Navigating the world of health insurance can feel like deciphering a complex code. One of the most crucial aspects, and often the first question on everyone’s mind, is: “What will my monthly premium be?” This seemingly simple question opens a door to a multitude of factors that influence the final cost, from your age and location to the type of plan you choose and even your pre-existing conditions. Understanding these factors empowers you to make informed decisions about your healthcare coverage.

This guide aims to demystify the process of understanding health insurance premiums. We’ll explore the key variables that impact your monthly payments, compare different plan types and their associated costs, and provide practical strategies for finding affordable coverage. By the end, you’ll have a clearer picture of what constitutes your monthly premium and how to navigate the complexities of health insurance.

Types of Health Insurance Plans and Their Costs

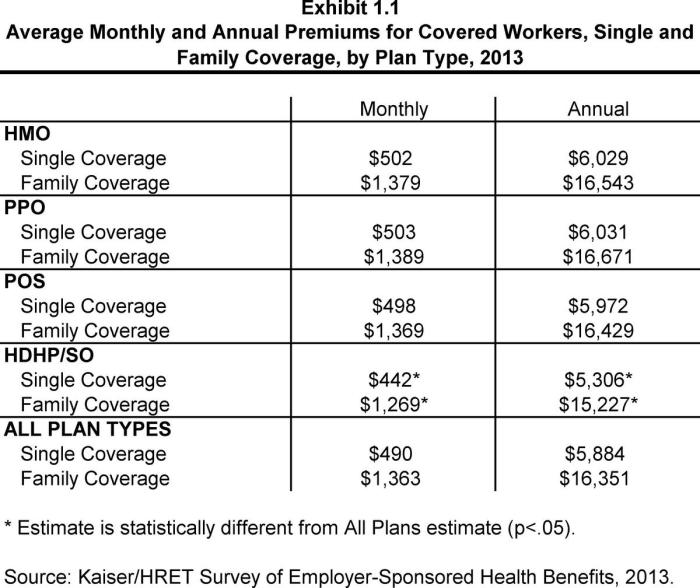

Choosing a health insurance plan can be complex, largely due to the variety of plan types and their associated costs. Understanding the differences between common plans, such as HMOs, PPOs, and POS plans, is crucial for making an informed decision that aligns with your healthcare needs and budget. This section will explore these plan types and illustrate how their structures impact monthly premiums.

HMO, PPO, and POS Plan Premiums

The monthly premiums for HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), and POS (Point of Service) plans vary significantly based on several factors, including your location, age, the plan’s coverage level, and the insurer. Generally, HMO plans tend to have the lowest monthly premiums because they offer a more limited network of providers. PPO plans typically have higher premiums than HMOs due to their broader network of doctors and specialists and greater flexibility in choosing care. POS plans fall somewhere in between, offering a compromise between the cost and flexibility of HMOs and PPOs. However, these are generalizations, and specific premium costs can differ substantially.

Examples of Plans with Varying Coverage and Premiums

Consider two hypothetical examples: a Bronze plan and a Platinum plan offered by the same insurance company in a particular region. A Bronze plan, which represents a lower level of coverage, might have a monthly premium of $250, but a high deductible of $7,000. This means the individual would pay a significant amount out-of-pocket before the insurance coverage kicks in. In contrast, a Platinum plan, offering significantly higher coverage, might have a monthly premium of $700 but a much lower deductible of $1,000. The higher premium reflects the greater financial protection offered. These are illustrative examples; actual premiums vary widely based on the specifics of the plan and individual circumstances.

High-Deductible vs. Low-Deductible Plan Costs

The difference in monthly premiums between high-deductible and low-deductible plans is substantial. A high-deductible health plan (HDHP) usually has a significantly lower monthly premium, but requires the policyholder to pay a much larger amount out-of-pocket before the insurance coverage begins. Conversely, a low-deductible plan boasts a higher monthly premium but offers more substantial coverage from the outset. For example, a high-deductible plan might have a monthly premium of $300 and a $6,000 deductible, while a low-deductible plan with similar coverage might have a monthly premium of $600 and a $1,000 deductible. The best choice depends on individual risk tolerance and financial capacity.

