Insurance premiums: the price we pay for peace of mind. But what exactly are they, and how are these costs determined? This guide delves into the intricacies of insurance premiums, explaining their fundamental nature, the factors influencing their calculation, and how to navigate the complexities of choosing the right coverage. Understanding your premiums is key to securing the right level of protection without unnecessary expense.

We will explore the various components that contribute to the final premium amount, from risk assessment and administrative costs to profit margins and the impact of your claims history. We’ll also examine how demographic factors, coverage levels, deductibles, and even lifestyle choices can significantly affect the cost of your insurance. Ultimately, the goal is to equip you with the knowledge to make informed decisions about your insurance needs.

Defining Insurance Premiums

Insurance premiums are essentially the price you pay for an insurance policy. Think of it as a monthly or annual fee for the protection an insurance company provides against potential financial losses. The more protection you want, and the higher the risk you represent to the insurer, the higher your premium will be.

Insurance premium calculation is a complex process, but it fundamentally boils down to assessing risk and establishing a price that covers the insurer’s expected payouts and administrative costs. Actuaries, specialists in assessing risk, utilize statistical models and historical data to predict the likelihood of claims and their potential costs. This involves analyzing a multitude of factors specific to the insured individual or property.

Factors Influencing Premium Costs

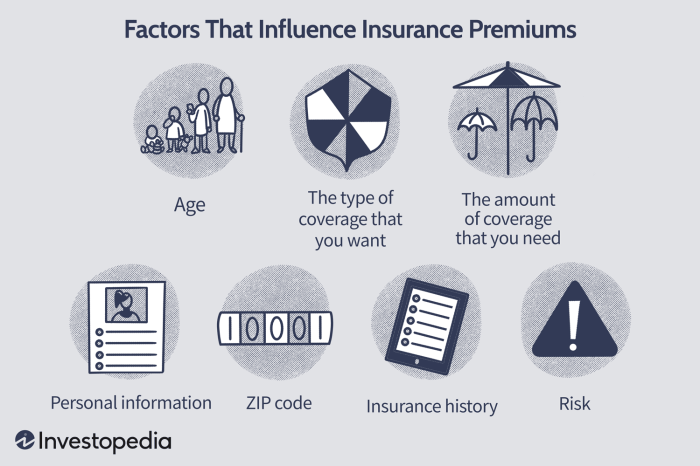

Several key factors significantly influence the cost of insurance premiums. These factors are carefully weighed by insurance companies to accurately assess the risk involved in covering a particular policyholder. A higher risk profile typically translates to a higher premium.

- Risk Assessment: This is the cornerstone of premium calculation. Factors considered include age, health history (for health insurance), driving record (for auto insurance), credit score, location (for home and auto insurance), and the value of the insured property or asset.

- Coverage Amount: The higher the coverage amount you choose, the higher your premium will be. This is because the insurance company is committing to pay out a larger sum in the event of a claim.

- Deductible: A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible usually results in a lower premium, as the insurer’s potential payout is reduced.

- Claim History: A history of filing insurance claims can lead to higher premiums, reflecting a perceived higher risk of future claims.

- Policy Type: Different types of insurance policies carry varying levels of risk and, consequently, different premium structures. For example, comprehensive auto insurance is generally more expensive than liability-only coverage.

Examples of Insurance Premiums and Their Variations

The cost of insurance premiums varies greatly depending on the type of insurance and the specific circumstances of the policyholder.

- Health Insurance: Premiums are heavily influenced by age, health status, location, and the chosen plan’s coverage level. A young, healthy individual in a low-cost area might pay significantly less than an older person with pre-existing conditions in a high-cost area. For example, a basic health plan might cost $200 per month, while a comprehensive plan could cost $800 or more.

- Auto Insurance: Premiums are affected by factors like driving history (accidents, tickets), age, vehicle type, location (urban areas often have higher rates), and coverage level. A young driver with a poor driving record in a large city will likely pay much more than an older driver with a clean record in a rural area. A premium might range from $50 to $200 or more per month.

- Home Insurance: Premiums depend on the value of the home, its location (risk of natural disasters, crime rates), the age and condition of the property, and the level of coverage. A large, expensive home in a high-risk area will have a higher premium than a smaller, less valuable home in a low-risk area. Monthly premiums could range from $50 to $200 or more.

Components of Insurance Premiums

Insurance premiums, the payments made to secure coverage, aren’t arbitrarily determined. They are carefully calculated based on several key factors that reflect the insurer’s risk and operational costs. Understanding these components provides a clearer picture of how your premium is structured.

Several factors contribute to the final premium amount. These elements are intricately linked, with changes in one area often impacting the others. A thorough understanding of these components is crucial for consumers to make informed decisions about their insurance choices.

