Securing a loan often involves navigating the intricacies of credit life insurance. Understanding the factors that determine the cost of group credit life insurance premiums is crucial for both borrowers and lenders. This guide delves into the multifaceted nature of premium calculations, exploring the interplay of individual characteristics, insurer practices, economic conditions, and regulatory frameworks. We’ll unpack the complexities, providing a clear and concise understanding of this often-overlooked aspect of borrowing.

From the borrower’s age and loan amount to the insurer’s underwriting practices and prevailing economic factors, numerous variables contribute to the final premium. This exploration aims to demystify the process, empowering readers with the knowledge to make informed decisions about their financial protection.

Factors Influencing Group Credit Life Insurance Premiums

Group credit life insurance premiums are calculated based on several key factors, ensuring a fair and accurate reflection of the risk involved. Understanding these factors helps borrowers make informed decisions and allows lenders to manage their risk effectively. These factors interact in complex ways to determine the final premium.

Loan Amount and Premium Cost

The most straightforward relationship is between the loan amount and the premium. Generally, larger loan amounts result in higher premiums. This is because a larger death benefit is required to cover the outstanding debt in case of the borrower’s death. The premium is typically calculated as a percentage of the loan amount, although this percentage can vary based on other factors. For example, a $100,000 loan will generally have a higher premium than a $20,000 loan, all other factors being equal.

Borrower’s Age and Premium Calculation

Age is a significant factor in premium determination. Older borrowers typically face higher premiums than younger borrowers. This is due to the increased probability of death at older ages, leading to a higher likelihood of a claim. Insurers use actuarial tables to assess the risk associated with different age groups, translating this risk into premium costs. A 30-year-old borrower will generally pay less than a 50-year-old borrower for the same loan amount.

Premium Rates for Different Loan Terms

The length of the loan term also influences premium costs. Longer loan terms generally result in higher overall premiums, even though the monthly payments might be lower. This is because the insurance coverage is in effect for a longer period, increasing the insurer’s exposure to risk. A 15-year loan will likely have a higher total premium than a 5-year loan, even if the loan amount remains the same.

Borrower’s Health and Premium Determination

While group credit life insurance typically doesn’t require individual medical underwriting, certain health conditions could, in some cases, influence the overall pricing for the entire group. If a group demonstrates a significantly higher-than-average risk profile based on aggregated health data (though not individual health assessments), insurers may adjust premiums accordingly. This is less common than the other factors discussed but can impact the overall cost for all members of the group.

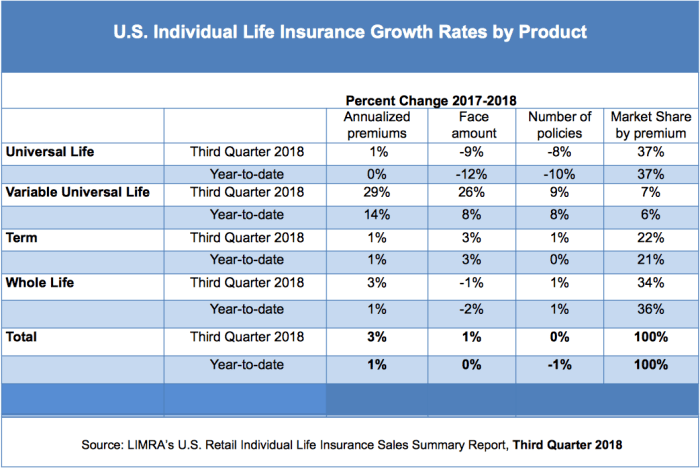

Premium Comparison Table

The following table illustrates how premiums can vary based on age and loan amount. Note that these are illustrative examples and actual premiums will vary depending on the specific insurer, loan terms, and other factors.

| Age | Loan Amount: $20,000 | Loan Amount: $50,000 | Loan Amount: $100,000 |

|---|---|---|---|

| 30 | $100 | $250 | $500 |

| 40 | $150 | $375 | $750 |

| 50 | $250 | $625 | $1250 |

The Role of the Insurer in Premium Setting

Insurers play a pivotal role in determining group credit life insurance premiums. Their practices, profitability, and employed methodologies significantly influence the final cost for borrowers. Understanding the insurer’s perspective is crucial for both lenders and borrowers to comprehend the pricing dynamics of this type of insurance.

