Securing your family’s financial well-being is a paramount concern, and whole life insurance plays a crucial role in achieving this goal. Understanding the intricacies of whole life insurance premiums, however, can feel daunting. This guide demystifies the process by providing a clear explanation of how whole life insurance premium calculators work, enabling you to make informed decisions about your financial future.

We’ll explore the key factors influencing premium calculations, including age, health, and policy features. We’ll also delve into the functionality of online calculators, highlighting their strengths and limitations. By the end, you’ll be equipped to navigate the world of whole life insurance with confidence, leveraging the power of a premium calculator to make strategic choices that align with your financial objectives.

Understanding Whole Life Insurance Premiums

Whole life insurance premiums are the regular payments you make to maintain your policy’s coverage. Understanding how these premiums are calculated is crucial for making informed decisions about your financial future. Several factors interact to determine the cost, and it’s important to differentiate between guaranteed and non-guaranteed components.

Factors Influencing Whole Life Insurance Premium Calculations

Numerous factors contribute to the calculation of your whole life insurance premium. These factors are carefully assessed by insurance companies to accurately reflect the level of risk associated with insuring your life. Key elements include your age, health status, the death benefit amount you choose, the policy’s cash value accumulation features, and the insurer’s operational costs and profit margins.

Guaranteed Versus Non-Guaranteed Premiums

A crucial distinction exists between guaranteed and non-guaranteed premiums. Guaranteed premiums remain fixed throughout the life of the policy, offering predictability and financial stability. Non-guaranteed premiums, on the other hand, can fluctuate based on investment performance or changes in the insurer’s underlying expenses. While potentially offering higher returns, non-guaranteed premiums introduce an element of uncertainty. Many whole life policies include a guaranteed minimum premium, offering a safety net even if the non-guaranteed component underperforms.

Impact of Age, Health, and Policy Features on Premiums

Age significantly impacts premium costs. Younger individuals generally receive lower premiums due to their statistically longer life expectancy. Health plays a crucial role; individuals with pre-existing conditions or poor health often face higher premiums reflecting the increased risk for the insurer. Policy features such as the death benefit amount (higher benefits mean higher premiums), riders (additional coverage options that add to the cost), and cash value accumulation options (policies with higher cash value growth potential often have higher premiums) also affect premium costs. For example, a 30-year-old in excellent health purchasing a $500,000 whole life policy will likely pay significantly less than a 55-year-old with a pre-existing condition purchasing the same coverage.

Premium Comparison Across Policy Types

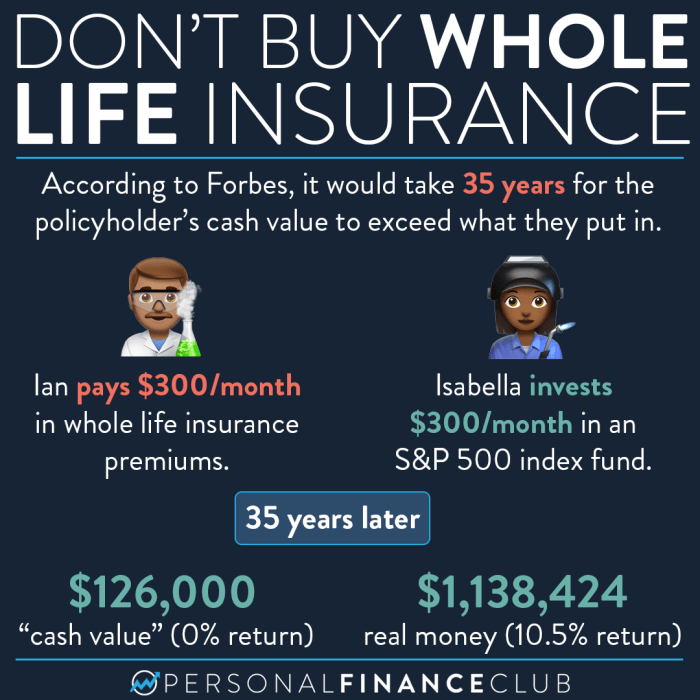

The following table compares premiums for different policy types, illustrating the variations in cost and cash value growth. Note that these are illustrative examples and actual premiums will vary based on individual circumstances and insurer specifics.

