Securing your family’s financial future is a paramount concern, and life insurance plays a vital role in achieving this. Understanding the cost, however, can feel like navigating a complex maze. This guide unravels the mysteries surrounding life insurance premiums, providing clarity on the factors that influence them and empowering you to make informed decisions.

We’ll explore the various types of life insurance policies, from term life’s temporary coverage to the lifelong protection offered by whole life insurance. We’ll delve into the crucial role of underwriting, examining how factors like age, health, lifestyle choices, and even hobbies impact your premium. By the end, you’ll possess a solid understanding of how life insurance premiums are determined and how you can find a policy that aligns with your budget and needs.

Defining Life Insurance Premiums

Life insurance premiums are the regular payments you make to maintain your life insurance policy. These payments compensate the insurance company for the risk they assume in providing financial protection to your beneficiaries in the event of your death. The amount you pay is determined by a complex interplay of factors, ensuring a fair and actuarially sound system.

Factors Determining Life Insurance Premiums

Several key factors influence the cost of your life insurance premiums. Understanding these elements allows for a more informed decision when choosing a policy. These factors are carefully analyzed by actuaries to assess the risk associated with insuring an individual.

Types of Life Insurance and Premium Structures

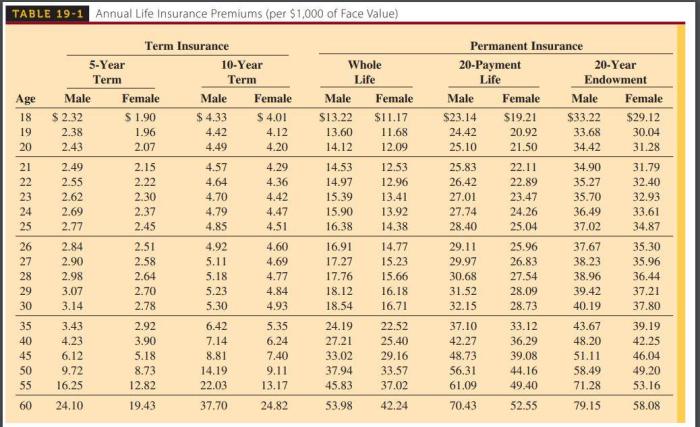

Different types of life insurance policies have distinct premium structures. Term life insurance, for instance, offers coverage for a specified period (term), typically ranging from 10 to 30 years. Premiums for term life insurance are generally lower than those for permanent policies because the coverage is temporary. Whole life insurance, conversely, provides lifelong coverage and builds cash value over time. Premiums for whole life insurance are typically higher and remain level throughout the policy’s duration. Universal life insurance offers flexibility in premium payments and death benefits, resulting in premiums that can fluctuate based on market performance and policy adjustments.

Impact of Age, Health, and Lifestyle on Premiums

Age is a significant factor influencing premium costs. Younger individuals generally qualify for lower premiums because they statistically have a longer life expectancy. Health plays a crucial role; applicants with pre-existing conditions or unhealthy lifestyles may face higher premiums due to an increased risk of early death. Lifestyle choices, such as smoking, excessive alcohol consumption, and hazardous occupations, also impact premium calculations. Insurance companies assess these factors to determine the level of risk associated with insuring an individual. For example, a smoker will generally pay significantly more for the same coverage amount than a non-smoker of the same age and health status.

Premium Comparison: Term Life vs. Whole Life

The table below illustrates a sample comparison of premiums for term life insurance and whole life insurance, considering different age ranges and coverage amounts. Remember that these are illustrative examples, and actual premiums will vary based on the specific insurer, policy features, and individual circumstances.

| Policy Type | Age | Coverage Amount ($1,000,000) | Approximate Annual Premium |

|---|---|---|---|

| Term Life (20-year) | 30 | $1,000,000 | $500 – $800 |

| Term Life (20-year) | 40 | $1,000,000 | $1000 – $1500 |

| Whole Life | 30 | $1,000,000 | $3000 – $5000 |

| Whole Life | 40 | $1,000,000 | $4000 – $7000 |

Factors Influencing Premium Costs

Life insurance premiums aren’t a one-size-fits-all price. Several factors contribute to the final cost, and understanding these factors can help you make informed decisions when purchasing a policy. The process involves a careful assessment of your individual risk profile, which is largely determined by the insurer’s underwriting process.

Underwriting’s Role in Premium Determination

Underwriting is the crucial process where insurance companies assess the risk associated with insuring an individual. Underwriters meticulously review applications, examining medical history, lifestyle choices, and other relevant information. This comprehensive review allows them to categorize applicants into different risk pools, with higher-risk individuals paying higher premiums to reflect the increased likelihood of a claim. The more data an underwriter has access to, the more accurately they can assess risk and price the policy accordingly. This ensures that premiums accurately reflect the potential cost to the insurance company. For example, a person with a history of heart disease will likely be placed in a higher risk category than someone with a clean bill of health, resulting in a higher premium.

