Insurance is a cornerstone of financial security, but understanding its terminology can sometimes feel like navigating a maze. One of the most fundamental yet often misunderstood terms is “premium.” This guide will demystify the meaning of insurance premiums, exploring what they are, how they’re calculated, and how they impact your overall coverage. We’ll delve into various factors influencing premium costs, different payment options, and the crucial distinctions between premiums, deductibles, and copays.

Understanding your insurance premium is key to making informed decisions about your financial protection. This guide provides a clear and concise explanation of this vital concept, empowering you to navigate the world of insurance with greater confidence and clarity.

Defining “Premium” in Insurance

In the world of insurance, understanding the term “premium” is fundamental to grasping how insurance works. It’s the price you pay for the protection offered by an insurance policy. Think of it as your monthly or annual membership fee for a safety net.

Premium payments are what enable insurance companies to pool funds from many policyholders to cover potential losses experienced by a smaller number of those individuals. This shared risk model is the cornerstone of insurance.

Premium Definition

An insurance premium is the recurring payment made by a policyholder to an insurance company in exchange for coverage against specified risks. The amount of the premium depends on various factors, including the type of insurance, the level of coverage, the assessed risk of the policyholder, and the insurer’s operating costs. It’s essentially the cost of transferring risk to the insurance company.

Examples of Insurance Premiums

Insurance premiums vary significantly depending on the type of insurance. For instance, a health insurance premium covers medical expenses, an auto insurance premium protects against car accidents and damages, and a home insurance premium safeguards your property from various risks like fire or theft. The premium amount reflects the potential cost of claims associated with each type of insurance. A higher risk profile typically leads to a higher premium.

Comparison of Premiums Across Insurance Types

The following table provides a general comparison of average premiums across different insurance types. It is important to note that these are illustrative examples and actual premiums will vary widely based on individual circumstances and location.

| Insurance Type | Average Monthly Premium (USD) | Factors Influencing Premium | Example of Covered Risks |

|---|---|---|---|

| Health Insurance | $500 – $1000+ | Age, health status, location, plan type | Hospital stays, doctor visits, prescription drugs |

| Auto Insurance | $100 – $200+ | Driving record, vehicle type, location, age | Accidents, theft, property damage |

| Homeowners Insurance | $100 – $300+ | Location, home value, coverage amount, security features | Fire, theft, vandalism, liability |

| Life Insurance | $50 – $200+ | Age, health, coverage amount, policy type | Death benefit to beneficiaries |

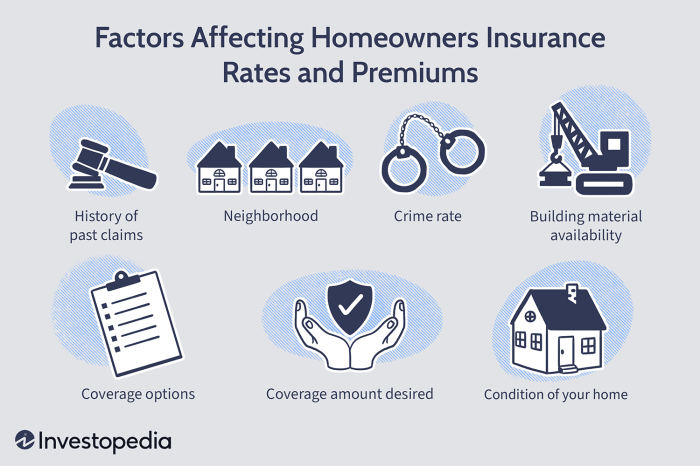

Factors Influencing Insurance Premiums

Insurance premiums, the price you pay for coverage, aren’t arbitrarily set. Insurers use a complex system to assess risk and determine a fair price that reflects the likelihood of a claim. Numerous factors contribute to this calculation, ensuring that premiums accurately reflect the potential cost of covering policyholders.

Several key factors influence the premiums insurance companies charge. These factors are carefully weighed and analyzed to create a comprehensive risk profile for each individual or entity seeking coverage. The ultimate goal is to ensure the insurer maintains financial stability while providing appropriate coverage at a competitive price.

Age

Age is a significant factor in many types of insurance. For health insurance, older individuals generally pay higher premiums due to a statistically higher likelihood of requiring medical care. Conversely, younger, healthier individuals may qualify for lower premiums. In auto insurance, younger drivers, particularly those with less driving experience, often face higher premiums because of their increased risk of accidents. This risk profile typically decreases with age and experience, leading to lower premiums over time. For life insurance, younger individuals typically receive lower premiums as their life expectancy is longer.

Health

Health status significantly impacts health insurance premiums. Individuals with pre-existing conditions or a history of serious illnesses typically pay higher premiums because they pose a greater risk of requiring expensive medical treatment. Insurers may request medical records and conduct health assessments to accurately assess this risk. Conversely, individuals with excellent health histories may qualify for lower premiums. The level of detail and the specific conditions considered can vary between insurers.

