Securing your family’s financial future is a paramount concern for many Canadians. Whole life insurance offers a unique approach to long-term financial planning, providing lifelong coverage and a cash value component that grows over time. Understanding the costs associated with this type of insurance is crucial, and that’s where a whole life insurance premium calculator becomes an invaluable tool. This guide navigates the complexities of whole life insurance in Canada, empowering you to make informed decisions about your financial security.

We’ll explore the key features of whole life insurance policies available in Canada, examining the various plan types offered by insurers. We’ll compare whole life with term life insurance, highlighting the advantages and disadvantages of each. A detailed walkthrough of using a whole life insurance premium calculator will be provided, including interpreting results and considering additional factors beyond the calculated premium. Finally, we’ll delve into common policy riders and their impact on overall costs, providing a comprehensive overview to help you navigate this important financial decision.

Understanding Whole Life Insurance in Canada

Whole life insurance provides lifelong coverage, offering a guaranteed death benefit and a cash value component that grows over time. Unlike term life insurance, which covers a specific period, whole life insurance remains in effect as long as premiums are paid. Understanding its features and variations is crucial for making an informed decision about whether it aligns with your financial goals.

Key Features of Whole Life Insurance Policies in Canada

Canadian whole life insurance policies typically include a guaranteed death benefit, meaning your beneficiaries receive a predetermined sum upon your death, regardless of when it occurs. The policy also builds cash value, which grows tax-deferred and can be accessed through loans or withdrawals. Premium payments are typically level, meaning they remain consistent throughout the life of the policy. This predictability offers financial stability, though the premiums may be higher than term life insurance. Many policies also offer optional riders, such as accidental death benefits or long-term care riders, which can enhance coverage.

Types of Whole Life Insurance Plans in Canada

Several types of whole life insurance are available in Canada, each with slightly different features and cost structures. These include traditional whole life, universal life, and variable universal life insurance. Traditional whole life offers a fixed premium and a fixed death benefit, providing simplicity and predictability. Universal life policies offer more flexibility, allowing for adjustments to premiums and death benefit amounts within certain limits. Variable universal life policies allow for investments in sub-accounts, offering the potential for higher returns but also increased risk. The choice depends on individual risk tolerance and financial objectives.

Whole Life Insurance vs. Term Life Insurance: A Comparison

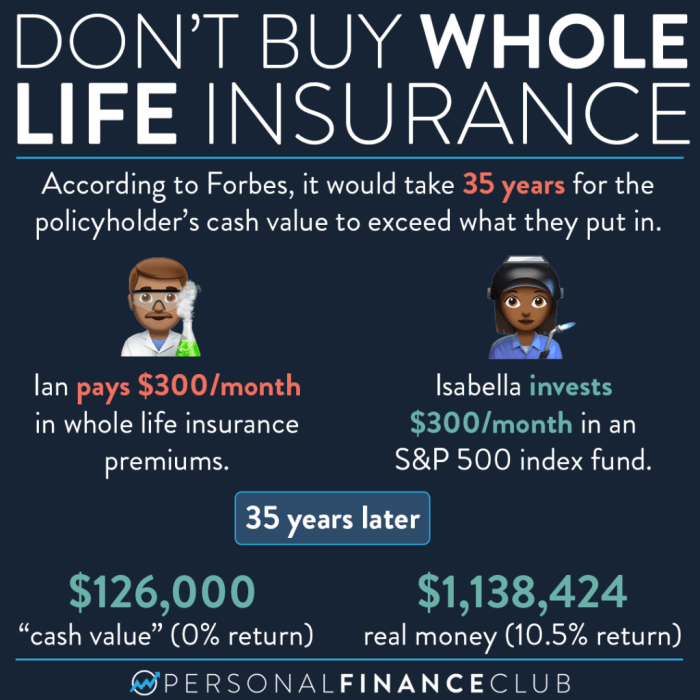

Whole life insurance and term life insurance serve different purposes. Term life insurance provides coverage for a specified period (e.g., 10, 20, or 30 years) at a lower premium than whole life. If you die within the term, your beneficiaries receive the death benefit. If you outlive the term, the coverage expires. Whole life insurance, conversely, offers lifelong coverage and builds cash value. The higher premiums reflect the lifelong coverage and cash value accumulation. Choosing between them depends on your individual needs and financial circumstances; term life is often suitable for younger individuals focusing on temporary coverage needs, while whole life might be preferred by those seeking long-term security and cash value growth.

