Securing your family’s financial future is a paramount concern, and whole life insurance often plays a significant role in achieving this goal. Understanding the intricacies of whole life insurance premiums, however, can feel daunting. This guide demystifies the process, providing a clear and concise overview of premium calculations, payment options, potential adjustments, and long-term projections. We’ll explore the factors influencing your premium, empowering you to make informed decisions about this crucial aspect of financial planning.

From the basic components of your premium to advanced concepts like riders and waivers, we aim to equip you with the knowledge necessary to navigate the world of whole life insurance with confidence. We’ll also compare whole life premiums to other insurance types and delve into various payment strategies, ensuring you find the plan that best aligns with your financial circumstances and long-term objectives.

Premium Adjustments and Changes

Whole life insurance premiums, while designed for long-term stability, can be subject to adjustments under certain circumstances. Understanding these potential changes and the processes involved is crucial for policyholders to manage their financial planning effectively. This section will detail the factors that can influence premium adjustments, both increases and decreases, and Artikel the procedure for requesting any modifications.

Circumstances Leading to Premium Adjustments

Several factors can trigger adjustments to your whole life insurance premiums. These adjustments are usually governed by the specific terms and conditions Artikeld in your policy contract. It is important to review your policy documents carefully to understand the specific clauses related to premium adjustments. These clauses often include provisions for specific situations and their potential impact on your premiums.

Factors Causing Premium Increases or Decreases

Premium increases are less common in whole life insurance compared to other types of policies, as they are generally level premium policies. However, increases might occur due to specific policy riders or add-ons added after the initial policy issuance. For example, adding a long-term care rider or increasing the death benefit can lead to a higher premium. Conversely, premium decreases are exceptionally rare in standard whole life policies. They might occur only under very specific circumstances, such as a significant decrease in the policy’s death benefit (at the policyholder’s request).

Process for Requesting Premium Changes

Requesting a premium change typically involves contacting your insurance provider directly. This usually involves submitting a written request detailing the reason for the requested change, supported by any relevant documentation. The insurance company will then review your request, considering the policy’s terms and conditions, before making a decision. The response time may vary depending on the complexity of the request and the insurer’s internal processes. It is advisable to keep a record of all correspondence regarding your request.

Potential Scenarios Leading to Premium Changes

The following table illustrates potential scenarios that might lead to premium adjustments in a whole life insurance policy:

| Scenario | Type of Change | Reason | Impact |

|---|---|---|---|

| Adding a Long-Term Care Rider | Increase | Increased coverage and benefits | Higher monthly premiums |

| Increasing the Death Benefit | Increase | Higher payout upon death | Substantially higher premiums |

| Decreasing the Death Benefit (Policyholder’s Request) | Decrease | Reduced coverage amount | Lower monthly premiums |

| Policy Misstatement Correction (e.g., age or health) | Increase or Decrease | Adjustment based on corrected information | Premium adjustment based on corrected risk assessment |

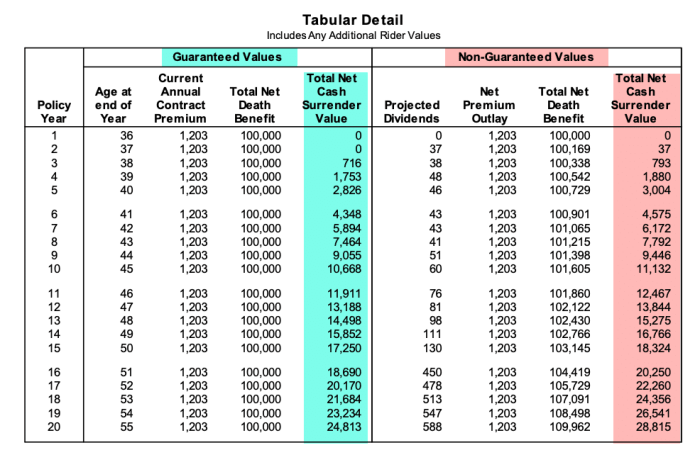

Long-Term Premium Projections

Accurately projecting whole life insurance premiums over an extended period is crucial for financial planning. Understanding the potential total cost allows for informed budgeting and ensures the policy remains affordable throughout its duration. This involves considering several factors and acknowledging inherent limitations.

