Insurance premiums: the price we pay for peace of mind. But what exactly *is* an insurance premium, and why do they vary so dramatically? This guide unravels the mystery, explaining the concept in simple terms and illustrating it with real-world examples. We’ll explore the factors influencing premium costs, different payment structures, and how to understand your insurance premium notice. Understanding your premiums empowers you to make informed decisions about your financial protection.

From the seemingly straightforward monthly payment to the complex calculations behind it, understanding your insurance premium is crucial for managing your financial well-being. This exploration will delve into the intricacies of premium determination, providing a clear understanding of how various factors contribute to the final cost, and empowering you to navigate the world of insurance with confidence.

Defining “Premium” in Insurance

Insurance premiums are the regular payments you make to an insurance company in exchange for coverage. Think of it as your contribution to a shared risk pool that protects you from financial losses due to unforeseen events. This payment secures a promise from the insurer to compensate you for specified losses, up to the limits of your policy.

An insurance premium is the price paid for transferring the risk of financial loss from the policyholder to the insurance company. The insurer pools premiums from many policyholders, enabling them to pay out claims to those who experience covered losses. The premium calculation considers factors like the likelihood of a claim, the potential severity of the loss, and administrative costs. A higher risk profile typically results in a higher premium.

Premium Payment: Analogy

Imagine a community deciding to share the risk of house fires. Each homeowner contributes a small amount (the premium) to a shared fund. If one house burns down, the fund covers the rebuilding costs, reducing the individual financial burden on the homeowner. This collective effort spreads the risk and minimizes the impact of a significant loss for any single individual. The amount each homeowner contributes depends on factors such as the size of their house, its location (fire risk), and the level of protection they want.

A Beginner’s Guide to Insurance Premiums

Insurance premiums are the fees you pay to an insurance company for coverage against potential financial losses. The amount you pay depends on several factors, including the type of insurance, the coverage amount, your risk profile, and the insurer’s pricing. Paying your premiums regularly ensures your policy remains active and you’re protected when you need it most. A simple example: a car insurance premium is the monthly or annual payment you make to be covered for accidents or damage to your vehicle.

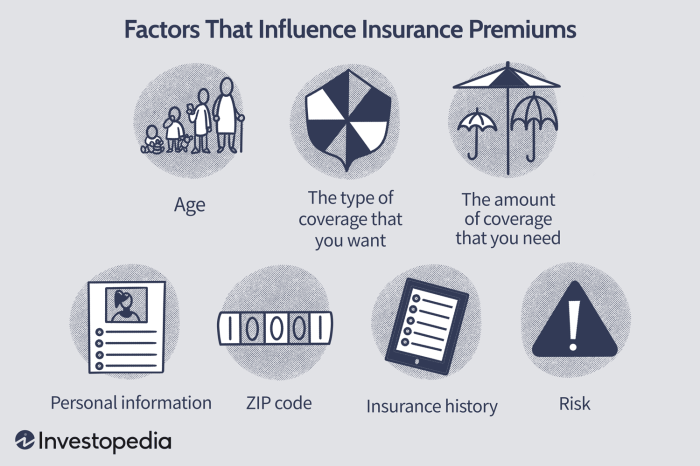

Factors Affecting Insurance Premiums

Insurance premiums, the amount you pay for coverage, aren’t arbitrary figures. Several interconnected factors influence the cost, ultimately reflecting the insurer’s assessment of risk. Understanding these factors empowers you to make informed decisions about your insurance choices and potentially lower your premiums.

Age, Health, and Lifestyle

These personal factors significantly influence premium calculations across various insurance types. Insurers consider age because risk profiles change throughout life. Younger individuals generally pay less for car insurance due to statistically lower accident rates, while older drivers might face higher premiums due to potential age-related health concerns impacting driving ability. Health conditions, particularly pre-existing conditions in health insurance, increase premiums as they indicate a higher likelihood of claims. Lifestyle choices like smoking, excessive alcohol consumption, or risky hobbies can also elevate premiums, reflecting the increased risk they pose. For example, a smoker applying for life insurance will likely receive a higher premium than a non-smoker of the same age and health status due to increased risk of health complications.

Premium Variations Across Insurance Types

Premium structures differ substantially depending on the type of insurance. Auto insurance premiums consider factors like vehicle type, driving history, location (urban areas often have higher rates due to increased accident frequency), and coverage level. Health insurance premiums vary based on age, health status, location, and the chosen plan’s coverage extent. Home insurance premiums depend on the property’s location, value, age, security features (alarms, security systems), and the level of coverage desired. For instance, a home in a high-risk area prone to natural disasters will command a higher premium compared to a similar home in a low-risk area.

