Stepping beyond basic coverage, premium insurance offers a world of enhanced protection and added value. This exploration delves into the nuances of premium insurance plans, examining their defining characteristics, cost considerations, and the significant benefits they provide across various insurance types. We’ll navigate the selection process, claims procedures, and ultimately, demonstrate how premium insurance can offer peace of mind and superior protection compared to standard plans.

From enhanced coverage limits and 24/7 emergency assistance to exclusive concierge services and streamlined claims processes, premium insurance caters to those seeking a higher level of security and personalized support. Understanding the cost-benefit analysis is crucial, and this guide aims to equip you with the knowledge to make an informed decision regarding your insurance needs.

Defining Premium Insurance

Premium insurance represents a higher tier of coverage compared to standard plans, offering enhanced benefits and broader protection. It’s designed for individuals and families seeking comprehensive security and peace of mind, often willing to pay a higher premium for superior services and features. The core difference lies in the extent of coverage, the level of service provided, and the overall value proposition.

Premium insurance plans are characterized by several key distinctions. They generally include higher coverage limits, faster claim processing times, access to specialized services, and a more personalized customer experience. These features are often absent or limited in standard plans, which focus on providing basic protection at a lower cost.

Key Characteristics of Premium Insurance

Premium insurance plans stand apart due to several defining characteristics. They offer significantly higher coverage limits than standard plans, meaning larger payouts in the event of a claim. Furthermore, these plans frequently feature expedited claim processing, ensuring faster resolution and reduced stress during difficult times. Access to a dedicated concierge service, providing personalized assistance and support, is another common feature. Finally, premium plans often include additional benefits such as global coverage, travel assistance, and access to exclusive networks of healthcare providers.

Examples of Premium Insurance Benefits

A premium health insurance plan, for instance, might include coverage for a wider range of treatments, including alternative therapies and specialized medical procedures, not typically covered by basic plans. Similarly, a premium auto insurance policy could offer rental car reimbursement for the duration of repairs, roadside assistance, and accident forgiveness, features usually absent in standard plans. In the realm of home insurance, premium plans might include higher coverage limits for personal belongings, additional liability protection, and specialized services such as emergency home repair.

Comparison with Basic Insurance Options

The fundamental difference between premium and basic insurance lies in the scope of coverage and the level of service. Basic plans provide essential protection at a lower cost, but they often have lower coverage limits, longer claim processing times, and limited additional benefits. Premium plans, on the other hand, offer more comprehensive coverage, faster service, and additional perks designed to enhance the policyholder’s experience. The choice between the two depends on individual needs and risk tolerance; those seeking greater security and a higher level of service are likely to opt for premium plans, while those prioritizing affordability may prefer basic coverage.

Cost and Value of Premium Insurance

Premium insurance, while more expensive than standard policies, offers a higher level of coverage and benefits. Understanding the cost factors and the resulting value proposition is crucial for consumers making informed decisions about their insurance needs. This section will explore the factors influencing premium insurance costs and demonstrate the value it provides in various scenarios.

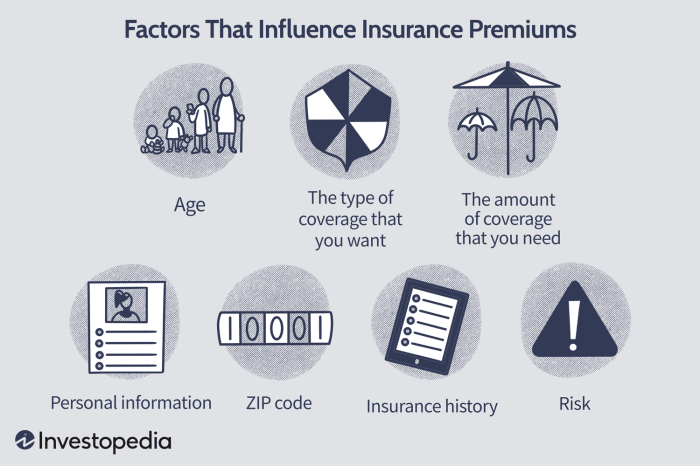

Factors Influencing the Cost of Premium Insurance

Several factors contribute to the higher cost of premium insurance. These include enhanced coverage limits, broader policy inclusions, specialized services, and a higher claims payout potential. For example, premium health insurance plans often feature lower deductibles, co-pays, and out-of-pocket maximums, resulting in lower overall costs for the insured in the event of a significant health issue. Similarly, premium auto insurance policies may include additional benefits like roadside assistance, rental car reimbursement, and higher liability limits, increasing the policy’s overall price. The insurer’s risk assessment, based on factors like the insured’s location, claims history, and the specific type of coverage, also plays a significant role in determining the final premium.

Value Proposition of Premium Insurance for Consumers

The value of premium insurance lies in its enhanced protection and peace of mind. It provides a safety net against potentially catastrophic financial losses associated with unexpected events. Premium policies offer significantly higher coverage limits than standard policies, meaning consumers are better protected against substantial financial burdens. Furthermore, premium insurance often includes additional services and benefits not found in standard policies, adding further value for the insured. This could range from concierge medical services to 24/7 emergency assistance. The reduced financial stress and increased access to specialized care are key aspects of the value premium insurance offers.