Driving History

Driving history is a cornerstone of auto insurance premium calculations. Insurers meticulously review driving records, looking for evidence of accidents, traffic violations, and DUI convictions. A clean driving record, demonstrating responsible driving habits, usually results in lower premiums. Conversely, a history of accidents or violations significantly increases the likelihood of higher premiums, reflecting the increased risk the insurer assumes. The severity of past incidents also plays a crucial role; a major accident will likely have a more significant impact on premiums than a minor fender bender.

Location

Geographic location plays a crucial role in determining insurance premiums, particularly for auto and home insurance. Areas with higher crime rates, a greater frequency of natural disasters (such as hurricanes or earthquakes), or higher rates of vehicle theft typically result in higher premiums. Insurers analyze crime statistics, weather patterns, and other relevant data to assess the risk associated with specific locations. This reflects the higher probability of claims in higher-risk areas. For example, someone living in a hurricane-prone coastal region will generally pay more for home insurance than someone in a less vulnerable inland area.

Risk Assessment and Premium Calculation Methods

Insurance providers employ various methods to assess risk and calculate premiums. While the specific methodologies vary, they all aim to quantify the likelihood of a claim and the potential cost of that claim. Some insurers may utilize sophisticated actuarial models incorporating vast datasets and statistical analyses. Others might rely on simpler scoring systems based on a limited number of factors. Ultimately, the goal is to arrive at a premium that accurately reflects the insurer’s expected cost of covering the policyholder while remaining competitive within the market. The differences in methodologies can lead to variations in premium pricing across different insurance providers, even for individuals with similar risk profiles. For instance, one insurer might place greater weight on credit score than another, leading to different premium calculations for the same applicant.

Understanding Your Insurance Policy and Premium Costs

Understanding your insurance policy and its associated premium costs is crucial for effective financial planning and avoiding unexpected expenses. Your policy document contains all the necessary information regarding your coverage, and importantly, the details of your premium payments. Knowing how to navigate this document and understand the information presented will empower you to manage your insurance effectively.

Locating Premium Information in Your Insurance Policy

Your insurance policy should clearly state your premium amount. This information is usually found on the declarations page, the first few pages of your policy. Look for sections titled “Premium Summary,” “Premium Schedule,” or similar headings. The declarations page will typically list the total annual premium, the payment frequency (e.g., monthly, quarterly, annually), and the due dates for each payment. Additional sections within the policy may detail any applicable discounts or surcharges that affect your premium. For example, a multi-car discount might be reflected here, showing the premium reduction compared to a single-car policy.

Interpreting Premium Information and Payment Schedules

Once you’ve located the premium information, understanding the payment schedule is essential. The policy will specify whether your payments are due monthly, quarterly, semi-annually, or annually. It will also list the due dates for each payment. Missed payments can result in late fees or even policy cancellation, so carefully note these dates and set up reminders to ensure timely payments. Your policy may also Artikel different payment methods, such as online payments, mail, or phone payments. For instance, a policy might offer a discount for setting up automatic payments.

Contacting Your Insurance Provider for Clarification

If you have any questions or require clarification regarding your premium, contacting your insurance provider directly is the best course of action. Most insurance companies offer various contact methods, including phone, email, and online chat. When contacting them, have your policy number readily available to expedite the process. Clearly explain your questions or concerns. For example, if you are unsure about a specific charge on your bill, provide the date and amount for efficient resolution.

Comparing Insurance Quotes and Premiums

Comparing insurance quotes from different providers is a vital step in securing the best possible coverage at a competitive price. Begin by obtaining quotes from multiple insurers, ensuring that you are comparing policies with similar coverage levels. Pay close attention to the premium amounts, payment schedules, and any additional fees or surcharges. Create a comparison table to organize the information, noting the premium amount, payment frequency, and any included features or discounts for each provider. For example, you can compare Company A offering a $1000 annual premium payable monthly, with Company B offering a $1100 annual premium payable annually, but with a 5% discount for online payment. This structured approach will allow for a clear and informed decision.

Summary

In conclusion, understanding your insurance premium is paramount to managing your financial risk effectively. By grasping the factors influencing premium costs, available payment options, and the relationship between premiums, deductibles, and copays, you can make informed choices that best suit your individual needs and budget. Remember to always review your policy documents carefully and don’t hesitate to contact your insurer with any questions. Proactive engagement ensures you receive the appropriate coverage at a price you can comfortably manage.

Query Resolution

What happens if I miss a premium payment?

Missing a premium payment can lead to a lapse in your coverage, leaving you vulnerable to financial burdens in the event of an accident or illness. Your insurer will typically send reminders, but late payment may result in penalties or cancellation of your policy.

Can I negotiate my insurance premium?

While you can’t always negotiate the base rate, you might be able to lower your premium by bundling policies, improving your credit score, or opting for a higher deductible. Shop around and compare quotes from different insurers.

How often are insurance premiums reviewed?

The frequency of premium reviews varies by insurer and policy type. Some insurers review premiums annually, while others may do so more or less frequently, often based on factors like claims history and risk assessment.

What factors affect my car insurance premium the most?

Your driving record (accidents, tickets), age, location, vehicle type, and coverage level are major factors influencing your car insurance premium. A clean driving record and choosing a less expensive vehicle can significantly reduce costs.