Securing your family’s financial future is a primary concern for many, and life insurance plays a crucial role in achieving this peace of mind. Understanding the cost, however, can be daunting. This guide unravels the complexities of life insurance premiums, explaining what they are, what influences their cost, and how to navigate the various options available to find the best fit for your individual needs.

From the fundamental components that make up your premium to the diverse payment schedules and policy features, we’ll explore the factors that contribute to the overall cost. We’ll also compare different types of life insurance policies – term, whole, and universal – providing clarity on how their structures impact premium payments. Ultimately, this guide aims to empower you with the knowledge to make informed decisions about your life insurance coverage.

Factors Affecting Premium Costs

Several key factors influence the cost of your life insurance premium. Understanding these factors can help you make informed decisions when purchasing a policy and potentially save money. These factors are often assessed during the underwriting process, where the insurance company evaluates your risk profile.

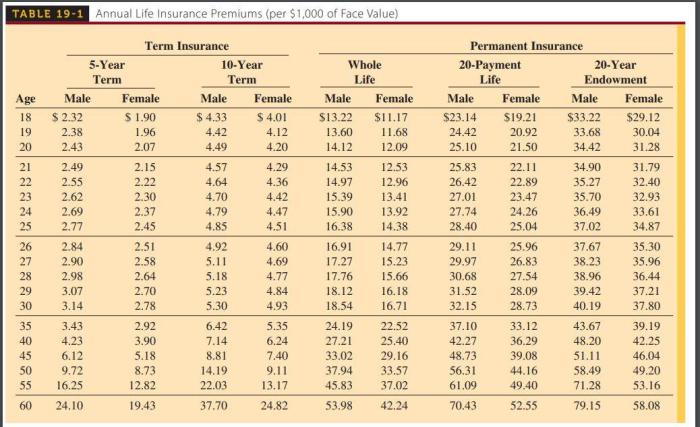

Age

Age is a significant determinant of life insurance premiums. Statistically, the older a person is, the higher their risk of death within the policy term. Therefore, insurance companies charge older individuals higher premiums to reflect this increased risk. A 30-year-old will generally pay significantly less than a 60-year-old for the same coverage amount. This is because younger individuals have a statistically longer life expectancy. The premium increases incrementally with age, reflecting the rising probability of a claim.

Health Status

An applicant’s health status plays a crucial role in premium calculations. Individuals with pre-existing conditions or a history of serious illnesses typically face higher premiums. This is because they pose a greater risk to the insurance company. Conditions like heart disease, diabetes, or cancer can significantly increase premium costs, or even lead to policy denial in severe cases. Conversely, applicants with excellent health often qualify for lower premiums. Regular check-ups and maintaining a healthy lifestyle can positively influence your premium rate.

Smoking Habits, Occupation, and Family History

Beyond age and health status, other factors contribute to premium costs. Smoking significantly increases the risk of various health problems, leading to higher premiums for smokers. The type of occupation also plays a role; individuals in high-risk professions, such as firefighters or construction workers, may face higher premiums due to increased accident risk. Family history of certain diseases can also influence premium calculations. A family history of heart disease or cancer may result in higher premiums, as these conditions can be hereditary.

Impact of Different Health Conditions on Premium Costs

| Health Condition | Premium Impact (Illustrative Example) | Reasoning | Possible Mitigation |

|---|---|---|---|

| No Significant Health Issues | Standard Rate | Low risk profile. | Maintain healthy lifestyle. |

| High Blood Pressure (Controlled) | Slightly Increased Rate | Increased risk of cardiovascular events. | Maintain medication and healthy lifestyle. |

| Type 2 Diabetes (Well-Managed) | Moderately Increased Rate | Increased risk of complications. | Strict blood sugar control and regular check-ups. |

| History of Cancer (in remission) | Substantially Increased Rate | Increased risk of recurrence. | Regular check-ups and follow-up care. |

Understanding Policy Features and Premiums

The cost of your life insurance premium is directly tied to the features and benefits included in your policy. A higher death benefit, more extensive coverage, and added riders all contribute to a higher premium. Understanding this relationship allows you to make informed choices about the level of protection you need and the premium you’re willing to pay.

Policy benefits significantly influence premium costs. Essentially, the greater the potential payout to your beneficiaries, the higher the premium. This is because the insurance company is taking on a greater financial risk. Similarly, policies offering broader coverage, such as those encompassing accidental death or critical illness benefits, typically come with higher premiums compared to simpler term life policies.

Death Benefit Amounts and Premiums

The death benefit is the core of a life insurance policy; it’s the amount paid to your beneficiaries upon your death. A higher death benefit translates to a higher premium. For example, a $500,000 term life insurance policy will generally cost more than a $250,000 policy, all other factors being equal. This increase is directly proportional to the increased risk the insurance company assumes. The difference in premiums can be substantial, depending on factors like age, health, and the policy’s term length.

Impact of Riders and Add-ons on Premium Costs

Riders and add-ons are optional features you can add to your base life insurance policy to enhance its coverage. These additions usually increase your premium. The extent of the increase depends on the type and scope of the rider. Choosing riders carefully is crucial to balancing added protection with affordability.

Common Policy Riders and Their Premium Implications

The following list Artikels common policy riders and their typical impact on premiums:

- Accidental Death Benefit Rider: This rider pays an additional death benefit if the insured dies due to an accident. Premiums increase moderately.

- Critical Illness Rider: This rider provides a lump-sum payment if the insured is diagnosed with a specified critical illness (e.g., cancer, heart attack). Premiums increase significantly, reflecting the higher payout potential.

- Waiver of Premium Rider: This rider waives future premiums if the insured becomes totally disabled. This adds a moderate increase to the premium.

- Guaranteed Insurability Rider: This rider allows the insured to purchase additional coverage at predetermined intervals without undergoing a medical exam. This typically adds a small to moderate increase to the premium.

- Term Conversion Rider: This rider allows the insured to convert a term life policy to a permanent policy without undergoing a medical exam. This usually adds a small increase to the premium.

Summary

Choosing the right life insurance policy involves careful consideration of various factors, including premium costs, coverage amounts, and payment schedules. By understanding the components of a life insurance premium and how different elements influence its calculation, you can effectively compare policies and find the most suitable and affordable option to protect your loved ones. Remember to compare quotes from multiple insurers and consult with a financial advisor to ensure you make a well-informed decision aligned with your financial goals and circumstances.

Commonly Asked Questions

What happens if I miss a premium payment?

Missing a premium payment can lead to your policy lapsing, meaning your coverage ends. Most insurers offer grace periods, but it’s crucial to contact your insurer immediately if you anticipate difficulty making a payment to explore options like reinstatement or payment plans.

Can my premiums increase over time?

This depends on the type of policy. Term life insurance premiums typically remain fixed for the policy term, while whole life and universal life premiums may increase, depending on the policy’s structure and the insurer’s performance.

How often can I change my premium payment schedule?

Most insurers allow changes to your payment schedule, but there may be limitations or fees associated with such adjustments. It’s best to review your policy documents or contact your insurer to understand their specific procedures and any potential implications.

What factors influence premium discounts?

Several factors can qualify you for discounts, including non-smoking status, healthy lifestyle choices, bundling policies (e.g., home and auto insurance), and good driving records (for some bundled policies).