Scenarios Where Whole Life Insurance Might Be Suitable

Whole life insurance can be a suitable option in several situations. For example, individuals who want to leave a guaranteed legacy for their heirs might find it beneficial. The guaranteed death benefit ensures that a specific amount will be available to their loved ones, regardless of market fluctuations. Furthermore, entrepreneurs or business owners may use whole life insurance as a component of their estate planning strategy, using the cash value component for business needs or succession planning. Families seeking financial security and long-term wealth building may also consider whole life insurance as part of a broader financial plan. A high-net-worth individual, for instance, might utilize the cash value component for tax-advantaged growth and estate planning, while simultaneously securing a guaranteed death benefit for their heirs.

Interpreting Calculator Results and Next Steps

A whole life insurance premium calculator provides an estimate, not a guaranteed price. Understanding how to interpret these results and what factors influence the final premium is crucial for making an informed decision. The calculator’s output serves as a starting point for your research, highlighting potential costs and allowing you to compare different coverage options.

Understanding the premium estimate requires recognizing that it’s based on the information you input. Inaccuracies in your input will lead to inaccuracies in the output. The calculator considers factors like age, health, smoking status, and desired coverage amount to generate a monthly or annual premium estimate. This estimate is usually presented as a range, reflecting the potential variations based on the insurer’s underwriting process. Remember that the final premium will be determined after a full application and medical review by the insurance company.

Premium Estimate Interpretation

The calculator will typically display a monthly or annual premium estimate. This figure represents the cost you’ll pay to maintain your whole life insurance policy. For example, a calculator might show a monthly premium of $100 to $150 for a $250,000 policy, depending on your health and other factors. This range is important, as it highlights the uncertainty until a full application is processed. The lower end of the range is the best-case scenario assuming optimal underwriting results, while the higher end represents a less favourable outcome. Always carefully review the details provided alongside the premium estimate, including any assumptions made by the calculator.

Factors Beyond the Calculated Premium

Several factors influence the final premium beyond those considered by the calculator. These include your specific health conditions, family history, lifestyle choices, and the insurer’s specific underwriting guidelines. Ignoring these can lead to inaccurate expectations about your actual costs.

| Factor | Consideration | Impact on Decision | Example |

|---|---|---|---|

| Health Status | Pre-existing conditions, recent illnesses, family history of specific diseases. | Higher premiums for individuals with poorer health. | A history of heart disease could lead to a significantly higher premium compared to someone with a clean bill of health. |

| Lifestyle Choices | Smoking, excessive alcohol consumption, risky hobbies. | Higher premiums for individuals engaging in high-risk activities. | Smokers typically pay considerably more than non-smokers for the same coverage. |

| Insurer’s Underwriting | Each insurer has its own criteria for assessing risk. | Premiums can vary significantly between insurers. | Insurer A might offer a lower premium than Insurer B for the same policy, even with identical applicant profiles. |

| Policy Riders and Add-ons | Optional features added to the policy, such as disability waivers or accelerated death benefits. | Increased premiums for added features. | Adding a waiver of premium rider will increase the monthly premium, but offers added protection if you become disabled. |

Obtaining Quotes from Multiple Insurers

To ensure you’re getting the best possible rate, obtain quotes from several reputable Canadian insurers. This comparative approach allows you to identify the insurer offering the most competitive premium for your specific circumstances. Use the premium estimate from the calculator as a benchmark, but remember that the final premium might differ. Contact multiple insurers directly, or use online comparison tools to gather quotes efficiently. Remember to provide accurate and complete information to each insurer to ensure accurate quotes.

Understanding Policy Features and Riders

Whole life insurance policies in Canada offer a degree of customization through the addition of riders. These riders provide supplemental benefits beyond the core death benefit, often tailoring the policy to better suit individual needs and circumstances. Understanding these riders and their associated costs is crucial for making an informed decision about your insurance coverage.

Common Whole Life Insurance Riders in Canada

Riders significantly impact the overall cost of your whole life insurance policy. The cost of each rider varies depending on factors such as your age, health, and the specific terms of the rider. It’s important to note that adding riders will increase your premiums. This increase is generally reflected in the final premium calculation provided by the insurance company or through a premium calculator.

