Ever wondered what that monthly payment to your insurance company actually covers? Understanding insurance premiums is crucial for managing your finances and ensuring you have adequate protection. This guide unravels the complexities of insurance premiums, explaining what they are, how they’re calculated, and how to make the most of your insurance investment.

From the fundamental definition of an insurance premium to the various factors influencing its cost, we’ll explore the intricacies of this essential aspect of insurance. We’ll delve into different payment methods, premium adjustments, and the crucial role premiums play in ensuring insurance companies can fulfill their obligations to policyholders.

Defining Insurance Premium

An insurance premium is essentially the price you pay for an insurance policy. It’s the fee you give to an insurance company in exchange for their promise to cover certain losses or expenses if a specific event occurs. Think of it as a monthly or annual membership fee that provides you with financial protection.

Insurance Premium: A Detailed Definition

An insurance premium is a calculated amount determined by several factors. These factors are analyzed by actuaries who assess the risk associated with insuring a particular individual or property. The components of an insurance premium typically include:

* Risk Assessment: This is the core component, evaluating the likelihood of a claim based on factors specific to the insured (e.g., age, driving history for car insurance; health history for health insurance; location for home insurance). Higher risk generally leads to higher premiums.

* Administrative Costs: These are the expenses the insurance company incurs to operate, including salaries, marketing, and claims processing. These costs are factored into the premium.

* Profit Margin: Insurance companies, like any business, aim to make a profit. A portion of the premium covers their operational expenses and desired profit.

* Reinsurance Costs: For large or complex risks, insurance companies may purchase reinsurance from other companies to mitigate their own exposure. The cost of this reinsurance is often factored into the premium.

* Claims History: Past claims data significantly influences premiums. A history of frequent or large claims will generally result in higher premiums for future coverage.

Examples of Insurance Premiums and Their Variations

Insurance premiums vary widely depending on the type of insurance, the level of coverage, and the risk profile of the insured.

* Health Insurance: Premiums are influenced by age, health status, location, and the chosen plan’s coverage level. A younger, healthier individual in a low-risk area might pay less than an older individual with pre-existing conditions in a high-risk area. A comprehensive plan will usually cost more than a basic plan.

* Auto Insurance: Factors affecting auto insurance premiums include age, driving record, type of vehicle, location, and coverage level. A young driver with a poor driving record will typically pay more than an older driver with a clean record. Comprehensive coverage will cost more than liability-only coverage.

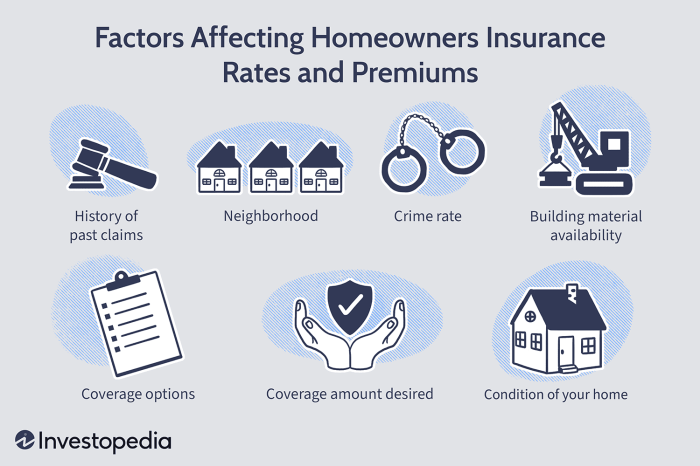

* Home Insurance: Premiums depend on the value of the home, its location (e.g., areas prone to natural disasters), security features, and the level of coverage. A home in a high-risk area with limited security features will likely have higher premiums than a home in a low-risk area with robust security.

Comparison of Insurance Premiums Across Types

The following table provides a simplified comparison of average annual premiums for different insurance types. Note that these are illustrative examples and actual premiums will vary considerably based on individual circumstances.

| Insurance Type | Low-Risk Individual/Property | Average-Risk Individual/Property | High-Risk Individual/Property |

|---|---|---|---|

| Health Insurance | $3,000 | $5,000 | $8,000 |

| Auto Insurance | $800 | $1,200 | $2,000 |

| Home Insurance | $1,000 | $1,500 | $2,500 |

Factors Influencing Premium Costs

Insurance premiums aren’t arbitrary numbers; they’re carefully calculated based on a multitude of factors that assess the likelihood of a claim. Understanding these factors can help individuals make informed decisions about their insurance coverage and potentially manage their premium costs.

Several key elements contribute to the final premium figure. Insurance companies utilize sophisticated actuarial models to analyze risk and price policies accordingly. This involves considering both the inherent risks associated with the insured item or individual and the broader economic environment.

Individual Risk Profiles

An individual’s risk profile is a crucial determinant of their insurance premium. This profile is built upon a comprehensive assessment of factors specific to the insured person or property. For example, a driver with a history of accidents and traffic violations will generally pay higher premiums for car insurance than a driver with a clean driving record. Similarly, a homeowner in a high-crime area might face higher premiums for home insurance compared to someone in a safer neighborhood. The assessment considers not only past incidents but also the likelihood of future events, based on statistical analysis and predictive modeling. For health insurance, pre-existing conditions and lifestyle choices (such as smoking or lack of exercise) can significantly impact premium costs.

