Ever wondered what that monthly or annual payment to your insurance company actually represents? Understanding your insurance premium is key to managing your finances and ensuring you have adequate coverage. This guide delves into the intricacies of insurance premiums, demystifying the terminology and providing you with a clear understanding of how they work.

From the fundamental definition and calculation of premiums to the factors influencing their cost and various payment methods, we’ll cover everything you need to know to become a more informed insurance consumer. We’ll also explore how to interpret your premium statement and what to do if you believe your premium is incorrect.

Defining Insurance Premium

An insurance premium is essentially the price you pay for an insurance policy. Think of it as a fee for the protection and financial security an insurance company provides against potential losses or risks. This payment guarantees that the insurer will cover specific costs if a covered event occurs, such as a car accident, house fire, or medical emergency.

Insurance premiums are calculated based on a variety of factors, ensuring that the price reflects the level of risk involved. A detailed definition would include the various components that contribute to the final cost. These components are carefully considered to ensure a fair and accurate pricing structure for all policyholders.

Insurance Premium Components

The calculation of an insurance premium is a complex process. Several key factors contribute to the final amount. These factors are analyzed and weighted to create a risk profile for each individual or entity seeking insurance. The resulting premium aims to reflect the likelihood and potential cost of a claim. Key components include the type of coverage, the insured’s risk profile (age, health, driving record, location, etc.), and the claims history of the insurance company. Administrative costs and profit margins are also factored in. A higher risk translates to a higher premium, as the insurer needs to account for the increased likelihood of having to pay out a claim.

Examples of Insurance Premiums and Their Variations

Different types of insurance policies come with varying premiums. For example, car insurance premiums are influenced by factors like the make and model of the vehicle, the driver’s age and driving history, and the location where the car is primarily driven. A young driver with a history of accidents in a high-risk area will generally pay a higher premium than an older, experienced driver with a clean record in a safer area. Similarly, health insurance premiums can vary widely depending on the plan’s coverage, the insured’s age and health status, and the location. A comprehensive health plan with extensive coverage will usually command a higher premium than a basic plan with limited benefits. Homeowners insurance premiums are also affected by factors like the location of the property, its value, and the level of coverage selected. A home in a high-risk area for natural disasters will likely have a higher premium than a similar home in a low-risk area.

Insurance Premium Calculation

Actuaries, specialists in the field of insurance, use complex statistical models to calculate insurance premiums. These models take into account historical claims data, statistical analysis of risk factors, and projections of future claims. The process involves analyzing large datasets to identify patterns and trends in claims. The goal is to set premiums that are both sufficient to cover expected claims and administrative expenses, and competitive enough to attract customers. The formula used isn’t a simple equation but a sophisticated model incorporating various factors, and it’s often proprietary to each insurance company. However, the fundamental principle is to balance the risk and the cost of providing coverage.

The basic principle is to ensure that the total premiums collected are sufficient to cover the expected payouts on claims, plus administrative expenses and a reasonable profit margin.

Factors Influencing Premium Costs

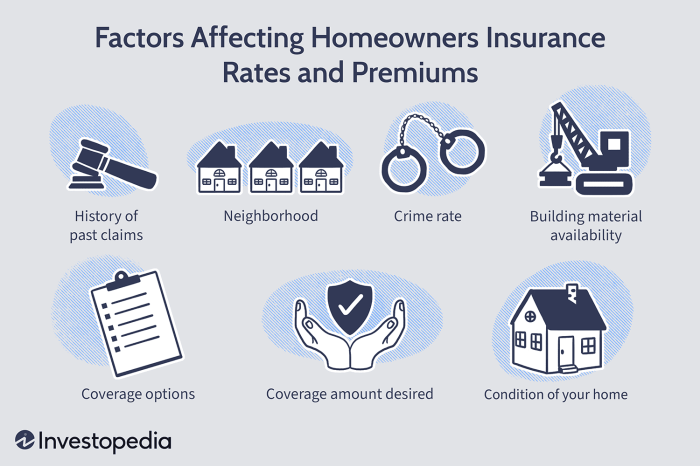

Insurance premiums aren’t arbitrary numbers; they’re carefully calculated based on a variety of factors that assess the risk the insurer takes in covering you. Understanding these factors can help you make informed decisions about your insurance choices and potentially find ways to lower your costs.

Several key elements contribute to the final premium amount you pay. These factors are analyzed individually and then combined to create a comprehensive risk profile. This profile then determines the price you’ll pay for your insurance coverage.

Age, Health, and Lifestyle

Age is a significant factor in many types of insurance. For example, car insurance premiums are often higher for younger drivers due to statistically higher accident rates in this demographic. Health insurance premiums reflect individual health conditions and predicted healthcare utilization. Pre-existing conditions, family history of illnesses, and current health status all influence the cost. Lifestyle choices, such as smoking, excessive alcohol consumption, or risky activities, also impact premium costs. Insurers consider these factors because they increase the likelihood of claims. For instance, a smoker may pay significantly more for life insurance than a non-smoker due to the increased risk of lung disease and other health problems.

