Understanding insurance premiums is crucial for navigating the world of financial security. This guide demystifies the concept, explaining what insurance premiums are, how they’re calculated, and what factors influence their cost. From health and auto insurance to homeowners’ policies, we’ll explore the various types of premiums and provide practical insights to help you make informed decisions.

We’ll delve into the components that contribute to premium calculation, including risk assessment, administrative costs, and profit margins. We’ll also examine how individual factors, such as age and health, along with policy choices and market conditions, affect your premium. This comprehensive overview aims to equip you with the knowledge needed to understand and manage your insurance costs effectively.

Defining Insurance Premiums

Insurance premiums are the recurring payments you make to an insurance company in exchange for coverage against potential financial losses. Think of it as a preemptive payment for a safety net; you pay a regular fee to protect yourself from unforeseen events like accidents, illnesses, or property damage. The more comprehensive the coverage, and the higher the potential payout, the higher the premium will generally be.

Types of Insurance Premiums and Their Examples

Insurance premiums vary significantly depending on the type of insurance. Common types include health, auto, and home insurance, each with its own unique set of factors influencing the premium calculation. Health insurance premiums cover medical expenses, auto insurance premiums protect against accidents and damage involving vehicles, and home insurance premiums safeguard your property against various risks. Other types include life insurance (covering financial losses upon death), liability insurance (covering legal responsibility for harm caused to others), and business insurance (covering various business-related risks).

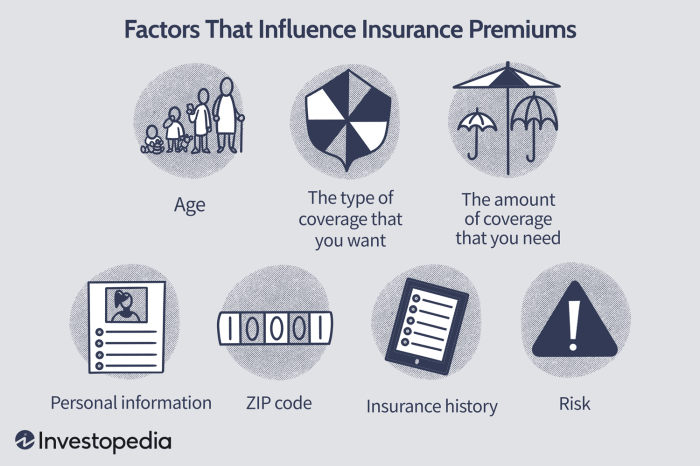

Factors Influencing Insurance Premium Calculations

Several factors influence the calculation of insurance premiums. These factors are assessed by the insurance company to determine the level of risk associated with insuring you. A higher risk profile generally translates to a higher premium. These factors can include your age, health status (for health insurance), driving history (for auto insurance), credit score, location (for home and auto insurance), and the value of the insured property or asset. For example, a young driver with a poor driving record will typically pay more for car insurance than an older driver with a clean record. Similarly, a home in a high-risk area for natural disasters will command a higher premium than a similar home in a low-risk area.

Comparison of Insurance Premiums

| Insurance Type | Average Premium | Factors Affecting Premium | Example Scenarios |

|---|---|---|---|

| Health Insurance | $500 – $1500 per month (varies widely based on plan and location) | Age, health status, pre-existing conditions, chosen plan | A young, healthy individual might pay $500/month for a basic plan, while someone with pre-existing conditions might pay $1500/month for a comprehensive plan. |

| Auto Insurance | $100 – $200 per month (varies widely based on location, vehicle, driving history) | Driving history, age, location, type of vehicle, credit score | A young driver with a speeding ticket might pay $200/month, while an older driver with a clean record might pay $100/month for similar coverage. |

| Homeowners Insurance | $100 – $300 per month (varies widely based on location, home value, coverage) | Location, home value, coverage amount, security features | A home in a high-risk area with a high value will have a higher premium than a similar home in a low-risk area. |

| Life Insurance | Varies greatly depending on coverage amount and policy type | Age, health, lifestyle, coverage amount, policy type | A 30-year-old in good health might pay less for a term life insurance policy than a 60-year-old with health concerns. |

Components of Insurance Premiums

Insurance premiums are not a single, monolithic figure; rather, they are comprised of several key components, each reflecting a different aspect of the insurance risk and the insurer’s operational costs. Understanding these components offers valuable insight into the pricing of insurance policies. This section details the key elements that contribute to the final premium amount.

