Navigating the world of health insurance can feel like deciphering a complex code, especially when it comes to understanding premiums. This seemingly simple term – the monthly payment for your health insurance coverage – actually encompasses a wide range of factors influencing its cost and ultimately, your financial responsibility for healthcare. This guide will demystify health insurance premiums, explaining what they are, what affects their cost, and how to best understand your own premium statement.

From the fundamental definition of a premium to the various types available and the crucial distinction between premiums and out-of-pocket costs, we will explore the intricacies of this essential aspect of healthcare financing. We will also delve into practical considerations, such as payment methods and addressing potential discrepancies on your premium statement. By the end, you will have a clearer understanding of how premiums work and how to make informed decisions about your health insurance coverage.

Definition of Health Insurance Premiums

Health insurance premiums are essentially the regular payments you make to your insurance company in exchange for the coverage they provide. Think of it like a membership fee – you pay consistently to access the benefits Artikeld in your insurance plan. This consistent payment ensures you have financial protection against unexpected medical costs.

The amount you pay for your health insurance premium depends on several factors, including your age, location, the type of plan you choose, and your health status. The more comprehensive the coverage, generally, the higher the premium. It’s a crucial aspect of the insurance contract, forming the basis of the agreement between you and your insurer.

Premium and Coverage Relationship

The relationship between premiums and health insurance coverage is directly proportional: higher premiums usually correspond to more extensive coverage. A plan with a low premium might have high deductibles and co-pays, meaning you’ll pay more out-of-pocket before the insurance company starts covering expenses. Conversely, a plan with a high premium often offers lower out-of-pocket costs and broader coverage for medical services. This means you’ll pay less when you need medical care, but your monthly payments will be higher. The key is to find a balance that aligns with your budget and healthcare needs. For example, a young, healthy individual might opt for a plan with a lower premium and higher deductible, while someone with pre-existing conditions might prioritize a plan with higher premiums and more comprehensive coverage to mitigate potential high medical expenses.

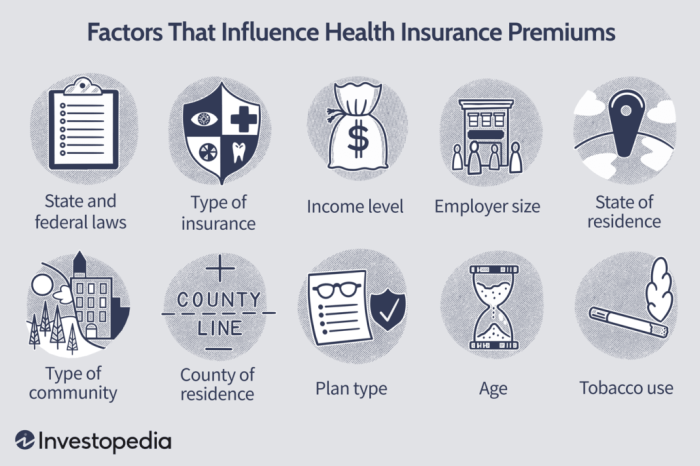

Factors Affecting Premium Costs

Several key factors interact to determine the cost of your health insurance premiums. Understanding these influences can help you make informed decisions about your coverage choices. These factors range from your personal characteristics to the type of plan you select.

Age

Age significantly impacts health insurance premiums. Older individuals generally pay more because they statistically have higher healthcare utilization rates. This is due to an increased likelihood of developing chronic conditions and requiring more frequent medical attention. For example, a 60-year-old might pay considerably more than a 30-year-old for the same plan, reflecting the higher expected healthcare costs associated with aging.

Location

Geographic location plays a crucial role in premium pricing. Areas with higher costs of living, a greater concentration of specialists, or a higher prevalence of certain diseases tend to have higher premiums. For instance, premiums in a major metropolitan area with a high concentration of specialized medical facilities will typically be higher than those in a rural area with fewer healthcare resources. This reflects the increased cost of healthcare services in those locations.

