Group credit life insurance offers a crucial safety net for borrowers and their families, but understanding who foots the bill for premiums can be surprisingly complex. This exploration delves into the multifaceted roles of employers, employees, and lenders in navigating the financial landscape of this vital insurance coverage. We’ll examine various payment structures, legal considerations, and real-world scenarios to provide a clear and comprehensive picture.

The cost of group credit life insurance premiums is often shared, or entirely borne, by different parties depending on the specific arrangement between the employer, employee, and lender. Several factors influence this arrangement, including the type of insurance policy, the loan amount, and applicable regulations. This analysis will unravel the complexities of these arrangements to provide a thorough understanding of who typically covers the cost.

Employer’s Role in Group Credit Life Insurance Premiums

Employers often play a significant role in providing and financing group credit life insurance for their employees. This benefit, typically tied to outstanding loans or credit balances, offers peace of mind by covering the debt in the event of the employee’s death. The employer’s contribution structure varies considerably depending on company policy, employee participation rates, and overall budgetary considerations.

Employer Contribution Structures for Group Credit Life Insurance Premiums

Employer Contribution Models

The employer’s contribution to group credit life insurance premiums can take several forms. The most common models include full employer-paid premiums, partially employer-paid premiums, and employee-only-paid premiums. The choice depends on factors such as the company’s overall benefits package, the employee population’s financial needs, and the employer’s financial capacity.

Variations Based on Employee Participation

The level of employer contribution can also fluctuate based on the percentage of employees who opt into the group credit life insurance plan. Higher participation rates might incentivize employers to offer a greater contribution, while lower rates may lead to a reduction or even elimination of employer contributions. This is because a larger pool of insured employees spreads the risk and reduces the overall cost per employee, allowing the employer to potentially offer more generous coverage or share a larger portion of the premium costs.

Examples of Employer Contribution Models

- Full Employer-Paid: In this model, the employer covers 100% of the premiums for all participating employees. This is a highly attractive benefit that can boost employee morale and loyalty. However, it represents a significant cost for the employer.

- Partial Employer-Paid: This is the most common approach. The employer might contribute a fixed percentage (e.g., 50%, 75%) of the premium, with the remaining portion paid by the employee. This balances the cost-sharing between the employer and the employee.

- Employee-Paid: In this scenario, the employee bears the full cost of the premium. While less expensive for the employer, this model may be less attractive to employees and might result in lower participation rates.

Comparison of Employer Contribution Scenarios

The following table illustrates different scenarios, highlighting the impact of varying premium costs and employee participation levels on the employer’s contribution and the employee’s cost. These are illustrative examples and actual costs will vary based on several factors.

| Scenario | Annual Premium per Employee | Employee Participation Rate | Employer Contribution (50% of total premium) | Employee Contribution |

|---|---|---|---|---|

| Scenario A (High Participation) | $100 | 90% | $4500 (50% of $9000 total) | $4500 |

| Scenario B (Moderate Participation) | $120 | 60% | $3600 (50% of $7200 total) | $3600 |

| Scenario C (Low Participation) | $150 | 30% | $2250 (50% of $4500 total) | $2250 |

Employee’s Responsibility for Premiums

While the employer often plays a significant role in establishing and administering group credit life insurance, employees frequently share the responsibility of paying premiums. This shared responsibility reflects the mutual benefit derived from the insurance – protection for the employee and reduced risk for the lender.

Employee premium contributions are a common feature of many group credit life insurance plans. Several factors influence the employee’s portion of the premium cost, ultimately impacting their overall financial burden.

Scenarios of Employee Premium Contributions

Employees often contribute to group credit life insurance premiums when their employer offers a partially subsidized plan. In such instances, the employer covers a percentage of the premium, while the employee pays the remaining amount. This arrangement is frequently seen with larger loans, where the risk to the lender is higher, necessitating a larger premium. Another scenario involves situations where the employee opts for a higher level of coverage than the employer’s basic plan provides. This often results in a higher premium, with the employee responsible for the additional cost. Finally, some employers may offer group credit life insurance as an optional benefit, requiring employees to pay the entire premium themselves if they choose to enroll.

