Ever wondered what that monthly insurance bill actually represents? It’s more than just a number; it’s the price of peace of mind. Understanding insurance premiums is crucial for making informed financial decisions, ensuring you’re adequately protected, and avoiding unexpected costs. This guide will demystify insurance premiums, explaining what they are, what influences their cost, and how to manage them effectively.

From car insurance to health coverage, premiums form the bedrock of the insurance system. This exploration will cover the fundamental aspects of insurance premiums, offering a clear understanding of this essential financial concept, allowing you to navigate the world of insurance with greater confidence.

Defining Insurance Premiums

An insurance premium is essentially the price you pay for an insurance policy. It’s the regular payment you make to an insurance company in exchange for their promise to cover certain costs or losses if a specific event occurs. Think of it as a membership fee that provides you with financial protection.

Insurance premiums are calculated based on a variety of factors, including the type of insurance, the level of coverage, your risk profile, and the insurance company’s own assessment of potential payouts. The purpose of the premium is to build a pool of funds that the insurance company can use to pay out claims to policyholders who experience covered losses. Its function is to transfer risk from the individual to the insurance company.

Analogy for Understanding Insurance Premiums

Imagine a community deciding to pool their money together to protect themselves against house fires. Each household contributes a small amount (the premium) into a shared fund. If one house burns down, the community uses the pooled money to help rebuild it. The more likely a house is to burn down (due to factors like age or location), the higher the contribution (premium) that household would pay. This is essentially how insurance works, with the insurance company acting as the community fund manager.

Comparison of Insurance Premiums Across Different Types

The cost of insurance premiums varies significantly depending on the type of insurance and other factors. The following table offers a general comparison; actual premiums will differ based on individual circumstances.

| Insurance Type | Factors Affecting Premium | Typical Premium Range (Annual, Example) | Notes |

|---|---|---|---|

| Auto Insurance | Driving record, vehicle type, location, coverage level | $500 – $2000 | Premiums are higher for high-risk drivers and more expensive vehicles. |

| Health Insurance | Age, health status, location, plan type | $1000 – $10000+ | Premiums vary widely based on plan coverage and individual health factors. |

| Homeowners Insurance | Home value, location, coverage level, security features | $500 – $2000+ | Premiums are higher for homes in high-risk areas or with higher values. |

| Life Insurance | Age, health, amount of coverage, policy type | $500 – $5000+ | Premiums are generally higher for younger individuals and larger death benefits. |

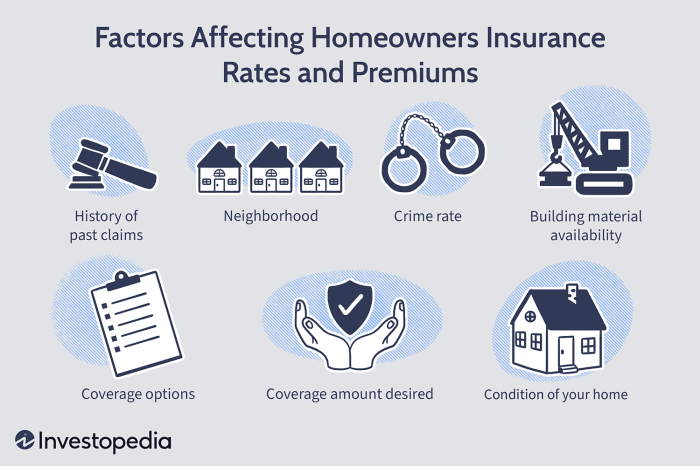

Factors Affecting Insurance Premiums

Insurance premiums, the price you pay for coverage, aren’t arbitrary figures. Insurers use a complex calculation that considers numerous factors to assess the risk involved in insuring you. Understanding these factors can help you make informed decisions about your insurance choices and potentially find more affordable coverage.

Key Factors in Premium Determination

Insurance companies meticulously analyze various aspects of your profile to determine your risk level. These factors are not equally weighted; some hold significantly more influence than others depending on the type of insurance. The ultimate goal is to price the premium to reflect the likelihood of a claim and the potential cost of that claim.

Impact of Age on Insurance Premiums

Age significantly influences premium calculations across various insurance types. For car insurance, younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates. Experience and a proven safe driving record typically lead to lower premiums as age increases. Conversely, in health insurance, older individuals often face higher premiums because of a greater likelihood of requiring more extensive medical care. This is often mitigated through government subsidies or employer-sponsored plans designed to offset the higher costs.

Impact of Health on Insurance Premiums

Health status is a primary factor in health insurance premium calculations. Individuals with pre-existing conditions or a history of significant health issues may see higher premiums because of the increased probability of costly medical treatments. Insurance companies assess medical history, lifestyle choices (such as smoking), and family medical history to evaluate the overall health risk. Conversely, maintaining a healthy lifestyle can lead to lower premiums or even discounts in some plans.

Impact of Location on Insurance Premiums

Geographic location plays a crucial role in determining insurance premiums, particularly for property and auto insurance. Areas with higher crime rates, a greater frequency of natural disasters (such as hurricanes or earthquakes), or higher traffic congestion often result in higher premiums. Insurance companies use sophisticated mapping and statistical analysis to assess risk based on location-specific data. For example, someone living in a high-crime urban area might pay more for home insurance than someone in a rural, low-crime area.

