Insurance premiums: the price we pay for peace of mind. But what exactly are they, and why do they vary so dramatically? This seemingly simple question opens a door to a complex world of risk assessment, actuarial science, and financial planning. Understanding insurance premiums is key to making informed decisions about protecting yourself and your assets.

This guide will unravel the mysteries surrounding insurance premiums, exploring everything from their fundamental components to the factors that influence their cost and how they are ultimately used. We’ll examine various insurance types, payment methods, and the crucial role premiums play in the financial stability of insurance companies and the compensation of insured losses.

Defining Insurance Premiums

Insurance premiums are essentially the price you pay for an insurance policy. Think of it as a regular payment that secures you against potential financial losses due to unforeseen events. The amount you pay depends on various factors specific to your circumstances and the type of insurance coverage you choose. This payment allows the insurance company to build a pool of funds to cover claims made by policyholders.

Insurance Premium Examples

Different types of insurance policies have varying premium structures. For instance, a health insurance premium covers medical expenses, an auto insurance premium protects against vehicle damage or liability in accidents, and a home insurance premium safeguards your property from damage or loss. These premiums differ based on risk assessments; a person with pre-existing health conditions might pay a higher health insurance premium, while someone with a history of accidents might pay more for auto insurance. The level of coverage also plays a significant role – a higher coverage amount usually means a higher premium.

Components of an Insurance Premium

Several factors contribute to the overall cost of your insurance premium. These include:

* Risk Assessment: This is a crucial factor. Insurance companies analyze your individual risk profile to determine the likelihood of you filing a claim. For example, your driving record influences your auto insurance premium, your health history affects your health insurance premium, and the location and age of your home impact your home insurance premium.

* Claims History: A history of filing claims can lead to higher premiums as it signals a higher risk to the insurer.

* Coverage Amount: The amount of coverage you choose directly impacts your premium. Higher coverage generally means a higher premium.

* Deductible: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually results in a lower premium, and vice versa.

* Administrative Costs: Insurance companies have operational costs, including salaries, technology, and marketing, which are factored into premiums.

* Profit Margin: Insurance companies need to make a profit, and this is built into the premium calculation.

Comparison of Insurance Premiums

| Insurance Type | Average Annual Premium (USD) | Factors Influencing Premium | Coverage Examples |

|---|---|---|---|

| Health Insurance | $700 – $2000+ (Highly Variable) | Age, health status, location, plan type | Doctor visits, hospital stays, prescription drugs |

| Auto Insurance | $1000 – $2000+ (Highly Variable) | Driving record, vehicle type, location, age | Liability, collision, comprehensive |

| Homeowners Insurance | $1000 – $2000+ (Highly Variable) | Home value, location, age of home, security features | Damage from fire, theft, weather events |

| Life Insurance | $500 – $5000+ (Highly Variable) | Age, health, coverage amount, policy type | Death benefit to beneficiaries |

Factors Influencing Premium Costs

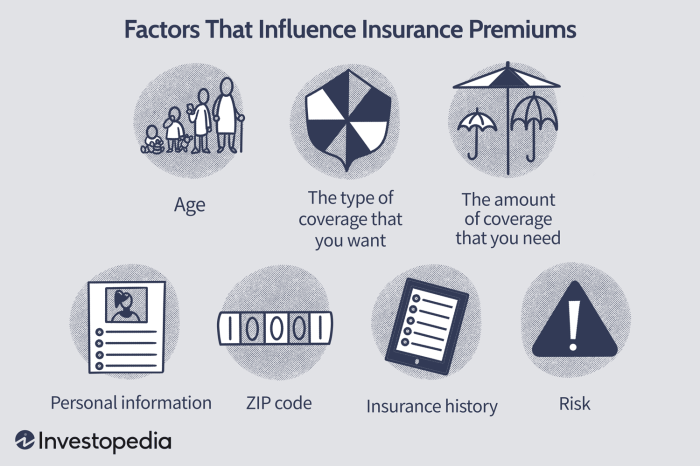

Insurance premiums aren’t arbitrarily assigned; they’re carefully calculated based on a multitude of factors that assess the likelihood of a claim. Insurance companies utilize sophisticated risk assessment models to determine the appropriate premium for each individual or entity, ensuring a fair and sustainable system. This process considers both statistical probabilities and individual characteristics.

Several key factors significantly impact the cost of insurance premiums. These factors are carefully weighed and analyzed to create a comprehensive risk profile for each policyholder. The interplay of these factors can lead to considerable variations in premium amounts, even for similar policies.

Age

Age is a significant factor in many types of insurance. For example, in health insurance, older individuals generally face higher premiums due to the increased likelihood of needing medical care. Conversely, younger individuals might enjoy lower premiums because they statistically represent a lower risk. In auto insurance, younger drivers, especially those with limited driving experience, tend to have higher premiums due to increased accident rates. As drivers age and build a clean driving record, their premiums usually decrease. This reflects the statistical correlation between age and driving risk.

Health

In health insurance, an individual’s health status heavily influences premium costs. Pre-existing conditions, current health concerns, and family medical history all contribute to the assessment of risk. Individuals with pre-existing conditions or a family history of serious illnesses may face higher premiums. Conversely, those with excellent health and a history of healthy lifestyle choices may qualify for lower premiums, reflecting the lower likelihood of costly medical claims. Some insurers might offer wellness programs to incentivize healthy behaviors and potentially reduce premiums.

