Understanding insurance premiums is crucial for navigating the world of financial protection. This seemingly simple concept—the price you pay for an insurance policy—encompasses a complex interplay of factors, from your personal risk profile to the insurer’s operational costs. This guide unravels the intricacies of insurance premiums, demystifying the process and empowering you to make informed decisions about your coverage.

From defining what constitutes a premium to exploring how various factors influence its calculation, we will delve into the different types of premiums, payment options, and how to interpret your premium statement. We’ll also examine how you can potentially adjust or lower your premiums, ultimately aiming to provide a holistic understanding of this essential aspect of insurance.

Defining “Premium” in Insurance

An insurance premium is essentially the price you pay for an insurance policy. Think of it as your monthly or annual fee for the protection and financial security the insurance company provides against covered risks. This payment guarantees the insurer’s commitment to compensate you for losses or damages specified within the policy’s terms and conditions.

Insurance Premium Explained

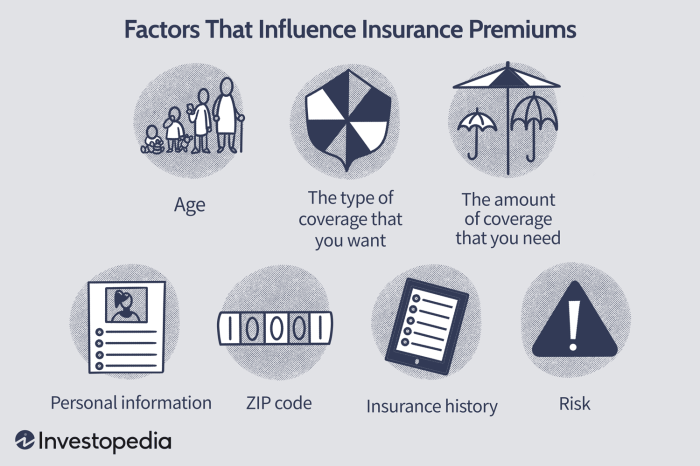

The insurance premium is calculated based on a variety of factors, ensuring the insurer can adequately cover potential claims while maintaining profitability. These factors include the type of coverage, the level of risk associated with the insured item or person, and the insurer’s administrative and operational costs. The more risk involved, the higher the premium tends to be. For example, a person with a history of accidents will typically pay more for car insurance than someone with a clean driving record.

Components of an Insurance Premium

Several key components contribute to the overall cost of an insurance premium. A significant portion goes towards paying out claims filed by policyholders. The insurer must maintain sufficient reserves to cover expected and unexpected claims. Administrative costs, encompassing salaries, technology, marketing, and general business expenses, also factor into the premium. Finally, a profit margin is included to ensure the insurer’s financial viability and to compensate for the inherent risk in the insurance business. The precise breakdown varies significantly among insurers and policy types.

Comparison of Premiums Across Different Insurance Types

The following table provides a simplified comparison of average annual premiums for different types of insurance. Remember that actual premiums vary considerably based on individual circumstances, location, and the specific policy details.

| Insurance Type | Average Annual Premium (USD) | Factors Affecting Premium | Typical Coverage |

|---|---|---|---|

| Auto Insurance | $1,500 | Driving record, vehicle type, location | Liability, collision, comprehensive |

| Health Insurance | $7,000 | Age, health status, location, plan type | Doctor visits, hospital stays, prescription drugs |

| Homeowners Insurance | $1,200 | Home value, location, coverage amount | Damage to home, liability, theft |

| Life Insurance | $1,000 | Age, health, policy type (term vs. whole life) | Death benefit to beneficiaries |

Understanding Your Insurance Premium Statement

Your insurance premium statement is a crucial document detailing the costs associated with your insurance policy. Understanding its components allows you to verify accuracy, identify potential overcharges, and ensure you’re paying the correct amount for the coverage you’ve selected. This section will guide you through interpreting your premium statement effectively.

Components of an Insurance Premium Statement

A typical insurance premium statement includes several key components. These components provide a comprehensive overview of your insurance costs and the factors influencing them. Understanding each element is vital for accurate financial planning and effective policy management.

| Component | Description |

|---|---|

| Policy Number | A unique identifier for your specific insurance policy. |

| Policyholder Information | Your name, address, and contact details as listed on the policy. |

| Policy Period | The dates your insurance coverage is active. |

| Premium Amount | The total cost of your insurance coverage for the policy period. |

| Premium Breakdown | A detailed list of charges contributing to the total premium, including coverage types, deductibles, and applicable fees. |

| Payment Method | How you are paying your premium (e.g., credit card, bank transfer). |

| Payment Due Date | The date your premium payment is due. |

| Outstanding Balance (if any) | The amount you owe if your payment is not up to date. |

| Contact Information | Details on how to contact your insurer if you have questions or require assistance. |

Interpreting Your Premium Statement: A Step-by-Step Guide

Carefully reviewing your premium statement is essential to ensure accuracy. Following these steps will help you understand and verify the information provided.

- Verify Policy Information: Check that your policy number, name, address, and policy period are correct.

- Review Premium Breakdown: Examine the detailed breakdown of your premium. This should clearly list each component contributing to the total cost. Look for unexpected or unusually high charges.

- Compare to Previous Statements: If this isn’t your first statement, compare it to previous ones to identify any significant changes in your premium and their reasons.

