Securing affordable and comprehensive car insurance is a crucial step for responsible drivers. But navigating the world of insurance policies, especially when considering a shorter-term, six-month option, can feel overwhelming. This guide unravels the complexities of finding a “good” six-month premium car insurance policy, helping you make an informed decision that aligns with your needs and budget. We’ll explore key factors influencing premiums, offer practical tips for comparison shopping, and clarify crucial policy details.

Understanding the nuances of car insurance is vital, regardless of the policy duration. Whether you’re a new driver, facing a temporary need for coverage, or simply prefer shorter-term commitments, this guide provides a structured approach to finding the right policy. We’ll delve into essential coverage types, the impact of your driving record, and the importance of comparing multiple quotes to secure the best possible value for your money.

Defining “Good” Car Insurance

Securing good car insurance for a six-month period involves careful consideration of several key factors. A policy that’s “good” for one person might not be ideal for another, depending on individual needs and risk profiles. The goal is to find a balance between comprehensive coverage and affordability.

Factors that contribute to a “good” six-month car insurance policy include the level of coverage offered, the premium cost, the insurer’s financial stability and customer service reputation, and the specific terms and conditions of the policy. It’s crucial to understand what you’re paying for and ensure it aligns with your personal circumstances and driving habits.

Essential Coverage Types for a Six-Month Policy

Choosing the right coverage is paramount. While the specific needs vary, certain types of coverage are generally considered essential. A well-rounded policy usually includes a combination of these to provide adequate protection.

- Liability Coverage: This protects you financially if you cause an accident that injures someone or damages their property. It covers medical bills, lost wages, and property repair costs. Liability coverage is typically expressed as a three-number limit (e.g., 100/300/100), representing bodily injury per person, bodily injury per accident, and property damage per accident.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of who is at fault. It’s particularly valuable if you have a newer car or a loan on your vehicle.

- Comprehensive Coverage: This protects your vehicle against damage from non-accident events, such as theft, vandalism, fire, or natural disasters. It provides broader protection than collision coverage alone.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical expenses and vehicle repairs, even if the other driver is at fault and lacks sufficient insurance.

The Importance of Comparing Quotes from Multiple Insurers

Obtaining quotes from several insurance companies is crucial for securing the best possible rate and coverage. Each insurer uses different rating factors and offers varying levels of coverage at different price points. Comparing quotes allows you to identify the most cost-effective option that meets your needs. Don’t solely focus on price; consider the overall value and reputation of the insurer.

Comparison of Key Features of Different Insurance Types

The following table provides a simplified comparison of key features across different insurance types. Remember that specific coverage amounts and costs will vary depending on the insurer, your location, and your individual risk profile.

| Insurance Type | Coverage | What it Covers | Typical Cost Factor |

|---|---|---|---|

| Liability | Bodily Injury & Property Damage | Medical bills, lost wages, property repairs caused by your fault. | Relatively low, mandatory in most states. |

| Collision | Vehicle Damage | Damage to your vehicle in an accident, regardless of fault. | Moderate to high, depends on vehicle value and deductible. |

| Comprehensive | Non-Accident Damage | Damage from theft, vandalism, fire, weather, etc. | Moderate, depends on vehicle value and deductible. |

| Uninsured/Underinsured Motorist | Accident with Un/Underinsured Driver | Your medical bills and vehicle repairs if hit by an uninsured driver. | Low to moderate, highly recommended. |

Factors Affecting Six-Month Premium Costs

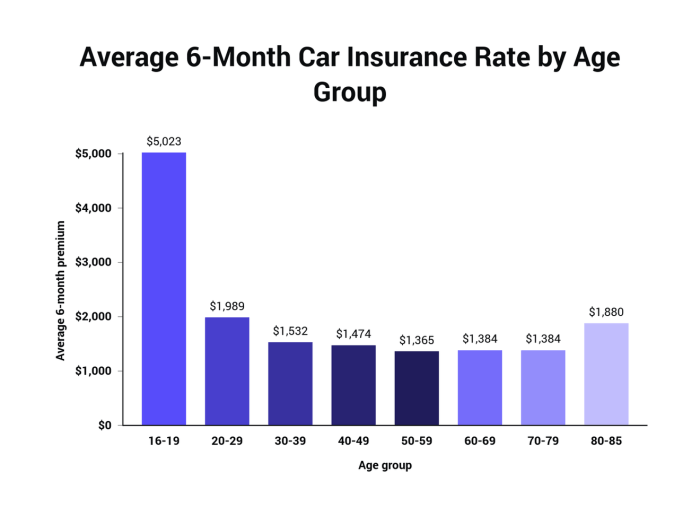

Securing affordable car insurance is a priority for many drivers. Understanding the factors that influence your six-month premium allows for informed decision-making and potentially significant savings. Several key elements contribute to the final cost, and this section will explore them in detail.

