Buying a home is a significant financial undertaking, and understanding all associated costs is crucial. One often-overlooked expense is the Mortgage Insurance Premium (MIP). This seemingly small detail can significantly impact your overall mortgage costs, potentially adding thousands of dollars to your total repayment. This guide delves into the intricacies of MIP, explaining its purpose, calculation, payment methods, and ultimate effect on your homeownership journey.

We will explore various aspects of MIP, including the different types available, factors influencing its calculation (such as loan-to-value ratio and credit score), and how it varies across different mortgage types and lenders. We’ll also examine how MIP payments are structured and the conditions under which it might be canceled or removed. Finally, we’ll compare MIP to other mortgage costs to provide a comprehensive understanding of its place in the overall financial picture.

Definition of Mortgage Insurance Premium (MIP)

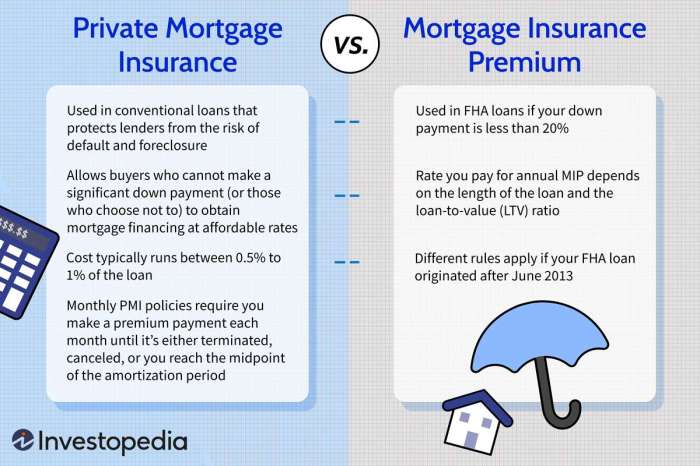

A Mortgage Insurance Premium (MIP) is an insurance policy protecting the lender in case a borrower defaults on their mortgage loan. It essentially safeguards the lender against potential financial losses if the homeowner fails to make their mortgage payments. This insurance is particularly relevant for loans with a lower down payment, as these carry a higher risk of default.

The fundamental nature of a MIP is to transfer the risk of default from the lender to the insurer. By paying the MIP, the borrower helps mitigate that risk for the lender, making it more likely that the lender will approve the loan. This allows individuals with smaller down payments to access homeownership.

Types of Mortgage Insurance Premiums

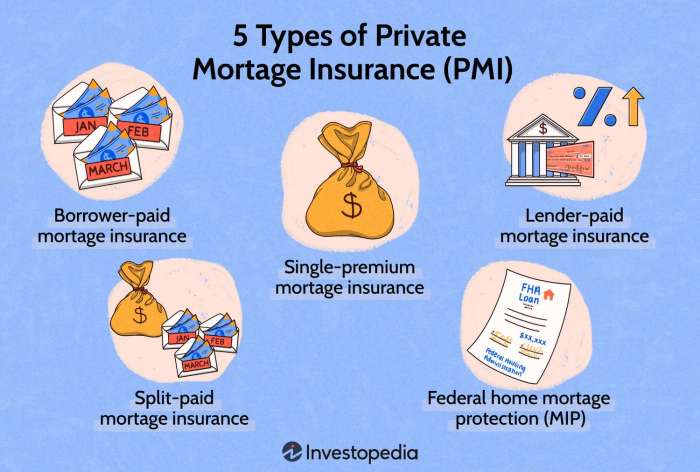

MIPs are categorized in several ways, depending on the type of loan and the borrower’s situation. Understanding these distinctions is crucial for accurately calculating the total cost of homeownership.

Upfront MIP and Annual MIP

The most common types of MIPs are the upfront MIP and the annual MIP (also known as the annual premium). An upfront MIP is a one-time payment made at the closing of the loan, typically calculated as a percentage of the loan amount. This percentage varies based on the loan-to-value ratio (LTV) and other factors. The annual MIP, on the other hand, is paid monthly as part of the mortgage payment and continues for the life of the loan or until a certain equity threshold is reached. For example, a borrower with a 90% LTV might pay a 1.75% upfront MIP and a 0.5% annual MIP.

Single-Premium MIP

A less common but still relevant type is the single-premium MIP. This is a one-time payment made at closing that covers the entire insurance period, essentially combining the upfront and annual premiums into a single lump sum. This option might be available for specific loan programs or lenders, offering a potentially lower overall cost compared to paying annual premiums. However, it requires a larger upfront capital outlay.