- Check Payment Information: Ensure the payment method and due date are accurate and align with your payment arrangements.

- Calculate Total Premium: Manually add up the individual charges in the premium breakdown to ensure it matches the total premium amount stated.

Identifying Potential Errors or Discrepancies

Discrepancies can occur; proactive identification prevents financial issues.

- Unexpected Charges: Any charges not previously communicated or understood should be investigated.

- Incorrect Calculations: If your manual calculation of the total premium differs from the statement’s total, contact your insurer immediately.

- Missing Information: Incomplete or missing information within the statement should be clarified with your insurer.

- Inconsistent Information: Any contradictions between different sections of the statement require immediate attention.

Example Insurance Premium Statement

Below is a sample premium statement illustrating the typical information included. Note that this is a simplified example, and actual statements may vary depending on your insurer and policy.

This is a sample premium statement and does not reflect any specific insurance policy or provider.

| Policy Number: | 1234567890 |

|---|---|

| Policyholder: | John Doe |

| Policy Period: | 01/01/2024 – 12/31/2024 |

| Coverage Type | Amount |

| Liability Coverage | $500 |

| Collision Coverage | $300 |

| Comprehensive Coverage | $200 |

| Administrative Fee | $50 |

| Total Premium: | $1050 |

| Payment Due Date: | 01/15/2024 |

Illustrative Examples of Premium Calculations

Insurance premiums are not arbitrary numbers; they are calculated based on a variety of factors specific to the policyholder and the type of insurance. Understanding this calculation process allows for a more informed approach to selecting and managing insurance coverage. The following examples demonstrate how premiums are determined for two common types of insurance: car insurance and health insurance.

Car Insurance Premium Calculation

Let’s consider a hypothetical scenario for a 30-year-old individual, Maria, applying for car insurance. Several factors contribute to her premium. Her vehicle is a 2020 Honda Civic, and she lives in a suburban area with a relatively low crime rate. She has a clean driving record with no accidents or tickets in the past five years. She opts for liability coverage of $100,000 and collision and comprehensive coverage with a $500 deductible.

The insurer uses a base rate for her vehicle type, age, and location. Let’s assume this base rate is $800 annually. Her clean driving record earns her a discount, say 20%, reducing the base rate to $640. The addition of collision and comprehensive coverage adds to the premium, let’s say $400. Finally, the chosen liability coverage level adds another $200. Therefore, Maria’s total annual premium would be $640 + $400 + $200 = $1240. This is a simplified example; in reality, numerous other factors could influence the final premium.

Health Insurance Premium Calculation

Calculating health insurance premiums is significantly more complex. Consider John, a 55-year-old male with a history of high blood pressure. His premium will be influenced by several key factors: age, health status, location, and the chosen plan.

Older individuals generally pay higher premiums due to increased risk of health issues. John’s age contributes significantly to his premium. His pre-existing condition, high blood pressure, further increases the cost, as it indicates a higher likelihood of requiring medical care. The plan he chooses—a high-deductible plan versus a low-deductible plan—also greatly impacts the premium; high-deductible plans generally have lower premiums but require higher out-of-pocket expenses. His location also plays a role, as healthcare costs vary geographically. Let’s assume his base premium due to age and location is $1000. The high blood pressure adds a surcharge, say 30%, resulting in an additional $300. If he chooses a plan with a lower deductible, the premium could further increase by $200. Therefore, his total annual premium could be $1000 + $300 + $200 = $1500. Again, this is a simplified example and actual premiums are far more intricate.

Visual Representation of Premium Breakdown: A Pie Chart

A pie chart depicting Maria’s car insurance premium would show several segments. The largest segment would represent the base rate (approximately 52%), reflecting the core cost associated with her vehicle, age, and location. The next largest segment would be collision and comprehensive coverage (approximately 32%). A smaller segment would represent the liability coverage (approximately 16%). This visual representation clearly illustrates the proportional contribution of each factor to the total premium. A similar pie chart for John’s health insurance premium would show larger segments for age and pre-existing conditions, with smaller segments for the chosen plan type and location. The exact proportions would depend on the specific factors and their influence in each individual case.

Closure

In conclusion, understanding your insurance premium is not merely about knowing the cost; it’s about understanding the value you receive for that cost. By grasping the factors influencing premiums, the different payment methods available, and how to interpret your premium statement, you can effectively manage your insurance costs and ensure you have the appropriate level of coverage for your needs. Armed with this knowledge, you can navigate the insurance landscape with greater confidence and make informed decisions that best protect your financial well-being.

General Inquiries

What happens if I miss a premium payment?

Missing a premium payment can lead to your policy being canceled or lapsed, leaving you without coverage. Late fees may also apply. Contact your insurer immediately if you anticipate difficulty making a payment to explore options.

Can I negotiate my insurance premium?

While not always possible, you can often negotiate your premium by shopping around for different insurers, improving your risk profile (e.g., better driving record, home security upgrades), or opting for a higher deductible.

How often are insurance premiums reviewed?

Premium reviews vary by insurer and policy type. Some policies have annual reviews, while others might be reviewed less frequently. Your policy documents will Artikel the review process.

What does “actuarial analysis” mean in relation to premiums?

Actuaries use statistical methods to assess risk and predict future claims. This analysis heavily influences the calculation of insurance premiums, ensuring the insurer can cover potential payouts while remaining profitable.