Buying a home is a significant financial undertaking, and understanding all the associated costs is crucial. One such cost that often surprises first-time homebuyers is the Mortgage Insurance Premium (MIP). This seemingly small detail can significantly impact your overall mortgage expenses. This guide unravels the complexities of MIP, providing a clear understanding of its purpose, calculation, and implications for your financial future.

We’ll explore who needs MIP, how it’s calculated, and the various types available. We’ll also compare MIP to Private Mortgage Insurance (PMI) and illustrate its long-term financial impact. By the end, you’ll be equipped with the knowledge to navigate the MIP landscape confidently and make informed decisions about your mortgage.

How is MIP Calculated?

The calculation of Mortgage Insurance Premium (MIP) involves several factors related to the loan and the borrower’s financial situation. Understanding these factors is crucial for accurately determining the cost of MIP and planning your home purchase budget accordingly. The calculation itself isn’t overly complex, but understanding the underlying variables is key.

Factors Influencing MIP Calculation

Several key factors influence the MIP calculation. Primarily, the calculation centers around the Loan-to-Value ratio (LTV), which is the ratio of the loan amount to the appraised value of the property. A higher LTV generally results in a higher MIP. Additionally, the type of loan (e.g., FHA, VA) and the loan term also impact the MIP amount. Finally, the specific rules and regulations set by the relevant government agency or mortgage insurer play a vital role.

Common Methods for Determining MIP Amount

The most common method for calculating MIP is based on the LTV. The MIP is expressed as an annual percentage of the loan amount, and this percentage varies depending on the LTV. For example, a lower LTV might have a lower annual MIP percentage than a higher LTV. This annual percentage is then usually further broken down into monthly payments. Some lenders might also factor in other fees, but the core calculation always relies on the LTV. The specific percentages are set by the mortgage insurer and are subject to change.

Examples of MIP Calculations

Let’s illustrate MIP calculation with some examples. Keep in mind that these are simplified examples, and actual MIP calculations can be more nuanced. The precise MIP rates and calculation methods vary depending on the mortgage insurer and the specific loan program.

Step-by-Step MIP Calculation Guide

To calculate the MIP, follow these steps:

1. Determine the Loan-to-Value Ratio (LTV): Divide the loan amount by the appraised value of the property. For example, a $300,000 loan on a $350,000 property has an LTV of 85.7% (300,000 / 350,000).

2. Identify the Applicable MIP Rate: This rate depends on the LTV and the type of loan. FHA loans, for example, have a published table of MIP rates corresponding to various LTVs. Let’s assume, for our example, an annual MIP rate of 0.8% for an 85.7% LTV.

3. Calculate the Annual MIP: Multiply the loan amount by the annual MIP rate. In our example, the annual MIP would be $2,400 ($300,000 * 0.008).

4. Calculate the Monthly MIP: Divide the annual MIP by 12 to get the monthly payment. In this case, the monthly MIP would be $200 ($2,400 / 12).

MIP Calculation Examples

| Loan Amount | Down Payment | Loan-to-Value Ratio (LTV) | MIP Amount (Annual, assuming 0.8% rate) |

|---|---|---|---|

| $250,000 | $50,000 | 83.3% | $2,000 |

| $300,000 | $0 | 100% | $2,400 |

| $400,000 | $80,000 | 80% | $3,200 |

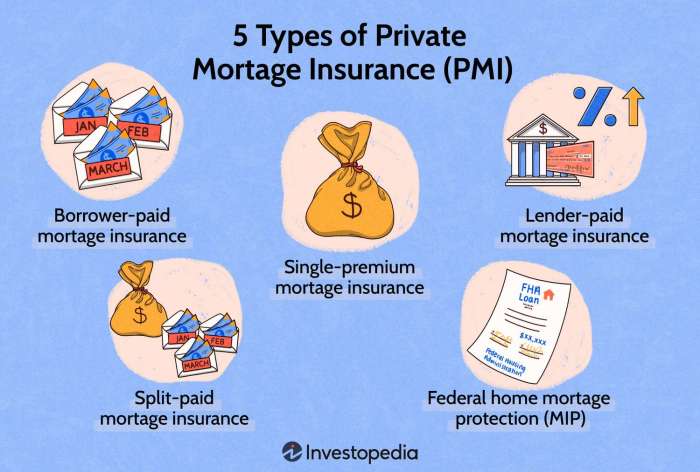

Types of MIP

Mortgage insurance premiums (MIPs) aren’t all created equal. The type of MIP you pay depends largely on the type of loan you have and when it was originated. Understanding these differences is crucial for accurately budgeting for your homeownership costs.