Driving History’s Impact on Premiums

Your driving record significantly impacts your insurance premium. A clean driving history, characterized by no accidents or traffic violations, typically results in lower premiums. Conversely, accidents and violations, especially serious ones like DUIs or reckless driving, lead to substantial increases. Insurance companies view these incidents as indicators of higher risk, justifying higher premiums to offset potential claims. For example, a single at-fault accident could increase your premium by 20-40%, while multiple violations could lead to even more significant hikes. The severity of the accident or violation also plays a role; a minor fender bender will have less impact than a serious collision resulting in significant property damage or injury.

Vehicle Type and Value’s Influence

The type and value of your vehicle are major factors determining your insurance cost. Generally, more expensive vehicles command higher premiums due to the increased cost of repair or replacement in the event of an accident. For example, insuring a luxury sports car will be considerably more expensive than insuring a compact economy car. Similarly, the vehicle’s safety features influence the premium. Cars with advanced safety technologies, such as automatic emergency braking or lane departure warnings, may qualify for discounts because they are statistically associated with fewer accidents. The vehicle’s age also plays a role; older cars are often cheaper to insure due to their lower replacement value.

Geographic Location’s Effect on Rates

Your location significantly influences your car insurance premium. Insurance companies assess risk based on various factors specific to different geographic areas, such as crime rates, accident frequency, and the average cost of vehicle repairs. Urban areas with high traffic density and higher crime rates typically have higher insurance premiums than rural areas with lower traffic volume and lower crime rates. For instance, insuring a car in a large metropolitan city like New York City will likely be more expensive than insuring the same car in a smaller, less populated town. This is because the probability of accidents and theft is statistically higher in densely populated areas.

Finding and Comparing Insurance Options

Finding the best six-month car insurance policy involves diligent research and comparison shopping. Several online tools and resources simplify this process, allowing you to quickly obtain quotes from multiple insurers and compare their offerings side-by-side. Understanding your needs and utilizing effective comparison strategies is crucial to securing a policy that provides adequate coverage at a competitive price.

Online Car Insurance Quote Acquisition

Obtaining car insurance quotes online is a straightforward process. First, gather necessary information such as your driver’s license number, vehicle information (make, model, year), and driving history. Then, visit the websites of various insurance providers. Most major insurers offer online quote tools. Enter your information into the quote request form, and the system will generate a personalized quote based on your risk profile. Repeat this process for several insurers to obtain a range of quotes for comparison. Remember to carefully review the coverage details included in each quote before making a decision.

Questions to Ask Insurance Providers

Before committing to a policy, it’s vital to clarify specific aspects of the coverage. The following points represent essential inquiries to make with potential insurance providers. Confirm the specifics of the coverage, including deductibles, limits, and exclusions. Inquire about discounts available based on factors like safe driving records or bundling insurance policies. Understand the claims process, including reporting procedures and the expected timeframe for claim resolution. Ask about payment options and available methods. Finally, confirm the policy’s renewal terms and conditions.