Risk Assessment in Premium Calculation

Risk assessment is the cornerstone of premium determination. Insurers employ sophisticated models to evaluate the likelihood of a claim occurring for a specific policyholder. This involves analyzing various data points relevant to the insured risk. For example, in car insurance, factors like driving history (accidents, tickets), age, location (accident rates in the area), and the vehicle’s make and model are all considered. Higher-risk profiles translate to higher premiums, reflecting the increased probability of a claim. Similarly, in health insurance, pre-existing conditions and lifestyle choices (smoking, diet, exercise) play a significant role in risk assessment and premium calculation. The more likely an insurer is to pay out a claim, the higher the premium will be. Actuaries, specialists in risk assessment, use statistical methods and predictive modeling to determine the appropriate premium for different risk levels.

Premium Component Breakdown

The following table illustrates the key components that constitute an insurance premium across different insurance types. Note that the relative weighting of each component varies significantly depending on the specific insurance product and the insurer’s business model.

| Insurance Type | Risk Assessment Factor | Administrative Costs | Profit Margin | Claim History Influence |

|---|---|---|---|---|

| Auto Insurance | Driving record, vehicle type, location | Policy processing, claims handling | Target return on investment | Significant; higher claims lead to higher premiums |

| Homeowners Insurance | Location (risk of natural disasters, crime), home value, security features | Policy administration, claims adjustment | Profit target | Significant; past claims increase future premiums |

| Health Insurance | Age, health status, pre-existing conditions, lifestyle | Network management, claims processing | Profitability goals | Significant; high utilization leads to higher premiums (often through tiered plans) |

| Life Insurance | Age, health, lifestyle, occupation (risk level) | Underwriting, policy administration | Investment returns and profit margins | Not directly applicable; premiums are based on future mortality risk |

Premium Payment Methods and Schedules

Paying your insurance premiums is a crucial aspect of maintaining your coverage. Understanding the available payment methods and schedules allows you to choose the option that best suits your financial situation and preferences. This section Artikels the various ways you can pay your premiums and the implications of your chosen payment plan.

Choosing a suitable premium payment method and schedule involves balancing convenience with potential cost implications. Some methods might offer discounts for paying in full, while others provide greater flexibility but may incur additional fees. It’s vital to carefully review the options offered by your insurer to make an informed decision.

Premium Payment Methods

Several methods exist for paying insurance premiums, each with its own advantages and disadvantages. These options cater to diverse preferences and financial situations. The most common methods include: monthly installments, annual payments, electronic fund transfers, and payment via mail.

| Payment Method | Frequency | Advantages | Disadvantages |

|---|---|---|---|

| Monthly Installments | Monthly | Easier budgeting, smaller payments, greater flexibility | May involve higher overall cost due to potential interest charges or administrative fees. |

| Annual Payment | Annually | Often results in lower overall cost due to discounts offered for paying in full. | Requires a larger upfront payment, less flexibility for budgeting. |

| Electronic Funds Transfer (EFT) | Monthly or Annually | Convenient, automated payments, reduces risk of missed payments. | Requires bank account access and setup. |

| Monthly or Annually | Accessible to those without online banking or credit cards. | Slower processing time, higher risk of lost payments, requires postage. |

Consequences of Late or Missed Premium Payments

Failure to pay insurance premiums on time can lead to several serious consequences. These consequences vary depending on the insurer and the specific policy, but generally include:

* Cancellation of Coverage: This is the most significant consequence. Your policy may be terminated, leaving you without insurance protection. This can have severe financial implications, especially in the event of an accident or unforeseen event. For example, if you have auto insurance and fail to pay your premiums, your coverage will be terminated, leaving you liable for any accident costs.

* Late Payment Fees: Most insurers charge penalties for late payments, adding to your overall cost. These fees can vary widely, and some insurers might charge a percentage of the missed payment while others might have a fixed fee.

* Impact on Credit Score: Repeated late or missed payments can negatively affect your credit score, making it harder to obtain loans or credit in the future. This can have far-reaching consequences on your financial well-being.

* Reinstatement Difficulties: Reinstatement of coverage after cancellation can be difficult and may require a new application process, medical examinations (for health insurance), or higher premiums. This process often involves proving insurability once again.

Final Wrap-Up

In conclusion, understanding insurance premiums is crucial for responsible financial planning. By grasping the fundamental principles of premium calculation, the influence of various factors, and the available payment options, you can effectively manage your insurance costs and secure the appropriate coverage for your specific needs. Remember to compare premiums from different providers, carefully read policy details, and don’t hesitate to seek clarification from your insurer. Making informed choices about your insurance is an investment in your financial security and peace of mind.

Question & Answer Hub

What happens if I can’t afford my premium payment?

Contact your insurer immediately. They may offer payment plans, hardship programs, or other solutions to avoid policy cancellation.

Can I negotiate my insurance premium?

While direct negotiation is less common, you can often lower your premiums by increasing your deductible, bundling policies, or improving your risk profile (e.g., safe driving).

How often are insurance premiums reviewed?

This varies by insurer and policy type. Some policies have annual reviews, while others may adjust premiums less frequently, or only when significant changes occur (like a claim).

Does paying my premium annually save me money?

Often, yes, as many insurers offer discounts for annual payments to avoid administrative costs associated with monthly billing.