Securing affordable car insurance is a priority for many drivers. Understanding the intricacies of six-month premiums, however, can feel like navigating a complex maze. This guide demystifies the process, exploring the factors influencing your cost, comparing six-month plans to annual ones, and providing strategies to find the best rates. We’ll delve into coverage options, illustrative examples, and answer frequently asked questions to empower you with the knowledge needed to make informed decisions.

From the impact of your driving history and vehicle type to the influence of your location and chosen coverage levels, we’ll break down the key elements that contribute to your six-month car insurance premium. This guide aims to provide a clear and concise understanding of this important financial aspect of car ownership.

Comparing 6-Month vs. Annual Premiums

Choosing between paying your car insurance annually or in six-month installments is a common dilemma. Both options have their own advantages and disadvantages, and the best choice depends heavily on your individual financial situation and risk tolerance. This comparison will help you weigh the pros and cons to make an informed decision.

Cost Differences Between Payment Plans

The most significant difference between six-month and annual payments lies in the total cost. While insurers rarely explicitly charge extra for six-month installments, the total premium paid over the year is often slightly higher when spread out. This is due to administrative costs associated with processing multiple payments. The difference might seem minimal on a single policy, but it can add up over several years. For example, an annual premium of $1200 might translate to six-month payments of $610 each, totaling $1220 over the year. This represents a small increase of 1.67%, but this percentage can vary significantly based on the insurer and the specific policy.

Advantages and Disadvantages of Each Payment Plan

- Annual Payment Advantages: Lower overall cost, convenience of a single payment, potential for discounts from some insurers for paying in full.

- Annual Payment Disadvantages: Requires a larger upfront payment, may create a cash flow burden for some individuals.

- Six-Month Payment Advantages: Easier budget management due to smaller, more manageable payments, flexibility if financial circumstances change.

- Six-Month Payment Disadvantages: Slightly higher overall cost, more administrative work for both the insurer and the insured (processing multiple payments).

Situations Favoring Six-Month or Annual Payments

The ideal payment plan depends on individual circumstances. For example, someone with a stable income and a healthy emergency fund might find annual payments more advantageous due to the lower overall cost. Conversely, someone with fluctuating income or a tighter budget might prefer the smaller, more predictable payments of a six-month plan, even if it costs slightly more. A recent college graduate starting their first job, for instance, might benefit from the six-month plan until their financial stability increases. Conversely, a high-earning professional with substantial savings might find the annual payment a more efficient use of their funds.

Potential Cost Differences for Various Driver Profiles

It’s difficult to provide exact figures without specific insurer data. However, we can illustrate potential scenarios. Let’s assume a base annual premium of $1000. A young, inexperienced driver with a history of minor accidents might see a higher premium, perhaps $1500 annually, while an older, experienced driver with a clean record might have a lower premium, say $800 annually. The six-month payment structure would likely add a small percentage to each of these scenarios, resulting in slightly higher total costs over the year. The percentage increase might remain consistent across driver profiles, but the absolute dollar amount difference will vary depending on the base annual premium.

Finding the Best 6-Month Car Insurance Rates

Securing the most affordable 6-month car insurance policy requires a proactive approach involving strategic comparison shopping and a thorough understanding of policy details. This involves utilizing various resources and carefully analyzing the quotes you receive to ensure you’re getting the best value for your money.

Finding the best 6-month car insurance rates necessitates a multi-pronged strategy focusing on obtaining competitive quotes, comparing them comprehensively, and skillfully navigating online comparison tools. Ignoring any of these steps can lead to overpaying for your coverage.

