Understanding insurance premiums is crucial for navigating the world of financial protection. This guide demystifies the concept, exploring what insurance premiums are, how they’re calculated, and how you can manage their cost. We’ll delve into the factors influencing premium costs, explore various payment options, and discuss the impact of claims on future premiums. Think of it as your personal crash course in insurance premium literacy.

From the fundamental definition of an insurance premium to strategies for securing lower rates, we’ll cover a comprehensive range of topics. We’ll examine how different insurance types, individual circumstances, and risk assessments all contribute to the final premium amount. This guide aims to empower you with the knowledge needed to make informed decisions about your insurance coverage.

Defining Insurance Premiums

An insurance premium is essentially the price you pay to an insurance company for an insurance policy. This policy protects you financially against potential losses or damages specified within the contract. Think of it as a pre-emptive payment for future risk mitigation. The more risk you present to the insurer, the higher the premium will generally be.

Insurance premiums are calculated based on a variety of factors, including the type of coverage, the amount of coverage, the insured’s risk profile, and the insurer’s own operating costs and profit margins. They are the lifeblood of the insurance industry, funding the payouts made to policyholders who experience covered losses.

Types of Insurance Premiums and Their Variations

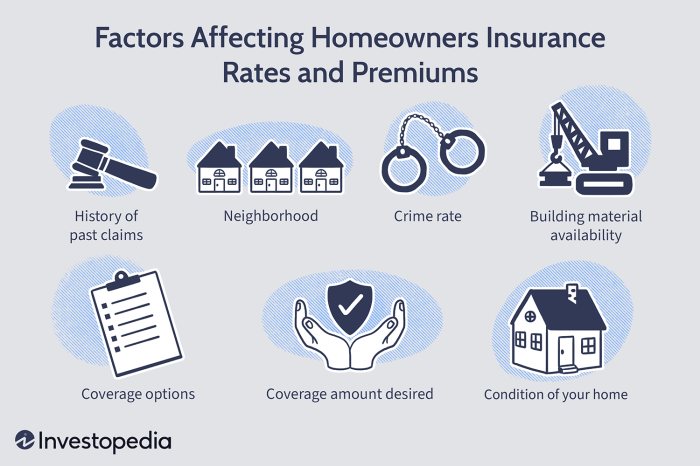

Different types of insurance policies come with different premium structures. For example, a car insurance premium will vary widely based on factors such as the driver’s age, driving history, the vehicle’s make and model, and the location where the vehicle is primarily driven. Similarly, health insurance premiums are influenced by factors such as age, health status, location, and the type of plan chosen (e.g., HMO, PPO). Homeowners insurance premiums are affected by the value of the home, its location, the level of coverage desired, and the presence of security features. Life insurance premiums are dependent on the policy type (term, whole life, etc.), the death benefit amount, the insured’s age and health, and the length of the policy term. These premiums can vary significantly depending on the specific details of the policy and the individual’s risk profile.

Premium Comparison Across Providers

Let’s consider a hypothetical example: a $250,000 homeowners insurance policy in a medium-risk suburban area. Three different insurers might offer the following annual premiums:

| Insurer | Annual Premium | Deductible | Coverage Details |

|---|---|---|---|

| Insurer A | $1,200 | $1,000 | Standard coverage, no additional riders. |

| Insurer B | $1,500 | $500 | Standard coverage plus flood coverage, higher deductible. |

| Insurer C | $1,000 | $2,000 | Standard coverage, higher deductible, lower premium. |

This table illustrates how premiums can differ even for the same type of coverage. The differences reflect variations in coverage details, deductibles, and the insurers’ risk assessments. It highlights the importance of comparing quotes from multiple providers before selecting a policy. It’s crucial to understand that the lowest premium doesn’t always represent the best value; a higher premium might offer more comprehensive coverage or a lower deductible, which could be more beneficial in the long run.

Factors Influencing Premium Costs

Insurance premiums aren’t arbitrary; several factors contribute to their final cost. Understanding these factors allows consumers to make informed decisions about their coverage and potentially reduce their premiums. This section will explore the key elements that insurance companies consider when setting premium rates.

