial responsibility in the event of a claim. This is because you are responsible for paying the deductible amount before your insurance coverage kicks in. For example, if you have a $1,000 deductible and your car repair costs $3,000, you will pay the first $1,000, and your insurance will cover the remaining $2,000. This is a significant difference compared to someone with a $500 deductible who would only pay $500 upfront.

Scenarios Illustrating Deductible Benefits and Drawbacks

A higher deductible can be beneficial if you have a strong emergency fund and rarely experience claims. In this scenario, the lower monthly premium offsets the higher out-of-pocket expense should a claim arise. For instance, someone who hasn’t had a car accident in ten years might find a higher deductible plan more cost-effective.

Conversely, a higher deductible can be detrimental if you frequently experience claims or have limited financial resources. Imagine a situation where someone experiences multiple small accidents within a year. The cumulative cost of the deductibles could easily outweigh the savings in premium costs. Someone with a pre-existing health condition might also find a higher deductible plan more financially stressful.

Premium Costs and Out-of-Pocket Expenses

The following table illustrates how different deductible levels affect both monthly premiums and out-of-pocket expenses. These figures are illustrative examples and will vary based on individual circumstances, location, and insurance provider.

| Deductible Amount | Monthly Premium | Annual Premium | Out-of-Pocket Maximum |

|---|---|---|---|

| $500 | $150 | $1800 | $5,000 |

| $1000 | $120 | $1440 | $6,000 |

| $2000 | $100 | $1200 | $7,000 |

| $5000 | $75 | $900 | $10,000 |

Insurance Company Profitability

Higher deductibles significantly impact insurance company profitability by altering their payout frequency and overall financial risk. This, in turn, allows them to offer lower premiums to policyholders. The relationship is complex, driven by actuarial science and risk assessment.

Insurance companies operate on the principle of pooling risk. They collect premiums from many individuals, and use a portion of those premiums to pay out claims. A larger pool of premiums allows for a better distribution of risk, enabling the company to cover unexpected high-cost claims. The introduction of higher deductibles directly affects this dynamic.

Impact of Higher Deductibles on Payout Frequency

Higher deductibles mean policyholders absorb a greater portion of the initial costs associated with a claim. This directly translates to a lower frequency of payouts for the insurance company. Instead of processing numerous smaller claims, the insurer handles fewer, larger claims, once the deductible has been met. This reduces administrative overhead and processing costs associated with each claim. For example, if a policyholder has a $1,000 deductible and experiences a $1,500 repair, the insurance company only pays $500, whereas a $200 deductible would have resulted in a $1300 payout. This difference, multiplied across thousands of policies, significantly reduces the company’s overall payout burden.

Reduced Payouts and Lower Premiums

The reduction in payout frequency, resulting from higher deductibles, directly contributes to lower premiums for policyholders. Since the insurance company is paying out less money in claims, they can afford to lower the premium they charge. This is a fundamental principle of insurance pricing. The lower risk to the insurer translates into lower costs, which are passed on to the consumer in the form of more affordable premiums. This makes higher deductible plans more attractive to those willing to accept a higher upfront cost in exchange for lower monthly payments.

Actuarial Calculations and Premium Adjustments

Actuaries use sophisticated statistical models to calculate premiums. These models take into account numerous factors, including historical claims data, demographics, risk profiles, and, crucially, deductible levels. The impact of a higher deductible is incorporated into these models by reducing the expected payout per claim. A simplified illustration might involve using a formula like: Premium = (Expected Claims Cost + Administrative Costs + Profit Margin) / Number of Policyholders. Increasing the deductible lowers the “Expected Claims Cost” component, directly leading to a reduction in the calculated premium.

Hypothetical Scenario: Financial Impact of High Deductibles

Let’s consider a hypothetical insurance company with 10,000 policyholders. With a standard $500 deductible, they experience an average of 5,000 claims per year, totaling $5 million in payouts. If they switch to a $1,000 deductible, the number of claims might decrease to 3,000, reducing the payout to $3 million (assuming the severity of claims remains relatively constant). This $2 million reduction in payouts directly impacts profitability, allowing the company to potentially lower premiums or increase profit margins, thereby making the insurance more affordable or increasing their bottom line. This scenario highlights how a seemingly small change in deductible can significantly affect the insurance company’s financial performance.

