Securing your home is a significant investment, and understanding the intricacies of homeowners insurance is paramount. This guide delves into the often-confusing world of homeowners insurance premiums, breaking down the factors that influence cost and empowering you to make informed decisions about protecting your most valuable asset. We’ll explore the components of your premium, how different coverage levels impact your cost, and strategies for finding affordable yet comprehensive protection.

From understanding the role of your credit score and claims history to navigating policy documents and comparing quotes from different providers, we aim to provide a clear and concise overview. This guide equips you with the knowledge to confidently navigate the insurance landscape and secure the best possible coverage for your needs and budget.

Defining Homeowners Insurance Premium

A homeowner’s insurance premium is the amount you pay regularly to your insurance company to maintain your policy’s coverage. This payment protects your home and belongings from various unforeseen events, offering financial security in case of damage or loss. Understanding the components and factors that influence your premium is crucial for making informed decisions about your insurance coverage.

Components of a Homeowners Insurance Premium

Your homeowners insurance premium is calculated based on several key factors, combining to create your total cost. These components typically include costs associated with administrative expenses, claims handling, risk assessment, and the insurer’s profit margin. The specific weighting of these components varies between insurance companies and policies.

Factors Influencing Premium Calculation

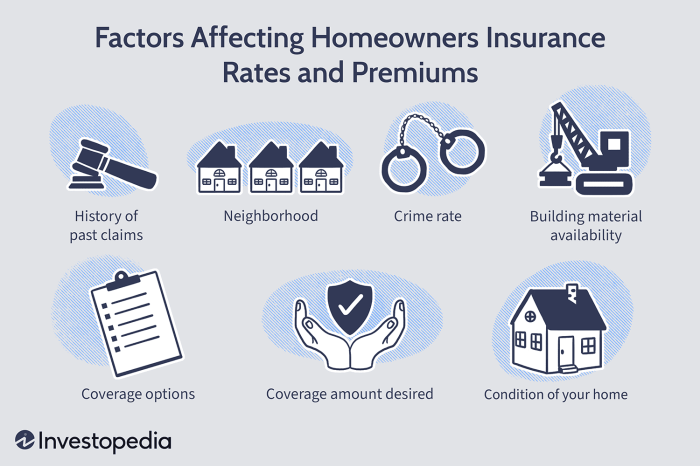

Several factors influence the calculation of your homeowners insurance premium. These factors are assessed by the insurance company to determine your level of risk. Higher risk typically translates to a higher premium. Key factors include:

- Location: Homes in areas prone to natural disasters (hurricanes, earthquakes, wildfires) generally command higher premiums due to increased risk of damage.

- Home Value: The replacement cost of your home is a significant factor. A more expensive home will typically have a higher premium because it costs more to rebuild or repair.

- Coverage Level: The amount of coverage you choose impacts your premium. Higher coverage levels naturally lead to higher premiums.

- Deductible: A higher deductible (the amount you pay out-of-pocket before your insurance kicks in) will generally result in a lower premium. This is because you’re accepting more financial responsibility for smaller claims.

- Home Features: Features like a security system, fire sprinklers, or impact-resistant roofing can lower your premium as they reduce the risk of loss.

- Claim History: A history of filing claims can lead to higher premiums, as it suggests a higher likelihood of future claims.

- Credit Score: In many states, your credit score is a factor in determining your premium. A higher credit score is often associated with lower premiums.

Impact of Different Coverage Levels on Premiums

Choosing different coverage levels significantly impacts your premium. For example, selecting a higher dwelling coverage amount (the amount your insurance will pay to rebuild your home) will result in a higher premium. Similarly, increasing liability coverage (which protects you financially if someone is injured on your property) will also increase your premium. Conversely, opting for a higher deductible will generally lower your premium, although it increases your out-of-pocket expense in the event of a claim.

Premium Comparison for Various Coverage Options

The following table illustrates how different coverage levels can affect your premium. These are hypothetical examples and actual premiums will vary based on the factors mentioned above.

| Coverage Level | Dwelling Coverage | Liability Coverage | Annual Premium (Estimate) |

|---|---|---|---|

| Low | $200,000 | $100,000 | $800 |

| Medium | $300,000 | $200,000 | $1,200 |

| High | $400,000 | $300,000 | $1,600 |

| High with High Deductible | $400,000 | $300,000 | $1,400 |

Illustrative Examples

Understanding homeowners insurance premiums can be easier with concrete examples. These illustrations will clarify the impact of factors like deductibles and home characteristics on your overall cost.

Higher Deductibles and Lower Premiums

Imagine a bar graph. The horizontal axis represents the deductible amount, ranging from $500 to $5000, increasing incrementally. The vertical axis represents the annual premium cost. The graph shows a clear downward sloping line. As the deductible increases (moving right along the horizontal axis), the premium cost (vertical axis) decreases. For instance, a $500 deductible might correspond to a premium of $1500 per year, while a $5000 deductible might result in a premium of $1000 per year. This visually demonstrates the inverse relationship: a higher deductible means you pay less upfront for insurance, but more out-of-pocket in the event of a claim. The graph clearly shows that the savings in premium are significant for choosing a higher deductible. This is because the insurance company is assuming less risk with a higher deductible.

New Home versus Older Home Premiums

Consider two side-by-side columns. The left column represents a new home, while the right depicts an older home. Within each column, we list key features and their impact on premiums. The new home column might list features like: “Modern Construction (lower risk of damage): Lower Premium,” “Up-to-date plumbing and electrical (reduced risk of costly repairs): Lower Premium,” “Advanced security systems (reduced risk of theft): Lower Premium,” “New roof and appliances (less likely to need repairs): Lower Premium.” The older home column might show: “Older Construction (higher risk of damage): Higher Premium,” “Outdated plumbing and electrical (increased risk of costly repairs): Higher Premium,” “Basic security systems (increased risk of theft): Higher Premium,” “Older roof and appliances (higher probability of needing repairs): Higher Premium.” The comparison highlights that newer homes, due to their inherent lower risk profile, generally attract lower premiums compared to older homes requiring more frequent maintenance and repairs. The differences in features directly translate to varying levels of risk for the insurance company, thus influencing the premium cost.

Epilogue

Ultimately, understanding your homeowners insurance premium is key to responsible homeownership. By carefully considering the factors influencing your premium, comparing quotes, and selecting appropriate coverage, you can protect your investment while managing your expenses effectively. Remember, a well-informed decision ensures you have the right level of protection without unnecessary financial burden. Take the time to understand your policy and don’t hesitate to contact your insurance provider with any questions.

Answers to Common Questions

What happens if I don’t pay my homeowners insurance premium?

Failure to pay your premium can result in policy cancellation, leaving your home uninsured and vulnerable to financial losses in case of damage or liability claims.

Can I pay my homeowners insurance premium monthly?

Many insurers offer monthly payment plans, but they often come with added fees. Check with your provider for available options.

How often are homeowners insurance premiums reviewed?

Premiums are typically reviewed annually, and adjustments are made based on factors like claims history, changes in coverage, and market conditions.

What is the difference between a deductible and a premium?

A premium is the amount you pay regularly for your insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in after a claim.