Insurer Underwriting Practices and Profitability Influence on Premium Structures

Underwriting Practices Employed by Insurers

Different insurers utilize varying underwriting practices to assess risk. Some may rely heavily on credit scores and borrower demographics, while others might incorporate more nuanced assessments, such as medical history (where permissible) or employment stability. For example, a more conservative insurer might apply stricter underwriting guidelines, resulting in higher premiums for higher-risk borrowers. Conversely, a more lenient insurer might accept a broader range of applicants, potentially leading to lower premiums but a higher risk profile for their portfolio. This difference in risk appetite directly impacts premium setting. The level of automation in the underwriting process also influences efficiency and, consequently, the cost of insurance.

Impact of Insurer Profitability on Premium Structures

An insurer’s profitability significantly influences its premium structure. If an insurer experiences substantial losses, it will likely adjust premiums upward to improve its financial position. Conversely, a highly profitable insurer might have more flexibility to offer competitive premiums, potentially attracting more business. For instance, if an insurer experiences a high claim payout rate due to unforeseen circumstances (like a pandemic impacting mortality rates), they may need to raise premiums across the board to offset these losses and maintain solvency. Conversely, a period of low claim payouts could allow an insurer to offer lower premiums or increase profit margins.

Key Financial Metrics Used to Determine Premiums

Insurers rely on several key financial metrics to determine premiums. These metrics are used to model the expected cost of claims and administrative expenses. Crucial metrics include mortality rates (the probability of death within a specific time frame), lapse rates (the rate at which policies are cancelled), claim payout ratios (the ratio of claims paid to premiums received), and administrative expenses. These metrics, often combined with statistical modeling and actuarial analysis, are used to calculate the expected cost of providing coverage. A higher mortality rate, for example, would necessitate higher premiums to cover the increased expected claims.

Comparison of Premium Setting Methodologies

While specific methodologies are proprietary, a general comparison can be made. Insurer A might employ a more sophisticated actuarial model incorporating numerous risk factors, leading to a more granular pricing structure with varying premiums based on individual borrower profiles. Insurer B, on the other hand, might use a simpler, more generalized model, leading to a more uniform premium structure across all borrowers, regardless of risk level. This difference in approach directly reflects the insurer’s risk management strategy and ultimately affects the final premium charged. The choice between these approaches also depends on the insurer’s technological capabilities and the scale of its operations.

Factors Considered Beyond Borrower Risk

Beyond borrower risk, several other factors influence an insurer’s premium setting.

- Operational Costs: These include salaries, technology, and administrative expenses.

- Regulatory Requirements: Compliance with state and federal regulations adds to the cost of doing business.

- Reinsurance Costs: The cost of transferring some risk to a reinsurer impacts premiums.

- Profit Margins: Insurers need to generate profit to remain viable.

- Competition: Market competition can influence the pricing strategies of insurers.

- Economic Conditions: Broad economic factors can impact claim payouts and underwriting practices.

Impact of Economic Factors on Premiums

Group credit life insurance premiums, while fundamentally driven by risk assessment, are significantly influenced by broader economic conditions. Fluctuations in interest rates, inflation, economic cycles, and mortality rates all contribute to the adjustments insurers make in their pricing strategies. Understanding these influences is crucial for both insurers and borrowers.