Types of Insurance Policies and Deductibles

Deductibles represent a significant aspect of insurance policies across various sectors. Understanding how deductibles function within different insurance types, and how factors like personal circumstances influence both deductible selection and premium costs, is crucial for informed decision-making. This section explores these relationships, providing examples to illustrate the impact of deductible choices on overall insurance expenses.

Deductible options vary considerably depending on the type of insurance policy. The interplay between deductible amount and premium cost remains consistent: a higher deductible generally translates to a lower premium, and vice versa. However, the typical deductible ranges and the influence of personal factors differ significantly.

Auto Insurance Deductibles

Auto insurance deductibles typically range from $250 to $1000 or more, depending on coverage and the insurer. A higher deductible (e.g., $1000) will lower the premium compared to a lower deductible (e.g., $250). Factors like age, driving history (accidents, tickets), and location (urban areas tend to have higher premiums) significantly impact both the deductible offered and the premium cost. For example, a young driver with a poor driving record in a high-risk area may find it difficult to secure a low deductible, leading to higher premiums. Conversely, an older driver with a clean driving record in a low-risk area may qualify for a lower deductible and lower premium.

Health Insurance Deductibles

Health insurance deductibles vary greatly, often ranging from a few hundred dollars to several thousand dollars annually. These deductibles represent the amount an individual must pay out-of-pocket for covered healthcare services before the insurance coverage kicks in. Factors influencing deductible selection and premiums include the type of health plan (e.g., HMO, PPO), age (older individuals often pay more), and location (healthcare costs vary geographically). A high-deductible health plan (HDHP) typically comes with a lower monthly premium but requires a higher out-of-pocket payment before insurance coverage begins. For instance, a family might choose a $10,000 deductible plan to reduce monthly costs, understanding that they’ll face significant upfront expenses before insurance significantly covers medical bills. A lower deductible plan, such as $1,000, would offer more immediate coverage but at a higher monthly premium.

Homeowners Insurance Deductibles

Homeowners insurance deductibles generally range from $500 to $2,000 or more. The deductible amount is the amount the homeowner is responsible for paying in the event of a covered loss before the insurance company pays. Factors influencing deductible amounts and premiums include the location of the home (higher risk areas = higher premiums), the value of the home (higher value = higher premiums), and the home’s features (e.g., security systems can lower premiums). A homeowner in a high-risk area for fire damage might choose a higher deductible to lower premiums, accepting the increased financial responsibility in case of a fire. Conversely, a homeowner in a low-risk area with a less valuable home might opt for a lower deductible for greater financial protection.

Impact of Policy Structure on Overall Cost

Different policy structures significantly impact the overall cost, including the influence of the deductible. Consider two auto insurance policies with identical coverage: Policy A has a $500 deductible and a $100 monthly premium, while Policy B has a $1000 deductible and a $75 monthly premium. If no claims are made in a year, Policy B saves $300 annually ($3000/year) in premiums. However, if a $750 accident occurs, Policy A would cost $750 + $1200 (premiums) = $1950 while Policy B would cost $750 + $900 (premiums) = $1650. This illustrates how the deductible interacts with the premium to affect the overall cost, with the optimal choice depending on risk tolerance and financial circumstances.

Ending Remarks

In conclusion, the connection between higher deductibles and lower insurance premiums is a direct result of risk allocation and the inherent economics of insurance. By accepting greater upfront financial responsibility for smaller claims, policyholders effectively reduce the insurer’s potential payouts, leading to a decrease in the overall cost of coverage. While a higher deductible means greater out-of-pocket expense in the event of a claim, the potential for long-term savings through lower premiums makes it a strategic consideration for many individuals. Careful evaluation of personal financial circumstances and risk tolerance is key to selecting the optimal deductible level.

FAQ Guide

What happens if I have a high deductible and experience a major claim?

While a high deductible means you pay more upfront, your insurance policy will still cover the remaining costs after you meet your deductible. It’s crucial to consider your ability to cover the deductible in case of a significant event.

Can I change my deductible amount?

Typically, you can change your deductible amount when your policy renews, but some insurers may allow adjustments during the policy term. Changes will likely affect your premium.

Does my credit score affect my deductible?

No, your credit score does not directly impact your deductible amount. However, it can influence your overall premium.

Are there any penalties for changing my deductible?

Generally, there are no penalties for changing your deductible, but the change will be reflected in your premium. Increasing your deductible usually lowers your premium, while decreasing it will increase it.