Understanding insurance premiums is crucial for navigating the world of financial protection. This guide demystifies the concept of insurance premiums, explaining what they are, how they’re calculated, and how to make informed decisions about your coverage. We’ll explore the various factors influencing premium costs, different payment methods, and the relationship between premiums and policy benefits. Whether you’re a seasoned policyholder or a newcomer to the insurance landscape, this comprehensive overview will equip you with the knowledge to confidently manage your insurance needs.

From the seemingly simple question, “What does premium in insurance mean?”, we’ll delve into the intricacies of risk assessment, administrative costs, and profit margins – all key components that shape the final price you pay. We’ll also examine how your choices, such as payment frequency and coverage level, impact your overall premium cost. By the end, you’ll have a clear understanding of how to interpret premium quotes, compare different providers, and make the best choices for your financial well-being.

Defining “Premium” in Insurance

In simple terms, an insurance premium is the amount of money you pay to an insurance company to maintain an active insurance policy. This payment secures your coverage against potential financial losses Artikeld in your policy agreement. Think of it as a fee for the peace of mind and financial protection the insurance provides.

Insurance Premium Explained

An insurance premium is essentially the price you pay for a specific level of risk coverage. The insurer assesses the risk associated with insuring you (or your property) and sets a premium accordingly. Higher risk profiles generally translate to higher premiums. The premium covers the insurer’s costs, including administrative expenses, claims payouts, and profit margins. Premiums can be paid in various ways, such as monthly, quarterly, or annually, depending on the policy and the insurer’s terms.

Examples of Different Insurance Premiums

Insurance premiums vary widely depending on the type of insurance. For example, a health insurance premium covers medical expenses, while an auto insurance premium covers damages or injuries related to car accidents. Homeowners insurance premiums protect against property damage or loss, and life insurance premiums provide financial security for beneficiaries upon the policyholder’s death. Each type of insurance carries its own set of risks and associated premium costs. Business insurance premiums are also quite varied and depend on the industry, size, and risk factors associated with the specific business.

Factors Influencing Insurance Premium Costs

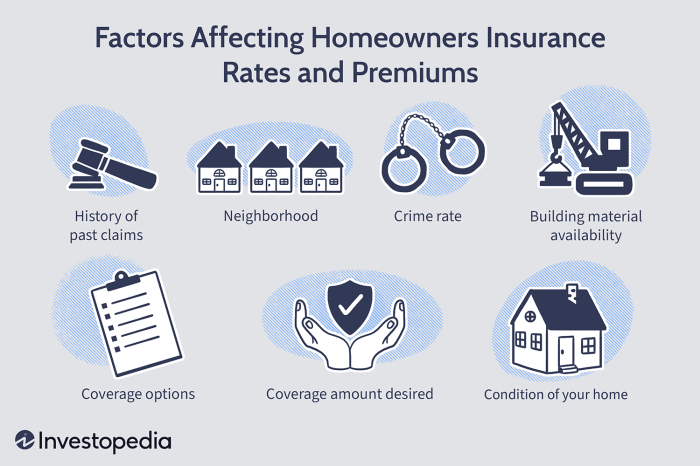

Several factors influence the cost of an insurance premium. These factors are used by insurers to assess risk and calculate the appropriate premium for each policyholder. For auto insurance, factors such as driving history (accidents, tickets), age, location, and the type of vehicle significantly impact premiums. For home insurance, factors like the home’s location, age, value, and security features play a crucial role. Health insurance premiums are influenced by age, health status, location, and the chosen plan’s coverage level. The broader economic climate and claims experience also affect premium adjustments over time.

Comparison of Premiums Across Different Insurance Types

The following table provides a general comparison of average annual premiums across different insurance types. Note that these are illustrative examples and actual premiums can vary significantly based on individual circumstances and specific policy details. The values are intended to show the relative differences in cost across insurance types, not to reflect precise amounts.

| Insurance Type | Average Annual Premium (USD) | Factors Influencing Cost | Typical Coverage |

|---|---|---|---|

| Auto Insurance | $1500 | Driving record, age, vehicle type, location | Liability, collision, comprehensive |

| Homeowners Insurance | $1200 | Home value, location, security features, age of home | Property damage, liability, additional living expenses |

| Health Insurance | $7000 | Age, health status, plan type, location | Doctor visits, hospital stays, prescription drugs |

| Life Insurance | $1000 | Age, health, coverage amount, policy type | Death benefit for beneficiaries |

Components of an Insurance Premium

An insurance premium, the price you pay for coverage, isn’t a random number. It’s a carefully calculated amount reflecting several key factors that contribute to the overall cost. Understanding these components helps consumers make informed decisions about their insurance choices.

Several key factors influence the final premium amount. These components work together to create a comprehensive pricing model that balances the insurer’s need for profitability with the insured’s need for affordable coverage.

Risk Assessment’s Role in Premium Calculation

Risk assessment is the cornerstone of premium calculation. Insurers meticulously evaluate the likelihood of a claim being filed. This involves analyzing various factors specific to the insured individual or property. For example, a car insurance premium for a young driver with a history of accidents will be significantly higher than that of an older driver with a clean driving record. This is because the insurer assesses a higher probability of a claim from the younger driver. Similarly, homeowners insurance premiums vary based on location (e.g., areas prone to natural disasters), the age and condition of the property, and the presence of security systems. The higher the perceived risk, the higher the premium. Statistical models, incorporating vast amounts of historical claims data, are used to quantify these risks and translate them into numerical values used in the premium calculation. For instance, a model might predict that drivers aged 18-25 are three times more likely to be involved in an accident than those aged 30-40. This increased risk is reflected directly in the premium.