Comparison of Six-Month Insurance Policies

The following table provides a hypothetical comparison of six-month car insurance policies from three different insurers. Remember that actual prices and coverage details will vary based on individual circumstances and location. This table serves as an example to illustrate the comparison process.

| Insurer | Price (Six Months) | Liability Coverage | Collision Coverage | Comprehensive Coverage |

|---|---|---|---|---|

| Insurer A | $600 | $100,000/$300,000 | $500 deductible | $500 deductible |

| Insurer B | $750 | $250,000/$500,000 | $1000 deductible | $1000 deductible |

| Insurer C | $550 | $100,000/$300,000 | $1000 deductible | $0 deductible |

Interpreting Policy Documents

Carefully reviewing the policy document is crucial to fully understanding the coverage. Pay close attention to the declarations page, which Artikels the insured’s information, policy period, and coverage amounts. The policy’s definitions section clarifies terminology used throughout the document. The coverage sections detail the specific types of protection offered, including liability, collision, and comprehensive coverage. Each coverage section will specify coverage limits, which represent the maximum amount the insurer will pay for a covered loss. Exclusions are also clearly defined; these are specific circumstances or types of losses not covered by the policy. For example, damage caused by wear and tear might be excluded. Understanding these details allows you to make an informed decision and ensure the policy aligns with your needs.

Alternative Insurance Options

Choosing the right car insurance policy often involves considering alternatives beyond the standard six-month term. This section explores different options, comparing their features, costs, and suitability for various circumstances. Understanding these alternatives allows for a more informed decision based on individual needs and driving habits.

Traditional Six-Month Policies Versus Usage-Based Insurance

Traditional six-month policies offer predictable, fixed premiums. The cost is calculated based on factors like your age, driving history, vehicle type, and location. Conversely, usage-based insurance (UBI), also known as pay-as-you-go insurance, bases premiums on your actual driving habits. Data collected through a telematics device or smartphone app tracks mileage, speed, braking, and other driving behaviors. Drivers who demonstrate safe and infrequent driving typically receive lower premiums. The advantage of UBI is potential cost savings for low-mileage drivers, while traditional policies offer the predictability of a fixed monthly payment. A disadvantage of UBI is the potential for higher premiums if driving habits are deemed risky, and the privacy implications of data collection.

Advantages and Disadvantages of Short-Term Car Insurance

Short-term car insurance policies, typically covering periods shorter than six months, provide flexibility for those with temporary car needs, such as seasonal drivers or those renting a vehicle for a limited time. Advantages include lower upfront costs compared to longer-term policies and the ability to adjust coverage based on specific needs. However, short-term policies usually come with higher premiums per month than longer-term options, and they might not offer the same level of comprehensive coverage. For example, a person needing car insurance for a three-month road trip would benefit from a short-term policy, while someone with a year-round need for a car would likely find a longer-term policy more cost-effective.

Factors to Consider When Choosing Between Insurance Providers

Several factors influence the selection of an insurance provider. These include the price of premiums, the level and type of coverage offered (liability, collision, comprehensive), customer service reputation, claims processing efficiency, and the availability of discounts. Comparing quotes from multiple insurers is crucial to finding the best value. For instance, one insurer might offer a lower premium but limited coverage, while another might offer a higher premium but superior customer service and a wider range of coverage options. Considering these factors holistically is vital in making an informed choice.

Scenarios Where Six-Month Policies Are More or Less Suitable

A six-month policy is ideal for individuals with predictable driving needs over that timeframe. For example, a student returning home for summer break and temporarily using their parent’s car might benefit from a six-month policy instead of a full-year policy. Conversely, a six-month policy might be less suitable for someone who anticipates significant changes in their driving habits or needs during the year. A person moving to a new city with different insurance rates, or someone purchasing a new car with different insurance requirements, would likely benefit from a longer-term policy offering more flexibility and stability in premium payments.

Closing Notes

Choosing the right six-month car insurance policy requires careful consideration of various factors, from coverage needs to individual circumstances. By understanding the key elements discussed—comparing quotes, analyzing policy details, and considering alternative options—you can confidently navigate the insurance market and secure a policy that provides adequate protection without unnecessary expense. Remember, proactive research and informed decision-making are key to finding the best fit for your specific requirements.

FAQ

What are the penalties for late payments on a six-month car insurance policy?

Late payment penalties vary by insurer but typically involve late fees and, potentially, policy cancellation.

Can I cancel my six-month policy early?

Yes, but you’ll likely receive a prorated refund, meaning you’ll only get back a portion of the premium paid.

How does my credit score affect my six-month car insurance premium?

In many states, insurers use credit-based insurance scores to assess risk. A higher credit score often translates to lower premiums.

What happens if I get into an accident during my six-month policy?

Follow your insurer’s claims process immediately. Report the accident, gather information, and cooperate fully with the investigation.