Cost-Benefit Ratio Comparison: Premium vs. Standard Insurance

The following table illustrates a simplified comparison of the cost-benefit ratio between premium and standard insurance. Note that these figures are illustrative and can vary significantly based on individual circumstances and the specific policy details.

| Feature | Premium Insurance | Standard Insurance |

|---|---|---|

| Annual Premium | $3000 | $1500 |

| Deductible (Health/Auto) | $500/$500 | $2000/$1000 |

| Coverage Limits (Liability) | $1,000,000 | $300,000 |

| Additional Benefits | Concierge Service, Roadside Assistance | None |

Scenarios Demonstrating Premium Insurance Value

Consider a scenario where an individual experiences a major car accident resulting in significant property damage and injuries. A standard insurance policy might leave the individual with substantial out-of-pocket expenses due to higher deductibles and lower liability coverage. However, a premium policy with higher coverage limits and additional benefits would significantly mitigate these financial burdens, covering medical expenses, property damage, and potentially providing rental car coverage while the vehicle is being repaired. Similarly, in the case of a serious illness requiring extensive medical treatment, a premium health insurance policy with lower deductibles and out-of-pocket maximums would significantly reduce the financial strain on the individual and their family.

Illustrative Examples of Premium Insurance Benefits

Premium insurance, while often more expensive upfront, offers significant advantages beyond basic coverage. These benefits translate to enhanced peace of mind and potentially substantial financial savings in the event of unforeseen circumstances. The following examples illustrate the tangible value provided by premium insurance plans across different sectors.

24/7 Emergency Assistance

Imagine this: you’re on a cross-country road trip, miles from civilization, when your car breaks down in the middle of a blizzard. A standard auto insurance policy might cover the eventual tow and repairs, but leave you stranded and exposed to the elements for hours, or even days. However, a premium policy often includes 24/7 emergency assistance. In this scenario, a single call would connect you with a roadside assistance provider who would dispatch a tow truck, potentially provide temporary shelter, and even arrange for alternative transportation to your destination or a safe location. This rapid response minimizes the inconvenience and potential dangers associated with a breakdown in a remote or hazardous location, adding significant value beyond basic coverage. The immediate support, rapid response, and proactive problem-solving offered by 24/7 emergency assistance represent a considerable advantage for premium policyholders.

Higher Coverage Limits in Auto Insurance

Consider a scenario involving a serious car accident resulting in significant property damage and substantial injuries to others. A standard auto insurance policy might have liability limits of $100,000. If the damages exceed this amount, you would be personally responsible for the difference – a potentially crippling financial burden. A premium auto insurance plan, however, often offers much higher liability limits, perhaps $500,000 or even $1 million. In the accident scenario, the higher coverage limit ensures complete protection, preventing a devastating financial fallout. The peace of mind provided by knowing you are adequately protected against significant liability claims is a key benefit of premium auto insurance. This superior protection extends to comprehensive coverage, potentially including coverage for damage to your vehicle exceeding the market value in certain cases.

Concierge Services in Health Insurance

Premium health insurance plans sometimes include concierge services. Imagine you need a specialist referral for a complex medical issue. Navigating the healthcare system can be time-consuming and frustrating. With concierge services, a dedicated healthcare professional assists in finding the right specialist, scheduling appointments, and managing all the administrative details. They can also help coordinate care across multiple providers, ensuring seamless treatment. This service saves valuable time and reduces the stress associated with managing a serious health concern, significantly improving the overall healthcare experience. The personalized attention and proactive management of healthcare needs provided by concierge services significantly enhances the value of a premium health insurance plan. This goes beyond simply paying for medical procedures; it facilitates access to optimal care with reduced stress and enhanced efficiency.

Final Review

Ultimately, the decision to opt for premium insurance hinges on a careful assessment of individual needs and risk tolerance. While the cost may be higher than standard plans, the enhanced coverage, added benefits, and potentially smoother claims process can offer significant value, especially in unforeseen circumstances. By understanding the features, comparing options, and evaluating your specific requirements, you can confidently choose a premium insurance plan that aligns perfectly with your priorities and provides the peace of mind you deserve.

FAQ Section

What are the typical cancellation policies for premium insurance?

Cancellation policies vary by provider and insurance type. It’s crucial to review the specific terms and conditions of your policy for details on cancellation fees, refund procedures, and any applicable waiting periods.

Can I upgrade from a standard to a premium insurance plan at any time?

Generally, yes, but there may be limitations depending on your insurer and the specific policy. You might need to meet certain criteria or wait for a renewal period. Contact your insurance provider to discuss upgrade options.

How does premium insurance affect my insurance score?

Premium insurance itself doesn’t directly impact your insurance score. However, consistent on-time premium payments contribute positively to your credit history, which can indirectly influence your insurance score in some cases.

Are there any tax benefits associated with premium insurance?

Tax benefits related to insurance vary widely by location and type of insurance. Consult a tax professional to determine if any deductions or credits are applicable to your specific premium insurance plan.