Understanding insurance premiums is crucial for securing adequate coverage without overspending. This guide unravels the complexities of insurance premiums, explaining what they are, the factors influencing their cost, and strategies for securing the best value for your money. We’ll explore various insurance types, highlighting the nuances of premium calculation and offering practical tips to help you navigate the often-confusing world of insurance pricing.

From the fundamental components of a premium to advanced strategies for saving money, this resource aims to empower you with the knowledge needed to make informed decisions about your insurance needs. We will delve into specific examples, compare different policy options, and offer clear explanations to demystify the process of determining your insurance costs.

Defining “Insurance Premium”

An insurance premium is the amount of money an individual or business pays to an insurance company in exchange for insurance coverage. This payment secures a policy that protects against specified risks or losses. Understanding the components and factors influencing premiums is crucial for making informed decisions about insurance coverage.

Components of an Insurance Premium

The premium is calculated by considering several key factors. These factors are combined to arrive at the final price. A significant portion goes towards covering claims and administrative costs. A further portion is allocated to the insurer’s profit margin and reserves for future uncertainties.

Factors Influencing Premium Calculation

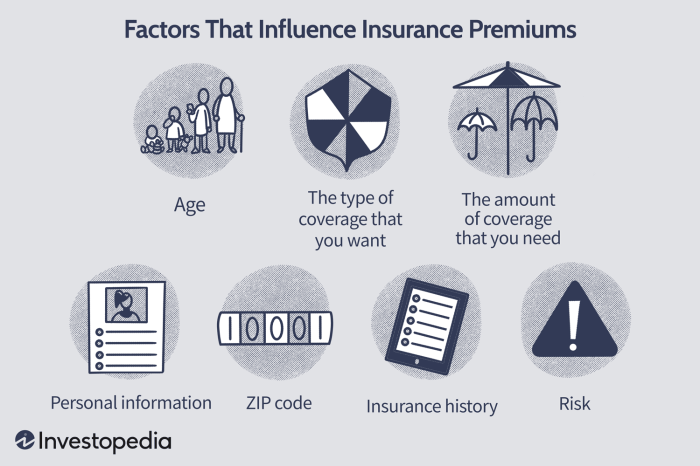

Numerous factors influence the calculation of insurance premiums. These factors vary depending on the type of insurance. For example, age, health status, driving record, and location all play significant roles. Risk assessment is a central process. The higher the perceived risk, the higher the premium.

- Risk Assessment: Insurers assess the likelihood of a claim based on statistical data and individual circumstances. Higher-risk individuals or properties generally pay higher premiums.

- Claim History: A history of filing claims can lead to increased premiums. Insurers view this as an indicator of higher future risk.

- Coverage Level: Higher coverage amounts typically result in higher premiums. More extensive coverage means the insurer is potentially liable for larger payouts.

- Deductibles: Choosing a higher deductible (the amount you pay out-of-pocket before insurance coverage begins) usually results in lower premiums. This is because the insured assumes a greater portion of the risk.

- Location: Geographic location influences premiums. Areas with higher crime rates or a greater frequency of natural disasters often have higher premiums.

Examples of Different Insurance Premiums and Their Variations

Insurance premiums vary significantly across different types of insurance. For example, health insurance premiums for a young, healthy individual will be lower than those for an older person with pre-existing conditions. Similarly, car insurance premiums for a new driver with a clean record will differ from those for an experienced driver with multiple accidents. Homeowners insurance premiums also vary based on the value of the property, its location, and the level of coverage.

Comparison of Premiums for Different Coverage Levels

The following table illustrates how premiums can vary based on coverage levels for a hypothetical auto insurance policy. These are illustrative examples and actual premiums vary widely based on individual circumstances.

| Coverage Level | Liability Coverage | Collision Coverage | Comprehensive Coverage |

|---|---|---|---|

| Basic | $500/year | $300/year | $200/year |

| Standard | $750/year | $450/year | $300/year |

| Premium | $1000/year | $600/year | $400/year |

Factors Affecting Premium Costs

Insurance premiums, the price you pay for coverage, aren’t arbitrary figures. Numerous factors contribute to the final cost, making it crucial to understand these elements to secure the best possible value for your insurance needs. These factors can be broadly categorized into demographic details, driving and claims history, and the competitive landscape of insurance providers.

