Securing your family’s financial future through life insurance is a significant decision, and understanding the costs involved is crucial. A key element of this understanding is grasping the concept of life insurance premiums. This guide will demystify what a life insurance premium is, how it’s calculated, and the various factors influencing its cost, empowering you to make informed choices about your coverage.

We’ll explore different premium structures, payment options, and the impact of factors like age and health on your premiums. By the end, you’ll have a clear understanding of how to navigate the world of life insurance premiums and find the best policy to fit your needs and budget.

Factors Affecting Life Insurance Premiums

Several key factors influence the cost of life insurance premiums. Insurers meticulously assess these elements to determine the risk associated with insuring an individual, ultimately setting a premium that reflects that risk. A higher perceived risk translates to a higher premium, while a lower risk results in a lower premium. Understanding these factors can help individuals make informed decisions when purchasing life insurance.

Underwriting and Premium Determination

The underwriting process is central to determining life insurance premiums. Underwriters are professionals who thoroughly review an applicant’s information to assess their risk profile. This involves a detailed examination of the applicant’s medical history, lifestyle, occupation, and family history. The more comprehensive the information, the more accurately the insurer can assess the risk and set a fair premium. Underwriters use sophisticated actuarial models and statistical data to calculate the probability of a claim occurring within a specific timeframe. This probability, combined with the policy’s death benefit, directly impacts the premium calculation. Factors deemed high-risk, such as pre-existing conditions or hazardous occupations, increase premiums, while low-risk factors decrease them.

Key Factors Considered by Insurers

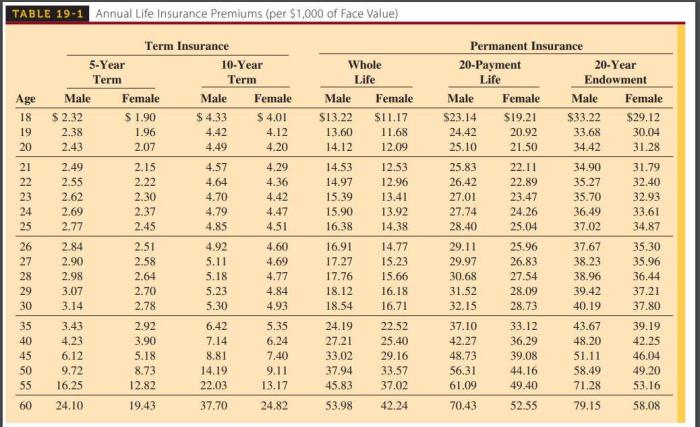

Insurers consider a range of factors when setting life insurance premiums. Age is a significant factor, with premiums generally increasing as age increases due to the higher statistical probability of death at older ages. Health status plays a crucial role; individuals with pre-existing conditions or poor health often face higher premiums. Lifestyle choices, such as smoking, excessive alcohol consumption, or dangerous hobbies, can also impact premiums. Occupation is another important consideration, as some professions carry higher risk of injury or death. Finally, the type of policy chosen (term life, whole life, etc.) and the policy’s death benefit amount influence the premium.

Age and Premium Costs

Imagine a graph charting the relationship between age and life insurance premiums. The horizontal axis represents age, starting at 18 and extending to 70. The vertical axis represents the premium cost. The line starts relatively flat at younger ages, representing lower premiums for younger individuals. As age increases, the line steadily climbs upwards, showing a significant increase in premium costs as individuals get older. This illustrates the higher risk associated with insuring older individuals. For example, a 25-year-old might pay significantly less than a 55-year-old for the same coverage amount. The steeper incline of the line in later ages reflects the exponentially increasing probability of mortality.