Risk Assessment’s Influence on Premium Determination

The most significant factor determining an insurance premium is the assessment of risk. Insurers meticulously analyze various factors to predict the likelihood and potential cost of claims. For example, a car insurance company considers factors such as the driver’s age, driving history (accidents and violations), the type of vehicle, and the location where the vehicle is primarily driven. Higher risk profiles, indicated by a greater likelihood of accidents or claims, result in higher premiums. Similarly, health insurance premiums reflect the insured’s health status, family history of illnesses, and lifestyle choices. The more likely an individual is to require expensive medical care, the higher their premium will be. This assessment often involves sophisticated statistical modeling and actuarial analysis to quantify risk accurately. For instance, a statistically higher incidence of burglaries in a specific neighborhood might lead to higher home insurance premiums for residents of that area.

Administrative Costs’ Impact on Premiums

Beyond risk assessment, administrative costs play a crucial role in shaping premium rates. These costs encompass a wide range of expenses, including salaries for claims adjusters and underwriters, marketing and advertising expenses, IT infrastructure maintenance, and regulatory compliance costs. For example, the cost of processing claims, including investigating accidents, assessing damages, and making payments, directly impacts premiums. Higher administrative overhead necessitates higher premiums to ensure the insurer remains financially viable. The cost of maintaining a large network of agents or brokers, particularly for geographically dispersed insurance providers, also contributes to premium increases. These costs are factored into the overall premium calculation, ensuring that the insurer can cover its operational expenses.

Profit Margins in Premium Rate Setting

Insurers, like any business, require a profit margin to remain solvent and invest in future growth. This profit margin is incorporated into the premium calculation. The size of the profit margin can vary depending on the insurer’s business model, competitive landscape, and regulatory environment. A highly competitive market might lead to lower profit margins, while a less competitive market might allow for higher margins. It’s important to note that excessive profit margins can be subject to regulatory scrutiny and may lead to public backlash. The balance between profitability and affordability is a crucial consideration for insurers when setting premium rates. For example, a new insurer entering a market may initially offer lower premiums with a smaller profit margin to gain market share.

Premium Calculation Process

The process of calculating an insurance premium can be visualized through a flowchart:

[Diagram Description: The flowchart would begin with a box labeled “Risk Assessment,” leading to boxes representing individual risk factors (e.g., age, health status, driving record). These boxes would then converge into a box labeled “Risk Score Calculation,” which would feed into a box labeled “Base Premium Calculation.” This would be followed by a box labeled “Administrative Cost Addition,” then a box for “Profit Margin Addition,” finally leading to a box labeled “Final Premium.”]

Factors Affecting Premium Costs

Insurance premiums, the price you pay for coverage, aren’t arbitrary figures. They’re carefully calculated based on a variety of factors, reflecting the insurer’s assessment of your risk. Understanding these factors can empower you to make informed decisions and potentially lower your premiums.

The Influence of Age, Health, and Location on Insurance Premiums

Age, health status, and geographic location significantly impact insurance costs across various types of insurance. For health insurance, younger individuals generally pay lower premiums due to statistically lower healthcare needs. As age increases and the likelihood of health issues rises, premiums tend to increase to reflect the higher potential for claims. Similarly, pre-existing conditions or current health concerns can lead to higher premiums, as insurers account for the increased risk. Location plays a role due to variations in healthcare costs and the prevalence of certain health issues in different areas. For example, areas with high rates of specific illnesses might see higher premiums. In contrast, auto insurance premiums often see a decrease after a certain age (usually mid-20s to mid-30s) as statistical accident rates decline. However, location significantly influences auto insurance, with higher-crime areas or those with more frequent accidents typically resulting in higher premiums.