A common method for projecting whole life insurance premiums involves utilizing the policy’s guaranteed premium schedule, if available. This schedule, typically provided by the insurance company, Artikels the expected premium payments for a specific period, often the first few years or until a certain age. For projections beyond the guaranteed period, assumptions must be made regarding potential future premium increases, which are usually based on the insurer’s historical practices and the anticipated economic environment. Alternatively, if no guaranteed schedule exists, a projection might be based on current premium rates with an assumed rate of increase applied annually. This rate might reflect the company’s typical adjustments or broader market trends. It’s important to note that these are just projections and not guaranteed amounts.

Assumptions and Limitations of Long-Term Premium Projections

Long-term premium projections are inherently uncertain. They rely on several assumptions that may not hold true in the future. These include assumptions about the insurer’s financial stability, changes in mortality rates, the insurer’s pricing strategies, and general economic conditions such as inflation. For example, an assumption of a 3% annual premium increase might be based on historical data, but unexpected economic downturns could lead to higher increases or even policy cancellations. Furthermore, the projections do not account for potential policy changes or additions that could alter premium costs.

Calculating Potential Total Premium Cost

To calculate the potential total premium cost, one must first establish a projected annual premium. Let’s assume a policy with an initial annual premium of $1,000 and a projected annual increase of 3%. We can use a future value of an annuity formula or a spreadsheet program to calculate the cumulative premium over the policy’s lifetime. For instance, if the policy is expected to last for 50 years, the total projected premium cost would be significantly higher than simply multiplying $1,000 by 50. The 3% annual increase will compound over time, resulting in a substantially larger total. A simple spreadsheet calculation, or a financial calculator using the future value of an ordinary annuity formula, will quickly provide this value. For example, using a financial calculator or spreadsheet software, we find the total projected premium cost would be approximately $95,491.

Total Projected Premium Cost = Σ (Initial Premium * (1 + Annual Increase Rate)^(Year – 1)) for Year = 1 to 50

Impact of Inflation on Long-Term Premium Costs

Inflation erodes the purchasing power of money over time. While the nominal premium might increase at a projected rate (e.g., 3% annually), the real cost (adjusted for inflation) might be different. If inflation averages 2% annually, the real increase in premium is only about 1% (approximately 3% – 2%). This means that while the dollar amount of the premium increases, its relative cost compared to overall prices may not rise as dramatically as the nominal increase suggests. Conversely, unexpectedly high inflation could significantly impact the real cost of the premiums, making them more burdensome than initially projected. Consider a scenario where inflation unexpectedly surges to 5%. In this case, the real increase in premiums would be negative, meaning the real cost of the insurance would be decreasing. However, this is a simplified illustration and does not account for other potential factors affecting the cost of the policy.

Last Point

Navigating the complexities of whole life insurance premiums requires careful consideration of various factors, from your age and health to your chosen payment method and any added riders. By understanding the components of your premium, exploring available payment options, and planning for potential adjustments, you can effectively manage your insurance costs and ensure long-term financial security for yourself and your loved ones. Remember, consulting with a qualified financial advisor can provide personalized guidance tailored to your specific needs and circumstances.

Popular Questions

What happens if I miss a whole life insurance premium payment?

Missing a payment can result in your policy lapsing, meaning the coverage ends. Most policies offer a grace period, typically 30 days, to make the payment before lapse. Contact your insurer immediately if you anticipate difficulty making a payment to explore available options.

Can I change my whole life insurance premium payment frequency?

Yes, you may be able to change your payment frequency (e.g., from annual to monthly). However, this often depends on your policy and insurer. Contact your insurance provider to inquire about available options and any associated fees or changes to your premium amount.

How does my health affect my whole life insurance premium?

Your health status significantly impacts your premium. Individuals with pre-existing conditions or poor health generally pay higher premiums due to a higher risk of claims. A thorough health assessment is conducted during the application process to determine your premium.

Are there tax advantages to whole life insurance premiums?

The tax implications of whole life insurance vary depending on your location and specific policy. While premiums themselves are generally not tax-deductible, the death benefit is usually tax-free to beneficiaries. Consult a tax professional for personalized advice.