Health Status

An individual’s health status is a major determinant of premium costs. People with pre-existing conditions or a history of significant health issues typically pay higher premiums. Insurers assess risk based on this information, and those considered higher risk will contribute more to the overall cost pool. Someone with a history of heart disease, for example, would likely pay more than someone with a clean bill of health.

Insurance Plan Type

Different insurance plans offer varying levels of coverage and cost-sharing, directly impacting premiums. HMOs (Health Maintenance Organizations) generally have lower premiums than PPOs (Preferred Provider Organizations) because they often restrict access to care to a specific network of providers. PPOs, offering more flexibility in choosing doctors and hospitals, typically come with higher premiums to reflect this broader access. The trade-off is between cost and convenience.

Pre-existing Conditions

Pre-existing conditions, as mentioned, are a significant factor. The Affordable Care Act (ACA) in the United States prohibits insurers from denying coverage or charging higher premiums based solely on pre-existing conditions for most plans. However, the impact on premiums can still be indirect, as the overall risk pool influences pricing. Insurers consider the collective risk of their insured population, and the inclusion of individuals with pre-existing conditions can subtly affect overall premium levels.

Table Illustrating Premium Variations

| Factor | Low Cost Example | Medium Cost Example | High Cost Example |

|---|---|---|---|

| Age | 25 years old: $300/month | 40 years old: $450/month | 65 years old: $800/month |

| Location | Rural Area: $350/month | Suburban Area: $450/month | Major City: $600/month |

| Health Status | Excellent Health: $400/month | Minor Health Issues: $500/month | Significant Pre-existing Conditions: $700/month |

| Plan Type | HMO: $400/month | PPO: $550/month | High Deductible Plan: $300/month |

Types of Health Insurance Premiums

Health insurance premiums are not a one-size-fits-all cost. The price you pay depends significantly on the type of plan you choose, reflecting various factors like the scope of coverage, the number of people covered, and the insurer’s risk assessment. Understanding these different premium structures is crucial for making informed decisions about your health insurance.

Different premium structures impact affordability in several ways. A family plan, while covering multiple individuals, may be more expensive than several individual plans, but often offers better value per person. Conversely, a group plan offered through an employer might offer lower premiums due to economies of scale and risk pooling, but may offer less choice in plan options.

Individual Health Insurance Premiums

Individual health insurance premiums are paid by a single person to cover their own healthcare expenses. This offers flexibility in plan selection but often comes with a higher premium compared to group plans. The cost is solely based on the individual’s age, health status, location, and chosen plan. For example, a 30-year-old healthy individual in a low-cost area might pay a lower premium than a 60-year-old with pre-existing conditions in a high-cost area, even if they choose similar plans.

- Pros: Flexibility in plan choices, complete control over coverage details.

- Cons: Generally higher premiums than group plans, full financial responsibility for premiums.

Family Health Insurance Premiums

Family health insurance premiums cover multiple individuals within a defined family unit (typically spouse and children). While the total premium is higher than an individual plan, it often provides a cost-effective solution for families, especially those with multiple dependents. The cost calculation considers the age and health status of each family member, leading to variations even within the same family type. For instance, a family with young, healthy children might pay less than a family with older members requiring more frequent medical care.

- Pros: Cost-effective for families, comprehensive coverage for multiple individuals.

- Cons: Higher total premium than individual plans, coverage dependent on family definition Artikeld by the insurer.

Group Health Insurance Premiums

Group health insurance premiums are offered through employers or other organizations to their employees or members. These plans typically leverage the combined risk pool of the group to negotiate lower premiums for individual members. However, plan options might be more limited than individual plans. For example, a large company with thousands of employees might secure significantly lower premiums per employee than individuals purchasing plans independently. The employer usually contributes a portion of the premium, reducing the employee’s out-of-pocket cost.

- Pros: Often lower premiums than individual plans, employer contribution reduces cost.

- Cons: Less plan choice, coverage dependent on employer’s selection, premium changes can be tied to employment status.

