Purchasing a home is a significant financial undertaking, often requiring a mortgage loan. However, many borrowers don’t fully understand the intricacies of mortgage insurance premiums (MIPs). These premiums, essentially insurance policies protecting lenders against borrower defaults, can significantly impact the overall cost of homeownership. This guide will demystify MIPs, exploring their purpose, calculation, payment schedules, and cancellation possibilities, empowering you to navigate the complexities of home financing with confidence.

Understanding mortgage insurance premiums is crucial for prospective homeowners. This knowledge allows for informed decision-making, enabling buyers to accurately budget for their new home and avoid unexpected financial burdens. From determining eligibility and calculating premiums to understanding cancellation options, this guide provides a clear and concise overview of this important aspect of homeownership.

What are Mortgage Insurance Premiums (MIPs)?

Mortgage insurance premiums (MIPs) are insurance payments made by borrowers to protect lenders against potential losses if the borrower defaults on their home loan. Essentially, they’re a safety net for the lender, ensuring they recoup their investment even if the homeowner fails to make payments. MIPs are a common requirement for many types of mortgages, particularly those with a lower down payment.

Mortgage Insurance Premiums: Their Purpose and Types

MIPs serve a crucial function in the mortgage lending process. They mitigate the risk for lenders, especially when borrowers put down less than 20% of the home’s purchase price. This reduced risk allows lenders to offer mortgages to a broader range of borrowers, including those who may not have substantial savings for a large down payment. The premiums generated contribute to a fund that covers losses incurred by lenders when borrowers default.

Types of Mortgage Insurance Premiums

There are primarily two main types of MIPs: upfront and annual premiums. Upfront MIPs are a one-time payment made at the closing of the mortgage. Annual MIPs, also known as monthly premiums, are paid along with the monthly mortgage payment throughout the loan term. The specific type of MIP required depends on the loan program and the borrower’s circumstances. Some loan programs may even require both an upfront and an annual MIP.

Situations Requiring MIPs

MIPs are most frequently required when a borrower obtains a conventional loan with a down payment of less than 20% of the home’s purchase price. This is because a smaller down payment represents a higher risk for the lender. However, MIPs may also be required for other types of loans, such as Federal Housing Administration (FHA) loans, even if the down payment is higher. The specific requirements vary based on the loan program and the lender’s policies. For example, a borrower purchasing a $300,000 home with a 10% down payment ($30,000) would likely be required to pay MIPs, while a borrower purchasing the same home with a 20% down payment ($60,000) would likely not.

Comparison of Different MIP Programs

| Program Name | Eligibility Criteria | Premium Calculation | Cancellation Conditions |

|---|---|---|---|

| Conventional Loan with MIP | Conventional loan with less than 20% down payment | Based on loan-to-value ratio (LTV); can be upfront, annual, or both | Typically canceled once LTV reaches 80% through equity build-up or refinancing |

| FHA Loan Insurance | FHA-insured loan | Annual premium based on loan amount and loan term; upfront MIP may also apply | Cancellation conditions vary depending on the loan and the year it was originated. It’s often canceled once the loan is paid off. |

| VA Loan Funding Fee | VA-guaranteed loan | One-time fee based on loan amount and the borrower’s military service history. Can be financed into the loan. | Not typically canceled unless the loan is paid off. |

| USDA Loan Guarantee Fee | USDA-guaranteed loan for rural properties | Annual guarantee fee based on loan amount. An upfront guarantee fee may also apply. | Not typically canceled unless the loan is paid off. |

Who Pays Mortgage Insurance Premiums?

Mortgage insurance premiums (MIPs) are a crucial aspect of home financing, and understanding who bears the cost is vital for prospective homeowners. The responsibility for paying MIPs primarily falls on the borrower, the individual taking out the mortgage. However, the exact arrangement can vary depending on the type of mortgage and the lender’s specific terms.

MIP payments are a significant factor in a borrower’s overall budget. They represent an additional monthly expense on top of the principal and interest payments, property taxes, and homeowner’s insurance. This added cost can significantly impact a homebuyer’s financial capacity and their ability to comfortably manage their monthly expenses. The impact of MIPs on affordability is directly proportional to the size of the loan and the length of the mortgage term.