| Age | Policy Type | Annual Premium (Illustrative) | Cash Value Growth Illustration (Annualized, Illustrative) |

|---|---|---|---|

| 35 | Whole Life | $2,000 | 3-4% |

| 35 | Level Term (20-year) | $500 | 0% (no cash value) |

| 35 | Variable Universal Life | $1,500 | Variable, depending on market performance (potential for higher or lower growth than whole life) |

| 50 | Whole Life | $4,000 | 3-4% |

Beyond the Calculator

While our calculator provides a valuable estimate of your whole life insurance premiums, it’s crucial to remember that it’s just a starting point. Several factors beyond the basic information entered influence the final cost and suitability of a policy. Seeking professional guidance is essential for making informed decisions.

This section explores additional considerations that go beyond the scope of a simple premium calculator, highlighting the importance of expert advice and detailing how various policy aspects can affect your overall costs.

The Role of a Financial Advisor

A financial advisor provides personalized guidance tailored to your specific financial situation, risk tolerance, and long-term goals. They can help you understand the nuances of different whole life insurance policies, compare quotes from various insurers, and determine the optimal coverage amount for your needs. A qualified advisor can also integrate your whole life insurance policy into your broader financial plan, considering factors like retirement savings, estate planning, and tax implications. Their expertise ensures you choose a policy that aligns with your overall financial objectives, rather than solely focusing on the initial premium cost.

The Impact of Riders and Add-ons

Whole life insurance policies often offer riders and add-ons that enhance coverage but increase premiums. For example, a waiver of premium rider ensures your premiums are paid if you become disabled, while a term rider provides additional temporary coverage. These additions offer valuable benefits, but it’s essential to weigh the added cost against the potential value they provide. Understanding the impact of each rider on your premium is crucial for making an informed decision. For instance, a long-term care rider, designed to cover the costs of nursing home care, significantly increases premiums compared to a basic whole life policy.

Comparing Whole Life Policy Structures

Different whole life insurance policies have varying structures that affect premium costs and cash value accumulation. Traditional whole life insurance offers a fixed premium and a guaranteed cash value growth rate. Variable whole life insurance premiums may fluctuate, and the cash value growth depends on the performance of the underlying investment options. Universal life insurance allows for flexible premiums and death benefits, but it carries more risk and requires careful monitoring. Understanding the differences between these structures is crucial for selecting a policy that aligns with your financial goals and risk tolerance. A financial advisor can help you navigate the complexities of each type and choose the most suitable option.

Steps After Receiving a Whole Life Insurance Quote

After using a whole life insurance premium calculator, several steps are recommended to ensure you’re making a well-informed decision:

- Review the quote thoroughly: Carefully examine all the details, including the premium amount, death benefit, cash value projections, and any riders or add-ons.

- Compare quotes from multiple insurers: Don’t rely on a single quote. Obtain quotes from several reputable insurers to compare pricing and policy features.

- Consult with a financial advisor: Discuss your options with a qualified professional who can help you assess your needs and choose the most suitable policy.

- Understand the policy’s terms and conditions: Carefully read the policy document to ensure you fully understand its provisions, limitations, and exclusions.

- Consider your long-term financial goals: Ensure the policy aligns with your overall financial plan and objectives.

Visualizing Premium Growth

Understanding how whole life insurance premiums behave over time is crucial for financial planning. While the initial premium is fixed, the overall cost increases significantly as you age and the policy continues. This section will illustrate the typical pattern of premium growth using a visual representation.