Who Pays the MIP and When

The borrower is responsible for paying the MIP. The upfront MIP is typically paid at closing, along with other closing costs. The annual MIP, if applicable, is included in the monthly mortgage payment. Therefore, the borrower pays the MIP throughout the life of the loan, usually until a specific equity percentage is achieved, or the loan is paid off. The timing and amount of the MIP are clearly Artikeld in the loan documents and the closing disclosure.

Factors Affecting MIP Calculation

The cost of Mortgage Insurance Premium (MIP) isn’t a fixed amount; it’s influenced by several key factors related to both the borrower and the loan itself. Understanding these factors can help prospective homeowners better estimate their overall mortgage costs. This section will detail the most significant influences on MIP calculations.

Loan-to-Value Ratio (LTV) and MIP

The loan-to-value ratio (LTV) is a crucial determinant of MIP. The LTV is the ratio of the loan amount to the appraised value of the property. A higher LTV indicates a larger loan relative to the property’s worth, representing a higher risk for the lender. Consequently, a higher LTV generally results in a higher MIP. For example, a borrower with an 80% LTV (meaning they borrowed 80% of the home’s value) will typically pay a lower MIP than a borrower with a 95% LTV. The relationship is generally inverse: as the LTV decreases, so does the MIP. This reflects the reduced risk to the lender as the borrower contributes a larger down payment.

Credit Score’s Impact on MIP

Your credit score significantly impacts the MIP calculation. A higher credit score indicates a lower risk of default, leading to a potentially lower MIP. Lenders view borrowers with excellent credit scores as more reliable, reducing their perceived risk. Conversely, a lower credit score suggests a higher risk of default, potentially resulting in a higher MIP or even loan denial in some cases. The specific impact of credit score varies among lenders, but a consistent trend shows that better credit translates to lower insurance costs. For instance, a borrower with a credit score above 760 might qualify for a lower MIP rate compared to a borrower with a score below 660.

MIP Rate Variations Across Lenders

While the government sets the baseline for MIP calculations, individual lenders may have some flexibility in setting their own rates. This means that MIP rates can vary slightly between different lenders. Factors such as the lender’s risk assessment models, operational costs, and competitive market conditions can contribute to these differences. Therefore, it is advisable to compare offers from multiple lenders to find the most favorable MIP rate. Although the variations might not be substantial, even small differences can accumulate over the life of the loan, making comparison shopping worthwhile. Borrowers should carefully review all loan terms, including the MIP, before committing to a mortgage.

MIP Payment Methods and Schedules

Understanding how you pay your Mortgage Insurance Premium (MIP) is crucial for effective budget management. The payment method and schedule will vary depending on your loan type and lender. Generally, MIP payments are integrated into your monthly mortgage payment, offering convenience but potentially obscuring the true cost of insurance.

MIP payments can be structured in several ways, each with its own advantages and disadvantages. These payment structures directly impact your monthly mortgage payment and overall loan cost.

MIP Payment Methods and Schedules Overview

The following table summarizes common MIP payment methods and schedules, highlighting their key features. Note that specific options may vary depending on the lender and loan program.

| Payment Method | Payment Schedule | Advantages | Disadvantages |

|---|---|---|---|

| Upfront MIP | Paid at closing | Lower monthly mortgage payments; potentially lower overall interest paid over the life of the loan (depending on interest rates). | Requires a larger down payment at closing; may create a financial strain upfront. |

| Annual MIP | Paid annually as a separate payment | Potentially lower upfront costs; allows for better budgeting control (as a separate payment). | Requires separate payments, which can be easily overlooked; potentially higher overall cost due to compounded interest on the loan principal. |

| Monthly MIP | Paid monthly as part of the mortgage payment | Convenient and integrated into the regular mortgage payment; simplifies budgeting. | Slightly higher monthly mortgage payments compared to upfront MIP; may obscure the true cost of the mortgage insurance. |

Cancellation or Removal of MIP

Mortgage insurance premiums (MIP) are designed to protect lenders against losses in the event of borrower default. However, under certain circumstances, the MIP requirement can be cancelled or removed, offering borrowers significant financial relief. This section Artikels the conditions and scenarios under which MIP cancellation is possible.

MIP cancellation is primarily tied to the borrower reaching a specific point in their mortgage repayment schedule and maintaining a satisfactory payment history. The precise conditions vary depending on the type of loan and the specific requirements set forth by the lender and the Federal Housing Administration (FHA), if applicable.