Location

Geographic location plays a significant role in determining insurance premiums, particularly for property and auto insurance. Areas with higher crime rates, a greater frequency of natural disasters (like hurricanes or earthquakes), or higher rates of traffic accidents typically command higher premiums. Insurers analyze historical claims data for specific regions to assess the risk profile of a given location. For instance, a home located in a high-crime area with a history of burglaries will likely have a higher homeowner’s insurance premium than a similar home in a safer neighborhood.

Driving Record

In auto insurance, a driver’s record is a crucial factor in premium calculations. A clean driving record, free of accidents and traffic violations, typically results in lower premiums. Conversely, accidents, speeding tickets, and other moving violations increase premiums significantly. The severity of the violation also matters; a DUI conviction will generally lead to a far greater premium increase than a minor speeding ticket. Insurance companies use points systems to track driving infractions and adjust premiums accordingly. This reflects the direct correlation between driving behavior and the likelihood of future accidents and claims.

Risk Assessment Methodologies

Insurance companies employ various risk assessment methodologies, often involving sophisticated statistical models and algorithms. These models analyze vast amounts of data to predict the likelihood of claims. Factors considered extend beyond the individual characteristics already discussed, encompassing things like credit scores (in some jurisdictions), occupation, and even the type of vehicle driven. The complexity of these models varies among insurers, leading to differences in premium calculations. For example, one insurer might heavily weigh credit scores, while another might focus more on driving history.

Premium Calculation Methods

Different insurance providers utilize varying methods for calculating premiums. While the underlying principles remain similar – assessing risk and pricing accordingly – the specific algorithms and weighting of factors can differ considerably. Some insurers may use simpler, more transparent methods, while others might employ complex actuarial models. This lack of uniformity makes direct comparison of premiums between insurers challenging, emphasizing the importance of obtaining multiple quotes before selecting a policy. The precise formula used is often proprietary information, not publicly disclosed by the insurance company.

The Role of Premiums in Risk Management

Insurance premiums are the lifeblood of the insurance industry, playing a crucial role in ensuring the financial stability of insurance companies and enabling them to fulfill their promise of compensating policyholders for covered losses. Their significance extends beyond simple transaction; they are the cornerstone of effective risk management for both individuals and the insurance provider.

Premiums contribute significantly to the overall financial health and stability of insurance companies. They form the primary source of revenue, allowing insurers to cover operational expenses, invest in growth initiatives, and, most importantly, maintain sufficient reserves to pay out claims. A consistent and adequate flow of premiums ensures the insurer’s solvency and ability to meet its obligations to policyholders.

Premium Levels and Risk Coverage

The level of premium directly correlates with the extent of risk coverage offered. Higher-risk policies, such as those covering expensive property or high-liability exposures, naturally command higher premiums. This reflects the increased probability of a claim and the potential for a larger payout. Conversely, lower-risk policies, such as those for less valuable possessions or lower liability limits, typically attract lower premiums. This relationship ensures that the pricing accurately reflects the level of risk undertaken by the insurer. For instance, a comprehensive car insurance policy covering collision and theft will cost more than a liability-only policy because the insurer assumes a greater financial burden.

Premiums and Loss Compensation

Premiums are the primary source of funds used to compensate policyholders for insured losses. When a covered event occurs (e.g., a car accident, a house fire, or a medical emergency), the insurance company utilizes the accumulated premiums to pay out claims. The size of the claim is determined by the terms of the insurance policy and the extent of the damage or loss. A well-structured premium system ensures that there is sufficient capital to cover a wide range of claims, including those involving significant financial losses. This process is central to the insurance promise: providing financial protection against unforeseen events.

Visual Representation of Premium Flow and Claim Settlement

Imagine a simple diagram. A large circle represents the pool of premium payments collected from numerous policyholders. Arrows flow into this central circle from various sources, each arrow representing individual premium payments. From this central circle, another set of arrows flow outwards. Some arrows are labeled “Operational Expenses” (salaries, administrative costs, etc.), others “Reserves” (funds set aside for future claims), and the largest arrows are labeled “Claim Settlements,” showing payments going to policyholders who have experienced covered losses. The size of the “Claim Settlements” arrows would vary depending on the size and frequency of claims, demonstrating the dynamic relationship between premium inflows and claim outflows. The effective management of this flow ensures the long-term financial sustainability of the insurance company and its ability to meet its obligations to its policyholders. The balance between premium inflow and claim outflow is crucial for the insurer’s financial health and the stability of the insurance system as a whole.

Ultimate Conclusion

In conclusion, understanding insurance premiums is not just about paying a bill; it’s about comprehending the intricate mechanism that underpins the entire insurance industry. By grasping the factors that influence premium costs and the various payment options available, consumers can make informed choices that best suit their individual needs and financial situations. Remember, a well-informed consumer is a better-protected consumer.

Question & Answer Hub

What happens if I can’t afford my insurance premium?

Most insurance companies offer payment plans or options to help manage premium costs. Contact your insurer to discuss potential solutions, such as monthly payments or hardship programs.

Can my insurance premium change during the policy term?

Premiums can adjust, typically due to changes in risk factors (e.g., a claim filed, changes in your driving record, or changes in the policy coverage). Your policy documents will Artikel the conditions under which adjustments can occur.

How are insurance premiums calculated for businesses?

Business insurance premiums are based on factors such as the type of business, industry, location, number of employees, and the specific risks involved. A detailed risk assessment is usually conducted to determine the premium.

What is a deductible and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage begins. Higher deductibles typically result in lower premiums, and vice versa.