Premium growth in whole life insurance isn’t linear; it’s not simply a consistent yearly increase. Instead, the cost tends to remain relatively stable during the early years of the policy. However, the longer the policy is in force, the more pronounced the effect of compounding becomes, leading to a steeper increase in the overall cost. This is because the insurer’s risk increases as the insured ages.

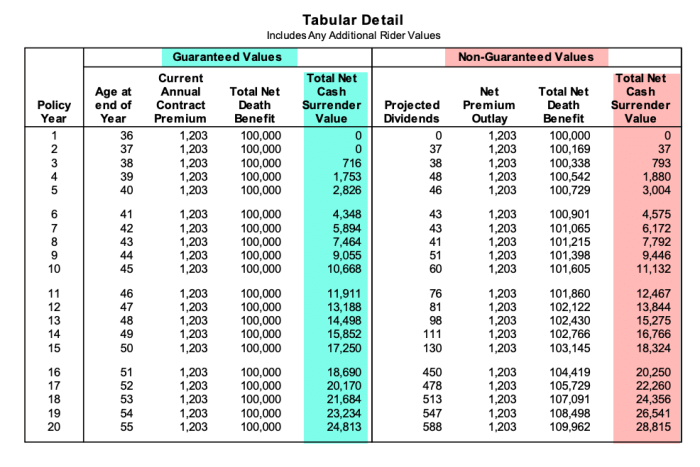

Premium Growth Chart: Age vs. Annual Premium

The following description details a chart visualizing the relationship between the policyholder’s age and the annual premium cost over a 20-year period. This example assumes a 35-year-old male purchasing a $250,000 whole life policy. Remember that actual premiums vary based on numerous factors including health, lifestyle, and the insurance company.

The chart uses a line graph. The horizontal (x-axis) represents the policyholder’s age, ranging from 35 to 55 years old (20 years). The vertical (y-axis) represents the annual premium cost in US dollars. The y-axis scale should start at $0 and extend to a value comfortably above the highest premium, ensuring all data points are clearly visible. For this example, let’s assume the maximum annual premium reaches approximately $3,500.

Data points would be plotted as follows (these are illustrative and not actual premium figures; they serve to demonstrate the general trend):

* Age 35: $1,200

* Age 40: $1,250

* Age 45: $1,400

* Age 50: $1,700

* Age 55: $2,200

The line connecting these points will show an upward trend, initially relatively flat, becoming steeper as the policyholder ages. The chart’s title would be “Annual Premium Growth Over 20 Years,” and clear axis labels would be included (“Policyholder Age” for the x-axis and “Annual Premium (USD)” for the y-axis). A legend might not be necessary as only one line is present. The overall visual representation would clearly show the accelerating cost of premiums over time. This visual aid helps illustrate the importance of understanding the long-term financial commitment associated with whole life insurance.

Last Point

Choosing the right whole life insurance policy is a significant financial decision. While online calculators offer a valuable tool for preliminary estimations, remember that personalized advice from a qualified financial advisor is invaluable. By combining the insights gained from using a whole life insurance premium calculator with professional guidance, you can confidently select a policy that provides the appropriate level of coverage and aligns seamlessly with your long-term financial strategy, ensuring peace of mind for you and your loved ones.

FAQ Section

What is the difference between term life insurance and whole life insurance?

Term life insurance provides coverage for a specific period (term), while whole life insurance offers lifelong coverage and builds cash value.

Can I use a whole life insurance premium calculator if I have pre-existing health conditions?

Yes, but be sure to accurately disclose your health information. The calculator will provide an estimate based on the information provided.

How often are whole life insurance premiums adjusted?

With a guaranteed premium policy, premiums remain level throughout the policy’s duration. Non-guaranteed policies may adjust premiums based on investment performance.

Are there any hidden fees associated with whole life insurance?

Some policies may have fees such as administrative fees or surrender charges. Carefully review the policy details to understand all associated costs.