Impact of Driving History on Insurance Premiums

Driving history is paramount in determining auto insurance premiums. A clean driving record, free from accidents and traffic violations, typically results in lower premiums. Conversely, accidents, speeding tickets, and DUI convictions significantly increase premiums, reflecting the higher risk associated with less cautious drivers. Insurance companies use a points system to track driving infractions, and the more points accumulated, the higher the premium. Many insurers also offer discounts for completing defensive driving courses, demonstrating a commitment to safe driving practices.

Premium Calculation Methods Across Providers

Different insurance providers utilize varying methods for calculating premiums, although the underlying principles remain similar. Some insurers rely heavily on statistical models and actuarial data, while others may incorporate more subjective assessments of risk. The specific algorithms and weighting of factors can differ significantly, leading to variations in premium quotes from different companies for the same individual. This highlights the importance of comparing quotes from multiple providers to find the most competitive pricing.

Risk Assessment in Premium Determination

Risk assessment forms the cornerstone of premium calculation. Insurers use sophisticated statistical models and algorithms to quantify the likelihood and potential cost of future claims. This involves analyzing vast amounts of data, including historical claims data, demographic information, and external factors such as weather patterns and economic conditions. The more accurately an insurer can assess risk, the more effectively they can price premiums to ensure profitability while remaining competitive. The entire process is underpinned by the fundamental principle of spreading risk across a large pool of policyholders.

Paying and Managing Insurance Premiums

Paying your insurance premiums on time is crucial to maintaining your coverage. Understanding the various payment methods and strategies for managing costs can significantly impact your financial well-being and peace of mind. This section Artikels the common ways to pay premiums, the consequences of late payments, and effective strategies for managing and reducing your insurance expenses.

Payment Methods for Insurance Premiums

Several convenient methods exist for paying insurance premiums. Choosing the most suitable method depends on personal preference and financial habits. These options generally include online payments through the insurer’s website or mobile app, automatic bank drafts or electronic fund transfers (EFT), mailing a check or money order, and paying in person at a designated location (often a physical office or authorized agent). Many insurers offer a combination of these options to cater to diverse customer needs. For example, you might set up automatic payments for convenience while retaining the option to make occasional manual payments if needed.

Consequences of Late or Missed Premium Payments

Failure to pay premiums by the due date can lead to several negative consequences. The most immediate is the cancellation or lapse of your insurance coverage. This means you’ll be left without protection against the risks you’re insured against, potentially leading to significant financial hardship in the event of an accident, illness, or other covered event. Late payments often incur late fees or penalties, adding extra costs to your already overdue premium. Your credit score may also be negatively impacted, making it more difficult and expensive to obtain credit in the future, including potentially higher insurance premiums. In some cases, insurers may reinstate coverage after a late payment, but this usually involves additional fees and may require proof of insurability.

Strategies for Managing Insurance Costs and Reducing Premiums

Effective management of insurance costs involves a proactive approach. One key strategy is to shop around and compare quotes from multiple insurers. Different companies offer varying rates based on factors like your risk profile and coverage options. Bundling multiple insurance policies (like auto and home insurance) with the same provider can often result in discounts. Increasing your deductible, which is the amount you pay out-of-pocket before your insurance coverage kicks in, can also lower your premium, though it means a higher upfront cost in case of a claim. Maintaining a good driving record (for auto insurance) and taking steps to improve your home’s security (for homeowners insurance) can also reduce premiums. Finally, reviewing your coverage periodically to ensure you’re not paying for unnecessary coverage is essential.

Finding Affordable Insurance Options and Comparing Providers

Finding affordable insurance requires research and comparison. Utilizing online comparison tools allows you to input your information and receive quotes from multiple insurers simultaneously. Reading reviews and checking the insurer’s financial stability rating is also important. Consider the insurer’s customer service reputation and claim settlement process. Remember that the cheapest option isn’t always the best; prioritize finding a balance between cost and the level of coverage that meets your needs. For example, you might find a lower premium with a higher deductible, but that might mean a larger out-of-pocket expense if you need to file a claim. Therefore, careful consideration of your risk tolerance is crucial when comparing options.

Concluding Remarks

In conclusion, understanding insurance premiums is key to responsible financial planning. By grasping the factors that influence premium costs and employing effective management strategies, you can ensure you receive adequate coverage while optimizing your expenses. Remember to regularly review your insurance needs and compare providers to find the best value for your specific circumstances. Armed with this knowledge, you can navigate the complexities of insurance with greater clarity and confidence.

User Queries

What happens if I can’t afford my insurance premium?

Contact your insurance provider immediately. They may offer payment plans, hardship programs, or suggest ways to lower your premium.

Can I negotiate my insurance premium?

While not always possible, you can try negotiating by demonstrating good driving history (for auto insurance), healthy lifestyle choices (for health insurance), or home security improvements (for homeowners insurance).

How often are insurance premiums reviewed?

This varies by insurer and policy type. Some are reviewed annually, while others might be reviewed less frequently. Check your policy documents for specifics.

What factors affect my car insurance premium besides driving history?

Your car’s make and model, your location, your age, and your credit score can all impact your car insurance premium.