MIPs and the Overall Cost of Homeownership

MIPs contribute substantially to the overall cost of homeownership. They add to the total amount paid over the life of the loan, increasing the total cost beyond the original loan amount. For example, a homebuyer with a $300,000 mortgage might pay an additional $10,000 or more in MIPs over the loan’s term, depending on the loan-to-value ratio (LTV) and the type of MIP. This increased cost should be carefully considered when budgeting for homeownership. It’s crucial to factor MIPs into the long-term financial projections for responsible homeownership.

Illustrative Scenario: MIP Impact on Monthly Payments

Consider a first-time homebuyer purchasing a $300,000 home with a 5% down payment ($15,000). This leaves an $285,000 loan. If the lender requires MIPs due to the relatively high LTV ratio, the monthly payment will include not only principal and interest but also the MIP. Let’s assume a 30-year fixed-rate mortgage at 6% interest with an annual MIP of 0.5%. This would translate to an additional monthly payment of approximately $71.25 (calculated as 0.5%/12 * $285,000). Therefore, the total monthly payment would be significantly higher than the principal and interest alone. This additional cost can be substantial and must be considered when determining affordability. This scenario highlights the need for careful budgeting and financial planning when dealing with MIPs. The actual amount will vary based on factors such as interest rates, loan amount, and MIP rate.

How are Mortgage Insurance Premiums Calculated?

Calculating mortgage insurance premiums (MIPs) involves several factors and isn’t a simple, single formula. The exact calculation depends on the type of mortgage, the loan-to-value ratio (LTV), and sometimes the borrower’s credit score. The process generally involves a combination of upfront and annual premiums.

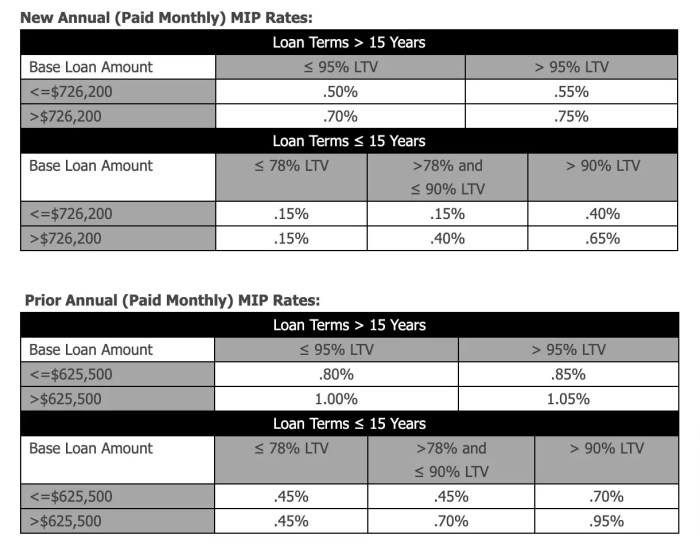

The primary factors influencing MIP calculations are the loan amount, the down payment (which determines the LTV), and the type of mortgage. For FHA loans, the credit score also plays a significant role. Lenders use established formulas and guidelines set by government agencies or private mortgage insurers to determine the premium amounts. These formulas are complex and often involve actuarial tables reflecting risk assessments. It’s important to remember that these calculations are not static; they can change based on market conditions and government policy.

Factors Influencing MIP Calculation

Several key factors interact to determine the final MIP amount. Understanding these factors is crucial for borrowers to accurately estimate their overall mortgage costs. These factors include:

- Loan Amount: The higher the loan amount, the higher the MIP will generally be, as the risk to the insurer increases.

- Loan-to-Value Ratio (LTV): This is the ratio of the loan amount to the property’s appraised value. A lower LTV (meaning a larger down payment) indicates less risk and typically results in lower MIPs or even eliminates the need for MIPs entirely. For example, an 80% LTV loan will generally have a higher MIP than a 70% LTV loan.