The Impact of Lifestyle and Family History on Premiums

Certain lifestyle choices and family history significantly influence premium costs. Smoking, for instance, is a major risk factor for numerous health problems, leading to substantially higher premiums. Insurers consider this a significant predictor of future health issues and increased claims. Similarly, a family history of diseases like cancer or heart disease increases the likelihood of developing those conditions, resulting in higher premiums. The insurer assesses the probability of inheriting genetic predispositions and factors this into the risk assessment. Occupation also plays a role; high-risk professions, such as firefighters or construction workers, often lead to higher premiums due to increased chances of injury or death.

Other Factors Considered by Insurers

Beyond the major factors, insurers also consider various other aspects. Hobbies, particularly those considered high-risk (e.g., skydiving, mountain climbing), can impact premiums. Insurers view these activities as increasing the risk of accidents and potential claims. Driving record is another important factor; a history of accidents or traffic violations indicates a higher risk of future incidents, potentially leading to increased premiums. Even seemingly minor details, such as height and weight, can influence the assessment of overall health and risk.

Premium Comparison Across Different Providers

Premium costs can vary significantly between different insurance providers, even for the same individual. Consider this hypothetical example: A 35-year-old non-smoking male, in good health, with a clean driving record, seeking a $500,000 term life insurance policy.

| Insurance Provider | Annual Premium | Policy Features | Notes |

|---|---|---|---|

| Company A | $500 | Standard Term Life | May offer additional riders |

| Company B | $600 | Enhanced Term Life with benefits | Higher premium due to added benefits |

| Company C | $450 | Basic Term Life | Lower premium, fewer benefits |

| Company D | $550 | Standard Term Life with optional riders | Premium reflects additional rider options |

Note: These are hypothetical examples and actual premiums will vary based on many factors. It’s crucial to obtain quotes from multiple providers to compare costs and benefits before making a decision.

Understanding Policy Details and Premium Adjustments

Life insurance premiums aren’t static; they can fluctuate throughout the policy’s duration. Understanding these potential changes and the factors influencing them is crucial for responsible financial planning. This section will clarify how premiums are adjusted and what situations might trigger those adjustments.

Premium adjustments are usually a result of factors either within your control or external circumstances impacting the insurer’s risk assessment. It’s important to regularly review your policy to understand these changes and their implications for your financial obligations.

Premium Changes Over Time

Premiums for many life insurance policies, particularly term life insurance, are typically fixed for a specified period (the term). However, some policies, such as whole life insurance or universal life insurance, allow for adjustments in premiums based on several factors. For instance, whole life insurance premiums remain consistent throughout the policy’s lifetime, while universal life insurance premiums can be adjusted based on the policy’s cash value and the performance of the underlying investments. Changes to interest rates, mortality rates, and the policyholder’s health status can also impact premium adjustments in these types of policies. For example, a decrease in interest rates might lead to a slight premium increase in a universal life policy to maintain the death benefit. Conversely, a policyholder’s improved health status may not lead to a decrease in premiums, but it may influence the approval of additional coverage at a later date.

Reviewing and Adjusting a Life Insurance Policy

Regularly reviewing your policy is recommended. Contact your insurance provider to request a policy review. They can provide an updated analysis of your policy’s performance and address any questions about premium changes. You might choose to adjust your policy coverage (increase or decrease the death benefit), change the payment schedule, or even consider switching to a different type of policy altogether. These adjustments will often result in a change to your premium payments. This process often involves completing forms and providing any required updated information, such as a new health assessment if you are requesting a significant change in coverage.

Situations Leading to Premium Increases or Decreases

Several factors can influence premium adjustments. A premium increase might occur due to a change in the policy’s underlying investment performance (for certain types of policies), an increase in the mortality risk associated with the policyholder’s age or health status, or a change in the insurer’s risk assessment due to broader economic factors. Conversely, a decrease in premiums is less common, but it could theoretically occur if the underlying investments perform exceptionally well (for some types of policies), if the insurer revises its mortality tables downward, or if the policyholder makes significant changes to reduce the insurer’s risk, such as adopting a healthier lifestyle (though this is not a guarantee).

Policy Features Affecting Premiums

Understanding how policy features impact your premiums is vital for making informed decisions.

- Death Benefit Amount: A higher death benefit generally results in higher premiums, as the insurer is taking on a greater financial obligation.

- Policy Type: Term life insurance typically has lower premiums than permanent life insurance (whole life or universal life) because it provides coverage for a limited period.

- Policy Term Length: Longer term life insurance policies often have higher premiums than shorter-term policies, reflecting the increased risk for the insurer.