Prevailing Interest Rates Influence Premium Calculations

Interest rates play a vital role in determining the profitability of an insurer’s investment portfolio. Lower interest rates reduce the returns insurers earn on their investments, impacting their ability to offset the cost of claims. Consequently, insurers may need to increase premiums to maintain profitability in a low-interest-rate environment. Conversely, higher interest rates allow insurers to generate greater investment income, potentially leading to lower premiums or increased profit margins. For example, a period of persistently low interest rates, like those seen in the aftermath of the 2008 financial crisis, often results in upward pressure on insurance premiums across various lines, including group credit life.

Inflation’s Effect on Group Credit Life Insurance Costs

Inflation erodes the purchasing power of money. As the cost of goods and services rises, the cost of providing insurance benefits also increases. Insurers must adjust premiums to account for this inflation to ensure they can adequately cover future claims. For instance, if inflation rises significantly, the cost of administering claims and paying out death benefits will also increase, necessitating higher premiums to compensate. This is particularly relevant for long-term policies, where the impact of inflation over time can be substantial.

Economic Downturns and Their Impact on the Insurance Market and Premiums

Economic downturns often lead to increased claim rates in group credit life insurance. During recessions, borrowers may face financial hardship, resulting in higher default rates on loans and, consequently, more claims. This increased risk necessitates adjustments to premiums to ensure the insurer’s solvency. The 2008 financial crisis, for example, saw a significant increase in defaults on mortgages and other loans, leading many insurers to re-evaluate their risk profiles and adjust their pricing strategies to account for this increased risk. Furthermore, economic downturns can lead to reduced consumer spending, potentially impacting the insurer’s investment income, adding to the pressure to raise premiums.

Changes in Mortality Rates Affect Premium Adjustments

Mortality rates are a fundamental factor in life insurance pricing. Improvements in healthcare and overall public health can lead to lower mortality rates, allowing insurers to potentially reduce premiums. Conversely, unexpected increases in mortality rates, such as those seen during pandemics, require insurers to reassess their risk and may necessitate premium increases to maintain sufficient reserves to cover increased claims. Accurate mortality rate projections are crucial for accurate premium setting. Insurers use actuarial models and demographic data to forecast mortality rates and incorporate these projections into their premium calculations.

Economic Conditions and Premium Fluctuations: A Descriptive Illustration

Imagine a simplified scenario: An insurer offers group credit life insurance. In a period of strong economic growth (high interest rates, low inflation, low unemployment), the insurer experiences high investment returns and low claim rates. This allows them to offer competitive premiums, attracting more customers. However, when a recession hits (low interest rates, high inflation, high unemployment), the insurer faces reduced investment returns, increased claim rates due to higher loan defaults, and potentially higher administrative costs due to increased claim processing. To maintain profitability and solvency, the insurer must adjust its premiums upwards, reflecting the increased risk and reduced investment income associated with the economic downturn. The subsequent economic recovery, characterized by improving interest rates and decreasing claim rates, would then allow for potential premium reductions, illustrating the dynamic relationship between economic conditions and premium fluctuations.

Ultimate Conclusion

In conclusion, determining premiums for group credit life insurance is a complex process involving a delicate balance of individual risk assessment, insurer profitability, economic fluctuations, and regulatory oversight. By understanding the interplay of these factors—from loan size and borrower age to prevailing interest rates and insurer underwriting practices—borrowers can gain a clearer picture of the cost of this crucial financial protection. This comprehensive analysis underscores the importance of careful consideration and informed decision-making when evaluating group credit life insurance options.

FAQs

What happens if I pay off my loan early?

The insurance coverage typically ends when the loan is paid off, and any remaining premiums are usually refunded or adjusted.

Can I get group credit life insurance if I have pre-existing health conditions?

Generally, group credit life insurance doesn’t require extensive medical underwriting, making it accessible even with pre-existing conditions. However, severe health issues might influence eligibility in some cases.

Is group credit life insurance mandatory?

It depends on the lender. Some lenders require it as a condition of loan approval, while others offer it as an optional add-on.

How do I compare group credit life insurance quotes from different lenders?

Pay close attention to the premium amounts, coverage details, and any additional fees. Carefully read the policy documents to understand the terms and conditions.