Factors Influencing Employee Premium Contributions

Several factors influence the amount an employee contributes towards their group credit life insurance premiums. The loan amount is a primary factor; larger loans generally carry higher premiums due to the increased risk for the lender. An individual’s credit score also plays a significant role; a lower credit score typically leads to higher premiums because it suggests a greater risk of default. Age is another influential factor; older borrowers may face higher premiums due to increased mortality risk. The type of loan (e.g., auto loan versus mortgage) may also influence the premium amount, as different loan types carry varying levels of risk.

Methods for Premium Deduction

Employee premiums are typically deducted directly from their paychecks through payroll deduction. This is a convenient and efficient method for both the employee and the insurance provider. Alternatively, some plans may utilize direct billing, where the employee receives a separate bill and makes payments directly to the insurance company. This method is less common due to the administrative burden it places on both the employee and the insurer.

Consequences of Non-Payment of Premiums

Non-payment of employee premiums can have several serious consequences.

- Loss of Coverage: The most immediate consequence is the lapse of insurance coverage. This means the employee’s beneficiaries would not receive the death benefit in the event of their death.

- Negative Impact on Credit Score: Unpaid premiums may be reported to credit bureaus, potentially leading to a lower credit score, making it harder to obtain loans or credit in the future.

- Collection Actions: The insurance company may pursue collection actions, such as sending debt collection notices or initiating legal proceedings, to recover unpaid premiums.

- Increased Premiums in the Future: Even if coverage is reinstated, future premiums may be higher to account for the previous non-payment.

Lender’s Involvement in Premium Payment

Lenders play a crucial role in group credit life insurance, often acting as the primary point of contact for premium collection and administration. Their involvement varies depending on the specific arrangement with the employer and the type of loan. Understanding the lender’s role clarifies the process for borrowers and ensures smooth premium payments.

Lenders’ involvement in managing group credit life insurance premiums differs significantly depending on whether they receive premiums directly from the borrower or if the employer handles the process. When lenders receive premiums directly, they typically integrate the cost into the loan payment. This simplifies the process for the borrower, consolidating all payments into a single monthly installment. Conversely, when employers manage premiums, lenders often verify coverage and may require proof of insurance from the employer. This approach necessitates more administrative overhead for both the employer and the lender.

Direct Premium Collection by Lenders

In scenarios where lenders directly collect premiums, they usually add the cost to the borrower’s monthly loan payment. This creates a streamlined process, minimizing administrative burden for the borrower. The lender then directly remits the premiums to the insurance company. Transparency is key here; borrowers receive clear statements detailing the breakdown of their loan payments, including the insurance premium component. This method often utilizes automated payment systems, reducing the risk of missed payments and ensuring timely premium remittance to the insurance provider. For example, a car loan might include a monthly payment that encompasses the loan principal, interest, and the group credit life insurance premium, all handled by the lender.

Employer-Managed Premium Payments

Conversely, when employers manage the premiums, the lender’s role shifts to verification and oversight. The employer collects premiums from employees, typically through payroll deductions, and then remits the total premium to the insurance company. The lender’s responsibility becomes ensuring that adequate insurance coverage exists for each borrower. This often involves requesting proof of insurance from the employer and verifying the accuracy of coverage information. The lender might require regular reports from the employer detailing premium payments and coverage status. This system requires more coordination between the employer, lender, and insurer. A potential challenge is the need for effective communication to ensure accurate and timely premium payments.

Lender Premium Payment Procedures

Lenders typically establish clear procedures for handling premium payments. These procedures usually involve: (1) Integrating the premium into the loan repayment schedule, (2) Collecting the combined payment from the borrower, (3) Tracking payments through their accounting system, (4) Remitting the premium portion to the insurance company according to the agreed-upon schedule, and (5) Maintaining detailed records of all transactions for auditing purposes. Effective communication with borrowers regarding premium payments is vital. Many lenders utilize automated systems for tracking payments and generating reports, ensuring efficiency and accuracy.

Lender Premium Payment Process Flowchart

A simplified flowchart depicting the lender’s perspective on the premium payment process could look like this:

[Imagine a flowchart here. The flowchart would start with “Borrower Loan Application,” leading to “Loan Approval and Insurance Enrollment.” This would branch to two paths: “Employer Manages Premiums” (leading to “Employer Collects Premiums,” then “Employer Remits Premiums to Insurer,” and finally “Lender Verifies Coverage”) and “Lender Manages Premiums” (leading to “Lender Collects Premiums with Loan Payment,” then “Lender Remits Premiums to Insurer,” and finally “Premium Payment Confirmation”). Both paths ultimately converge at “Insurance Coverage in Effect.”]