Risk Assessment and Premium Pricing

Insurance companies employ sophisticated risk assessment models to determine premium costs. These models analyze vast amounts of data to predict the likelihood of claims. The more likely an insurer believes a claim will be filed, the higher the premium will be. This assessment considers factors like location (higher crime rates may lead to higher home insurance premiums), the type of vehicle (sports cars typically have higher car insurance premiums than sedans), and the coverage level chosen (more comprehensive coverage usually means higher premiums). For example, a house located in a flood-prone area will have a higher home insurance premium than a similar house in a less risky area.

Comparison of Premiums Across Providers

Premium costs can vary significantly between different insurance providers, even for the same type of policy and coverage level. This variation stems from differences in their risk assessment models, administrative costs, and profit margins. For example, a comparison of car insurance quotes from three different companies for a 30-year-old driver with a clean driving record might show premiums ranging from $800 to $1200 annually. It is crucial to obtain quotes from multiple providers to find the most competitive pricing.

Factors Influencing Premium Costs: A Summary

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Age | Individual’s age | Higher premiums for higher-risk age groups (e.g., young drivers) | A 20-year-old driver typically pays more for car insurance than a 50-year-old driver. |

| Health Status | Pre-existing conditions, family history, lifestyle choices | Higher premiums for individuals with poorer health or risky lifestyles | A smoker will generally pay more for life insurance than a non-smoker. |

| Location | Geographic location of the insured property or vehicle | Higher premiums for high-risk areas (e.g., areas prone to natural disasters or crime) | Home insurance is typically more expensive in areas prone to hurricanes. |

| Coverage Level | Amount and type of coverage selected | Higher premiums for more comprehensive coverage | Comprehensive car insurance costs more than liability-only coverage. |

Understanding Your Premium Statement

Your insurance premium statement is a crucial document that details the costs associated with your insurance policy. Understanding its components allows you to verify the accuracy of your charges and identify any potential discrepancies. This section will guide you through interpreting the typical information found on a premium statement.

Components of an Insurance Premium Statement

A typical insurance premium statement includes several key elements that provide a comprehensive overview of your insurance costs. These components help you understand the breakdown of your total premium and the factors contributing to its value. It’s important to review each component carefully to ensure accuracy and identify any areas that may require further clarification.

Sample Premium Statement Illustration

Let’s examine a hypothetical premium statement to illustrate the typical components. Remember that the specific terms and amounts will vary depending on your insurer and policy type.

| Item | Description | Amount |

|---|---|---|

| Premium Base | This represents the fundamental cost of your insurance coverage, calculated based on factors such as your age, location, and the type of coverage selected. For example, a basic liability car insurance policy will have a lower base premium than comprehensive coverage. | $500 |

| Deductible | This is the amount you pay out-of-pocket before your insurance coverage begins. A higher deductible typically results in a lower premium, and vice versa. This statement reflects the amount you have chosen for your policy. | $500 |

| Coverage Add-ons | These are additional coverages you’ve chosen, such as roadside assistance, rental car reimbursement, or uninsured/underinsured motorist protection. Each add-on increases the premium cost. For example, adding roadside assistance might add $50 to the premium. | $75 |

| Discounts | These reduce your overall premium. Examples include good driver discounts, multi-policy discounts (bundling home and auto insurance), and safe-driver discounts based on telematics data. A good driver discount might reduce the premium by 10%. | -$50 |

| Taxes and Fees | These are government-mandated taxes and fees added to your premium. The specific amounts and types of taxes vary by location and policy type. | $25 |

| Total Premium | This is the final amount you owe for the insurance period. It’s the sum of all the above items. | $550 |

Interpreting Your Premium Statement

By carefully reviewing each item on your statement, you can understand the cost breakdown of your insurance. Comparing this breakdown to previous statements can highlight changes in your premium and help you identify the reasons behind those changes. If you have any questions or notice discrepancies, contact your insurance provider for clarification. For example, a significant increase in your premium might be due to a change in your risk profile (e.g., a recent accident or moving to a higher-risk area). Always ensure the discounts applied are correct and that the taxes and fees are consistent with your location and policy.

Closing Summary

In conclusion, understanding your insurance premium is a crucial aspect of responsible financial planning. By grasping the factors influencing premium costs, available payment options, and the information presented on your premium statement, you can make informed decisions about your insurance coverage and ensure you’re getting the best value for your money. Proactive engagement with your insurance provider can help you maintain optimal coverage and manage your premiums effectively.

Clarifying Questions

What happens if I miss an insurance premium payment?

Missing a payment can lead to a lapse in coverage, leaving you vulnerable to financial repercussions in case of an incident. Late fees may also apply. Contact your insurer immediately if you anticipate a missed payment to explore options.

Can I negotiate my insurance premium?

While not always guaranteed, you can often negotiate your premium by exploring different coverage options, improving your risk profile (e.g., installing security systems), or shopping around for different insurers.

How often are insurance premiums reviewed?

Premium reviews vary depending on the insurer and type of policy. Some policies have annual reviews, while others might be reviewed less frequently. Your policy documents will specify the review schedule.

What is a deductible and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, and vice versa.