The Impact of Driving History and Credit Score on Auto Insurance Premiums

Your driving history is a primary factor in determining auto insurance premiums. A clean driving record, free of accidents and traffic violations, usually translates to lower premiums. Conversely, accidents, speeding tickets, and DUI convictions significantly increase premiums, reflecting the higher risk you pose to the insurer. Surprisingly, your credit score can also influence auto insurance rates in many jurisdictions. Insurers often use credit scores as an indicator of risk, with individuals possessing lower credit scores generally facing higher premiums. This is based on the idea that those with poor credit management may exhibit riskier behavior in other aspects of their lives. For instance, someone with multiple accidents and a low credit score would likely pay significantly more than someone with a clean driving record and good credit.

The Effect of Claims History on Future Premium Costs

Filing insurance claims directly impacts future premium costs. Each claim filed increases your risk profile in the insurer’s eyes. The more claims you file, the higher your premiums are likely to become. The type of claim also matters; a larger, more expensive claim will have a more substantial impact on future premiums than a smaller one. This is because insurers interpret frequent or high-cost claims as indicators of higher risk. For example, filing multiple small claims for minor damage might not initially seem significant, but over time, this can still lead to premium increases.

Categorizing Factors Affecting Premiums

The factors influencing insurance premiums can be categorized for better understanding.

- Individual Factors: These are characteristics specific to the insured individual, such as age, health status (for health insurance), driving history (for auto insurance), and credit score (for some types of insurance).

- Policy Factors: These relate to the specific insurance policy itself, including coverage amounts, deductibles, and policy type (e.g., liability only vs. comprehensive).

- Market Factors: These are broader economic and environmental factors that impact the overall cost of insurance, such as inflation, competition among insurers, and changes in claims frequency.

Risk Mitigation Strategies to Lower Premiums

Several strategies can help mitigate risk and potentially lower insurance premiums. Maintaining a clean driving record, improving your credit score, and practicing safe driving habits are effective ways to reduce auto insurance costs. For health insurance, maintaining a healthy lifestyle and regularly visiting a doctor for preventative care can help manage health risks. Choosing higher deductibles and opting for less comprehensive coverage can also lead to lower premiums, although this means you’ll pay more out-of-pocket in the event of a claim. In essence, by demonstrating lower risk to the insurer, you can often negotiate more favorable premium rates.

Insurance Premium Adjustments

Insurance premiums, while initially calculated based on risk assessment, aren’t static. Several factors can lead to adjustments, either increasing or decreasing your payments. Understanding the process and circumstances surrounding these adjustments is crucial for maintaining financial control and ensuring your insurance coverage remains appropriate.

Premium adjustments are a common occurrence in the insurance industry, reflecting changes in the insured’s risk profile or the insurer’s overall cost structure. The process generally involves submitting a request to your insurance provider, providing supporting documentation, and awaiting their review and decision.

Requesting a Premium Adjustment

To request a premium adjustment, you typically need to contact your insurance company directly. This is usually done through their website, phone, or by mail. You’ll need to clearly explain the reason for your request and provide any supporting documentation that demonstrates the change in your circumstances. For example, if you’re requesting a reduction due to improved safety measures, you might need to provide proof of installation (receipts, photos). The insurer will then review your request and determine whether an adjustment is warranted. The response time varies depending on the complexity of the request and the insurer’s policies.

Circumstances Leading to Premium Adjustments

Insurance companies adjust premiums based on several factors, primarily revolving around changes in the risk associated with insuring you. A significant change in your risk profile, whether positive or negative, often triggers a premium adjustment. For instance, if you’ve made significant improvements to your home’s security system (e.g., installing a monitored alarm system), this could reduce your homeowner’s insurance premium. Conversely, a claim made on your policy, especially a large one, could lead to a premium increase as the insurer reassesses your risk. Similarly, changes in your driving record (e.g., receiving speeding tickets or being involved in accidents) will likely affect your car insurance premium. External factors, such as changes in the overall cost of claims or the introduction of new regulations, can also influence premium adjustments.

