Navigating the complexities of the Affordable Care Act (ACA) can feel overwhelming, especially when it comes to understanding financial assistance for health insurance. One crucial element often shrouded in mystery is the Premium Tax Credit (PTC). This guide aims to demystify the PTC, providing a clear and concise explanation of its purpose, eligibility requirements, and application process. Understanding the PTC is key to accessing affordable and quality healthcare under the ACA.

The Premium Tax Credit, a cornerstone of the ACA, offers financial assistance to eligible individuals and families to purchase health insurance through the Health Insurance Marketplace. This program significantly reduces the cost of monthly premiums, making health coverage accessible to those who might otherwise struggle to afford it. We will explore the intricacies of eligibility, calculation methods, and the overall impact of the PTC on healthcare access in the United States.

Definition of Premium Tax Credit (PTC)

The Premium Tax Credit (PTC) is a vital component of the Affordable Care Act (ACA), designed to make health insurance more affordable for millions of Americans. In essence, it’s a subsidy that helps eligible individuals and families pay their monthly health insurance premiums. Think of it as a government discount on your health insurance bill.

The PTC reduces the cost of monthly health insurance premiums purchased through the Health Insurance Marketplace (also known as the ACA Marketplace). It’s a crucial part of the ACA’s goal to expand access to affordable health coverage. The amount of the tax credit is determined based on several factors, including household income, location, and the cost of insurance plans in your area.

Purpose of the PTC within the ACA

The PTC plays a central role in achieving the ACA’s objective of expanding health insurance coverage. By lowering the cost of health insurance, it makes coverage accessible to individuals and families who otherwise might not be able to afford it. This directly addresses the issue of affordability, a major barrier to healthcare access for many Americans. The PTC helps to ensure that people can obtain essential healthcare services without facing significant financial hardship. This contributes to a healthier population overall.

Examples of Who Might Qualify for the PTC

Several factors determine eligibility for the PTC. Generally, individuals and families with incomes between 100% and 400% of the federal poverty level (FPL) may qualify. For example, a family of four with an annual income between approximately $26,500 and $106,000 in 2023 might be eligible. However, the exact income limits vary each year and depend on household size and location. Self-employed individuals, part-time workers, and those who are unemployed but have some income may also qualify. The specific requirements and eligibility criteria are updated annually, so it’s important to check the official government website for the most current information. For instance, a single individual with an income around $13,500 might also be eligible. Furthermore, eligibility is not limited to full-time employment; individuals working part-time or even those without a job may still qualify, provided their income falls within the stipulated ranges.

Eligibility Requirements for PTC

Obtaining a Premium Tax Credit (PTC) to help afford health insurance through the Affordable Care Act (ACA) marketplaces hinges on several key factors. Understanding these requirements is crucial for determining eligibility and accessing this valuable financial assistance.

Eligibility for the PTC is primarily determined by income, household size, citizenship or immigration status, and enrollment through the Health Insurance Marketplace. The interaction of these factors dictates whether an individual or family qualifies for a subsidy, and the amount of that subsidy.

Income Limitations and Household Size

The amount of the PTC, if any, is directly tied to both your household income and the number of people in your household. The lower your income, relative to the federal poverty level (FPL), the larger the potential tax credit. Household size significantly impacts this calculation because the FPL is adjusted based on family size. For example, a family of four will have a higher FPL threshold than a single individual. The exact income limits change annually and are adjusted for inflation. Those earning above a certain income threshold will not qualify for any PTC. The marketplace website provides updated income limits and calculators to help determine eligibility.

Citizenship and Immigration Status

Generally, U.S. citizens and nationals are eligible for the PTC. However, eligibility extends to some lawful immigration status holders as well. Specific requirements for lawful permanent residents and other qualifying non-citizens are defined by the IRS and may change periodically. Individuals should check the official guidelines to confirm their eligibility based on their specific immigration status. Those who are undocumented or lack legal immigration status are generally ineligible for the PTC.

Comparison with Other Government Assistance Programs

The PTC is distinct from other government assistance programs like Medicaid and CHIP (Children’s Health Insurance Program), although there can be overlap. Medicaid and CHIP typically provide more comprehensive coverage for lower-income individuals and families, often with no cost-sharing. However, eligibility for these programs also depends on income and household size, with more stringent requirements than the PTC. The PTC, on the other hand, is designed to help individuals and families who earn too much to qualify for Medicaid or CHIP but still need assistance affording marketplace health insurance. Individuals may qualify for one or both programs depending on their circumstances. It’s important to note that the specific rules and eligibility criteria for all programs are subject to change.

