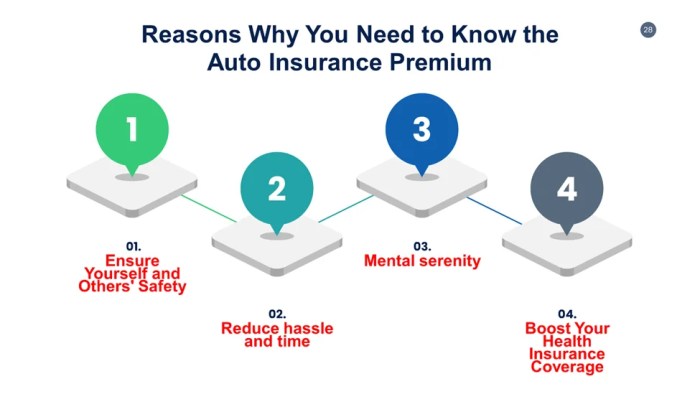

Understanding your auto insurance premium is crucial for responsible car ownership. It’s more than just a number; it’s a reflection of your risk profile and the cost of protecting yourself financially against potential accidents and damages. This guide delves into the intricacies of auto insurance premiums, explaining how they’re calculated, what factors influence them, and how you can potentially lower your costs.

From the fundamental components of your premium to strategies for securing more favorable rates, we’ll navigate the complexities of auto insurance, empowering you to make informed decisions about your coverage and budget. We’ll explore various coverage options, compare provider differences, and address common misconceptions to provide a clear and concise understanding of this essential aspect of car ownership.

Factors Affecting Auto Insurance Premiums

Your auto insurance premium, the amount you pay for coverage, isn’t arbitrarily determined. Several factors contribute to the final cost, and understanding these elements can help you make informed decisions about your insurance choices and potentially save money. This section details the key influences on your premium.

Demographic Factors

Demographic information plays a significant role in premium calculations. Insurers use statistical data to assess risk. Younger drivers, for example, are statistically more likely to be involved in accidents due to inexperience, leading to higher premiums. Conversely, older drivers with extensive, clean driving records often receive lower rates due to their lower accident risk profile. Location also significantly impacts premiums. Areas with high crime rates or a high frequency of accidents typically command higher premiums because of the increased likelihood of claims. Driving history, encompassing past accidents, tickets, and even insurance lapses, directly affects premium costs. A history of at-fault accidents will almost certainly increase your premiums, reflecting the higher risk you represent to the insurer.

Vehicle Characteristics

The type of vehicle you drive is another critical factor. The make, model, and year of your car significantly influence your premium. Generally, newer cars with advanced safety features command lower premiums because they are often safer and more expensive to repair. Conversely, older vehicles, particularly those with a history of mechanical problems or a higher theft rate, tend to have higher premiums. High-performance vehicles, known for their speed and power, are often associated with higher risk and, consequently, higher insurance costs. The cost of parts and repairs also influences premiums; vehicles with expensive parts will naturally result in higher premiums for collision and comprehensive coverage.

Driving Habits

Your driving habits directly impact your insurance costs. The number of miles you drive annually is a key consideration. The more miles you drive, the greater your exposure to potential accidents, thus increasing your premium. A clean driving record, free from accidents and traffic violations, is crucial for securing lower premiums. Conversely, even a single at-fault accident can significantly increase your rates for several years. Safe driving habits, including adherence to traffic laws and defensive driving techniques, contribute to lower risk profiles and, consequently, lower premiums. Some insurers offer discounts for completing defensive driving courses, which can help reduce your premiums.

Insurance Provider Differences

Insurance companies use different rating systems and risk assessment models, resulting in varying premiums for the same coverage. It’s crucial to compare quotes from multiple insurers to find the best rate. Factors such as the insurer’s financial stability, customer service reputation, and available discounts also influence the overall value proposition. Some insurers specialize in certain types of drivers or vehicles, leading to potentially better rates for specific demographics or vehicle types. For example, a company specializing in insuring classic cars may offer better rates for vintage vehicle owners than a mainstream insurer. It’s essential to shop around and compare quotes before settling on an insurance provider.

