Navigating the world of healthcare can feel like deciphering a complex code, and understanding medical insurance premiums is often the first hurdle. This seemingly simple phrase, “medical insurance premium,” holds the key to unlocking access to healthcare services, but its meaning extends far beyond a simple monthly payment. This guide will unravel the intricacies of medical insurance premiums, explaining what they are, what influences their cost, and how they contribute to the larger healthcare landscape.

We’ll delve into the various components that make up your premium, explore different payment methods, and address the crucial role premiums play in ensuring the financial stability of healthcare providers. By the end, you’ll have a clear understanding of this fundamental aspect of healthcare financing and how it directly impacts your access to care.

Defining Medical Insurance Premiums

Medical insurance premiums are the regular payments you make to an insurance company in exchange for coverage of medical expenses. Think of it like a membership fee that grants you access to their services when you need them. The more comprehensive the coverage, the higher the premium is likely to be.

Medical insurance premiums are the recurring payments you make to your insurance provider to maintain your health insurance policy. They represent the cost of your coverage and are calculated based on several factors, including your age, location, chosen plan, family size (if applicable), and pre-existing conditions. The premium amount covers the insurance company’s administrative costs, claims processing, and the overall risk associated with providing coverage to you. Premiums can be paid monthly, quarterly, or annually, depending on the terms of your policy. They are a crucial element in accessing healthcare services and managing the financial burden of unexpected medical costs.

Types of Medical Insurance Premiums

Medical insurance premiums are offered in various structures catering to different needs and circumstances. These structures reflect the scope of coverage and the number of individuals covered under the policy.

Comparison of Premium Structures

The following table compares characteristics of different premium structures. Note that these are general examples and actual premiums vary widely depending on the insurance provider, location, and specific plan details.

| Premium Type | Coverage | Cost Factors | Typical Payers |

|---|---|---|---|

| Individual | Covers only the policyholder. | Age, health status, location, chosen plan. | Self-employed individuals, those not covered by employer plans. |

| Family | Covers the policyholder and their dependents (spouse, children). | Age, health status of all covered individuals, location, chosen plan, number of dependents. | Families, individuals with dependents. |

| Group | Covers employees of a company or members of a specific group (e.g., union). | Negotiated rates between the employer/group and the insurance provider, average health status of the group. | Employees of companies offering group health insurance. |

| Catastrophic | High deductible plan with lower premiums, covering only major medical expenses after a significant out-of-pocket expense. | Age, location, chosen plan, usually lower than comprehensive plans. | Individuals willing to accept higher risk and pay higher deductibles for lower premiums. |

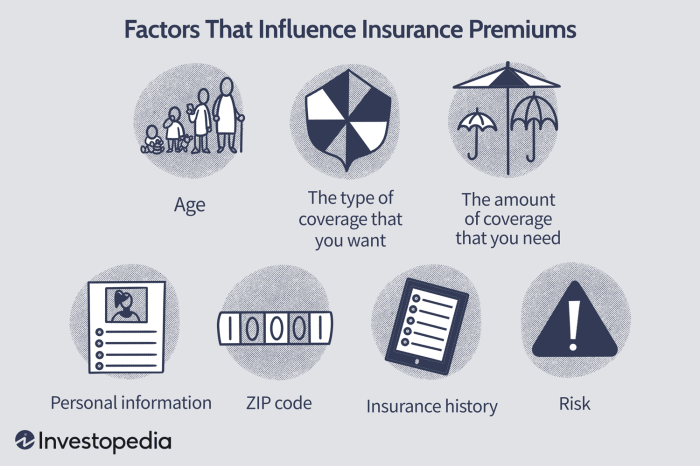

Factors Influencing Premium Costs

Several interconnected factors contribute to the final cost of your medical insurance premium. Understanding these factors can help you make informed decisions when choosing a plan and managing your healthcare expenses. These factors can be broadly categorized into personal characteristics, plan features, and market dynamics.

Age

Age is a significant factor in determining premium costs. Generally, older individuals tend to have higher premiums than younger individuals. This is because the likelihood of needing more extensive medical care increases with age. Insurance companies use actuarial data to assess the risk associated with insuring different age groups, and these risks are reflected in the premium structure. For example, a 65-year-old might pay significantly more than a 25-year-old for the same coverage, reflecting the higher probability of needing expensive treatments or long-term care.

Health Status

Pre-existing conditions and current health significantly impact premium costs. Individuals with pre-existing conditions, such as diabetes or heart disease, typically pay higher premiums because they represent a higher risk to the insurance company. Similarly, individuals with a history of frequent medical visits or hospitalizations will likely face higher premiums. Conversely, those with excellent health and a clean medical history may qualify for lower premiums or discounts. Insurance companies often use medical history questionnaires and sometimes require medical examinations to assess the risk.

Location

Geographic location plays a role in premium costs due to variations in healthcare costs across different regions. Areas with higher healthcare provider fees, higher prescription drug costs, and a higher concentration of specialists often have higher insurance premiums. For instance, premiums in major metropolitan areas with high concentrations of specialized medical facilities tend to be higher than those in rural areas with fewer resources. This is because the cost of providing healthcare services in these areas is inherently higher.