- Type of Mortgage: Different mortgage types (e.g., FHA, VA, conventional) have different MIP calculation methods and rates. FHA loans, for example, often require MIPs even with larger down payments, while VA loans typically don’t require MIPs but may have funding fees.

- Credit Score (for FHA loans): A higher credit score generally translates to a lower MIP for FHA loans, reflecting a lower perceived risk of default.

MIP Calculation Methods

The precise formulas used to calculate MIPs are complex and vary depending on the mortgage type and insurer. However, the general process involves assessing the risk associated with the loan and applying a corresponding premium rate. This rate is often expressed as a percentage of the loan amount or a percentage of the annual loan amount.

For FHA loans, the calculation typically involves an upfront MIP paid at closing and an annual MIP paid as part of the monthly mortgage payment. The upfront MIP is usually a percentage of the loan amount, while the annual MIP is a percentage of the remaining loan balance.

For conventional loans with private mortgage insurance (PMI), the calculation is similarly based on risk factors such as LTV and credit score, but the specific formulas are proprietary to the private mortgage insurers.

MIP Calculation Examples

Let’s illustrate with simplified examples. Remember that these are simplified examples and do not reflect the complexities of real-world calculations.

- Example 1: FHA Loan: Assume a $200,000 FHA loan with an LTV of 96.5% and a good credit score. The upfront MIP might be 1.75% of the loan amount ($3,500), and the annual MIP might be 0.85% of the loan balance, paid monthly. This would result in an additional monthly payment of approximately $141.67 ($3,500/12 months).

- Example 2: Conventional Loan: A $300,000 conventional loan with an LTV of 90% and a good credit score might have an annual PMI rate of 0.5% to 1% of the loan amount, depending on the lender and risk assessment. This would translate to a monthly PMI payment of $125 to $250 ($3000 to $6000/12 months).

It is crucial to obtain a Loan Estimate from your lender to get precise MIP calculations for your specific situation.

Can Mortgage Insurance Premiums be Cancelled or Refunded?

Mortgage insurance premiums (MIPs), while a necessary cost for many borrowers, aren’t necessarily a permanent expense. Under certain circumstances, cancellation or a refund of previously paid premiums may be possible. The specific conditions and process depend on the type of mortgage and the lender’s policies, but generally revolve around reaching a certain level of equity in the home.

Cancellation or refund of MIPs is possible when specific conditions are met. These conditions primarily focus on achieving a sufficient level of equity in the mortgaged property. This usually means that the homeowner has paid down a significant portion of their loan, resulting in a loan-to-value ratio (LTV) that falls below the threshold requiring MIPs. The exact LTV threshold varies depending on the loan type and the year the mortgage was originated. For example, for FHA loans, reaching an LTV of 80% may trigger eligibility for MIP cancellation.

Conditions for MIP Cancellation or Refund

Reaching a specific loan-to-value ratio (LTV) is the primary condition. This ratio compares the outstanding loan balance to the current appraised value of the property. Once the LTV drops below the threshold set by the mortgage insurer (e.g., FHA, VA, or a private insurer), cancellation may be possible. Additional factors, such as the type of mortgage (FHA, conventional, etc.), the year the mortgage was originated, and the lender’s specific policies, can also influence eligibility. Some lenders may also require a formal appraisal to verify the property’s current value.

Process for Cancelling or Requesting a Refund of MIPs

The process for canceling or requesting a refund of MIPs typically involves several steps. It’s crucial to understand that the process can vary depending on your lender and the type of mortgage you have. It’s always recommended to contact your lender directly for specific instructions.

- Verify Eligibility: Determine if your LTV has fallen below the required threshold for MIP cancellation. You can usually find this information in your mortgage documents or by contacting your lender.

- Gather Necessary Documentation: This may include a copy of your mortgage statement, a recent appraisal of your home (if required by your lender), and any other documentation your lender requests.

- Submit a Formal Request: Contact your lender and formally request cancellation of your MIPs. Provide them with the necessary documentation.

