Understanding insurance premiums is crucial for navigating the world of financial protection. This seemingly simple concept underpins the entire insurance industry, representing the price you pay for the peace of mind that comes with coverage against unforeseen events. From car accidents to medical emergencies, the cost of insurance premiums directly reflects the level of risk involved and the potential financial burden should an incident occur. This guide will demystify the intricacies of insurance premiums, exploring how they are calculated, the factors influencing their cost, and the various payment options available.

We will delve into the mechanics of premium calculation, revealing the role of actuarial science and risk assessment in determining the price you pay. We’ll also explore different payment structures, comparing their advantages and disadvantages to help you make informed choices. Finally, we’ll provide a clear explanation of your premium statement, empowering you to understand and verify the charges you are billed.

Definition of Insurance Premium

An insurance premium is essentially the price you pay for an insurance policy. Think of it like a membership fee – you pay regularly to access the protection offered by the insurer should something unexpected happen. This payment guarantees that the insurance company will cover specific losses or liabilities as Artikeld in your policy contract.

In simpler terms, an insurance premium is the regular payment made to an insurance company in exchange for financial protection against potential losses or risks. It’s the cost of transferring risk from yourself to the insurance provider.

The Role of Premiums in the Insurance Mechanism

Insurance premiums are the lifeblood of the entire insurance system. They serve several crucial functions. Firstly, they form the pool of funds from which the insurance company pays out claims to policyholders who experience covered losses. Imagine a large bucket – premiums are the water constantly being added, and claims are the water being drawn out. For the system to work, the inflow (premiums) must generally exceed the outflow (claims) over time, allowing the insurer to remain solvent and fulfill its obligations.

Secondly, premiums help insurance companies cover their operating expenses. This includes salaries for employees, office rent, marketing costs, and the costs associated with investigating and processing claims. Essentially, a portion of your premium contributes to the smooth running of the insurance business.

Thirdly, premiums allow insurance companies to invest and build reserves. These reserves act as a safety net, ensuring the company can meet its future obligations even during periods of high claim payouts or unexpected events. This is vital for long-term stability and the ability to offer consistent coverage to policyholders. A well-managed insurance company carefully balances its premium income, claim payouts, expenses, and investments to ensure financial soundness.

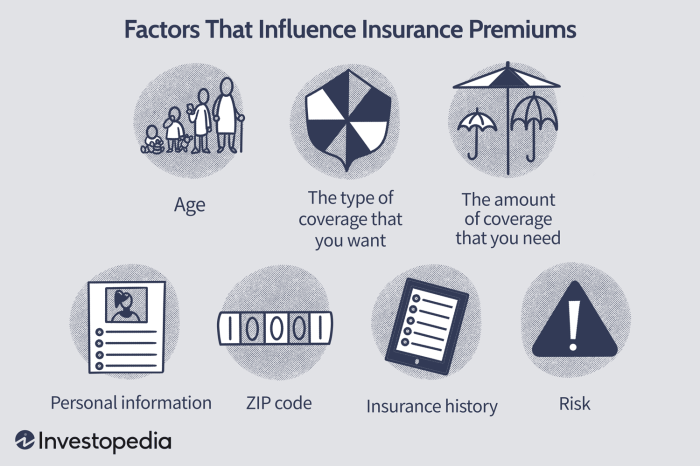

Factors Affecting Premium Costs

Insurance premiums, the price you pay for coverage, aren’t arbitrary numbers. Several interconnected factors influence how much you’ll pay, ultimately reflecting the level of risk the insurer assumes when covering you. Understanding these factors empowers you to make informed decisions about your insurance choices and potentially lower your costs.

Age and Health

Age significantly impacts insurance premiums across various types. In health insurance, older individuals generally pay more due to a higher likelihood of needing medical care. Pre-existing conditions and current health status also play a crucial role; individuals with pre-existing conditions or poor health often face higher premiums reflecting the increased risk to the insurer. Similarly, in life insurance, younger, healthier individuals typically qualify for lower premiums because they represent a lower risk of early death. Conversely, those with risky lifestyles or pre-existing conditions may see substantially higher premiums. Auto insurance premiums often see a decrease as drivers age and build up a clean driving record, reflecting a statistically lower risk of accidents.