Claims History

Your claims history significantly impacts future premiums. Filing multiple claims suggests a higher risk profile, leading insurers to increase premiums to offset potential future payouts. Conversely, a clean claims history usually translates to lower premiums as it indicates a lower likelihood of future claims. For example, an individual with a history of multiple car accidents will likely face higher auto insurance premiums than someone with a spotless driving record.

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Age | Individual’s age | Generally increases with age (except in some auto insurance cases), reflecting increased risk in certain insurance types. | A 65-year-old driver may pay more for auto insurance than a 25-year-old driver, while a younger person may pay more for health insurance. |

| Health | Pre-existing conditions, lifestyle choices | Poor health or risky lifestyle choices increase premiums across insurance types. | A smoker will pay more for life insurance than a non-smoker; someone with a pre-existing condition will pay more for health insurance. |

| Lifestyle | Driving habits, hobbies, occupation | Risky activities increase premiums. | A person with a history of speeding tickets will pay more for auto insurance; someone with a dangerous hobby (e.g., skydiving) might pay more for life insurance. |

| Claims History | Past claims filed with the insurer | Frequent claims lead to higher premiums. | Someone with multiple car accidents will pay more for auto insurance than someone with a clean driving record. |

Examples of Insurance Premiums

Understanding insurance premiums requires looking at real-world examples. The cost of your insurance is rarely a single number; it’s a reflection of numerous factors specific to your situation and the policy you choose. The following examples illustrate this complexity.

Auto Insurance Premium Example

This example illustrates the cost of auto insurance for a 30-year-old individual living in a suburban area with a clean driving record. The policy chosen is a comprehensive policy with liability coverage of $100,000 per person and $300,000 per accident, collision coverage, and uninsured/underinsured motorist coverage. The annual premium for this policy is approximately $1200. Several factors influence this cost, including the driver’s age (younger drivers generally pay more), location (areas with higher accident rates have higher premiums), driving history (accidents and traffic violations increase premiums), and the type of vehicle insured (more expensive vehicles generally cost more to insure). The clean driving record contributes to a lower premium than someone with several accidents or traffic tickets. The comprehensive coverage also adds to the overall cost compared to a more basic liability-only policy.

Homeowners Insurance Premium Example

A 45-year-old couple living in a rural area with a newly built, $350,000 home chose a homeowners insurance policy with a $1,000 deductible and liability coverage of $500,000. Their annual premium is approximately $1,500. This cost is affected by several factors, including the home’s location (rural areas often have lower premiums than urban areas), the home’s value (higher value homes typically have higher premiums), the age and condition of the home (newer homes in good condition usually cost less to insure), the deductible amount (higher deductibles lead to lower premiums), and the level of coverage selected (more comprehensive coverage results in higher premiums). The couple’s lack of prior claims also contributes to a lower premium. The specific features of the home, such as security systems, also play a role in determining the final premium.

Health Insurance Premium Example

A 60-year-old individual with a pre-existing condition (diabetes) living in a city with a high cost of living opted for a comprehensive health insurance plan with a low deductible. Their monthly premium is $750. This cost is influenced by numerous factors, including age (older individuals generally pay higher premiums), health status (pre-existing conditions significantly increase premiums), location (areas with higher healthcare costs have higher premiums), and the type of plan chosen (plans with lower deductibles and more comprehensive coverage typically cost more). The pre-existing condition is a major factor driving up the premium. The individual’s choice of a plan with low out-of-pocket expenses contributes significantly to the higher monthly cost.

Ending Remarks

In conclusion, understanding your insurance premium is key to responsible financial planning. By grasping the factors influencing premium costs, exploring various payment options, and interpreting your premium notice effectively, you can make informed decisions about your insurance coverage. Remember, a little knowledge can go a long way in securing your financial future. This guide provides a foundation for further exploration and empowers you to engage confidently with your insurance provider.

Q&A

What happens if I don’t pay my insurance premium?

Failure to pay your premium on time can result in your policy being canceled, leaving you without coverage. Late payment fees may also apply.

Can I negotiate my insurance premium?

While not always guaranteed, you can sometimes negotiate your premium by bundling policies, improving your credit score, or shopping around for better rates.

How often are insurance premiums reviewed?

The frequency of premium reviews varies by insurer and policy type. Some policies have annual reviews, while others may be reviewed less frequently.

What is a deductible, and how does it relate to my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles usually result in lower premiums.