Administrative Costs’ Influence on Premium Pricing

Administrative costs represent a significant portion of the premium. These encompass a wide range of expenses, including salaries for claims adjusters, underwriters, and customer service representatives; costs associated with IT infrastructure and data processing; marketing and advertising expenses; and regulatory compliance costs. For instance, a large insurer with a complex claims processing system and a substantial workforce will naturally have higher administrative costs compared to a smaller, more streamlined company. These higher costs are then passed on to policyholders in the form of increased premiums. An example could be a significant increase in the cost of processing claims due to new regulatory requirements, leading insurers to adjust premiums accordingly to maintain profitability.

Profit Margins’ Impact on Insurance Premiums

Insurance companies, like any other business, aim to generate a profit. The profit margin, the percentage of revenue remaining after all expenses are deducted, is factored into the premium calculation. A higher desired profit margin will directly result in higher premiums. This margin is often influenced by market competition, investment performance, and the overall economic climate. For example, during periods of low interest rates, insurers might increase premiums to compensate for lower investment returns, thereby maintaining their target profit margins. Conversely, increased competition within the insurance market might lead companies to lower their profit margins and thus offer more competitive premiums to attract customers. It’s important to remember that a reasonable profit margin is necessary for insurers to remain financially stable and continue providing coverage.

Premium and Policy Coverage

The amount you pay for your insurance premium is directly linked to the level of protection your policy offers. Higher premiums generally correspond to more comprehensive coverage, while lower premiums typically mean less extensive protection. Understanding this relationship is crucial for making informed decisions about your insurance needs.

The relationship between premium amount and coverage is not always linear. Factors beyond the scope of coverage, such as your risk profile (age, location, driving history, etc.), also influence premium costs. However, the fundamental principle remains: greater coverage usually translates to a higher premium.

Premium Comparison Across Coverage Levels

Consider a car insurance policy. A basic liability-only policy, covering only damages you cause to others, will have a significantly lower premium than a comprehensive policy that also covers damage to your own vehicle, medical expenses, and other potential losses. Similarly, higher coverage limits (e.g., a higher liability limit) will result in a higher premium than lower limits. For instance, a liability limit of $100,000 might have a lower premium than a $500,000 limit for the same policy type. The difference reflects the increased financial responsibility assumed by the insurer at the higher limit.

Deductibles and Co-pays’ Impact on Premiums and Out-of-Pocket Costs

Deductibles and co-pays are significant components influencing both premiums and your out-of-pocket expenses. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A co-pay is a fixed amount you pay for a covered medical service. Choosing a higher deductible usually results in a lower premium, as the insurer’s financial risk is reduced. Conversely, a lower deductible leads to a higher premium because the insurer assumes more of the initial financial burden. Co-pays function similarly; higher co-pays often translate to lower premiums.

The trade-off lies in the balance between upfront costs (premiums) and potential out-of-pocket expenses when you need to file a claim. A high deductible policy might save you money on premiums, but if you have a significant claim, your out-of-pocket expenses could be substantially higher. A low deductible policy means higher premiums, but lower out-of-pocket expenses in the event of a claim.

High vs. Low Premium Policies: A Comparison

Let’s visualize this with a simple comparison:

Imagine two car insurance policies, Policy A and Policy B, both covering the same vehicle.

Policy A (High Premium, High Coverage): This policy features a low deductible ($250), comprehensive coverage (including collision, comprehensive, and high liability limits), and a monthly premium of $200. In the event of an accident causing $5,000 in damage to your car, your out-of-pocket expense would be only $250.

Policy B (Low Premium, Low Coverage): This policy has a high deductible ($1,000), liability-only coverage with lower limits, and a monthly premium of $100. If the same $5,000 accident occurs, your out-of-pocket expense would be $1,000, significantly higher than Policy A.

This illustrates the fundamental trade-off: higher premiums often equate to lower out-of-pocket costs in the event of a claim, while lower premiums mean higher potential out-of-pocket expenses. The optimal choice depends on individual risk tolerance and financial circumstances.

Last Recap

In conclusion, understanding what constitutes an insurance premium goes beyond simply knowing it’s the price of your coverage. It involves comprehending the complex interplay of risk assessment, administrative costs, and profit margins that determine its value. By understanding these factors, and by exploring different payment options and coverage levels, you can make informed decisions that align with your financial needs and risk tolerance. This empowers you to secure the appropriate level of protection without overspending or compromising on essential coverage. Remember to always compare quotes, understand your policy, and communicate openly with your insurer to ensure your insurance needs are adequately met.

Detailed FAQs

What happens if I miss a premium payment?

Missing a premium payment can lead to policy cancellation, resulting in a lapse of coverage. Late payment fees may also apply.

Can I change my premium payment frequency?

Generally, yes. Most insurers allow you to switch between monthly, quarterly, or annual payments, although this might affect the overall cost.

How do discounts affect my premium?

Discounts, such as for safe driving (auto insurance) or bundling policies, reduce your overall premium cost.

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.