Navigating the world of insurance can feel like deciphering a complex code, especially when confronted with terms like “premium.” Understanding what this crucial element represents is key to making informed decisions about your financial protection. This guide unravels the mystery surrounding insurance premiums, explaining their composition, influencing factors, and the relationship between cost and coverage.

From the seemingly simple definition of a premium as the price you pay for insurance coverage to the intricate factors influencing its calculation, we’ll explore the nuances that determine the amount you contribute. We’ll examine how individual risk profiles, coverage levels, and claims history impact your premium, offering clarity on what you’re paying for and how to manage your costs effectively.

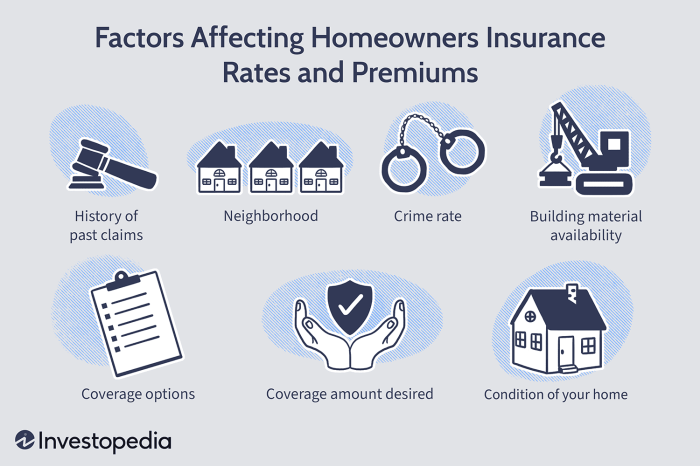

Factors Affecting Premium Costs

Insurance premiums, the amount you pay for coverage, aren’t arbitrarily set. Numerous factors influence the price, reflecting the insurer’s assessment of risk and the cost of providing coverage. Understanding these factors allows consumers to make informed decisions about their insurance choices.

Several key elements contribute to the calculation of insurance premiums. These factors are carefully weighed by insurance companies to accurately reflect the likelihood and potential cost of claims.

Individual Risk Profiles and Premium Amounts

An individual’s risk profile significantly impacts their premium. This profile is built upon various personal characteristics and lifestyle choices. For example, a young, inexperienced driver will generally pay more for car insurance than an older driver with a clean driving record. Similarly, someone with a pre-existing medical condition may pay higher premiums for health insurance than a healthy individual. The insurer assesses the probability of a claim based on these factors, adjusting the premium accordingly. Someone who lives in a high-crime area might face higher premiums for home insurance due to the increased risk of theft or damage. The more risk an individual presents, the higher their premium will likely be.

Premium Costs for Different Coverage Levels

The level of coverage selected directly impacts the premium. A comprehensive car insurance policy, offering broader protection against various incidents, will naturally cost more than a basic liability policy. Similarly, in health insurance, a plan with a lower deductible and co-pay will generally have a higher premium than a high-deductible plan. This relationship holds true across most insurance types; higher coverage translates to higher premiums, reflecting the increased financial responsibility the insurer undertakes. For instance, a homeowner’s insurance policy with higher coverage limits for rebuilding costs will command a higher premium than one with lower limits.

Claims History and Future Premiums

An individual’s claims history is a critical factor in determining future premiums. Filing multiple claims, especially for significant amounts, signals a higher risk to the insurer. This increased risk translates into higher premiums in subsequent policy periods. Conversely, maintaining a clean claims history, with no or few claims filed, can result in lower premiums as it demonstrates a reduced risk profile. Many insurers offer discounts for drivers with accident-free periods or homeowners with no prior claims. The impact of claims history is often significant, highlighting the importance of safe driving practices and preventative home maintenance.

Understanding Premium Payment Options

Choosing how you pay your insurance premiums is a crucial aspect of managing your policy. Different payment methods offer varying levels of convenience and financial implications. Understanding these options allows you to select the method best suited to your budget and lifestyle.

Payment methods typically fall into two main categories: lump-sum payments and installment payments. The most common options are discussed below.

Payment Frequency Options

Insurance companies generally offer several options for paying premiums, each with its own set of advantages and disadvantages. These commonly include annual, semi-annual, quarterly, and monthly payments.

Annual payments offer the lowest overall cost due to the absence of interest or processing fees associated with more frequent payments. However, this requires a significant upfront capital outlay. Semi-annual, quarterly, and monthly payments spread the cost over a longer period, easing the financial burden but often incurring additional fees. For example, a monthly payment plan might include a small administrative fee per payment. The exact fees vary considerably depending on the insurance provider and policy type.

