Securing a mortgage can feel like navigating a maze, especially when encountering terms like “FHA mortgage insurance premium.” This seemingly complex concept is crucial for understanding the costs and benefits of FHA loans, a popular option for first-time homebuyers and those with less-than-perfect credit. This guide unravels the mysteries surrounding FHA mortgage insurance premiums, providing clarity and empowering you to make informed decisions about your home financing.

We’ll explore the different types of premiums, how they’re calculated, and the factors influencing their amount. We’ll also delve into the conditions under which these premiums can be cancelled, the impact on refinancing, and a comparison with private mortgage insurance (PMI). By the end, you’ll have a firm grasp on FHA mortgage insurance premiums and their implications for your financial future.

FHA Mortgage Insurance Premium

The FHA mortgage insurance premium (MIP) is an insurance policy protecting the lender in case a borrower defaults on their FHA-insured loan. It’s a crucial part of obtaining an FHA loan, allowing borrowers with lower credit scores or down payments to become homeowners. This insurance helps mitigate the risk for lenders, making it possible for them to offer mortgages to a wider range of individuals.

FHA’s Role in the Mortgage Process

The Federal Housing Administration (FHA) is a government agency within the Department of Housing and Urban Development (HUD). The FHA doesn’t lend money directly; instead, it insures mortgages issued by FHA-approved lenders. This insurance protects lenders against losses if a borrower defaults on their loan. By insuring these loans, the FHA encourages lenders to offer more favorable terms to borrowers who might not otherwise qualify for a conventional mortgage. This increases access to homeownership for a broader segment of the population. The FHA sets guidelines for lenders regarding loan amounts, borrower qualifications, and property appraisals.

Comparison of FHA MIP and Private Mortgage Insurance (PMI)

Both FHA MIP and PMI are types of mortgage insurance designed to protect lenders against losses in the event of borrower default. However, there are key differences. PMI is typically required for conventional loans with down payments below 20%, while FHA MIP is required for all FHA-insured loans regardless of the down payment. The cost, eligibility requirements, and cancellation options also differ significantly.

FHA MIP vs. PMI: A Detailed Comparison

| Feature | FHA MIP | PMI | Notes |

|---|---|---|---|

| Cost | Higher upfront and annual premiums | Typically lower annual premiums; no upfront premium | The exact cost varies depending on the loan amount, loan term, and credit score. |

| Eligibility | Lower credit scores and down payments accepted | Generally requires higher credit scores and a larger down payment (typically at least 10%) | FHA has more lenient eligibility criteria, making it accessible to a wider range of borrowers. |

| Cancellation | Usually requires reaching 20% equity in the home; some loans have a lifetime premium | Can be canceled once 20% equity is reached in the home | FHA MIP cancellation can be more complex and may not always be possible, depending on the loan terms. |

Types of FHA Mortgage Insurance Premiums

FHA mortgage insurance premiums (MIP) are designed to protect lenders against losses in the event of borrower default. Understanding the different types of MIP and how they’re calculated is crucial for prospective homebuyers. There are two main components: an upfront MIP and an annual MIP.

Upfront Mortgage Insurance Premium (UFMIP)

The UFMIP is a one-time fee paid at closing. It’s calculated as a percentage of the loan amount. The percentage varies depending on the loan-to-value ratio (LTV) and the type of loan. For most loans, the UFMIP is 1.75% of the base loan amount. This fee can be financed into the loan, meaning it’s added to the total loan amount, increasing the overall cost of borrowing.

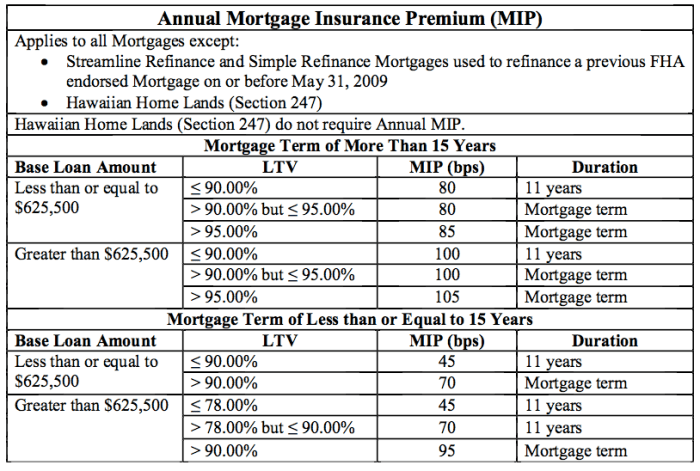

Annual Mortgage Insurance Premium (AMIP)