Impact of Insurance Type on Premium Payment

The type of group credit life insurance policy significantly impacts premium payment responsibilities and structures. Understanding these differences is crucial for both employers and employees to manage their financial obligations effectively. The primary variations stem from the way the death benefit is structured over the loan term.

Different insurance types result in varying premium payment amounts and schedules. Decreasing term insurance, for instance, aligns the death benefit with the outstanding loan balance, while level term insurance maintains a constant death benefit throughout the loan’s duration. This difference directly influences the premium calculation. The loan’s duration also plays a pivotal role, affecting the total premium paid and the payment schedule.

Decreasing Term Insurance Premiums

Decreasing term insurance premiums are generally lower than level term premiums because the death benefit decreases over time, mirroring the declining loan balance. This means the insurer’s risk decreases, leading to lower premiums. Premiums are typically paid monthly, coinciding with loan repayments. The total premium paid over the loan’s life is lower compared to level term insurance.

Level Term Insurance Premiums

Level term insurance offers a constant death benefit throughout the loan’s term, regardless of the outstanding balance. This provides consistent coverage, but the premiums remain constant, even though the loan balance decreases. The premium is typically paid monthly, and the total premium paid over the loan term is higher than with decreasing term insurance.

Loan Duration’s Influence on Premium Payments

The length of the loan significantly affects the total premium paid. A longer loan term will naturally result in higher total premiums for both decreasing and level term insurance, although the per-payment amount might be lower. Conversely, shorter loan terms mean lower total premiums, even though the per-payment amount might be higher.

Premium Calculation Examples

Let’s consider two hypothetical scenarios:

Scenario 1: A $10,000 loan with a 5-year term.

* Decreasing Term: Assume an initial annual premium of $200, decreasing proportionally each year as the loan balance decreases. The total premium paid over five years would be significantly less than the level term option.

* Level Term: Assume a constant annual premium of $250. The total premium paid over five years would be $1250.

Scenario 2: A $10,000 loan with a 10-year term.

* Decreasing Term: The initial annual premium might be slightly lower than in Scenario 1, but the total premium over ten years would still be lower than the level term option, although higher than the total premium in Scenario 1.

* Level Term: The annual premium would likely be lower than in Scenario 1, reflecting a lower per-year cost, but the total premium over ten years ($2500) would be significantly higher than the decreasing term option and also higher than the total premium in Scenario 1.

Premium calculations are complex and depend on several factors beyond loan amount and term, including the borrower’s age, health, and the insurer’s risk assessment. These examples are simplified illustrations.

Legal and Regulatory Aspects of Group Credit Life Insurance Premium Payment

Group credit life insurance premium payments are subject to a complex web of federal and state laws and regulations designed to protect both consumers and insurers. These laws govern various aspects of the premium payment process, from the determination of premium amounts to the handling of disputes. Understanding these legal frameworks is crucial for all parties involved – employers, employees, and lenders.

Relevant Laws and Regulations

Federal laws, such as the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA), indirectly influence group credit life insurance premium payments by impacting the overall lending process. State insurance regulations, however, directly address the specifics of group credit life insurance, often dictating permissible premium calculation methods, disclosure requirements, and dispute resolution procedures. These regulations vary significantly across jurisdictions, highlighting the need for careful consideration of the applicable state laws. For example, some states may mandate specific disclosure forms regarding premium amounts and payment methods, while others may have stricter rules concerning the handling of premium disputes.

Potential Legal Issues in Premium Payment Disputes

Disputes regarding group credit life insurance premiums can arise between employers, employees, and lenders. Employers might dispute the accuracy of premium calculations or the legitimacy of premium increases imposed by the insurer. Employees might challenge the employer’s method of premium deduction from their wages or the insurer’s refusal to cover a claim. Lenders might dispute the insurer’s handling of premium payments affecting the loan repayment schedule. These disputes can lead to legal action, involving claims of breach of contract, misrepresentation, or unfair business practices. The outcome of such disputes often hinges on the specific terms of the insurance policy, the applicable state regulations, and the evidence presented by each party.

