Navigating the world of health insurance can feel like deciphering a complex code, especially when confronted with terms like “premium.” Understanding what a premium is and how it impacts your healthcare costs is crucial for making informed decisions about your coverage. This guide provides a clear and concise explanation of health insurance premiums, exploring their components, influencing factors, and payment methods.

We’ll delve into the various types of health insurance plans and how their premiums differ, shedding light on the often-confusing relationship between premium costs and the level of coverage provided. By the end, you’ll have a solid grasp of what constitutes a health insurance premium and how to manage this essential aspect of your healthcare finances.

Defining “Premium” in Health Insurance

Understanding your health insurance policy requires grasping the meaning of several key terms. One of the most fundamental is the “premium.” This seemingly simple word holds significant weight in determining your financial responsibility for healthcare.

Premiums are essentially the recurring payments you make to your health insurance company in exchange for coverage. Think of it as your monthly membership fee for access to their services. This consistent payment guarantees that you’ll have financial protection should you need medical care.

Premium versus Other Health Insurance Costs

It’s crucial to differentiate premiums from other out-of-pocket expenses associated with health insurance. While premiums are your regular payments for coverage, other costs come into play when you actually use your insurance. These include deductibles, copays, and coinsurance. The deductible is the amount you pay out-of-pocket before your insurance begins to cover expenses. Copays are fixed fees you pay at the time of service, such as a doctor’s visit. Coinsurance is your share of the costs after you’ve met your deductible. Premiums are distinct from these; they’re the price you pay for having the insurance plan in place, regardless of whether you use it or not.

Analogy for Understanding Premiums

Imagine subscribing to a gym membership. Your monthly payment is analogous to your health insurance premium. You pay this fee to have access to the gym’s facilities and equipment. You might not use the gym every day, but your consistent payment guarantees access when you need it. Similarly, your health insurance premium guarantees access to healthcare services, even if you don’t require them frequently. The gym membership fee doesn’t cover individual workouts (like copays); nor does it cover the cost of major equipment repairs (like deductibles). It simply ensures access to the gym’s services. Similarly, the premium ensures access to your health plan’s network of providers and coverage benefits.

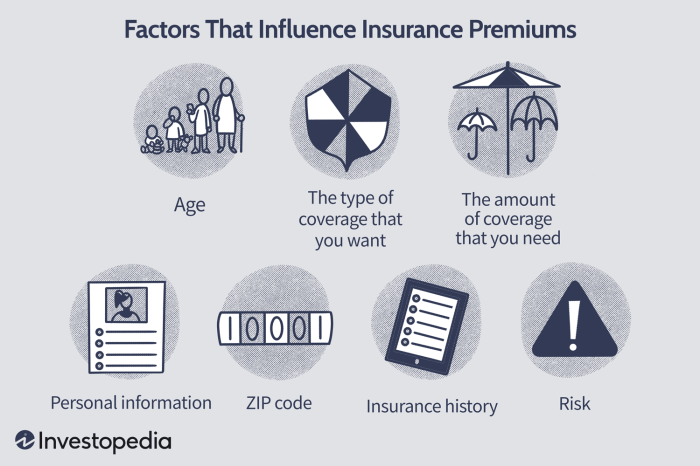

Factors Affecting Health Insurance Premiums

Several key factors influence the cost of your health insurance premiums. Understanding these factors can help you make informed decisions when choosing a plan. These factors interact in complex ways, and the final premium is a reflection of the insurer’s assessment of your risk.

Age

Age is a significant factor in determining health insurance premiums. Generally, older individuals tend to have higher premiums than younger individuals. This is because the likelihood of needing more extensive healthcare increases with age. Insurers factor in the increased risk of chronic illnesses and age-related health issues when setting premiums. For example, a 60-year-old might pay significantly more than a 25-year-old for the same coverage, reflecting the higher probability of requiring more expensive medical care.

Location

Geographic location plays a crucial role in premium pricing. The cost of healthcare varies considerably across different regions. Areas with higher concentrations of specialists, advanced medical facilities, and a higher cost of living tend to have higher premiums. For instance, premiums in major metropolitan areas with high healthcare costs are typically higher than those in rural areas with fewer healthcare providers and lower overall costs. This reflects the insurer’s need to cover the higher expenses associated with providing care in these locations.