Lifestyle Choices

Lifestyle choices such as smoking, excessive alcohol consumption, and a lack of physical activity can also influence premium costs. Insurers consider these factors because they increase the risk of developing health problems, leading to higher healthcare utilization and costs. Individuals who engage in unhealthy lifestyle choices may face higher premiums than those who maintain a healthy lifestyle. Some insurance companies offer incentives, such as discounts, to encourage healthier habits.

Plan Coverage Levels

Different insurance plans offer varying levels of coverage, impacting premium costs. A comprehensive plan with low out-of-pocket expenses will generally have a higher premium than a high-deductible plan with lower monthly payments.

- High Deductible Health Plan (HDHP): Lower monthly premiums, higher out-of-pocket costs before insurance coverage begins.

- Preferred Provider Organization (PPO): Moderate monthly premiums, flexibility in choosing doctors and hospitals, but potentially higher costs if outside the network.

- Health Maintenance Organization (HMO): Lower monthly premiums, but usually require choosing a primary care physician (PCP) within the network and referrals for specialists.

- Exclusive Provider Organization (EPO): Similar to HMOs, but often with slightly higher premiums and fewer restrictions on specialist referrals.

The choice of plan should reflect an individual’s risk tolerance and financial situation. A younger, healthier individual might opt for a high-deductible plan to save on premiums, while an older individual with pre-existing conditions might prefer a more comprehensive plan despite the higher cost.

The Role of Premiums in Healthcare Financing

Medical insurance premiums are the cornerstone of the healthcare financing system in many countries. They represent the individual or employer’s contribution to a shared risk pool, enabling the provision of healthcare services to a large population. The efficient and effective flow of premium payments is crucial for the smooth operation and financial stability of both the insurance companies and the healthcare system as a whole.

Premiums are the primary source of revenue for most private health insurance companies. This revenue stream is essential for covering the costs of claims paid out to policyholders, administrative expenses, and the profits needed to maintain the insurance company’s operations and attract investors. The relationship between premium income and claim payouts is a delicate balance; a high volume of claims, relative to premium income, can lead to financial instability, while excessive premiums might deter potential customers and affect market share.

Premium Contributions to Insurance Company Solvency

Insurance companies rely heavily on premium payments to remain solvent. These payments are pooled together to form a reserve fund that is used to pay for healthcare expenses incurred by policyholders. Actuaries use sophisticated statistical models to predict the likely amount of claims based on factors such as the age, health status, and lifestyle of the insured population. They then set premium rates to ensure that the collective premiums are sufficient to cover the anticipated claims and operational costs, while also maintaining a level of profitability. If the actual claims exceed projections, the insurance company may face financial losses, impacting its solvency and potentially leading to increased premiums in the future. Conversely, if premiums are too high relative to claims, the company might accumulate excessive reserves.

Premium Levels and Healthcare Access

The level of premiums significantly impacts healthcare access. High premiums can create a barrier to healthcare, particularly for individuals and families with limited financial resources. This can lead to delayed or forgone care, resulting in poorer health outcomes. In contrast, affordable premiums increase healthcare accessibility, encouraging individuals to seek preventive care and timely treatment for illnesses, which can lead to better overall health and reduce the burden on the healthcare system in the long run. Government subsidies and regulations often aim to mitigate the impact of high premiums on healthcare access, ensuring a basic level of coverage for vulnerable populations. For example, the Affordable Care Act in the United States aimed to increase access to health insurance by providing subsidies to individuals and families with low incomes to help them afford premiums. This illustrates the direct relationship between premium affordability and the ability of individuals to access essential healthcare services.

Ultimate Conclusion

Understanding your medical insurance premium isn’t just about knowing the amount you pay each month; it’s about understanding the value you receive in return – access to essential healthcare services. By carefully considering the factors that influence premium costs and the different components that comprise your premium, you can make informed decisions about your healthcare coverage and ensure you’re receiving the best possible value for your investment. Remember, proactive engagement with your insurance plan empowers you to navigate the healthcare system with confidence and control.

FAQ Explained

What happens if I miss a premium payment?

Missing a premium payment can result in your coverage being suspended or cancelled, leaving you responsible for the full cost of any medical services you receive. Late payment fees may also apply.

Can I change my medical insurance plan after enrollment?

Most plans allow changes during specific open enrollment periods or if you experience a qualifying life event (like marriage or job loss). Contact your insurance provider for details.

Are there tax benefits associated with medical insurance premiums?

In many countries, portions of medical insurance premiums may be tax-deductible, depending on your individual circumstances and local tax laws. Consult a tax professional for personalized advice.

How do I compare different medical insurance plans?

Compare plans based on factors like premium costs, deductibles, co-pays, out-of-pocket maximums, and the network of doctors and hospitals covered. Use online comparison tools or consult an insurance broker.