Situations Where Premium Reduction Might Be Possible

Several situations could lead to a potential premium reduction. Improved safety measures, as mentioned earlier, are a key factor. For example, installing a security system, upgrading to impact-resistant windows, or adding fire suppression systems to your home can significantly reduce your homeowner’s insurance premiums. Similarly, completing a defensive driving course or installing anti-theft devices in your car can lead to a reduction in your car insurance premium. Increased credit scores can also influence premiums favorably, especially in the case of certain types of insurance. Bundle discounts for insuring multiple items (car and home insurance with the same company) are also a common way to achieve premium reduction.

Successful Negotiation of a Lower Premium: A Scenario

Sarah, a homeowner, recently installed a state-of-the-art security system in her house, complete with motion detectors, alarm monitoring, and high-definition security cameras. She contacted her insurance company, providing them with detailed documentation of the installation, including receipts and photos. After reviewing her submission, the insurance company recognized the significant reduction in risk and adjusted Sarah’s homeowner’s insurance premium downward by 15%, saving her $200 annually. This scenario illustrates how proactive risk mitigation can translate into tangible financial benefits.

Illustrative Examples of Premiums

Understanding how insurance premiums are calculated and what factors influence their cost is crucial for making informed decisions. Let’s examine several scenarios to illustrate the variability in premium amounts.

High and Low Auto Insurance Premiums

Consider two individuals, both applying for auto insurance with the same company. Person A is a 22-year-old with a recent DUI conviction, driving a high-performance sports car in a high-crime urban area. Person B is a 45-year-old with a clean driving record, driving a mid-sized sedan in a suburban area with a low accident rate. Person A’s premium will be significantly higher due to their higher risk profile. The DUI conviction indicates a higher likelihood of future accidents, the sports car is more expensive to repair, and the urban location statistically experiences more accidents and theft. Conversely, Person B’s lower risk profile results in a much lower premium. The difference could easily be hundreds of dollars annually.

Impact of Coverage Options on Homeowners Insurance Premiums

Imagine two homeowners with similar houses in the same neighborhood. Homeowner A opts for basic coverage, including only liability and dwelling protection. Homeowner B chooses comprehensive coverage, including liability, dwelling, personal property, loss of use, and additional living expenses coverage. Homeowner B’s premium will be substantially higher because they are insured against a wider range of potential losses. The added coverage provides greater financial protection but comes at a higher cost.

Lifestyle Choices and Health Insurance Premiums

A comparison of two individuals illustrates the effect of lifestyle choices on health insurance premiums. Individual A is a smoker, rarely exercises, and has a family history of heart disease. Individual B is a non-smoker, maintains a regular exercise routine, and has a family history free of major health issues. Individual A will likely pay a higher premium due to their increased risk of developing health problems. Insurance companies assess risk based on various factors, including lifestyle choices, and adjust premiums accordingly. The higher premium reflects the increased likelihood of costly medical claims for Individual A compared to Individual B.

Conclusive Thoughts

In conclusion, understanding insurance premiums involves grasping a complex interplay of factors, from individual risk profiles to broader market dynamics. By understanding the components of premiums, the factors that influence their cost, and the available payment options, you can make informed choices about your insurance coverage and effectively manage your financial responsibilities. Remember to regularly review your policy and consider risk mitigation strategies to potentially lower your premiums over time.

Top FAQs

What happens if I miss a premium payment?

Missing a premium payment can lead to policy cancellation or suspension, leaving you without coverage. Late payment fees may also apply.

Can I negotiate my insurance premiums?

In some cases, you may be able to negotiate a lower premium by demonstrating risk mitigation (e.g., installing security systems, improving your driving record). Contact your insurer to discuss your options.

How often are insurance premiums reviewed?

The frequency of premium reviews varies depending on the insurer and type of insurance. Some policies have annual reviews, while others may be reviewed less frequently.

What is the difference between a deductible and a premium?

A premium is the amount you pay regularly to maintain your insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in for a claim.