- Waiver of Premium Rider: This rider waives future premiums if you become totally disabled and unable to work. This protects your policy from lapsing due to unforeseen circumstances. The cost is typically a small percentage of your base premium, often around 1-3% depending on the insurer and underwriting factors. For example, a $100 monthly premium could see an additional $1-3 added monthly for this rider.

- Accidental Death Benefit Rider (ADB): This rider pays an additional death benefit if the insured dies as a result of an accident. This provides a larger payout to beneficiaries in the event of an accidental death. The cost is typically low, perhaps adding 0.5% – 2% to your premium depending on the insurer and specific terms of the rider. For example, a $50,000 policy might add $250-$1000 to the death benefit at an increased cost of a few dollars per month.

- Critical Illness Rider: This rider pays out a lump-sum benefit if the insured is diagnosed with a critical illness listed in the policy. This lump sum can help with medical expenses and other financial burdens. The cost varies significantly depending on the specific illnesses covered and the insured’s age and health, but could add 2-5% or more to the monthly premium. A $100 monthly premium might increase by $2-$5 or more for this rider.

- Long-Term Care Rider: This rider provides a benefit to help cover the costs of long-term care, such as nursing home care or home healthcare. This can be a significant cost-saver for families. The cost of this rider is typically higher than other riders, and the percentage increase on the base premium can range from 5-10% or more depending on various factors. This depends heavily on age and health at the time of application.

Incorporating Rider Information into Premium Calculations

Most online whole life insurance premium calculators do not directly incorporate rider costs. The base premium is typically calculated first, and then the cost of any selected riders is added separately by the insurance company or agent. Some more sophisticated calculators might offer a dropdown menu to select riders and will adjust the premium accordingly. However, it is more common to receive a final premium quote including rider costs after providing your information and selecting the desired riders. You should then compare the total premium with different insurers to find the most suitable option.

Visual Representation of Premium Growth

Understanding how whole life insurance premiums behave over time is crucial for long-term financial planning. A visual representation, such as a line graph, can effectively illustrate this growth.

The graph would depict premium amounts on the vertical (y) axis, clearly labeled in Canadian dollars ($CAD), and the time period (in years) on the horizontal (x) axis. The line itself would represent the premium’s trajectory over the policy’s lifespan. Ideally, the graph would show premiums remaining level throughout the policy term, a key characteristic of whole life insurance. This contrasts sharply with term life insurance, where premiums typically increase at renewal. The graph could also include a shaded area representing the total premium paid over a given period, highlighting the cumulative cost.

Premium Growth in Whole Life Insurance

Whole life insurance premiums are typically level, meaning they remain constant throughout the policy’s duration. This differs significantly from term life insurance, where premiums increase as the policyholder ages and the risk of death increases. This consistency in premiums is a defining feature of whole life insurance, offering predictable budgeting for the policyholder. However, the level premium reflects the long-term commitment and the insurance company’s assumption of risk over an extended period. The consistent premium, while seemingly beneficial, accumulates to a substantial total cost over the policy’s life.