Advantages and Disadvantages of Payment Methods

| Payment Method | Advantages | Disadvantages |

|---|---|---|

| Annual | Lowest overall cost, potentially discounts | Requires large upfront payment |

| Semi-Annual | Lower overall cost than more frequent payments, manageable upfront payment | Higher cost than annual payments |

| Quarterly | Smaller payments than semi-annual, easier budgeting | Higher cost than semi-annual payments |

| Monthly | Most manageable monthly budget impact | Highest overall cost due to potential fees |

Consequences of Late Premium Payments

Late premium payments can have several serious consequences. It is crucial to understand these potential ramifications to ensure timely payments.

- Policy Cancellation: Non-payment can lead to the cancellation of your insurance coverage, leaving you vulnerable to significant financial losses in the event of an accident or other covered event.

- Late Payment Fees: Most insurers charge late payment fees, adding to the already due premium amount.

- Impact on Credit Score: Repeated late payments can negatively affect your credit score, making it more difficult to obtain loans or other forms of credit in the future.

- Reinstatement Challenges: Reinstatement of a cancelled policy may be difficult, and you might face higher premiums or stricter underwriting requirements.

Premium Financing Options

Premium financing involves taking out a loan to cover your insurance premiums. This can be a useful option for individuals who may not have the funds available to pay premiums upfront or prefer to spread the cost over time. However, it’s important to be aware that interest will accrue on the loan. Several financial institutions offer premium financing options, including banks, credit unions, and specialized insurance financing companies. It’s crucial to compare interest rates and terms from multiple lenders before committing to a loan. Failure to repay the loan can result in the same consequences as failing to pay the insurance premiums directly.

Premium and Policy Coverage

The amount you pay for your insurance premium is directly tied to the level of protection your policy offers. A higher premium generally signifies broader coverage, more generous benefits, or lower deductibles. Understanding this relationship is crucial for making informed decisions about your insurance needs.

The relationship between premium and coverage is not always linear; sometimes a small increase in premium can result in a significant boost in coverage, while other times, a substantial premium increase may only offer marginal improvements. This variance depends on several factors including the insurer, the type of insurance, and the specific features included in the policy.

Premium Comparison Across Providers

Different insurance providers offer similar policies with varying premium costs. This is due to a number of factors, including the insurer’s risk assessment, administrative costs, and profit margins. For example, a comprehensive car insurance policy with identical coverage limits might cost $100 per month from one company and $120 per month from another. This difference might be attributed to variations in their underwriting practices or the specific discounts they offer. Consumers should compare quotes from multiple insurers to find the best value for their money.

Higher Premiums Justified by Increased Coverage

Several scenarios justify paying a higher premium for increased coverage. For instance, adding liability coverage to a homeowner’s insurance policy significantly protects you against potential lawsuits stemming from accidents on your property. Similarly, increasing the coverage limits on your auto insurance policy can safeguard you from substantial financial losses in case of a major accident. Another example would be opting for a lower deductible on your health insurance; while the premium will be higher, you’ll pay less out-of-pocket in the event of a medical emergency.

Hypothetical Insurance Policy Example

This example illustrates a hypothetical comprehensive car insurance policy:

Policy Name: Comprehensive Auto Insurance – Gold Plan

Insurer: Example Insurance Company

Premium: $150 per month

Coverage Details:

* Liability Coverage: $250,000 bodily injury and $100,000 property damage.

* Collision Coverage: Covers damage to your vehicle in an accident, regardless of fault, with a $500 deductible.

* Comprehensive Coverage: Covers damage to your vehicle from non-accident events such as theft, vandalism, or hail, with a $500 deductible.

* Uninsured/Underinsured Motorist Coverage: $100,000 bodily injury and $50,000 property damage.

* Roadside Assistance: Towing, lockout service, and fuel delivery.Additional Features: Rental car reimbursement, accident forgiveness.

Conclusion

In conclusion, understanding your insurance premium is not merely about paying a bill; it’s about understanding the value you receive for your investment in financial security. By grasping the factors that contribute to premium calculations and exploring various payment options, you can make informed decisions that align with your individual needs and budget. Remember to regularly review your policy and compare offerings to ensure you’re receiving the most comprehensive coverage at a competitive price.

Q&A

What happens if I miss a premium payment?

Late payments can lead to penalties, suspension of coverage, and potential cancellation of your policy. The specific consequences vary depending on your insurer and policy terms.

Can I negotiate my insurance premium?

While you can’t always directly negotiate the base rate, you might be able to lower your premium by increasing your deductible, bundling policies, or exploring discounts for safe driving, security systems, or other qualifying factors.

How often are insurance premiums reviewed?

Premiums are typically reviewed annually at renewal time. However, adjustments can occur mid-term if significant changes affect your risk profile (e.g., a major claim).

What is premium financing?

Premium financing is a way to pay your premiums through a loan. This can be helpful for managing large annual payments, but remember to factor in interest charges.