Understanding Your Premium Statement

Your health insurance premium statement is a crucial document outlining the costs associated with your coverage. Understanding its components allows you to monitor your expenses, identify potential errors, and ensure you’re receiving the services you’re paying for. This section will guide you through deciphering your premium statement.

Components of a Health Insurance Premium Statement

A typical health insurance premium statement will include several key components. These components vary slightly depending on your insurance provider and plan, but the core elements remain consistent. Understanding these components is key to managing your health insurance costs effectively.

- Plan Name and ID: This clearly identifies your specific health insurance plan.

- Billing Period: This specifies the dates covered by the premium statement, usually a month.

- Premium Amount Due: This is the total amount you owe for the billing period.

- Payment Due Date: The date by which your payment must be received to avoid late fees.

- Payment Method: Shows how you are paying your premium (e.g., automatic payment, check).

- Breakdown of Premium Costs: This section details the different parts that make up your total premium. This might include the base premium, any additional charges for dependents, or surcharges based on your plan’s structure.

- Previous Balance (if applicable): This shows any outstanding amounts from previous billing cycles.

- Total Amount Due: This combines the current premium, any previous balances, and any applicable late fees.

- Contact Information: Details for contacting your insurance provider if you have questions or need assistance.

Interpreting a Sample Premium Statement

Let’s examine a hypothetical premium statement to illustrate how to interpret the information.

| Item | Amount |

|---|---|

| Plan Name: | Silver Value Plan |

| Billing Period: | October 1, 2024 – October 31, 2024 |

| Base Premium: | $300 |

| Dependent Coverage (1 child): | $100 |

| Total Premium: | $400 |

| Payment Due Date: | October 15, 2024 |

| Previous Balance: | $0 |

| Total Amount Due: | $400 |

In this example, the total premium of $400 is composed of a $300 base premium and a $100 charge for dependent coverage. The payment is due by October 15, 2024.

Addressing Discrepancies on Your Premium Statement

If you notice any discrepancies on your premium statement, follow these steps:

- Carefully review the statement: Check all amounts and dates to ensure accuracy. Compare it to previous statements to identify any changes.

- Contact your insurance provider: If you find an error, contact your insurance provider immediately using the contact information on the statement. Explain the discrepancy clearly and provide any relevant documentation.

- Keep records: Maintain copies of your premium statements, communications with your insurance provider, and any supporting documentation related to the discrepancy. This will help in resolving the issue quickly and efficiently.

- Understand your policy: Familiarize yourself with the terms and conditions of your health insurance policy. This will help you understand what charges are expected and which ones may be incorrect.

- Escalate if necessary: If you’re unable to resolve the discrepancy through initial contact, consider escalating the issue to a supervisor or filing a formal complaint.

Summary

Understanding health insurance premiums is a key step towards responsible healthcare planning. By grasping the factors that influence premium costs, recognizing the different types of premiums, and understanding the relationship between premiums and out-of-pocket expenses, you can make more informed choices about your coverage. Remember to carefully review your premium statement, utilize available payment options, and don’t hesitate to seek clarification from your insurance provider if needed. Empowering yourself with knowledge in this area ensures you are well-equipped to navigate the complexities of health insurance and protect your financial well-being.

Helpful Answers

What happens if I miss a premium payment?

Missing a premium payment can lead to your coverage being suspended or canceled. Late payment fees may also apply. Contact your insurer immediately if you anticipate difficulty making a payment to explore available options.

Can I change my health insurance plan and my premium amount?

Yes, you can usually change your health insurance plan during open enrollment periods or if you experience a qualifying life event (like marriage or job loss). Changing plans will likely result in a different premium amount.

How are premiums determined for families versus individuals?

Family premiums are generally higher than individual premiums because they cover multiple people. The exact cost depends on the insurer and the number of people covered.

What if I have a pre-existing condition? Will my premiums be higher?

In many countries, insurers cannot deny coverage or charge higher premiums solely based on pre-existing conditions due to the Affordable Care Act (or similar legislation). However, the specific details vary by location and policy.