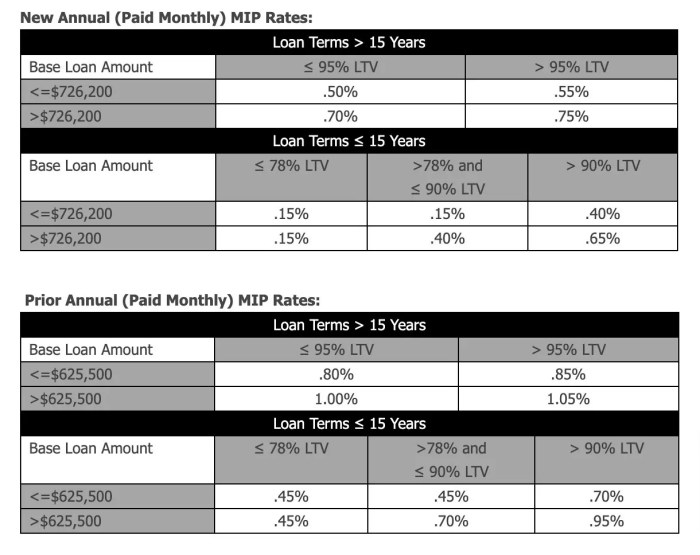

The AMIP is an ongoing premium paid monthly along with the mortgage payment. It is expressed as a percentage of the outstanding loan balance and is usually lower than the UFMIP percentage. The AMIP rate depends on the loan term and the LTV. For example, a 15-year loan will generally have a lower AMIP than a 30-year loan. The AMIP calculation is straightforward: it’s the annual premium rate multiplied by the outstanding loan balance, then divided by 12 to get the monthly payment.

Examples of MIP Application

Let’s consider a $300,000 mortgage.

For the UFMIP: A 1.75% UFMIP would be 0.0175 * $300,000 = $5,250. This amount could be added to the loan amount, increasing the total loan amount to $305,250.

For the AMIP: If the annual MIP rate is 0.8%, the annual premium would be 0.008 * $300,000 = $2,400. The monthly AMIP would then be $2,400 / 12 = $200. This $200 would be added to the monthly mortgage payment. Note that this AMIP amount is an example and can fluctuate depending on the loan’s outstanding balance over time.

Flowchart Illustrating MIP Payment Process

A flowchart visually depicting the payment process would show two distinct branches, one for the UFMIP and one for the AMIP.

UFMIP Flowchart:

[Start] –> [Loan Application & Approval] –> [Closing] –> [UFMIP Payment (1.75% of loan amount, often financed)] –> [Mortgage Disbursement] –> [End]

AMIP Flowchart:

[Start] –> [Loan Closing] –> [Monthly Mortgage Payment (including AMIP)] –> [Monthly Payment Processing] –> [Loan Balance Reduction] –> [Repeat monthly until loan payoff] –> [End] (Note: The AMIP calculation would involve a step within “Monthly Mortgage Payment” to calculate the current month’s AMIP based on the outstanding balance.)

FHA MIP

Understanding the factors that influence the amount of your FHA Mortgage Insurance Premium (MIP) is crucial for budgeting and planning your home purchase. Several key elements contribute to the final MIP calculation, impacting the overall cost of your mortgage. This section will detail these influential factors.

Loan-to-Value Ratio (LTV) and MIP

The loan-to-value ratio (LTV) is a significant determinant of your FHA MIP. The LTV is calculated by dividing the loan amount by the appraised value of the property. A lower LTV generally results in a lower MIP. For example, a borrower with a 20% down payment (resulting in an 80% LTV) will typically pay a lower MIP than a borrower with a 5% down payment (resulting in a 95% LTV). The higher the LTV, the greater the risk to the lender, hence the higher MIP to compensate for that increased risk. This relationship is consistent across various FHA loan programs.