Additional Considerations

Beyond the factors already discussed, several other elements significantly influence your auto insurance premium. Understanding these nuances can help you make informed decisions and potentially save money. This section will explore the roles of credit scores, optional coverage, and the appeals process, along with resources for further learning.

Credit Scores and Auto Insurance Premiums

In many states, insurance companies use your credit score as a factor in determining your auto insurance rates. The rationale behind this practice is that individuals with good credit scores tend to be more responsible and less likely to file claims. Therefore, insurers perceive them as lower risk and offer lower premiums. Conversely, those with poor credit scores may face higher premiums, reflecting a perceived higher risk of claims. It’s important to note that this practice is subject to state regulations, and some states prohibit the use of credit scores in insurance rating. The impact of credit scores on premiums can vary significantly depending on the insurer and the specific state’s regulations. For example, a person with an excellent credit score might receive a substantially lower rate compared to someone with a poor credit score, even if both have similar driving records.

The Impact of Optional Coverage Additions

Adding optional coverages, such as roadside assistance, rental car reimbursement, or gap insurance, will increase your overall premium. Roadside assistance, for example, covers costs associated with towing, flat tire changes, and jump-starts. While convenient, these added benefits come at a cost. The increase in premium will depend on the specific coverage chosen and the insurer. Carefully weigh the potential benefits of these optional coverages against the added cost to determine if they are worthwhile for your individual circumstances. For instance, someone who frequently drives long distances might find roadside assistance particularly valuable, justifying the added premium. Conversely, a driver who primarily uses public transportation might consider the added cost unnecessary.

Appealing an Insurance Premium Increase

If you receive a notice of a premium increase and believe it’s unjustified, you have the right to appeal the decision. The appeals process varies depending on your insurance company, so it’s essential to review your policy and contact your insurer directly. You’ll typically need to provide documentation supporting your appeal, such as a clean driving record or evidence of recent safety improvements to your vehicle. Be prepared to clearly articulate your reasons for contesting the increase. For example, if the increase is based on a perceived increase in risk due to a change in your address, you might provide information showing that your new neighborhood has a lower accident rate than your previous one. Successfully appealing a premium increase can save you a significant amount of money over the policy term.

Resources for Learning More About Auto Insurance

Several resources are available to help consumers understand auto insurance and premium calculations. Your state’s Department of Insurance website often provides valuable information about consumer rights, insurance regulations, and complaint procedures. Independent consumer advocacy organizations also offer educational materials and tools to compare insurance rates. Additionally, many insurance companies provide detailed explanations of their rating factors on their websites. By utilizing these resources, consumers can become better informed about their insurance options and make more financially savvy decisions.

Final Conclusion

Ultimately, understanding your auto insurance premium is key to responsible car ownership and financial planning. By carefully considering the factors that influence your premium and employing the strategies Artikeld in this guide, you can navigate the complexities of auto insurance and secure the most suitable and cost-effective coverage for your needs. Remember to regularly review your policy and compare quotes to ensure you’re getting the best possible value for your money.

FAQ Section

What happens if I don’t pay my auto insurance premium?

Failure to pay your premium can lead to policy cancellation, leaving you uninsured and potentially facing legal consequences if involved in an accident.

Can I change my auto insurance premium payment plan?

Many insurers offer flexible payment options, such as monthly installments. Contact your insurer to explore available alternatives.

How often are auto insurance premiums reviewed?

Premiums are typically reviewed annually, but adjustments might occur based on changes in your risk profile (e.g., accidents, moving to a new location).

Does my credit score affect my auto insurance premium?

In many jurisdictions, your credit score is a factor in determining your premium, reflecting your perceived risk as a policyholder.