Demographic Factors Influencing Premiums

Several personal characteristics significantly impact insurance premium calculations. Age, for example, plays a considerable role. Younger drivers, statistically, are involved in more accidents, leading to higher premiums. Conversely, older drivers, while potentially having more health concerns, often have better driving records, resulting in potentially lower premiums. Location also matters; areas with higher crime rates or more frequent accidents tend to have higher insurance costs due to increased risk for insurers. Finally, health status can be a factor, particularly for health insurance, where pre-existing conditions or lifestyle choices can influence premium calculations. Individuals with excellent health profiles generally qualify for lower premiums.

Driving History’s Impact on Auto Insurance Premiums

Your driving record is a critical determinant of your auto insurance premium. A clean driving history, free of accidents and traffic violations, typically translates to lower premiums. Conversely, accidents, especially those deemed the driver’s fault, significantly increase premiums. The severity of the accident, the amount of damage, and the number of claims filed also influence the increase. Similarly, traffic violations, such as speeding tickets or driving under the influence (DUI), can lead to substantial premium hikes. Insurers view these incidents as indicators of higher risk.

Claims History and Future Premiums

Filing insurance claims directly affects future premiums. Each claim filed increases your risk profile in the eyes of insurers. While claims are the purpose of insurance, frequent claims suggest a higher likelihood of future claims, leading to premium increases. The type of claim also matters; a minor claim might have a smaller impact than a major accident claim. Insurers analyze claim history to assess the probability of future payouts, which directly influences the premium calculation. Maintaining a clean claims history is crucial for keeping premiums low.

Premium Comparison Across Insurance Providers

Premiums can vary significantly between different insurance providers, even for identical coverage. The following table illustrates a hypothetical scenario comparing premiums for a 30-year-old driver with a clean driving record living in a medium-risk area, seeking liability and collision coverage for a mid-sized sedan:

| Insurance Provider | Annual Premium (Liability) | Annual Premium (Collision) | Total Annual Premium |

|---|---|---|---|

| Provider A | $500 | $700 | $1200 |

| Provider B | $600 | $650 | $1250 |

| Provider C | $450 | $800 | $1250 |

| Provider D | $550 | $750 | $1300 |

Understanding Policy Details & Premium Structure

Understanding the specifics of your insurance policy is crucial for managing your costs effectively. This section delves into the key components that influence your premium and how they interact. Knowing these details allows you to make informed decisions about your coverage and budget.

Deductibles and Co-pays Influence Premiums

Deductibles and co-pays are common features of many insurance policies, particularly health insurance. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A co-pay is a fixed amount you pay for a covered healthcare service. Higher deductibles generally result in lower premiums because the insurer assumes less immediate risk. Conversely, lower deductibles usually lead to higher premiums as the insurer anticipates paying out more frequently. Similarly, policies with higher co-pays often have lower premiums compared to those with lower co-pays. For example, a health insurance plan with a $5,000 deductible might have a monthly premium of $200, while a plan with a $1,000 deductible might cost $300 per month. The difference reflects the increased risk the insurer takes on with the lower deductible.

Coverage Limits and Premium Costs

Coverage limits define the maximum amount your insurance company will pay for covered losses or expenses. Higher coverage limits generally translate to higher premiums because the insurer is committing to pay out more in the event of a significant claim. For instance, a car insurance policy with a $100,000 liability limit will typically have a higher premium than a policy with a $50,000 limit. This is because the insurer is taking on a greater financial risk with the higher limit. Similarly, higher coverage limits for homeowners insurance (covering property damage or liability) will also result in higher premiums.

Premium Payment Structures

Insurance companies offer various payment structures to accommodate different budgets and preferences. The most common options include monthly, quarterly, semi-annually, and annually. Paying annually often results in a small discount compared to monthly payments, as it simplifies administrative costs for the insurer. Monthly payments offer greater flexibility but may come with a slightly higher overall cost. Quarterly and semi-annual payments represent a middle ground between the two extremes. The specific payment options and any associated discounts will vary depending on the insurer and the type of insurance.

Comparison of Policy Options and Premiums

The following illustrates how different policy choices affect premiums. Note that these are illustrative examples and actual premiums will vary based on numerous factors including location, individual risk profile, and the insurer.

- Policy A: High deductible ($5,000), low co-pay ($25), lower coverage limits. Annual Premium: $1200

- Policy B: Moderate deductible ($2,000), moderate co-pay ($50), moderate coverage limits. Annual Premium: $1800

- Policy C: Low deductible ($500), high co-pay ($100), high coverage limits. Annual Premium: $2400

This comparison highlights the trade-off between premium cost and the level of out-of-pocket expenses and coverage you receive. Choosing the right policy involves carefully considering your individual needs and financial situation.