Loan Term and Interest Rate’s Influence on MIP

While the LTV primarily affects the upfront MIP, the loan term and interest rate also play a role in the annual MIP calculation. Longer loan terms generally lead to higher overall MIP payments because the insurance covers a longer period. Similarly, although not directly impacting the rate itself, a higher interest rate results in a larger loan amount, indirectly increasing the total MIP paid over the life of the loan. It’s important to note that the annual MIP is calculated based on the outstanding loan balance, which decreases over time as you make principal payments.

Factors Influencing FHA MIP Calculation

The calculation of your FHA MIP involves several interconnected factors. Understanding these elements can help you better anticipate your monthly mortgage payments.

- Loan-to-Value Ratio (LTV): As discussed above, a higher LTV means a higher MIP.

- Loan Amount: A larger loan amount naturally translates to a higher MIP.

- Loan Term: Longer loan terms result in higher total MIP payments.

- Credit Score: While not directly impacting the MIP rate itself, a higher credit score may improve your chances of securing a better interest rate, indirectly influencing the total MIP paid.

- Property Type: The type of property (single-family home, condo, etc.) might influence eligibility for certain FHA loan programs and thus indirectly affect MIP.

- Upfront MIP vs. Annual MIP: The structure of the MIP payment (single upfront payment or annual premiums) impacts the immediate financial burden.

Paying the FHA MIP

Paying the FHA mortgage insurance premium (MIP) is a crucial aspect of securing an FHA loan. Understanding the payment methods and the overall cost is essential for responsible homeownership. This section details the various ways borrowers can pay their MIP and provides tools to calculate the total cost.

MIP Payment Methods

Borrowers typically pay their FHA MIP in one of two ways: It can be included in their monthly mortgage payment, or it can be paid upfront as a lump sum. Choosing the method depends on individual financial circumstances and preferences. Including the MIP in the monthly payment is the most common method, simplifying the payment process into a single monthly bill. Paying upfront, however, can potentially lower the overall cost of the loan over time, depending on the loan terms and interest rates.

MIP Inclusion in Monthly Mortgage Payment

When the MIP is included in the monthly mortgage payment, it’s added to the principal and interest components, along with property taxes and homeowner’s insurance (if applicable), creating a single monthly payment. This simplifies budgeting as all housing-related costs are consolidated into one bill. The lender calculates the MIP amount based on the loan amount, loan term, and the current MIP rate. This amount remains consistent throughout the life of the loan (for loans with annual MIP) or until the loan-to-value (LTV) ratio reaches a certain threshold (for loans with upfront MIP and annual MIP).

Calculating Total MIP Cost

Calculating the total cost of MIP involves multiplying the monthly MIP amount by the number of months in the loan term. For example, a $300 monthly MIP over a 30-year (360-month) loan would result in a total MIP cost of $108,000 ($300 x 360). However, remember that this calculation assumes a fixed MIP amount throughout the loan term, which isn’t always the case, especially with annual MIP changes. To obtain a more precise calculation, one should consult their lender’s amortization schedule, which details the exact MIP payment for each month. Also, for loans with upfront MIP, this upfront payment should be added to the total cost.

Examples of Monthly Payments with and without MIP

The following table illustrates the difference in monthly payments with and without MIP. These are illustrative examples and actual amounts will vary depending on factors such as loan amount, interest rate, loan term, and credit score.

| Loan Amount | Interest Rate | Monthly Payment (without MIP) | Monthly Payment (with MIP) |

|---|---|---|---|

| $200,000 | 4% | $955 | $1,055 |

| $300,000 | 5% | $1,610 | $1,760 |

| $400,000 | 6% | $2,390 | $2,590 |

Cancellation of FHA MIP

Cancelling your FHA mortgage insurance premium (MIP) is a possibility, but it’s not automatic. It depends on several factors related to your loan and your equity in the property. Understanding the conditions under which cancellation is possible is crucial for homeowners aiming to reduce their monthly mortgage payments.

Cancellation of FHA MIP is primarily determined by the loan-to-value (LTV) ratio of your mortgage. This ratio compares the amount you still owe on your mortgage to the current market value of your home. Once your LTV reaches a certain threshold, cancellation may be an option. The specific requirements and processes can vary slightly depending on when your loan was originated.