Conditions for MIP Cancellation

The most common method for MIP cancellation is through reaching a certain loan-to-value (LTV) ratio. This occurs as the borrower’s equity in the home increases over time due to mortgage principal payments. Once the LTV reaches a predetermined threshold (typically 78% or lower for FHA loans), the MIP may be cancelled. This means the borrower will no longer be required to pay the monthly MIP. Other conditions might include reaching a specific number of on-time payments or refinancing to a conventional loan. The specific requirements will be Artikeld in the mortgage documents.

Scenarios for MIP Cancellation

Let’s consider some examples. A homeowner with an FHA loan may have initially had an 80% LTV ratio. Over several years of consistent on-time payments, their principal balance reduces, increasing their equity. If their LTV drops to 78% or less, they can request MIP cancellation. Another scenario could involve a borrower refinancing their FHA loan to a conventional loan, eliminating the need for MIP altogether. Alternatively, a borrower who purchased a home with a substantial down payment might have started with a lower LTV and thus, might not have been required to pay MIP from the outset.

MIP Cancellation Process Flowchart

The following describes the process of MIP cancellation. Imagine a flowchart with distinct boxes and arrows connecting them.

[Start] –> [Meet LTV Threshold (e.g., 78% or less) OR Meet Other Cancellation Criteria] –> [Submit Cancellation Request to Lender] –> [Lender Verifies Eligibility] –> [Lender Processes Cancellation] –> [MIP Payments Cease] –> [End]

A request for MIP cancellation is typically initiated by the borrower. The lender will then verify the borrower’s eligibility based on the provided documentation, confirming that all conditions for cancellation have been met. Once the lender approves the cancellation, the MIP payments will cease. It’s important to note that the process and required documentation might vary depending on the lender and the type of mortgage. Borrowers should consult their lender for specific instructions and requirements.

Resources for Further Information on MIP

Understanding Mortgage Insurance Premiums can be complex, and accessing reliable information is crucial for homebuyers. Fortunately, several resources offer detailed explanations and guidance on MIP calculations, payment schedules, and cancellation options. These resources range from government agencies to reputable financial institutions, providing a variety of perspectives and information formats.

Finding accurate and up-to-date information on MIP is essential for making informed decisions about your mortgage. The following resources offer comprehensive details and can help you navigate the intricacies of mortgage insurance.

Government Websites

The federal government plays a significant role in mortgage insurance, particularly through the Federal Housing Administration (FHA) and the Department of Housing and Urban Development (HUD). These agencies offer official information, guidelines, and resources related to MIP.

The FHA website provides detailed information about FHA-insured loans and the associated MIP requirements. It includes explanations of MIP calculations, payment schedules, and cancellation policies specific to FHA loans. The HUD website offers broader information on housing finance and programs, including links to resources that explain MIP in the context of various mortgage types. Both websites often feature downloadable guides, FAQs, and contact information for further assistance. Navigating these sites can provide a thorough understanding of government regulations surrounding MIP.

Reputable Financial Institutions

Many reputable financial institutions offer educational materials and resources to help consumers understand MIP. These resources often include articles, blog posts, and FAQs that explain MIP in a clear and concise manner. Large banks and mortgage lenders often have sections on their websites dedicated to mortgage education, which include information about MIP. Credit unions and other smaller financial institutions may also provide similar resources, tailored to their specific loan programs. These institutions’ websites often include calculators that estimate MIP based on loan amount and other factors, which can be a valuable tool for prospective homebuyers. These resources can offer a practical, consumer-focused perspective on MIP, supplementing the official government information.

Wrap-Up

Securing a mortgage involves navigating a complex landscape of costs and regulations. Understanding Mortgage Insurance Premium (MIP) is paramount to making informed financial decisions. By carefully considering the factors influencing MIP calculation, payment options, and potential for cancellation, you can better budget for your home purchase and manage your long-term financial obligations. Remember, proactive planning and a thorough understanding of MIP can contribute significantly to a smoother and more financially sound homeownership experience.

FAQ Summary

What happens if I miss a MIP payment?

Missing a MIP payment can lead to late fees and potentially damage your credit score. It could also jeopardize your mortgage and result in foreclosure in severe cases. Contact your lender immediately if you anticipate difficulty making a payment.

Is MIP tax deductible?

The deductibility of MIP depends on several factors, including your specific circumstances and tax laws. Consult a tax professional for personalized advice on whether your MIP payments are deductible.

Can I refinance to remove MIP?

Refinancing your mortgage may allow you to remove MIP if your loan-to-value ratio falls below the threshold requiring it. This depends on your lender’s policies and your financial situation.

How does MIP affect my credit score?

Paying your MIP on time helps maintain a good credit score. Consistent on-time payments demonstrate responsible financial behavior to credit bureaus. Conversely, late or missed payments can negatively impact your score.