- Age and Health: Younger, healthier individuals typically qualify for lower premiums because they present a lower risk to the insurer. Pre-existing conditions or health issues can significantly increase premiums.

- Riders: Adding riders to your policy, such as accidental death benefits or long-term care riders, typically increases the overall premium.

- Payment Frequency: Paying premiums annually usually results in a slightly lower overall cost compared to more frequent payments (monthly or quarterly), due to administrative costs.

Illustrative Examples of Premium Calculations

Understanding how life insurance premiums are calculated can seem complex, but breaking down the process into its component parts reveals a logical system. Several key factors interact to determine the final cost, and examining hypothetical scenarios helps illuminate these interactions. This section will provide examples demonstrating the impact of age, health, and coverage amount on premium calculations.

Premium Calculation for Different Age Groups

Let’s consider three individuals: a 30-year-old, a 45-year-old, and a 60-year-old, all applying for a $500,000 term life insurance policy with similar health profiles (non-smokers with no significant health issues). The younger applicant (30 years old) will likely receive a significantly lower premium than the older applicants due to statistically lower mortality risk. The 45-year-old will have a higher premium than the 30-year-old, and the 60-year-old will have the highest premium. This is because the probability of a claim increases with age. For illustrative purposes, let’s assume the annual premiums are: $500 for the 30-year-old, $1,200 for the 45-year-old, and $2,500 for the 60-year-old. These are hypothetical figures and actual premiums will vary widely based on insurer and policy specifics.

Premium Calculation for Varying Coverage Amounts

Now, let’s examine the impact of coverage amount. Consider a 40-year-old, healthy non-smoker applying for different coverage levels: $250,000, $500,000, and $1,000,000. Naturally, the premium increases proportionally with the coverage amount. The insurer assumes a greater financial obligation with higher coverage, leading to a higher premium. Hypothetically, the annual premiums could be: $750 for $250,000 coverage, $1,500 for $500,000 coverage, and $3,000 for $1,000,000 coverage. Again, these are illustrative examples and actual premiums will differ.

Visual Representation: Age, Health, and Premium Costs

A bar graph could effectively illustrate the relationship between these factors. The horizontal axis would represent age groups (e.g., 25-35, 36-45, 46-55, 56-65), and the vertical axis would represent the annual premium. Three separate bars for each age group would depict premiums for individuals with different health profiles: “Excellent Health,” “Good Health,” and “Fair Health.” The graph would visually demonstrate that premiums generally increase with age and worsen with declining health status. For instance, the “Excellent Health” bars would be consistently lower than the “Good Health” and “Fair Health” bars across all age groups, and all bars would generally increase in height as age increases. The differences between the bars within each age group would highlight the significant impact of health status on premium cost. The graph would clearly show that younger applicants with excellent health receive the most favorable premiums.

Impact of Health and Lifestyle Factors

This section illustrates the influence of health and lifestyle choices on premium calculations. Consider two 40-year-old applicants seeking $500,000 in coverage. Applicant A is a non-smoker with a healthy BMI and no pre-existing conditions, while Applicant B is a smoker with high blood pressure and a history of heart problems. Applicant A will receive a significantly lower premium than Applicant B. The insurer assesses a higher risk associated with Applicant B’s health profile, resulting in a substantially higher premium to compensate for the increased probability of a claim. For example, Applicant A might pay $1,000 annually, while Applicant B might pay $2,500 annually or more. This highlights the importance of maintaining a healthy lifestyle to secure more affordable life insurance.

Outcome Summary

Choosing the right life insurance policy is a significant financial decision, and understanding the premium is key. This guide has provided a framework for navigating the complexities of life insurance costs, empowering you to compare options, assess your needs, and ultimately, secure a policy that provides peace of mind without straining your finances. Remember to consult with a qualified financial advisor to personalize your strategy and ensure your family’s long-term security.

Questions Often Asked

What is the difference between term and whole life insurance premiums?

Term life insurance premiums are generally lower than whole life insurance premiums because they only cover a specific period. Whole life insurance, providing lifelong coverage, carries a higher, but often consistent, premium.

Can I change my life insurance premium payment frequency?

Yes, many insurers offer flexible payment options, such as annual, semi-annual, or monthly payments. Note that more frequent payments may involve slightly higher overall costs due to administrative fees.

What happens if I miss a life insurance premium payment?

Missing a payment can result in a lapse in coverage. Most insurers offer grace periods, but it’s crucial to contact your insurer immediately to avoid policy cancellation.

How often are life insurance premiums reviewed and adjusted?

Premium adjustments depend on the policy type. Term life insurance premiums typically remain fixed for the policy term, while whole life insurance premiums might adjust based on the policy’s cash value.