Impact of Health Conditions and Lifestyle Choices

Specific health conditions can significantly affect premium costs. For instance, a history of heart disease, cancer, or diabetes will likely result in higher premiums compared to someone with no such history. Similarly, lifestyle choices such as smoking significantly increase premiums due to the increased risk of lung cancer, heart disease, and other smoking-related illnesses. Individuals who engage in risky activities, like skydiving or mountain climbing, may also face higher premiums. Conversely, maintaining a healthy lifestyle, including regular exercise and a balanced diet, can often lead to lower premiums, reflecting a reduced risk profile. For example, a smoker might pay double or even triple the premium of a non-smoker with the same age and health profile. A person with controlled diabetes might receive a slightly higher premium than a person with no history of diabetes, reflecting the manageable risk.

Understanding Your Life Insurance Premium

Your life insurance policy statement contains crucial information about your coverage and costs. Understanding this information empowers you to make informed decisions about your financial protection. This section will guide you through interpreting your policy statement, finding affordable premiums, and comparing quotes from different insurers.

Interpreting Your Life Insurance Policy Statement

A typical life insurance policy statement will detail your policy number, the type of coverage (term, whole life, etc.), the death benefit amount, your premium payment schedule (monthly, annually, etc.), and the current cash value (if applicable). It will also show the date of your last payment, any outstanding balances, and the policy’s status (active, lapsed, etc.). Look for sections detailing any riders or additional coverage you’ve purchased, as these impact the overall premium. Pay close attention to any changes in your premium amount, as this may indicate adjustments to your coverage or a change in your health status. For example, a policy statement might show a premium of $100 per month for a $250,000 term life policy, payable annually, with no outstanding balance. A change in the premium might reflect an increase in your coverage or a change in the insurer’s risk assessment.

Finding Affordable Life Insurance Premiums

Several strategies can help you secure affordable life insurance premiums. Maintaining a healthy lifestyle reduces your risk profile, leading to lower premiums. Consider increasing your coverage gradually rather than opting for a large policy upfront; this allows for manageable premium payments. Shopping around and comparing quotes from multiple insurers is crucial. You can also explore different policy types; term life insurance typically offers lower premiums than permanent life insurance. For instance, a non-smoker in excellent health might qualify for significantly lower premiums than a smoker with pre-existing conditions. Finally, consider the length of your term life insurance policy; a shorter term generally equates to a lower premium.

Comparing Quotes from Different Insurance Providers

When comparing quotes, focus on the total cost of coverage over the policy term, not just the monthly premium. Pay close attention to the policy’s features, including the death benefit, riders, and any exclusions. Ensure you’re comparing apples to apples—the same type of policy with similar coverage amounts. Use a comparison website or contact multiple insurance providers directly to obtain quotes. Organize the quotes in a table to easily compare key features and prices. For example, you might compare a $250,000 10-year term life policy from three different insurers, noting the monthly premium, any riders included, and any exclusions.

A Step-by-Step Guide to Shopping for Life Insurance and Comparing Premiums

- Assess your needs: Determine the amount of life insurance coverage you require based on your financial obligations and dependents.

- Get quotes from multiple insurers: Contact at least three different insurance providers to obtain quotes.

- Compare quotes carefully: Analyze the quotes, focusing on the total cost, policy features, and any exclusions.

- Review policy details: Thoroughly review the policy documents before making a decision.

- Choose the best policy: Select the policy that best meets your needs and budget.

Premium Payment Options and Flexibility

Choosing a life insurance policy involves not only selecting the right coverage amount but also understanding the various payment options available and how they can adapt to your changing financial circumstances. Flexibility in premium payments is a key factor in ensuring your policy remains active and continues to provide the protection you need.

Premium payment methods offer various levels of convenience and control over your finances. Understanding these options and the potential consequences of missed payments is crucial for maintaining your life insurance coverage effectively.

Available Premium Payment Methods

Life insurance companies typically offer several ways to pay your premiums. These methods cater to different preferences and financial situations. The most common include:

- Annual Payments: Paying your premium once a year usually results in a slightly lower overall cost due to reduced administrative fees. This option is ideal for those with stable income and a preference for minimizing the frequency of payments.

- Semi-Annual Payments: Splitting the annual premium into two payments provides a balance between convenience and cost-effectiveness. This is a popular choice for many policyholders.