Upfront MIP

Upfront MIP is a lump-sum payment made at the closing of your mortgage. It’s calculated as a percentage of the loan amount, typically ranging from 0.5% to 1.75%, depending on your loan-to-value ratio (LTV) and the specific program. This single payment covers a portion of the insurance coverage for the life of the loan. The advantage is that you don’t have to pay a recurring monthly premium. This type of MIP is generally required for FHA loans with a down payment less than 10%. For example, a $200,000 loan with a 0.5% upfront MIP would require a $1,000 upfront payment at closing.

Annual MIP

Annual MIP, also known as annual premium, is a recurring premium paid monthly as part of your mortgage payment. This premium is typically a percentage of the outstanding loan balance and is added to your monthly mortgage payment. The rate varies depending on the loan type and risk factors. This type of MIP is often associated with FHA loans, particularly those with lower down payments, and continues until a certain loan-to-value threshold is reached, usually around 78%. For instance, an annual MIP rate of 0.5% on a $200,000 loan would equate to an additional $83.33 per month ($1000/12 months). The exact amount will vary based on the outstanding loan balance and the current interest rate.

Single-Premium MIP

While less common than upfront and annual MIP, some mortgage insurance programs may offer a single-premium MIP option. This involves a single payment made at closing, similar to upfront MIP, but the premium calculation may differ, sometimes reflecting a longer-term insurance coverage. It’s important to compare this option carefully against other MIP structures, as the total cost may be higher or lower depending on the interest rates and loan terms. The specific circumstances under which this option is available will depend entirely on the lender and the mortgage insurance provider.

No MIP

It’s important to note that not all mortgages require MIP. Conventional loans with a down payment of 20% or more typically do not require mortgage insurance. This is because a larger down payment reduces the lender’s risk. A higher down payment signifies lower risk for the lender, eliminating the need for additional insurance protection. Therefore, borrowers with a substantial down payment can avoid MIP altogether, saving money over the life of the loan.

Paying MIP

Mortgage insurance premiums (MIP) are typically paid monthly, alongside your principal and interest payments. This ensures a consistent and manageable payment schedule for homeowners. The method of payment is generally straightforward and integrated into your overall mortgage payment process.

MIP payments are usually bundled with your regular mortgage payment, meaning you don’t receive a separate bill for the MIP. This simplifies the payment process, ensuring a single monthly payment covers both your mortgage principal and interest, as well as your MIP. This consolidated approach streamlines the payment process for borrowers.

MIP Payment Methods

Borrowers generally don’t have a wide range of options for *how* they pay their MIP. The most common method is through the lender’s automated payment system, integrated directly into the monthly mortgage payment. This typically involves making a single payment each month that includes the principal, interest, taxes (if applicable), and the MIP. Some lenders may offer other payment methods, such as mailing a check or using online banking portals, but the integration within the overall mortgage payment is the standard practice.

MIP on Monthly Mortgage Statements

Your monthly mortgage statement will clearly show the MIP as a separate line item. This allows for transparency and easy tracking of the insurance cost. The statement will break down the total monthly payment into its component parts: principal, interest, property taxes (if applicable), homeowner’s insurance (if applicable), and MIP. For example, a statement might show a breakdown like this:

| Item | Amount |

|---|---|

| Principal & Interest | $1,500 |

| Property Taxes | $200 |

| Homeowner’s Insurance | $100 |

| MIP | $50 |

| Total Monthly Payment | $1,850 |

This detailed breakdown provides borrowers with a clear understanding of their monthly mortgage expenses and the specific contribution of the MIP to their overall payment. Regularly reviewing your statement helps in monitoring your mortgage payments and ensuring accuracy.

Impact of MIP on Overall Mortgage Costs

Mortgage insurance premiums (MIP) significantly increase the overall cost of homeownership. While MIP protects lenders, borrowers ultimately bear this added expense, impacting their monthly payments and the total amount paid over the life of the loan. Understanding this impact is crucial for budgeting and making informed financial decisions.

MIP adds to your monthly mortgage payment, increasing the total amount you pay each month. This increase can be substantial, especially in the early years of the loan when the principal balance is higher. Furthermore, the longer you pay MIP, the more it contributes to the total cost of your home. This is because the premium is typically added to your principal and interest payments, resulting in a larger overall payment.

MIP’s Long-Term Financial Implications

The long-term financial implications of MIP can be substantial. Consider a 30-year fixed-rate mortgage of $300,000 with an interest rate of 6%. With an annual MIP of 0.5%, the borrower would pay an additional $1,500 annually ($125 monthly). Over 30 years, this adds up to $45,000 in MIP payments. This is a significant amount of money that could otherwise be used for other financial goals, such as investments, paying down debt, or saving for retirement. This example highlights how seemingly small monthly increases can translate to a large sum over the life of a loan.