Illustrative Examples of Premium Calculation

Understanding how insurance premiums are calculated can seem complex, but breaking down the process reveals a logical system based on assessing risk. This section provides detailed examples of premium calculation for car and homeowners insurance, illustrating the key factors involved.

Car Insurance Premium Calculation Example

Let’s consider a 30-year-old individual, Sarah, applying for car insurance for a 2020 Honda Civic. Several factors influence her premium. Her driving history (clean record), age (lower risk than a teenager), location (a suburban area with lower accident rates than a major city), the type of car (a relatively safe and common model), and the coverage level (comprehensive and collision) all play a role. The insurer uses a complex algorithm that assigns numerical values to each factor. For instance, a clean driving record might reduce the base premium by 20%, while her age might reduce it by 15%. Her location might result in a further 10% reduction. The car model itself might contribute a base premium of $500 annually. The comprehensive and collision coverage will add significantly to this base cost, perhaps increasing it by another $600.

The insurer might use a formula similar to this (though actual formulas are proprietary and far more intricate):

Base Premium + (Coverage Costs) – (Discounts based on driving history, age, location, car safety features) = Total Premium

Using estimated values, this could look like: $500 + $600 – ($500 * 0.20) – ($500 * 0.15) – ($500 * 0.10) = $950. Therefore, Sarah’s annual premium might be approximately $950. This is a simplified example; real-world calculations involve many more variables and are far more nuanced.

Homeowners Insurance Premium Calculation Example

Consider John, a homeowner with a 2,000 square foot house in a low-risk area. His premium calculation will differ significantly from Sarah’s. Factors include the value of his home ($300,000), its location (low crime rate, low risk of natural disasters), the construction materials (brick, which is more fire-resistant than wood), security features (alarm system), and the coverage level (comprehensive coverage).

The insurer assesses the risk of various events, such as fire, theft, and liability claims. A higher-value home in a high-risk area would command a higher premium due to increased likelihood of significant losses. John’s low-risk location and the use of fire-resistant materials would lower his premium. The presence of a security system might offer a further discount. The total premium is calculated by summing the cost of covering different perils and adjusting for risk factors. Again, the actual formula is complex and proprietary, but a simplified representation might be:

Base Premium (based on home value) + (Coverage Costs) – (Discounts based on location, construction, security features) = Total Premium

For example, a base premium might be $1,000, with coverage costs adding another $500. Discounts for location and security features might total $200. This would result in a total annual premium of $1300. This is, again, a simplification for illustrative purposes.

Impact of Risk Factors on Premium Cost

Imagine a graph with “Premium Cost” on the vertical axis and “Risk Level” on the horizontal axis. As the risk level increases (represented by factors like age of driver, home location, credit score, etc.), the premium cost rises sharply. A low-risk profile (young, responsible driver with a good credit score living in a safe area) would be represented by a point close to the origin (low cost, low risk). Conversely, a high-risk profile (older car, high-crime area, poor credit) would be shown far to the right, with a significantly higher premium cost. The slope of this line demonstrates the sensitivity of the premium to changes in risk. The steeper the slope, the more dramatically the premium increases with higher risk levels.

Final Wrap-Up

Securing appropriate insurance coverage is a vital aspect of financial planning, and understanding insurance premiums is the cornerstone of this process. By grasping the factors that influence premium calculations, comparing different providers and policy options, and implementing cost-saving strategies, you can effectively manage your insurance expenses while ensuring you have the protection you need. This guide serves as a starting point for your journey towards informed insurance decisions, allowing you to confidently navigate the complexities of insurance pricing and secure the best possible value.

General Inquiries

What happens if I miss an insurance premium payment?

Missing a payment can lead to policy cancellation or suspension, leaving you without coverage. Late fees may also apply.

Can I negotiate my insurance premium?

While not always guaranteed, you can often negotiate with your insurer, particularly if you have a clean driving record or have bundled multiple policies.

How often are insurance premiums reviewed?

This varies by insurer and policy type. Some policies have annual reviews, while others might be reviewed less frequently.

What is the difference between a deductible and a premium?

A premium is the regular payment you make for insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.

Does my credit score affect my insurance premium?

In some jurisdictions, your credit score can influence your insurance premium. A higher credit score may result in lower premiums.