MIP Cancellation Requirements

The primary requirement for MIP cancellation is achieving a loan-to-value ratio (LTV) of 80% or less. This means that the amount you owe on your loan must be 80% or less of your home’s current appraised value. Reaching this threshold signifies you’ve built sufficient equity in your home to mitigate the risk for the FHA. The appraisal process is vital in determining the current market value and subsequently, the LTV. Important note: The appraisal must be performed by an FHA-approved appraiser. Additionally, the homeowner is responsible for all associated appraisal costs.

Scenarios Allowing for MIP Cancellation

Several scenarios can lead to MIP cancellation. For instance, a homeowner who has consistently made on-time mortgage payments for several years might see their home appreciate in value, lowering their LTV. Alternatively, paying down a significant portion of their principal balance through additional payments can also achieve the necessary LTV reduction. Another example would be a homeowner who refinances their FHA loan into a conventional loan once their LTV is low enough. This refinancing eliminates the need for FHA insurance.

Process of Cancelling FHA MIP

The process for canceling FHA MIP typically involves contacting your mortgage servicer. You’ll need to provide documentation demonstrating your current LTV is at or below the required threshold (typically 80%). This usually involves providing a new appraisal from an FHA-approved appraiser. Your servicer will then review your request and initiate the cancellation process. The cancellation is not immediate and might take several weeks to be fully processed and reflected on your monthly mortgage statement. There are no upfront fees associated with this process, however, you are responsible for the cost of the new appraisal. It’s advisable to contact your lender directly to confirm the precise steps involved and the required documentation.

FHA MIP and Refinancing

Refinancing an FHA loan can offer several advantages, such as lowering your interest rate, shortening your loan term, or accessing your home equity. However, it’s crucial to understand how the FHA Mortgage Insurance Premium (MIP) will be affected by this process. The MIP remains a significant factor in your overall mortgage cost, even after refinancing.

Refinancing an existing FHA loan typically involves paying a new upfront MIP and continuing to pay the annual MIP. The amount of MIP you pay will depend on several factors, including your loan-to-value ratio (LTV), the type of refinance, and the current FHA MIP rates. It’s important to carefully weigh the potential savings from a lower interest rate against the ongoing cost of the MIP.

Upfront MIP for FHA Refinancing

An upfront MIP is typically charged when refinancing an FHA loan, regardless of whether it’s a rate-and-term refinance or a cash-out refinance. The upfront MIP is calculated as a percentage of the new loan amount. This percentage can vary depending on the year the loan was originated. For loans originated after December 31, 2022, the upfront MIP is 1.75% of the base loan amount. For loans originated before that date, the upfront MIP percentage may be lower. This upfront fee is typically financed into the loan, increasing the overall loan amount. For example, refinancing a $300,000 loan with a 1.75% upfront MIP would result in an additional $5,250 added to the loan amount.

Annual MIP for FHA Refinancing

In addition to the upfront MIP, you’ll likely continue paying an annual MIP. The annual MIP is expressed as a percentage of the outstanding loan balance and is paid monthly as part of your mortgage payment. The rate for the annual MIP also depends on several factors including the loan type and loan-to-value ratio. Unlike conventional loans, FHA loans typically require annual MIP payments even if you have a significant amount of equity in your home, unless you refinance into a loan with an LTV below 80%. For example, a $300,000 loan with a 0.85% annual MIP would result in a monthly MIP payment of approximately $212.50 ($300,000 x 0.0085 / 12).

Comparison of MIP Costs in Different Refinancing Options

The impact of MIP on refinancing costs depends significantly on the type of refinance. A rate-and-term refinance, which aims to lower your interest rate or shorten your loan term without changing the loan amount, will result in continued annual MIP payments but might also reduce your overall monthly payments depending on the interest rate reduction. A cash-out refinance, where you borrow additional funds, will likely result in a higher loan amount and therefore a higher upfront and annual MIP. A streamlined refinance, which simplifies the refinancing process, may have slightly different MIP requirements, but still usually involves an upfront MIP. The decision of which type of refinance to pursue should be carefully weighed against the cost implications of MIP.