Monthly Premium Variations by Plan Type

| Plan Type | Average Monthly Premium (Example) | Deductible (Example) | Network Size |

|---|---|---|---|

| HMO | $350 | $2,000 | Limited |

| PPO | $500 | $1,500 | Extensive |

| POS | $400 | $1,800 | Moderate |

| High-Deductible Plan (HDHP) | $200 | $7,000 | Varies |

Finding Affordable Health Insurance

Securing affordable health insurance can feel daunting, but understanding the available resources and strategies can significantly simplify the process. This section Artikels practical steps to navigate the complexities of finding and obtaining cost-effective health coverage.

Resources for Finding Affordable Health Insurance

Several resources can assist individuals in their search for affordable health insurance. These resources provide information, guidance, and often direct access to enrollment platforms.

- Healthcare.gov: This is the official website for the Affordable Care Act (ACA) marketplace. It offers a comprehensive platform to compare plans, determine eligibility for subsidies, and enroll in coverage.

- State Insurance Marketplaces: Many states operate their own insurance marketplaces, often offering additional resources and support tailored to their specific populations. These marketplaces function similarly to Healthcare.gov.

- Insurance Brokers and Agents: Independent insurance brokers can provide personalized guidance, helping individuals navigate the various plan options and compare costs. They often work with multiple insurance providers.

- Employer-Sponsored Plans: Many employers offer health insurance as part of their employee benefits package. Reviewing these options is crucial, as employer-sponsored plans often offer competitive rates and comprehensive coverage.

- Medicaid and CHIP: Medicaid and the Children’s Health Insurance Program (CHIP) provide low-cost or no-cost health coverage to eligible individuals and families based on income and other factors.

Obtaining Premium Quotes from Insurance Providers

The process of obtaining premium quotes involves providing personal information to insurance providers. This information is used to assess your risk profile and determine your premium.

- Visit Provider Websites: Most insurance companies offer online tools to obtain quick quotes. You will typically need to input basic information such as age, location, and desired coverage level.

- Contact Insurance Brokers: Insurance brokers can provide quotes from multiple providers simultaneously, simplifying the comparison process. They can also answer questions about plan details and coverage.

- Use Online Comparison Tools: Several websites allow you to compare quotes from multiple providers side-by-side. These tools often filter options based on your specific needs and preferences.

Government Subsidies and Their Impact on Monthly Premiums

Government subsidies, primarily offered through the ACA marketplaces, can significantly reduce the cost of health insurance for eligible individuals and families.

These subsidies are based on income and family size. For example, a family of four earning $60,000 annually might qualify for a substantial subsidy, reducing their monthly premium by hundreds of dollars. The exact amount of the subsidy varies depending on the plan selected and individual circumstances. Subsidies are often directly applied to the monthly premium, making coverage more affordable.

Strategies for Reducing Monthly Health Insurance Costs

Several strategies can help reduce monthly health insurance costs.

- Choose a Higher Deductible Plan: Higher deductible plans generally have lower monthly premiums but require you to pay more out-of-pocket before insurance coverage kicks in.

- Consider a High Deductible Health Plan (HDHP) with a Health Savings Account (HSA): HDHPs paired with HSAs offer tax advantages and allow you to save pre-tax dollars to pay for medical expenses.

- Explore Different Coverage Levels: Plans with lower coverage levels typically have lower premiums but offer less comprehensive benefits.

- Shop Around and Compare Plans: Regularly comparing plans from different providers can uncover more affordable options.

Comparing Health Insurance Plans and Premiums: A Step-by-Step Guide

Comparing health insurance plans requires a systematic approach to ensure you choose the most suitable and affordable option.

- Gather Information: Collect quotes and plan details from different providers. Pay close attention to the monthly premium, deductible, copay, and out-of-pocket maximum.

- Analyze Coverage Details: Compare the benefits offered by each plan. Consider the network of doctors and hospitals included, prescription drug coverage, and other essential services.

- Consider Your Health Needs: Assess your individual health needs and choose a plan that aligns with your expected healthcare utilization. If you have pre-existing conditions, ensure the plan covers necessary treatments.

- Factor in Government Subsidies: If eligible, incorporate the value of any government subsidies into your cost analysis.

- Make a Decision: Based on your analysis, choose the plan that best balances affordability and comprehensive coverage.