Compliance with Regulations and its Impact on Premium Payment

Compliance with relevant laws and regulations is paramount in ensuring the smooth and legal operation of group credit life insurance premium payments. Failure to comply can result in significant penalties, including fines, legal fees, and reputational damage. Compliance necessitates careful adherence to disclosure requirements, accurate premium calculation, transparent communication with all stakeholders, and the establishment of clear procedures for handling premium disputes. For instance, a company failing to properly disclose premium information to employees could face legal action for violating consumer protection laws. Similarly, an insurer failing to comply with state-specific regulations regarding premium calculation could be subject to regulatory sanctions. Effective compliance programs often involve regular internal audits, employee training, and ongoing monitoring of legal and regulatory changes.

Key Legal Requirements for Group Credit Life Insurance Premium Payments Across Jurisdictions

The following table provides a simplified overview. Note that this is not exhaustive and specific requirements vary significantly by state and may also be influenced by the specific insurer and policy. Always consult legal counsel and relevant state insurance departments for accurate and up-to-date information.

| Jurisdiction | Premium Disclosure Requirements | Dispute Resolution Mechanisms | Specific Regulatory Bodies |

|---|---|---|---|

| State A (Example) | Detailed written disclosure required; must include premium calculation methodology | Mediation, arbitration, or court action | State Department of Insurance |

| State B (Example) | Simplified disclosure acceptable; insurer may use summary information | Internal complaint process; potential escalation to state regulator | State Insurance Commission |

| State C (Example) | Specific format mandated by regulation; electronic disclosure permitted | Binding arbitration preferred; court action as last resort | State Office of Insurance Regulation |

| Federal (Example – TILA) | Disclosure requirements related to loan terms, including insurance costs, if applicable | Consumer Financial Protection Bureau (CFPB) complaint process | Consumer Financial Protection Bureau (CFPB) |

End of Discussion

Ultimately, determining who pays group credit life insurance premiums hinges on a careful examination of the agreement between the employer, employee, and lender. While various models exist – from fully employer-sponsored plans to arrangements where the employee bears the full cost – understanding the interplay of these stakeholders is key to navigating this crucial aspect of borrowing and financial protection. This understanding empowers both employers and employees to make informed decisions about their insurance coverage and financial responsibilities.

FAQ Insights

Can I opt out of group credit life insurance?

It depends on the terms of your loan and employer’s policy. Some lenders require it, while others may allow you to decline, potentially impacting your loan terms.

What happens if I lose my job and can’t afford the premiums?

Contact your lender immediately to discuss options. They may offer alternative payment plans or provide information about maintaining coverage.

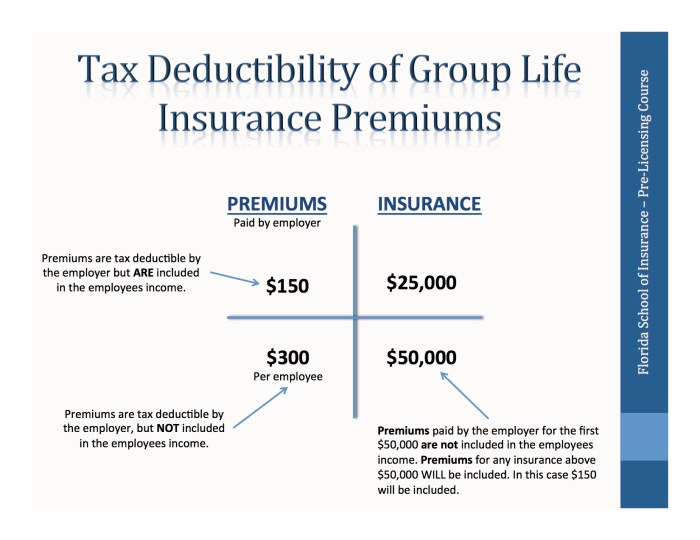

Are group credit life insurance premiums tax-deductible?

This depends on your country and specific tax laws. Consult a tax professional for personalized advice.

Does the premium amount change over the life of the loan?

It depends on the type of policy. Decreasing term insurance premiums may remain constant, while level term premiums typically decrease over time.