Demographic Factors

Demographic factors play a significant role in premium determination. Age is a major factor; younger drivers often pay more for car insurance due to statistically higher accident rates, while older drivers may face increased premiums for health insurance reflecting higher healthcare utilization. Location also significantly influences premiums. Insurance companies consider factors such as crime rates, the frequency of natural disasters (like hurricanes or earthquakes), and the cost of healthcare services in a particular geographic area. For example, homeowners in areas prone to wildfires will generally pay higher premiums than those in less risky regions. These geographical variations in risk directly translate into differing premium costs.

The Premium Determination Process

The process of determining an insurance premium is complex, involving numerous steps and calculations. A simplified flowchart can illustrate this process:

[Flowchart Description: The flowchart begins with “Application Received.” This leads to two branches: “Risk Assessment” and “Pricing Model Selection.” “Risk Assessment” involves gathering information on the applicant (age, location, driving history, health history, etc.). This then feeds into “Pricing Model Selection,” which chooses the appropriate actuarial model based on the type of insurance (auto, home, health, etc.). The output of the “Pricing Model Selection” step goes into “Premium Calculation,” where the model processes the risk assessment data to generate a preliminary premium. This preliminary premium then undergoes “Underwriting Review,” where an underwriter assesses the risk and may adjust the premium based on additional factors or exceptions. Finally, the process concludes with “Premium Quotation,” which presents the final premium to the applicant.]

Understanding Premium Adjustments and Renewals

Insurance premiums aren’t static; they fluctuate over time based on various factors. Understanding these adjustments and the renewal process is crucial for managing your insurance costs effectively. This section will explain how premiums are adjusted, the reasons behind these changes, and the process of policy renewal.

Premium adjustments reflect changes in risk assessment and the overall financial health of the insurance company. Several factors influence these changes, leading to either increases or decreases in your premium. The renewal process itself involves reviewing your policy and determining the premium for the upcoming period.

Premium Adjustment Factors

Premiums are adjusted based on a continuous evaluation of risk. For example, if your driving record shows an increase in accidents or violations, your car insurance premium will likely rise to reflect the higher risk you represent to the insurer. Conversely, maintaining a clean driving record, completing a defensive driving course, or installing security systems in your home could lead to a premium decrease. Similarly, changes in your health, such as developing a pre-existing condition, may lead to higher health insurance premiums. Conversely, improvements in overall health might lead to lower premiums in some plans. Changes in the overall economic climate, such as increased claims costs or inflation, can also impact premiums. Insurers regularly reassess these factors, leading to periodic adjustments.

Renewal Process and Associated Premiums

Renewing an insurance policy typically involves a review of your policy details and risk assessment. The insurer will assess any changes in your circumstances that might affect your risk profile since your last renewal. This review might involve providing updated information, such as a new address or changes in your vehicle. The insurer will then calculate your new premium based on this updated information and current market conditions. The renewal notice will typically include the new premium amount, the policy coverage details, and the payment options. It’s crucial to review this notice carefully to ensure the information is accurate and that you understand the coverage provided. Failure to pay the premium by the due date may result in policy cancellation.

Calculating Total Insurance Cost Over Time

Calculating the total cost of insurance over a specific period requires considering both the initial premium and any subsequent adjustments. Let’s illustrate with an example:

Imagine your initial annual car insurance premium is $1,200. After six months, due to a minor accident, your premium increases by 15% for the remaining six months. Your new premium for the remaining period will be $1,200 * 0.15 = $180 increase. This means your premium for the remaining six months is $1,200 + $180 = $1380. Therefore, your total annual cost will be $1,200 (first six months) + $1,380 (second six months) = $2,580. This example demonstrates how premium adjustments significantly impact the overall cost of insurance over a longer period. It is important to meticulously track all adjustments to accurately calculate your total insurance expenditure. To further complicate matters, at renewal the premium might be further adjusted based on your driving record and other factors, leading to another change in your annual cost. Careful budgeting and understanding of these dynamics are essential for effective insurance management.

Closure

In conclusion, understanding your insurance premium is key to responsible financial planning. By grasping the factors influencing premium costs, available payment options, and the relationship between premiums and coverage, you can make informed decisions about your insurance needs. Remember, a well-informed approach ensures you receive the appropriate level of protection while managing your expenses effectively.

Questions and Answers

What happens if I miss an insurance premium payment?

Missing a payment can lead to a lapse in coverage, leaving you vulnerable to financial losses in the event of a claim. Late fees may also apply.

Can I negotiate my insurance premium?

In some cases, you might be able to negotiate a lower premium by bundling policies, improving your credit score, or taking safety courses (for auto insurance).

How often are insurance premiums reviewed?

Premium reviews vary by insurer and policy type. Some are annual, while others might be reviewed less frequently. Your policy documents will specify the review schedule.

What factors influence the difference in premiums between two similar policies?

Differences can stem from varying risk assessments by different insurers, different coverage levels, or even the specific details of your personal circumstances.