Age, Health Status, and Driving History in Car Insurance

Age, health status, and driving history significantly impact car insurance premiums. Statistically, younger drivers are involved in more accidents than older, more experienced drivers. This higher risk translates to higher premiums for younger drivers. Conversely, older drivers with clean driving records often receive lower rates. Health status, while not always directly considered in car insurance, can indirectly influence premiums through the potential for increased risk of accidents due to pre-existing conditions. A poor driving history, including accidents, speeding tickets, and DUI convictions, substantially increases premiums due to the elevated risk of future claims.

Risk Assessment in Setting Premium Rates

Risk assessment is the cornerstone of insurance pricing. Insurance companies use sophisticated actuarial models to analyze vast amounts of data to predict the likelihood of claims. This involves evaluating a wide range of factors, not just those mentioned above. For example, location plays a crucial role; areas with higher crime rates or more frequent accidents typically result in higher premiums. The type of vehicle insured also matters; sports cars and high-performance vehicles are often more expensive to insure due to their higher repair costs and increased risk of theft. The chosen coverage level also influences the premium; comprehensive coverage will cost more than liability-only coverage.

Impact of Risk Factors on Premium Costs

The table below illustrates how different risk factors can affect insurance premium costs. Note that these are general examples and specific premiums will vary based on individual circumstances and the insurer’s specific rating system.

| Risk Factor | Premium Impact | Example | Explanation |

|---|---|---|---|

| Young Driver (under 25) | High | 20-year-old with a new driver’s license | Higher accident rate among young drivers. |

| Poor Driving History (multiple accidents/tickets) | High | Driver with three speeding tickets in the past year | Demonstrated higher risk of future accidents. |

| High-Value Vehicle (luxury car) | Medium | Insuring a new BMW | Higher repair costs and potential for greater theft losses. |

| Living in a High-Risk Area (high crime rate) | Medium | Residing in a city with a high rate of car theft | Increased likelihood of vehicle theft or damage. |

| Clean Driving Record (no accidents or tickets) | Low | Driver with a 10-year history of accident-free driving | Demonstrated low risk of future accidents. |

| Older Driver (over 65 with good health) | Low | A 70-year-old with a clean driving record and no health issues impacting driving ability. | Statistically lower accident rate for this demographic. |

Understanding Policy Documents and Premium Information

Locating and understanding the premium information within your insurance policy is crucial for managing your financial responsibilities. Policy documents can vary in format and length depending on the insurer and type of insurance, but the key information is always present, albeit sometimes requiring a bit of searching. This section will guide you through the process of finding and interpreting this vital information.

Policy documents typically present premium information in several key sections. These sections often include details about the initial premium payment, methods for making payments, options for adjusting premium payments (such as paying in installments), and potential adjustments based on policy changes or risk factors. Understanding these sections is essential for avoiding late payment fees and ensuring your coverage remains active.

Premium Payment Schedules and Methods

This section details how and when premiums are due. It will clearly state the amount of each payment, the payment due date(s), and the accepted payment methods (e.g., online payment, mail, phone). Many policies will also offer a grace period, a short timeframe after the due date before late fees are applied. This section may also Artikel potential penalties for late payments or missed payments. For example, a policy might state “Premiums are due on the 15th of each month. A 10% late fee will be applied if payment is received after the 25th.” Furthermore, it might detail different payment options like monthly, quarterly, or annual payments, with potential discounts for annual payments.

Premium Adjustments and Policy Changes

This section Artikels how changes to your policy might affect your premium. For example, adding coverage (such as increasing liability limits on car insurance) will usually increase your premium, while removing coverage (such as decreasing the amount of coverage on your homeowners insurance) may decrease it. This section should clearly state the factors that influence premium adjustments and provide examples or a formula to calculate these changes. For instance, a policy may state that increasing coverage by a certain percentage will lead to a corresponding increase in premium based on a specific formula or a provided table. This section may also explain how changes in your risk profile (e.g., moving to a higher-risk area) might affect your premium.

Common Terms and Abbreviations Related to Premiums

Understanding the terminology used in your policy is crucial. Common terms include:

- Premium: The amount you pay for your insurance coverage.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Co-pay: A fixed amount you pay for a covered healthcare service.

- Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage.

- Grace Period: A period of time after the due date during which you can make a payment without penalty.

- Late Fee: A penalty charged for paying your premium after the due date.

- Reinstatement Fee: A fee charged to reinstate a lapsed policy.

Abbreviations are also common. While specific abbreviations may vary by insurer, understanding their meaning is essential. For instance, “APR” might stand for Annual Percentage Rate (for interest on outstanding premiums), while “ACV” could mean Actual Cash Value (relevant for claims involving damaged property). Always refer to your policy’s glossary or contact your insurer for clarification on any unfamiliar terms or abbreviations.

Illustrative Example: Homeowner’s Insurance Premium

Let’s consider a fictional example to illustrate how various factors influence a homeowner’s insurance premium. We’ll follow a step-by-step process to understand the calculation.

This example demonstrates the interplay between property characteristics, location, coverage choices, and the resulting premium cost. Understanding this relationship allows homeowners to make informed decisions about their insurance coverage.

Homeowner Profile and Property Details

Our example involves Sarah, who owns a 2,500 square foot house in a suburban neighborhood of Anytown, USA. Her home is valued at $400,000, and it’s a brick structure built in 2010. The property includes a detached garage and a well-maintained yard. Anytown is considered a relatively low-risk area for natural disasters, but crime rates are moderate.

Coverage Selection and Premium Calculation

Sarah chooses a standard homeowner’s insurance policy with the following coverage levels: dwelling coverage of $400,000 (matching her home’s value), personal liability coverage of $300,000, and other structures coverage of $50,000 (for the garage). She also opts for a higher deductible of $2,000 to reduce her premium. Her insurance company, “InsureAll,” uses a complex algorithm considering numerous factors to determine her premium. These factors include the home’s age, construction, location, coverage amounts, and deductible.

Premium Breakdown

Based on InsureAll’s assessment, Sarah’s annual premium is broken down as follows:

| Coverage Type | Coverage Amount | Premium Component |

|---|---|---|

| Dwelling | $400,000 | $800 |

| Other Structures | $50,000 | $100 |

| Personal Liability | $300,000 | $200 |

| Deductible ($2,000) | – | -$100 (discount) |

| Total Annual Premium | – | $1000 |

Note: These figures are simplified for illustrative purposes. Actual premiums vary significantly depending on the specific insurer, location, and individual circumstances.

Visual Representation of Premium Calculation

Imagine a chart where the x-axis represents the different factors influencing the premium (home value, location risk, coverage levels, deductible). The y-axis represents the premium cost. Each factor would have a corresponding bar, showing its individual contribution to the total premium. For instance, the “home value” bar would be the tallest, reflecting the significant influence of the property’s value. The “deductible” bar would point downwards, illustrating the premium reduction resulting from choosing a higher deductible. The final premium amount ($1000 in this example) would be represented by the sum of all these bars, showcasing the cumulative effect of all factors. The chart visually depicts how each factor contributes to, or reduces, the overall insurance cost.

Closing Summary

In conclusion, understanding insurance premiums is a key component of responsible financial planning. By grasping the factors that influence premium costs, exploring various payment options, and understanding the impact of claims, you can effectively manage your insurance expenses and secure the appropriate level of coverage. Remember, proactive planning and informed decision-making are your best allies in navigating the complexities of insurance.

Question & Answer Hub

What happens if I miss an insurance premium payment?

Missing a payment can lead to a lapse in coverage, leaving you vulnerable to financial hardship in the event of an accident or unforeseen circumstance. Late fees may also apply.

Can I negotiate my insurance premium?

While not always guaranteed, you can often negotiate your premium by comparing quotes from multiple providers, highlighting your good driving record or other risk-reducing factors, and exploring available discounts.

How frequently are insurance premiums reviewed?

The frequency of premium reviews varies depending on the insurer and the type of insurance. Some policies are reviewed annually, while others might be reviewed less frequently.

What is the difference between a deductible and a premium?

A premium is the regular payment you make to maintain your insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in after a claim.