Location

Geographic location is a key determinant of insurance costs. Home insurance premiums, for instance, vary widely depending on factors such as the risk of natural disasters (earthquakes, hurricanes, floods), crime rates, and the cost of rebuilding in a particular area. Areas prone to natural disasters or high crime rates will typically have higher premiums to compensate for the increased risk. Similarly, auto insurance premiums can vary by location due to differences in traffic density, accident rates, and the cost of vehicle repairs. Urban areas often have higher premiums than rural areas due to increased risk factors.

Lifestyle and Risk Factors

Lifestyle choices significantly influence insurance premiums. In health insurance, smokers, individuals with unhealthy diets, and those who don’t engage in regular exercise often face higher premiums because of increased health risks. Auto insurance premiums are affected by driving history; individuals with a history of accidents or traffic violations will likely pay more. Home insurance premiums can be influenced by the presence of security systems and other safety measures; homes with robust security systems might receive discounts.

Variations Across Insurance Types

Premium variations are significant across different insurance types. Health insurance premiums are highly individualized, influenced by age, health status, and the chosen plan. Auto insurance premiums are affected by factors like vehicle type, driving history, and location. Home insurance premiums vary based on location, property value, and coverage level. Life insurance premiums are primarily determined by age, health, and the type of policy chosen.

| Factor | Impact on Premium | Example | Explanation |

|---|---|---|---|

| Age | Generally increases with age (health, life insurance); may decrease with age (auto insurance) | A 60-year-old paying more for health insurance than a 30-year-old. | Increased risk of health issues and mortality with age. In auto insurance, experience and a clean record often lead to lower rates. |

| Health Status | Higher premiums for poor health or pre-existing conditions. | A smoker paying more for health insurance than a non-smoker. | Increased risk of health claims for those with pre-existing conditions or unhealthy lifestyles. |

| Location | Higher premiums in high-risk areas. | Higher home insurance premiums in areas prone to hurricanes. | Increased risk of damage or loss due to location-specific factors (natural disasters, crime rates). |

| Lifestyle | Higher premiums for risky behaviors. | Higher auto insurance premiums for drivers with multiple speeding tickets. | Increased risk of accidents or claims due to risky behaviors. |

Understanding Your Premium Statement

Your insurance premium statement is a crucial document outlining the costs associated with your insurance coverage. Understanding its components allows you to verify the accuracy of your charges and ensure you’re paying the correct amount for the protection you’ve purchased. This section will guide you through deciphering your premium statement, helping you become a more informed consumer.

Common Components of an Insurance Premium Statement

Insurance premium statements typically include several key components. These elements provide a comprehensive breakdown of your insurance costs, allowing for a clear understanding of what you are paying for. A thorough review of these components can help identify any potential discrepancies or areas for improvement in your policy.

- Policy Number: A unique identifier for your specific insurance policy.

- Policyholder Information: Your name, address, and contact details.

- Coverage Period: The dates your insurance coverage is active.

- Premium Amount: The total amount due for the coverage period.

- Premium Breakdown: A detailed list of the individual charges that comprise the total premium, such as coverage type, deductibles, and applicable discounts or surcharges.

- Payment Due Date: The deadline for paying your premium.

- Payment Method: The method used to pay your premium (e.g., check, credit card, automatic payment).

- Outstanding Balance (if applicable): Any unpaid amount from previous premiums.

Interpreting the Different Sections of a Premium Bill

Each section of your premium bill contributes to a complete picture of your insurance costs. Understanding the purpose and content of each section is essential for effective review and verification. Carefully examining each section ensures that you are paying the correct amount for the specified coverage.

Understanding the premium breakdown is particularly important. This section will detail the cost of each component of your coverage. For example, you might see separate charges for liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage (if applicable for auto insurance). Deductibles and any applicable discounts or surcharges will also be itemized.

Step-by-Step Guide to Understanding and Verifying Premium Charges

Verifying your premium charges is a straightforward process that involves careful review and comparison. Following these steps ensures you are paying the correct amount and that your policy reflects your chosen coverage and preferences. Any discrepancies should be reported immediately to your insurance provider.

- Review the Policy Details: Confirm that the policy number, policyholder information, and coverage period are accurate.

- Analyze the Premium Breakdown: Carefully examine each line item in the premium breakdown to ensure that the charges align with your chosen coverage options and any applicable discounts or surcharges.

- Compare to Previous Statements: If possible, compare your current statement to previous statements to identify any significant changes in your premium and understand the reasons behind them.

- Check for Errors: Look for any mathematical errors or discrepancies in the calculations.

- Contact Your Insurer: If you identify any discrepancies or have questions, contact your insurance provider to clarify the charges.