Understanding Your Health Insurance Bill

Navigating your health insurance bill can feel overwhelming, but understanding its components is crucial for managing your healthcare costs effectively. This section will break down the key elements of a typical bill, helping you decipher the charges and understand your financial responsibility.

Your health insurance bill, often accompanied by an Explanation of Benefits (EOB), details the services you received, the costs associated with those services, and how your insurance plan covered those costs. Several key components contribute to the overall cost.

Components of a Health Insurance Bill

Understanding the different parts of your bill is key to avoiding unexpected expenses. The following components typically appear on your statement:

- Premiums: This is your regular monthly payment to maintain your health insurance coverage. The amount depends on your plan, your age, your location, and the number of people covered under the plan. Think of it as your membership fee for access to healthcare services.

- Deductible: This is the amount you must pay out-of-pocket for covered healthcare services before your insurance company begins to pay its share. For example, a $1,000 deductible means you pay the first $1,000 of your medical expenses before your insurance coverage kicks in.

- Copay: This is a fixed amount you pay for a covered healthcare service, such as a doctor’s visit or a prescription. Copays are typically due at the time of service. For instance, a $25 copay for a doctor’s visit means you’ll pay $25 each time you see your doctor, regardless of the total cost of the visit.

- Coinsurance: After you’ve met your deductible, coinsurance is the percentage of costs you’ll share with your insurance company. For example, an 80/20 coinsurance plan means your insurance company pays 80% of the covered expenses, and you pay the remaining 20%.

- Out-of-Pocket Maximum: This is the most you will pay out-of-pocket for covered services in a plan year. Once you reach this limit, your insurance company covers 100% of the costs for covered services for the remainder of the year. This provides a cap on your personal expenses.

Interpreting an Explanation of Benefits (EOB) Statement

The EOB is a summary of the healthcare services you received and how your insurance plan processed the claims. It details the charges, the amounts paid by the insurance company, and your responsibility. Understanding this document helps you verify that your claims were processed correctly and identify any potential discrepancies.

An EOB typically includes information such as the date of service, the provider’s name, the services rendered, the charges, the amount paid by the insurance company, the amount you owe, and the applicable codes and explanations for the coverage decisions.

For example, an EOB might show a doctor’s visit with a total charge of $200. Your copay was $25, which you paid at the time of service. Your insurance company covered the remaining $175 after applying your deductible and coinsurance. The EOB would clearly show these individual components and the final amount you owe (or have already paid).

Scenarios Impacting Monthly Costs

Several factors can influence your monthly healthcare expenses. Understanding these scenarios can help you budget more effectively.

- Preventative Care: Many plans cover preventative services, such as annual checkups and vaccinations, at no cost to you. Taking advantage of these services can help prevent more expensive health issues down the line.

- Unexpected Medical Expenses: Unexpected illnesses or injuries can significantly impact your healthcare costs. Hospitalizations, surgeries, and emergency room visits often result in substantial out-of-pocket expenses, even with insurance. Having an emergency fund can help mitigate the financial burden of these unexpected events. For instance, a broken leg requiring surgery and physical therapy could lead to thousands of dollars in expenses, even with insurance, exceeding the out-of-pocket maximum in some cases.

- Prescription Medications: The cost of prescription drugs can vary widely. Generic medications are typically cheaper than brand-name drugs. Your plan may require you to meet a deductible or pay a copay for prescription medications.

The Role of Pre-existing Conditions

Pre-existing conditions, health issues you have before starting a new health insurance plan, significantly impact your monthly premiums. Understanding how these conditions affect your costs is crucial for making informed decisions about your health insurance coverage. The Affordable Care Act (ACA) has played a pivotal role in shaping how insurers handle pre-existing conditions, but variations still exist among providers and plans.