Individual vs. Family Plans

Individual and family health insurance plans differ significantly in premium costs. Family plans, which cover multiple individuals, typically have higher premiums than individual plans. This is because the insurer is assuming a greater risk by covering a larger number of individuals, increasing the potential for higher healthcare expenses. The size of the family also impacts the premium; a larger family will generally have a higher premium than a smaller one. A single individual’s plan will always cost less than a plan that covers a spouse and two children, for example.

Table Summarizing Factors Affecting Health Insurance Premiums

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Age | Older individuals generally have higher health risks. | Premiums increase with age. | A 60-year-old pays more than a 30-year-old for the same plan. |

| Location | Healthcare costs vary significantly by geographic area. | Premiums are higher in areas with higher healthcare costs. | Premiums in New York City are typically higher than in rural Nebraska. |

| Plan Type (Individual vs. Family) | Family plans cover multiple individuals, increasing the insurer’s risk. | Family plans have higher premiums than individual plans. | A family plan for four people costs more than an individual plan. |

Types of Health Insurance Plans and Premium Variations

Understanding the different types of health insurance plans is crucial for making informed decisions about your healthcare coverage. The type of plan you choose significantly impacts both your monthly premium and your out-of-pocket costs when you need medical care. Different plans offer varying levels of flexibility and control over your healthcare choices.

The cost of your health insurance premium is directly related to the type of plan you select and the level of coverage it provides. Generally, plans with lower premiums tend to offer less comprehensive coverage, while plans with higher premiums offer more extensive benefits and greater choice of healthcare providers.

Health Insurance Plan Types and Premium Differences

Several common types of health insurance plans exist, each with its own structure and cost implications. Understanding these differences helps individuals choose the plan that best suits their needs and budget.

Here are three common examples: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs).

HMOs (Health Maintenance Organizations): HMO plans typically have lower premiums than PPOs or EPOs. However, they usually require you to choose a primary care physician (PCP) within the HMO network who will then refer you to specialists. Seeing out-of-network doctors generally isn’t covered, leading to higher out-of-pocket expenses. This structure encourages preventative care and managed care, potentially leading to lower overall healthcare costs.

PPOs (Preferred Provider Organizations): PPO plans usually have higher premiums than HMOs but offer greater flexibility. You can see any doctor, in-network or out-of-network, although seeing out-of-network doctors will result in higher costs. This flexibility comes at the price of a higher premium.

EPOs (Exclusive Provider Organizations): EPO plans are similar to HMOs in that they generally require you to choose a PCP within the network. However, unlike HMOs, EPOs typically do not allow you to see out-of-network doctors under any circumstances. This results in lower premiums compared to PPOs, but significantly less flexibility in choosing providers.

The relationship between plan coverage and premium cost is generally inverse: more comprehensive coverage (e.g., lower out-of-pocket maximums, broader provider networks) usually equates to higher premiums. Conversely, plans with lower premiums often come with higher deductibles, co-pays, and out-of-pocket maximums.

Premium Range Comparison Table

| Plan Type | Average Monthly Premium Range (Example) | Network Access | Out-of-Pocket Costs |

|---|---|---|---|

| HMO | $300 – $500 | In-network only (PCP referral usually required) | Generally lower, but limited provider choice |

| PPO | $500 – $800 | In-network and out-of-network (higher costs out-of-network) | Potentially higher, but greater provider choice |

| EPO | $400 – $600 | In-network only (no out-of-network coverage) | Generally lower than PPOs, but limited provider choice |

Note: These premium ranges are examples only and vary significantly based on factors like age, location, family size, and the specific plan details. Actual premiums will differ depending on the insurance company and the specific plan offered.

Understanding Premium Payment Methods

Paying your health insurance premiums is crucial to maintaining continuous coverage. Understanding the various payment options and the potential consequences of late or missed payments is essential for responsible health insurance management. This section details common payment methods, the repercussions of non-payment, and resources available to those facing financial difficulties.