Example of a Simplified Premium Statement

Policy Number: 1234567890

Policyholder: John Doe

Coverage Period: 01/01/2024 – 12/31/2024

Premium Amount: $1200

Premium Breakdown:

Liability Coverage: $500

Collision Coverage: $400

Comprehensive Coverage: $300

Payment Due Date: 02/15/2024

Premium Payment Options

Paying your insurance premiums is a crucial aspect of maintaining your coverage. Choosing a convenient and reliable payment method is essential to avoid interruptions in your protection and potential penalties. Several options are available, each with its own advantages and disadvantages.

Several methods exist for paying insurance premiums, each offering varying degrees of convenience and associated costs. Careful consideration of these factors will help you select the most suitable option for your needs and financial management style.

Online Payment Methods

Online payment methods offer a high degree of convenience and often provide immediate confirmation of payment. Many insurance companies offer online portals where policyholders can securely pay their premiums using debit cards, credit cards, or electronic bank transfers. This eliminates the need for mailing checks or visiting a physical office. While generally fee-free, some insurers might charge a small processing fee for using certain credit cards. It’s important to check your insurer’s specific payment policies. Online payment often includes email or text confirmations, providing a readily accessible record of your transaction.

Mail Payments

Traditional mail payments involve sending a check or money order through the postal service. This method is straightforward but can be slower than electronic options, and there’s a risk of lost or delayed mail. It’s crucial to ensure your payment reaches the insurer before the due date to avoid late fees. While generally free, the cost of postage should be considered. Many insurers provide a designated mailing address for premium payments, and it’s essential to use this address to ensure timely processing. Keeping a copy of the check and mailing confirmation is a recommended best practice.

Bank Draft Payments

Bank drafts provide a secure method of payment, offering a higher level of assurance for both the policyholder and the insurance company compared to personal checks. A bank draft is a check drawn by a bank on its own funds, guaranteeing payment. This method is often preferred for larger premium payments. While generally secure, the process of obtaining a bank draft may involve a small fee depending on your bank. This payment method usually requires visiting your bank branch to obtain the draft. It’s vital to confirm the payment details with your bank before sending it to your insurance company.

Automatic Payments

Automatic payments, often set up through electronic funds transfer (EFT) or direct debit, provide a highly convenient and reliable method of paying premiums. Funds are automatically deducted from your bank account on the due date, eliminating the need for manual payments. This reduces the risk of missed payments and associated late fees. While typically free, some insurers may have associated fees for using this option, depending on your account type or specific arrangement. This approach ensures consistent and timely premium payments.

Best Practices for Managing Premium Payments

To avoid late fees or lapses in coverage, establish a system for tracking due dates and making timely payments. Consider setting reminders on your calendar or phone. Always retain payment confirmation, whether electronic or physical. Review your premium statement regularly to ensure accuracy and identify any potential discrepancies. Communicate with your insurer promptly if you anticipate any difficulties in making a payment. Proactive communication can often prevent penalties. Keeping a dedicated file for all insurance-related documents, including payment confirmations, is highly advisable.

Closing Notes

In conclusion, understanding insurance premiums is key to responsible financial planning. By grasping the factors that influence premium costs, the various payment options available, and the information contained within your premium statement, you can make informed decisions about your coverage and effectively manage your financial protection. Remember that while premiums represent a cost, the potential financial consequences of being uninsured often far outweigh the expense of securing adequate coverage. Proactive understanding ensures you’re adequately protected without unnecessary financial strain.

Essential Questionnaire

What happens if I don’t pay my insurance premium?

Failure to pay your premium on time can lead to a lapse in coverage, leaving you vulnerable to significant financial liabilities in the event of an incident. You may also face late payment fees or even policy cancellation.

Can I negotiate my insurance premium?

While not always possible, you might be able to negotiate a lower premium by demonstrating a good driving record (for auto insurance), maintaining a healthy lifestyle (for health insurance), or implementing home security measures (for homeowners insurance). Shopping around and comparing quotes from different insurers is also crucial.

How often are insurance premiums reviewed?

The frequency of premium reviews varies depending on the type of insurance and the insurer’s policies. Some policies have annual reviews, while others may adjust premiums less frequently. You’ll usually receive notification of any changes before they take effect.

What factors affect my car insurance premium besides driving record?

Besides driving history, factors such as your age, location, the type of vehicle you drive, and your credit score can all significantly impact your car insurance premium.