- Quarterly Payments: Paying your premium four times a year offers greater frequency and potentially better cash flow management. However, the overall cost might be slightly higher compared to annual payments.

- Monthly Payments: This option offers the highest frequency and is the most convenient for many. However, it typically comes with the highest overall cost due to increased administrative expenses.

- Electronic Funds Transfer (EFT): Automatic payments directly from your bank account offer convenience and eliminate the risk of missed payments. This is a highly recommended method for reliable premium payment.

Consequences of Missed or Late Premium Payments

Failure to pay premiums on time can have significant repercussions. The specific consequences vary depending on the insurance company and the policy type, but generally include:

- Grace Period: Most policies include a grace period, typically 30 days, during which you can make the missed payment without penalty. However, coverage may lapse if payment isn’t received within this period.

- Policy Lapse: If the premium remains unpaid after the grace period, the policy may lapse, meaning your coverage ends. Reinstatement may be possible, but it often involves paying back premiums, interest, and potentially undergoing a new health assessment.

- Reduced Cash Value (for cash value policies): For policies with a cash value component, missed payments can reduce the accumulated cash value, impacting potential future benefits.

- Increased Premiums: In some cases, reinstating a lapsed policy may result in higher premiums than the original rate.

Adjusting Premium Payments Based on Changing Financial Circumstances

Life events often necessitate adjustments to your budget, including your life insurance premium payments. Most insurers offer options to manage this:

- Premium Loans (for cash value policies): Policyholders with cash value policies can often borrow against their accumulated cash value to cover missed premiums. However, interest accrues on these loans, and it’s crucial to understand the terms and conditions.

- Policy Surrender: In extreme cases, surrendering the policy allows you to receive the cash value (if applicable). This should be considered a last resort, as it terminates the policy and forfeits future coverage.

- Reduced Coverage: Contacting your insurer to discuss reducing your coverage amount can lower your premium. This option should be carefully evaluated to ensure the remaining coverage still meets your needs.

- Payment Plan Modifications: Some insurers allow changes to your payment schedule, such as switching from monthly to quarterly payments, to better align with your cash flow.

Examples of Situations Requiring Premium Adjustments

Several life situations may necessitate adjustments to your premium payments. For example:

- Job Loss: Unemployment can significantly impact your ability to pay premiums, requiring you to explore options like payment plan modifications or reduced coverage.

- Major Medical Expenses: Unexpected high medical bills can strain your finances, potentially leading to the need for premium loans or temporarily reduced coverage.

- Divorce or Separation: Significant life changes like divorce may necessitate adjustments to your insurance needs and premium payments.

- Unexpected Expenses: Home repairs, car accidents, or other unforeseen events can require a temporary reduction in premium payments or other financial adjustments.

Final Conclusion

Understanding life insurance premiums is fundamental to securing adequate coverage for your loved ones. From comprehending the various factors influencing premium costs to exploring flexible payment options, this guide provides a solid foundation for making informed decisions. Remember to compare quotes from different insurers, consider your individual circumstances, and don’t hesitate to seek professional advice to ensure you find the life insurance policy that best protects your future.

FAQ Guide

What happens if I miss a premium payment?

Missing a premium payment can lead to your policy lapsing, meaning your coverage ends. However, grace periods are often offered, and reinstatement may be possible depending on the insurer and policy type.

Can I change my premium payment frequency?

Many insurers allow you to adjust your payment frequency (annual, semi-annual, quarterly, monthly). Changing the frequency may affect the total premium amount due to administrative fees.

How do I compare life insurance quotes effectively?

When comparing quotes, focus on the death benefit, premium amount, policy type, and the insurer’s financial stability. Don’t solely focus on the lowest premium; ensure the coverage meets your needs.

What is the difference between a level and a decreasing premium?

Level premiums remain consistent throughout the policy’s term. Decreasing premiums start higher and decrease over time, often associated with specific types of term life insurance.