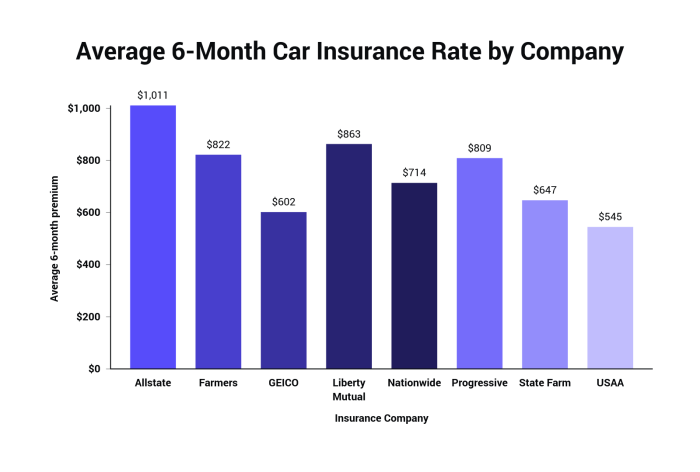

Strategies for Obtaining Competitive Quotes

Several strategies can help you secure the most competitive rates. Begin by contacting multiple insurance providers directly, both large national companies and smaller, regional insurers. Request quotes online, by phone, or in person, ensuring you provide consistent information across all inquiries. Leveraging online comparison websites can also significantly streamline this process, as they allow you to input your information once and receive quotes from numerous providers simultaneously. Finally, consider exploring insurance options through your employer or professional organizations, as they may offer discounted rates.

Comparing Quotes: Beyond the Premium Amount

While the premium amount is a crucial factor, focusing solely on price can be short-sighted. A thorough comparison should include a detailed review of coverage limits, deductibles, and exclusions. For instance, one policy might offer a lower premium but have significantly lower liability coverage compared to a slightly more expensive option. Analyzing policy details, such as the types of accidents covered and any specific exclusions, is critical to understanding the true value of each quote. Consider the financial implications of a potential accident; a lower premium might not be worth it if you face higher out-of-pocket costs due to insufficient coverage.

Utilizing Online Comparison Tools Effectively

Online comparison tools can dramatically simplify the process of obtaining multiple quotes. To use these tools effectively, start by accurately entering all requested information, including your driving history, vehicle details, and desired coverage levels. Be sure to review the results carefully, verifying that the quotes displayed accurately reflect your input. Remember that these tools are designed to provide a general overview; always confirm the details directly with the individual insurance providers before making a decision. Pay close attention to any additional fees or add-ons included in the quote.

Interpreting Policy Details and Identifying Hidden Fees

Once you receive quotes, carefully examine each policy document. Pay close attention to the fine print, looking for any hidden fees or limitations. Common areas to scrutinize include deductibles (the amount you pay before insurance coverage begins), coverage limits (the maximum amount the insurance company will pay), and exclusions (specific events or circumstances not covered by the policy). Understand how each element impacts your overall cost and risk exposure. For example, a policy with a low premium but a high deductible might end up being more expensive in the event of an accident. Similarly, limitations on rental car reimbursement or roadside assistance can unexpectedly add to your expenses.

Understanding Policy Coverage in a 6-Month Term

A six-month car insurance policy offers the same core protections as a yearly policy, but with a shorter term. Understanding the available coverage options and how they impact your premium is crucial for making an informed decision. This section details common coverage types, the influence of deductibles, and illustrative scenarios highlighting the benefits of specific coverages.

Common Car Insurance Coverage Options

Several types of car insurance coverage are typically available for six-month policies. These options protect you financially in various accident or damage scenarios. Choosing the right combination depends on your individual needs and risk tolerance. A higher level of coverage generally translates to a higher premium.

Deductible Amounts and Their Impact on Premiums

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible will lower your six-month premium, as you are accepting more financial responsibility in the event of a claim. Conversely, a lower deductible will result in a higher premium but lower out-of-pocket expenses if you need to file a claim. The optimal deductible depends on your financial situation and risk assessment. For example, someone with a robust emergency fund might opt for a higher deductible to save on premiums, while someone with limited savings might prefer a lower deductible for greater financial protection.

Scenarios Illustrating Coverage Benefits

Consider these scenarios to understand the value of different coverage options:

Scenario 1: Collision Coverage. Imagine you’re involved in a single-car accident, hitting a tree. Collision coverage would repair or replace your vehicle, regardless of fault. Without it, you’d bear the entire cost of repairs.

Scenario 2: Comprehensive Coverage. Suppose a hailstorm damages your car’s paintwork. Comprehensive coverage would cover these repairs, whereas collision coverage would not, as it only covers accidents involving another vehicle or object.

Scenario 3: Liability Coverage. If you cause an accident that injures another person, liability coverage would pay for their medical bills and property damage. The amount of liability coverage you choose directly affects the premium and the maximum amount the insurance company will pay.