Comparison of Mortgage Costs With and Without MIP

The following table illustrates the difference in total mortgage costs with and without MIP. This example assumes a 30-year fixed-rate mortgage of $300,000 at a 6% interest rate, with a 0.5% annual MIP.

| Item | Mortgage Without MIP | Mortgage With MIP | Difference |

|---|---|---|---|

| Loan Amount | $300,000 | $300,000 | $0 |

| Interest Rate | 6% | 6% | 0% |

| Loan Term | 30 years | 30 years | 0 years |

| Annual MIP | $0 | $1,500 | $1,500 |

| Total Interest Paid | $328,256 | $328,256 | $0 |

| Total MIP Paid | $0 | $45,000 | $45,000 |

| Total Cost of Mortgage | $328,256 | $373,256 | $45,000 |

Note: This is a simplified example and does not include other closing costs or potential tax implications. Actual costs may vary depending on individual circumstances and lender policies. The interest paid remains the same in both scenarios, but the total cost of the mortgage is significantly higher with MIP.

Illustrative Example

Understanding the breakdown of a mortgage payment can be simplified with a visual representation. A pie chart effectively illustrates the proportion of each component within the total monthly payment, making it easier to grasp the impact of MIP.

A well-designed pie chart would visually depict the different components of a monthly mortgage payment. The chart would be clearly labeled, using distinct colors for each segment to enhance readability and understanding.

Mortgage Payment Component Breakdown

The pie chart would be divided into several segments, each representing a different part of the monthly payment. One significant segment would represent the principal payment – the portion of the payment that goes towards reducing the loan’s principal balance. This segment might be colored a light blue, for instance, and clearly labeled “Principal.” Another large segment would represent the interest payment – the cost of borrowing money. This segment could be a shade of green, labeled “Interest.” A smaller segment, representing the property taxes, could be yellow and labeled “Property Taxes.” Similarly, a segment for homeowner’s insurance would be included, perhaps in orange and labeled “Homeowner’s Insurance.” Finally, a distinct segment would represent the Mortgage Insurance Premium (MIP). This segment could be a darker shade of blue, clearly labeled “MIP.” A legend would be provided alongside the chart, listing each color and its corresponding component of the mortgage payment, making it easy to understand the proportions at a glance. For example, a $2,000 monthly payment might show a large Principal segment (e.g., $800), a large Interest segment (e.g., $900), and smaller segments for Property Taxes (e.g., $100), Homeowner’s Insurance (e.g., $100), and MIP (e.g., $100). The relative sizes of these segments would visually represent their proportions within the total monthly payment. This visual representation would clearly show how MIP contributes to the overall cost of homeownership.

Final Thoughts

Securing a mortgage involves a multifaceted understanding of various financial components. While the mortgage insurance premium might initially seem like a minor detail, its impact on your overall homeownership costs is substantial. This guide has provided a thorough examination of MIP, covering its definition, calculation, payment methods, and cancellation options. By understanding the nuances of MIP, you can effectively budget for your home purchase and make well-informed choices to minimize long-term financial burdens.

FAQ Compilation

Can I cancel my MIP early?

Yes, in some cases. For FHA loans, MIP can be canceled once you reach 20% equity in your home. The specific requirements and process vary depending on your loan type and lender.

Is MIP tax deductible?

The deductibility of MIP depends on your specific circumstances and tax laws. Consult a tax professional for personalized advice.

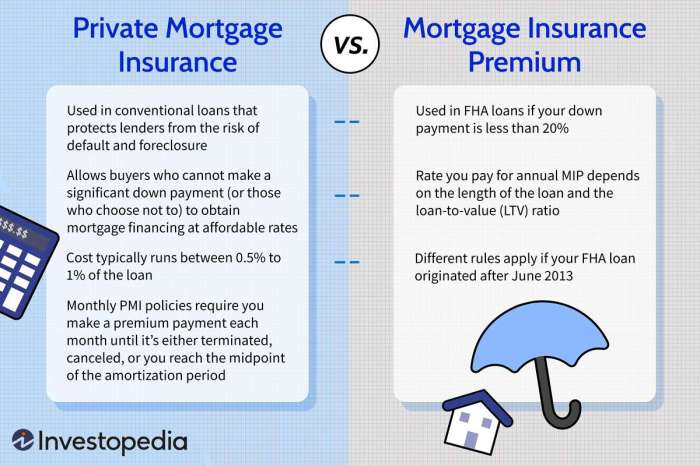

How does MIP differ from PMI?

MIP is typically required for FHA-insured loans, while PMI is required for conventional loans with down payments below 20%. Both protect the lender against losses if you default on the loan.

What happens if I miss a MIP payment?

Missing a MIP payment can lead to late fees and potentially impact your credit score. It could also lead to foreclosure if the issue is not resolved promptly.