Calculating the PTC Amount

The Premium Tax Credit (PTC) calculation isn’t a simple formula; it depends on several factors, primarily your household income and the cost of health insurance in your area. The process involves comparing your income to the Federal Poverty Level (FPL), determining your eligibility percentage, and then applying that percentage to the cost of the lowest-cost silver plan available in your marketplace.

The higher your household income, the lower your PTC will be. In fact, there’s a maximum income limit beyond which you’re ineligible for any PTC assistance. This limit changes annually and is adjusted based on the FPL. The calculation itself is handled by the HealthCare.gov marketplace (or your state’s marketplace), but understanding the general principles is helpful.

Household Income’s Influence on PTC Amount

Your household income is the cornerstone of the PTC calculation. The Affordable Care Act (ACA) uses the Federal Poverty Level (FPL) as a benchmark. Your income is compared to the FPL for your household size. The percentage of the FPL your income represents determines your eligibility for a PTC and the size of that credit. For example, a household earning 200% of the FPL will receive a smaller PTC than a household earning 150% of the FPL. Importantly, as income rises above 400% of the FPL, PTC assistance phases out completely.

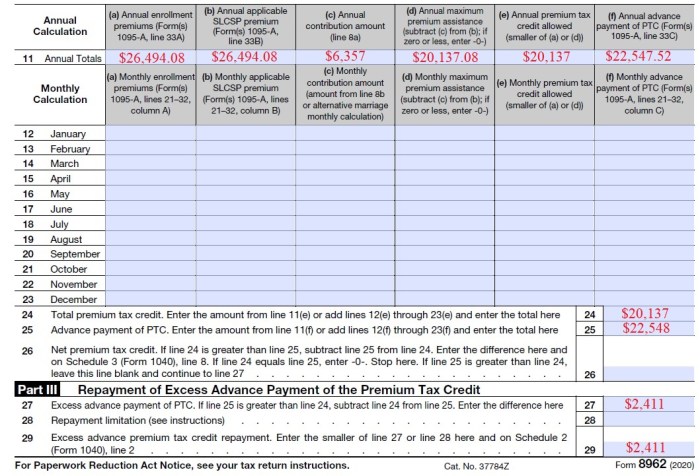

Illustrative PTC Calculations

The following table provides simplified examples. Remember that actual PTC amounts vary based on the specific cost of health insurance plans in your area, your location, and the plan you choose. These examples are for illustrative purposes only and should not be considered definitive calculations. Consult the HealthCare.gov website or your state marketplace for accurate and up-to-date information.

| Income Level (% of FPL) | Household Size | Calculated PTC (Example) | Percentage of Premium Covered (Example) |

|---|---|---|---|

| 150% | 2 | $4,000 | 75% |

| 200% | 4 | $2,000 | 50% |

| 250% | 1 | $500 | 25% |

| 300% | 3 | $0 | 0% |

Ending Remarks

Securing affordable healthcare is a fundamental right, and the Premium Tax Credit plays a vital role in making this a reality for millions of Americans. By understanding the intricacies of the PTC—from eligibility criteria to the application process—individuals can confidently navigate the ACA marketplace and access the financial assistance they deserve. Remember to regularly check for updates to the program, as regulations and eligibility requirements can change. Taking proactive steps to understand and utilize the PTC can lead to significant savings and improved access to essential healthcare services.

Answers to Common Questions

What happens if my income changes during the year?

You may need to report the change to the Marketplace. This could affect your PTC amount for the remainder of the year.

Can I still get the PTC if I’m self-employed?

Yes, self-employed individuals can qualify for the PTC as long as they meet the income and other eligibility requirements.

What if I don’t qualify for the PTC, are there other options?

Several other programs may offer assistance with healthcare costs, such as Medicaid or CHIP. You should explore these options if you don’t qualify for the PTC.

Is the PTC available in every state?

The PTC is generally available nationwide through the Health Insurance Marketplace, although specific eligibility rules may vary slightly by state.

How long does the application process take?

Processing times can vary, but it’s advisable to apply well in advance of the open enrollment period to allow sufficient time for processing.