- Review Lender’s Response: Your lender will review your request and inform you of their decision. If approved, they will Artikel the process for any refund or adjustment to your monthly payments.

- Monitor Account Updates: Once the cancellation is processed, monitor your mortgage account statements to ensure the MIPs are no longer being charged.

Examples of Situations Where a Refund Might be Possible

A homeowner with an FHA loan who initially paid MIPs and has since paid down their loan to the point where their LTV is below 80% might be eligible for a refund or cancellation of future MIP payments. Similarly, a borrower with a conventional loan and private mortgage insurance (PMI) may qualify for PMI cancellation once their LTV reaches 80%, resulting in a potential refund of previously paid premiums. However, the specifics depend on the terms of their mortgage agreement and lender policies. Note that not all private mortgage insurance allows for refunds, and some may have different cancellation policies than the FHA or VA.

Illustrative Examples of MIPs in Action

Understanding how Mortgage Insurance Premiums (MIPs) affect your mortgage payments and overall cost requires looking at concrete examples. The following illustrations demonstrate the impact of MIPs on both your monthly budget and your long-term financial picture.

MIPs Impact on a Mortgage Amortization Schedule

Imagine a visual representation of a standard mortgage amortization schedule, displayed as a table with columns for month, beginning balance, payment, interest, principal, and ending balance. A second, identical table is placed alongside the first, representing a mortgage with MIPs included. Both tables begin with the same loan amount and interest rate. The key difference is that the “payment” column in the second table will show consistently higher monthly payments throughout the loan term due to the addition of the MIP. The “principal” column in the second table will initially show a slightly lower amount of principal reduction each month compared to the first table, reflecting the portion of the payment allocated to MIPs. Consequently, the “ending balance” in the second table will show a slightly higher remaining balance compared to the first table at any given point during the loan term. Visually, this difference would be emphasized through contrasting colors or shading, clearly illustrating the extra cost incurred by the MIPs over the life of the loan. The total interest paid over the life of the loan would also be higher for the mortgage with MIPs, further highlighted in the visualization.

Borrower Equity and MIP Cancellation

Let’s consider a hypothetical scenario: Sarah purchases a home for $300,000 with a 10% down payment ($30,000), securing a mortgage of $270,000. Because her down payment is less than 20%, she’s required to pay MIPs. Over the first five years, Sarah diligently makes her mortgage payments, and her home appreciates in value by 15%, bringing its market value to $345,000. Simultaneously, she pays down her principal, reducing her mortgage balance to $240,000. Her equity now represents the difference between her home’s market value ($345,000) and her remaining mortgage balance ($240,000), totaling $105,000. Because her loan-to-value ratio (LTV) – the ratio of her mortgage balance to the home’s value – is now below 80% (approximately 69.6%), she can apply to have her MIPs canceled. The lender will review her application, and if approved, Sarah will no longer have to pay the MIPs, resulting in lower monthly mortgage payments for the remaining loan term. This example demonstrates how building equity through timely payments and property appreciation can lead to the cancellation of MIPs and significant long-term savings.

Conclusion

Securing a mortgage involves more than just securing a loan; understanding the nuances of mortgage insurance premiums is paramount. This guide has explored the various facets of MIPs, from their purpose and calculation methods to payment schedules and cancellation possibilities. By grasping these concepts, prospective homeowners can make informed decisions, budget effectively, and navigate the home-buying process with greater clarity and financial security. Remember, proactive research and a thorough understanding of MIPs are essential for responsible homeownership.

Detailed FAQs

What’s the difference between PMI and MIP?

PMI (Private Mortgage Insurance) is for conventional loans with less than 20% down payment. MIP (Mortgage Insurance Premium) is for FHA-insured loans.

Can I refinance to get rid of MIP?

Possibly. Refinancing to a loan with at least 20% equity might allow you to eliminate MIP, depending on the loan type and lender requirements.

What happens if I miss a MIP payment?

Late payments can lead to penalties and potentially affect your credit score, increasing the risk of foreclosure.

Are MIPs tax deductible?

Generally, no, but consult a tax professional for personalized advice as regulations may change.