Common Payment Methods for Health Insurance Premiums

Several methods exist for paying health insurance premiums, offering flexibility to suit individual circumstances. The most common options include monthly installments, which are often the default, and annual payments, which may offer discounts. Some insurers also accept payments through payroll deduction, directly debiting the premium from an employee’s paycheck. Online payment portals, often accessible through the insurer’s website, allow for secure and convenient payment via credit card, debit card, or electronic bank transfer. Finally, many insurers accept payments via mail, though this method is generally slower and less secure.

Consequences of Missed or Late Premium Payments

Failure to pay premiums on time can lead to significant consequences. The most immediate impact is the interruption or cancellation of health insurance coverage. This means that you will be responsible for the full cost of any medical services you receive. Depending on the insurer and the specifics of your policy, there may be penalties or fees for late payments. Furthermore, your credit score could be negatively affected, making it more difficult to secure loans or other financial products in the future. In some cases, persistent non-payment can result in legal action from the insurance company.

Options for Individuals Facing Payment Difficulties

Individuals experiencing financial hardship that makes premium payments difficult should contact their insurance provider immediately. Many insurers offer payment plans, allowing individuals to spread payments over several months, thus alleviating immediate financial pressure. They may also be able to explore options like reduced premiums or temporarily lower coverage levels. Depending on your circumstances, you may be eligible for government assistance programs designed to help individuals afford health insurance. It is crucial to proactively communicate with your insurer to explore available solutions rather than letting payments lapse.

Step-by-Step Guide to Paying a Health Insurance Premium

The specific steps for paying your premium will vary slightly depending on your insurance provider and chosen payment method. However, a general guide follows:

1. Locate your payment information: This typically includes your policy number, the amount due, and the due date. This information is usually found on your insurance bill or online account statement.

2. Choose your payment method: Select your preferred method from the options provided by your insurer (e.g., online payment portal, mail, phone payment).

3. Gather necessary information: Depending on the method, you may need your credit card details, bank account information, or a check.

4. Make the payment: Follow the instructions provided by your insurer to complete the payment process. For online payments, this usually involves logging into your account, selecting the “Pay Now” option, and entering your payment details. For mail payments, ensure your check or money order is made payable to your insurer and includes your policy number.

5. Retain confirmation: Keep a record of your payment, such as a confirmation email or receipt, for your records.

Premium Adjustments and Changes

Health insurance premiums are not static; they fluctuate over time due to a variety of interconnected factors. Understanding these changes is crucial for effective financial planning and managing healthcare costs. This section details the reasons behind premium adjustments, the process for addressing them, and provides a practical example.

Premium adjustments reflect the dynamic nature of the healthcare industry and the insurance market. Several key elements influence these changes, impacting both individual and group plans.

Factors Influencing Premium Changes

Several factors contribute to increases or decreases in health insurance premiums. These factors are often interconnected and can vary in their impact depending on the specific insurance market and plan type.

Increases are commonly driven by rising healthcare costs, including hospital stays, prescription drugs, and physician services. Increased utilization of healthcare services by the insured population, particularly the use of expensive treatments and technologies, also exerts upward pressure on premiums. Changes in the regulatory environment, such as new government mandates or changes to healthcare laws, can also influence premiums. Finally, the insurer’s own financial performance, including claims payouts and administrative expenses, play a role. Conversely, decreases, though less frequent, may occur if healthcare costs decline, if there is a decrease in claims, or if insurers implement cost-saving measures. The competitive landscape of the insurance market can also lead to premium adjustments as insurers try to attract and retain customers.

Understanding and Appealing Premium Adjustments

Insurers are generally required to provide advance notice of premium changes, typically outlining the reasons for the adjustments. This notification, often included in a formal communication, might detail the impact of factors such as increased medical costs, changes in utilization patterns within the insured population, or adjustments to the insurer’s risk assessment. Policyholders usually have the right to appeal premium adjustments they believe are unwarranted or incorrect. This typically involves submitting a formal appeal to the insurer, potentially providing supporting documentation to substantiate the claim. In some cases, state insurance departments provide avenues for resolving disputes regarding premium adjustments.