Long-Term Cost Implications

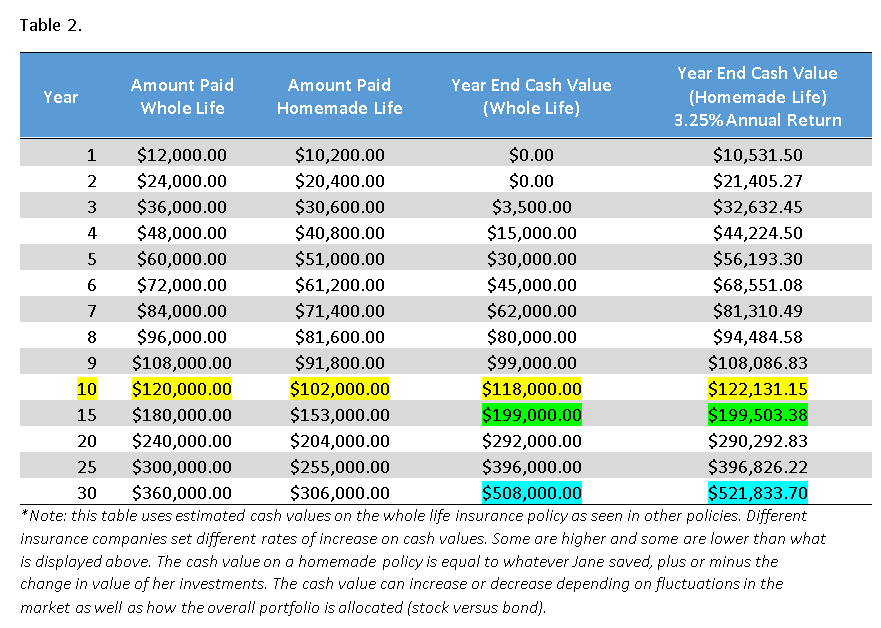

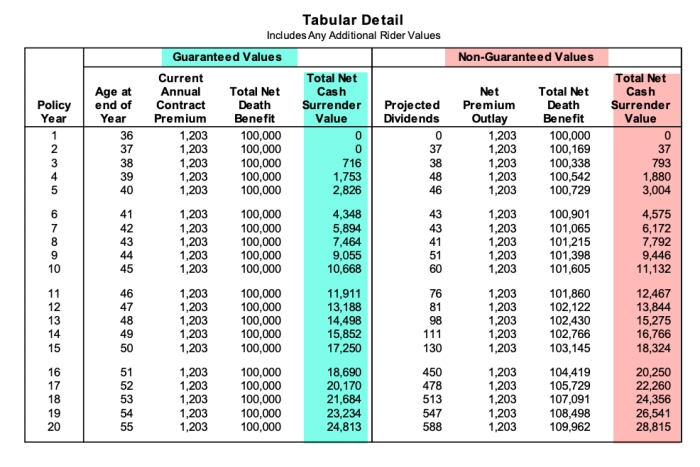

The long-term cost of whole life insurance can be significant. For example, a 30-year-old purchasing a $500,000 whole life policy might pay a consistent annual premium of $2,000. Over 50 years, the total premium paid would be $100,000. While this cost may seem manageable year-to-year, the cumulative expenditure should be carefully considered against the policy’s benefits and the policyholder’s overall financial goals. It’s important to weigh this against the potential long-term growth of the cash value component of the policy, which can be a factor in assessing overall cost-effectiveness. However, the cash value growth is subject to market fluctuations and the policy’s internal rate of return, making it a less certain aspect of the overall cost.

Comparison with Other Insurance Types

Unlike whole life insurance, term life insurance premiums generally increase at each renewal period. This increase reflects the higher risk associated with insuring an older individual. Universal life insurance premiums can also be adjusted, offering flexibility but potentially leading to higher costs if premiums are not managed carefully. The graph could include additional lines representing the premium trajectories of term and universal life insurance for comparison, illustrating the significant difference in long-term cost. This visual comparison would highlight the consistent, though ultimately higher, total cost of whole life insurance compared to the potentially lower, but variable, cost of term insurance.

Conclusive Thoughts

Choosing the right life insurance policy is a significant financial decision. By understanding the factors influencing whole life insurance premiums in Canada, utilizing online calculators effectively, and considering additional factors beyond the initial premium estimate, you can make a well-informed choice that aligns with your financial goals and provides peace of mind for your loved ones. Remember to compare quotes from multiple insurers to ensure you secure the best possible coverage at a competitive price. Taking the time to thoroughly understand your options is key to securing your family’s financial future.

Q&A

What is the difference between participating and non-participating whole life insurance?

Participating whole life insurance policies offer dividends based on the insurer’s performance, potentially lowering the overall cost. Non-participating policies have fixed premiums and no dividends.

Can I adjust my whole life insurance coverage amount after the policy is issued?

Generally, yes. You can usually increase or decrease your coverage amount, but this may affect your premiums. Contact your insurer to discuss options and potential adjustments.

What happens to the cash value in a whole life insurance policy if I cancel it?

The cash value is typically returned to you, though it may be subject to surrender charges depending on the policy terms and how long you’ve held the policy. It’s important to review your policy details.

Are there tax implications associated with whole life insurance in Canada?

Yes, there are tax implications related to both the premiums paid and the death benefit received. Consult with a tax professional for personalized advice based on your specific circumstances.