Scenario 4: Uninsured/Underinsured Motorist Coverage. You are involved in an accident caused by an uninsured driver. This coverage protects you from the financial burden of their negligence.

Summary of Key Coverage Features

| Coverage Type | Description | Benefits | Premium Impact |

|---|---|---|---|

| Liability | Covers injuries and damages to others in an accident you caused. | Protects you from significant financial losses. | Higher coverage limits increase premiums. |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Replaces or repairs your vehicle after an accident. | Generally increases premiums. |

| Comprehensive | Covers damage to your vehicle from non-collision events (e.g., theft, vandalism, weather). | Protects against a wide range of damage scenarios. | Generally increases premiums. |

| Uninsured/Underinsured Motorist | Covers injuries and damages caused by an uninsured or underinsured driver. | Protects you in accidents with at-fault drivers lacking sufficient coverage. | Adds to the overall premium. |

Illustrative Examples of 6-Month Premium Costs

Understanding the factors that influence six-month car insurance premiums is crucial for accurate budgeting. Several variables, including driver profile, vehicle type, and coverage level, significantly impact the final cost. The following examples illustrate how these factors can affect a six-month premium.

Six-Month Premium for a Young Driver with a Clean Driving Record

A 20-year-old driver with a clean driving record, residing in a suburban area with a low crime rate, and driving a mid-sized sedan might expect to pay around $800 – $1200 for a six-month comprehensive insurance policy. This range reflects the higher risk associated with younger drivers, even with a clean record. Factors like the specific car model, coverage choices (liability only vs. comprehensive), and the insurance company selected would all contribute to variations within this range. For instance, opting for higher liability limits would naturally increase the premium.

Six-Month Premium for an Older Driver with a History of Accidents

Conversely, a 55-year-old driver with two at-fault accidents in the past three years and driving a similar vehicle could anticipate a significantly higher six-month premium, potentially ranging from $1500 to $2500 or more. This increase reflects the elevated risk associated with a driver’s history of accidents. The higher premium serves to offset the increased likelihood of future claims. The severity of the past accidents would also influence the final cost. A history of more serious accidents would likely result in a higher premium than minor fender benders.

Six-Month Premium for a Driver with a High-Value Vehicle

A driver insuring a luxury SUV or a high-performance sports car, regardless of age or driving history, will generally pay a higher premium. For example, a 35-year-old driver with a clean record insuring a high-end luxury sedan could expect to pay anywhere from $1200 to $2000 for six months, even with standard coverage. The higher cost reflects the greater expense of repairing or replacing a more expensive vehicle. Comprehensive and collision coverage, crucial for protecting against damage to the vehicle, will contribute substantially to the overall premium.

Six-Month Premium for a Driver with a Low-Value Vehicle

In contrast, a driver with a clean record insuring an older, low-value vehicle might see a considerably lower six-month premium. A 40-year-old driver insuring a ten-year-old compact car could potentially pay between $500 and $900 for six months. The lower cost reflects the reduced financial risk to the insurance company in the event of an accident or theft. The lower repair or replacement costs associated with older, less expensive vehicles translate directly into a lower premium.

Outcome Summary

Ultimately, securing the best six-month car insurance premium involves careful consideration of multiple factors. By understanding the variables that influence your cost, comparing quotes from various providers, and carefully reviewing policy details, you can confidently choose a plan that offers comprehensive coverage at a price that aligns with your budget. Remember to regularly review your insurance needs as your circumstances change to ensure you maintain optimal protection.

Essential FAQs

What happens if I cancel my 6-month policy early?

Most insurers will apply a cancellation fee and prorate your refund based on the remaining coverage period. Check your policy details for the specific terms.

Can I switch insurance providers mid-term?

Yes, you can generally switch providers, but you may need to pay a cancellation fee to your current insurer. It’s advisable to compare quotes before making a switch.

Does my credit score affect my 6-month premium?

In some states, your credit score can be a factor in determining your insurance rates. A higher credit score may lead to lower premiums.

What is a usage-based insurance program?

These programs track your driving habits (mileage, speed, braking) using a telematics device and can potentially lower your premiums based on safe driving.