Scenario: Premium Change and Appropriate Actions

Imagine Sarah, a 35-year-old with a family plan, receives notification that her monthly premium will increase by $150 next year. The insurer’s explanation cites a significant increase in prescription drug costs within her plan’s network and an increase in claims for specific procedures. Sarah should first carefully review the insurer’s explanation, comparing it to the previous year’s premium notice. If she feels the increase is unjustified or believes the explanation is insufficient, she should contact her insurer to request a more detailed explanation and to explore any options for mitigating the increase. These options might include switching to a plan with a higher deductible and lower premium or exploring options to reduce her prescription drug costs, such as using generic medications or negotiating lower prices with her pharmacy. If the insurer’s response is unsatisfactory, she can explore filing a formal appeal with the insurer and, if necessary, contact her state’s insurance department for assistance.

Illustrative Examples of Premium Costs

Understanding the factors that influence health insurance premiums is crucial for making informed decisions. The following examples illustrate the wide range of premium costs based on age, plan type, and other individual circumstances. It’s important to remember that these are hypothetical examples and actual costs will vary depending on the specific insurer, location, and individual health profile.

Example Premium Costs Across Different Age Groups and Plan Types

The following examples demonstrate the variability in premium costs for different age groups and plan types. We will consider a single individual purchasing a plan, not a family plan, for simplicity. Remember that location and specific insurer details significantly affect these costs.

| Example | Age | Plan Type | Monthly Premium | Contributing Factors |

|---|---|---|---|---|

| 1 | 25 | Bronze Plan (high deductible, low premium) | $200 | Young age, lower risk profile, high deductible chosen to reduce premium. |

| 2 | 40 | Silver Plan (moderate deductible, moderate premium) | $450 | Middle-aged, generally healthy, moderate deductible chosen for balance between cost and coverage. |

| 3 | 60 | Gold Plan (low deductible, higher premium) | $800 | Older age, higher risk profile, lower deductible chosen for greater coverage, reflecting increased healthcare needs. Pre-existing conditions might also contribute. |

| 4 | 28 | Platinum Plan (very low deductible, highest premium) | $1200 | Young, but chooses maximum coverage with a very low deductible, resulting in a high premium. May reflect a preference for comprehensive coverage regardless of cost. |

Detailed Premium Cost Breakdown for Example 2

Let’s examine the $450 monthly premium for the 40-year-old individual with a Silver Plan in more detail. This breakdown is illustrative and actual components may vary:

| Cost Component | Approximate Amount | Explanation |

|---|---|---|

| Actuarial Risk | $250 | This reflects the insurer’s assessment of the likelihood of needing healthcare services based on age and general health statistics. |

| Administrative Costs | $100 | Covers the insurer’s operational expenses, including salaries, technology, and marketing. |

| Profit Margin | $50 | The insurer’s profit, which is a percentage of the premium. |

| Plan Features (Deductible, Copay, etc.) | $50 | The cost reflects the selected plan features; a lower deductible results in a higher premium. |

Conclusive Thoughts

In conclusion, understanding your health insurance premium is paramount to responsible healthcare planning. By carefully considering factors like age, location, plan type, and payment options, you can make informed choices that align with your budget and healthcare needs. Remember, regular review of your policy and proactive communication with your insurer are key to maintaining adequate coverage and managing your premium payments effectively.

Essential FAQs

What happens if I miss a premium payment?

Missing a premium payment can lead to your coverage being suspended or canceled, resulting in your inability to access healthcare services until the payment is made. Late fees may also apply.

Can I change my health insurance plan mid-year?

Generally, you can only change your health insurance plan during the annual open enrollment period, unless you qualify for a special enrollment period due to a qualifying life event (e.g., marriage, job loss).

Are there tax benefits associated with health insurance premiums?

Depending on your country and specific circumstances, you may be able to deduct some or all of your health insurance premiums from your taxes. Consult a tax professional for personalized advice.

How can I lower my health insurance premiums?

Consider factors like choosing a higher deductible plan, enrolling in a plan with a larger network of providers, or exploring options like a Health Savings Account (HSA).