Examples of Refinancing Impact on Mortgage Costs

Let’s consider two scenarios. Scenario 1: A homeowner with a $250,000 FHA loan at 4.5% interest refines to a 3.75% interest rate. While the lower interest rate reduces the monthly principal and interest payment, they’ll still pay the annual MIP. The overall savings might be modest depending on the MIP rate and loan term. Scenario 2: The same homeowner refines to a $300,000 loan at 3.75% to access equity for home improvements. Here, the lower interest rate is offset by the higher loan amount, increased upfront MIP, and higher annual MIP payments. The overall monthly payment might be higher despite the lower interest rate. Therefore, careful consideration of all costs, including MIP, is essential before deciding to refinance.

Understanding the Costs of FHA Mortgages

Securing a mortgage through the Federal Housing Administration (FHA) can offer advantages to borrowers with lower credit scores or smaller down payments. However, it’s crucial to understand the complete cost picture, including the Mortgage Insurance Premium (MIP), to make an informed decision. Comparing FHA mortgages to conventional mortgages requires a thorough examination of all associated fees and long-term financial implications.

FHA vs. Conventional Mortgage Costs: A Comparison

While FHA loans often require lower down payments and have more lenient credit score requirements, the added cost of MIP significantly impacts the overall expense. A conventional mortgage, while potentially requiring a larger down payment and a higher credit score, may ultimately prove less expensive over the life of the loan if the borrower can meet those requirements. The difference becomes particularly apparent over longer loan terms. For example, a 30-year FHA loan will accumulate significantly more MIP than a 15-year loan. The long-term savings of a shorter-term conventional loan may outweigh the initial higher down payment and stricter qualification criteria.

Long-Term Financial Implications of FHA MIP

The ongoing cost of MIP adds to the total amount paid over the life of an FHA loan. This can substantially increase the overall cost compared to a conventional loan, especially if the loan is for a longer term. Consider a scenario where two borrowers take out $200,000 mortgages: one with an FHA loan and the other with a conventional loan. The FHA borrower, paying MIP, will pay significantly more in interest and insurance over the 30-year term, even if their initial down payment was smaller. This difference can amount to tens of thousands of dollars. Careful financial planning and consideration of long-term expenses are essential when choosing an FHA loan.

Detailed Breakdown of FHA Mortgage Costs

Understanding the complete cost of an FHA mortgage involves more than just the principal and interest. Several other fees and costs contribute to the overall expense. These costs can vary depending on the lender and the specific circumstances of the loan. It’s vital to obtain a Loan Estimate from your lender to get a precise breakdown of your specific costs.

Cost Comparison Table

| Cost Item | FHA Mortgage | Conventional Mortgage | Notes |

|---|---|---|---|

| Down Payment | As low as 3.5% | Typically 5-20% | FHA loans allow for lower down payments. |

| Upfront MIP | 1.75% of the loan amount (can be financed) | None | Paid at closing or financed into the loan. |

| Annual MIP | 0.85% – 1.05% of the loan amount (depending on loan term and down payment) | None (for loans with 20% or more down payment) | Paid monthly as part of the mortgage payment. |

| Closing Costs | Varies | Varies | Includes appraisal, title insurance, etc. Can be higher for FHA loans in some cases. |

| Interest Rate | Generally higher than conventional loans | Generally lower than FHA loans | Rates vary depending on credit score and market conditions. |

| Total Cost (Example – 30 year loan) | Significantly higher due to MIP | Lower due to absence of MIP | This will vary based on loan amount, interest rates and MIP percentages. |

Summary

Understanding FHA mortgage insurance premiums is essential for anyone considering an FHA loan. While the upfront and annual costs might seem daunting at first, understanding how they work, when they’re applicable, and how they compare to other mortgage insurance options empowers you to make informed financial decisions. This guide has provided a comprehensive overview, equipping you with the knowledge to navigate the intricacies of FHA financing with confidence and clarity.

Common Queries

What happens if I miss an FHA MIP payment?

Missing an FHA MIP payment can lead to late fees and potentially damage your credit score. It could also jeopardize your loan and even lead to foreclosure.

Can I deduct FHA MIP from my taxes?

Generally, FHA MIP is not tax-deductible. However, consult a tax professional for personalized advice, as tax laws can change.

Is FHA MIP required for all FHA loans?

Yes, FHA mortgage insurance is required for all FHA-insured mortgages. This protects the lender against potential losses.

How does FHA MIP affect my loan-to-value ratio (LTV)?

The LTV is calculated before considering the MIP. A higher LTV generally results in a higher MIP.