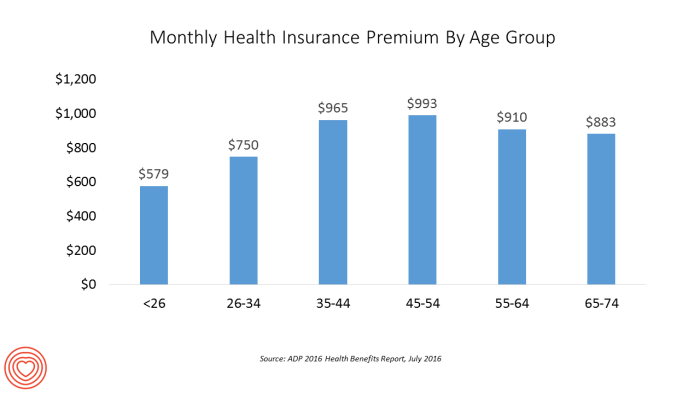

Impact of Pre-existing Conditions on Premiums

Pre-existing conditions can lead to higher monthly premiums because they increase the likelihood of needing expensive medical care. Insurers assess the potential risk associated with each individual based on their medical history. Someone with a history of heart disease, for example, is statistically more likely to require significant medical intervention compared to someone with no such history. This increased risk translates to higher premiums to offset the potential costs for the insurance company. The severity and the expected cost of managing the pre-existing condition directly influence the premium increase.

The Affordable Care Act and Pre-existing Conditions

The Affordable Care Act (ACA) significantly altered the landscape of health insurance in the United States by prohibiting insurers from denying coverage or charging higher premiums based solely on pre-existing conditions. Before the ACA, individuals with pre-existing conditions often faced difficulty obtaining affordable health insurance, or were denied coverage altogether. The ACA’s guaranteed issue provision ensures that individuals with pre-existing conditions can obtain coverage, although some cost-sharing may still apply. It is important to note that the ACA’s protections do not eliminate all cost variations, as explained below.

Variations in Insurer Practices

While the ACA prohibits discrimination based solely on pre-existing conditions, insurers still consider them when determining premiums. The way different providers handle pre-existing conditions and their associated costs varies. Some insurers might offer plans with higher premiums but more comprehensive coverage to accommodate the potential costs of managing pre-existing conditions. Others might offer more affordable plans with higher out-of-pocket costs, such as higher deductibles or co-pays. This highlights the importance of comparing plans carefully to find the best option that balances cost and coverage.

Potential Premium Increases Due to Pre-existing Conditions

The following table illustrates potential premium increases based on specific pre-existing conditions. These are illustrative examples and actual increases will vary significantly depending on factors such as age, location, the specific plan chosen, and the severity of the condition. It’s crucial to obtain personalized quotes from insurance providers for accurate cost estimations.

| Pre-existing Condition | Potential Premium Increase (%) | Notes | Example |

|---|---|---|---|

| Type 2 Diabetes | 10-25% | Varies based on severity and management needs. | A person with well-controlled diabetes might see a smaller increase than someone requiring insulin and frequent doctor visits. |

| Heart Disease | 15-35% | Dependent on the type and severity of heart condition. | Someone with mild hypertension might see a smaller increase than someone who has recently had a heart attack. |

| Cancer (in remission) | 20-40% | Significantly influenced by the type of cancer and length of remission. | A person in remission for five years from breast cancer might face a lower increase than someone recently diagnosed. |

| Asthma (severe) | 5-15% | Dependent on the frequency and severity of asthma attacks. | Someone requiring frequent hospitalizations would likely see a higher increase than someone with mild, infrequent symptoms. |

Outcome Summary

Securing affordable and adequate health insurance is a significant financial and personal decision. While the process of determining your monthly premium can initially seem daunting, understanding the contributing factors – age, location, plan type, and health status – allows for a more informed approach. By utilizing available resources, comparing plans, and understanding your health insurance bill, you can confidently navigate the system and find a plan that best suits your needs and budget. Remember, proactive planning and informed choices are key to securing your healthcare future.

Helpful Answers

What is a deductible?

A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance begins to pay.

What is a copay?

A copay is a fixed amount you pay for a covered healthcare service, like a doctor’s visit, at the time of service.

What is a co-insurance?

Co-insurance is the percentage of costs you share with your insurance company after you’ve met your deductible.

Can I change my health insurance plan during the year?

Generally, you can only change your health insurance plan during open enrollment periods, unless you experience a qualifying life event (e.g., marriage, job loss).

Where can I find help understanding my Explanation of Benefits (EOB)?

Contact your insurance provider directly; they can explain the details of your EOB.