Securing a mortgage is a significant financial step, often involving more than just the principal loan amount. Understanding mortgage insurance premiums (MIPs) is crucial for navigating this process effectively. These premiums, essentially insurance policies protecting lenders against potential losses if a borrower defaults, can significantly impact your overall homeownership costs. This guide unravels the complexities of MIPs, offering clarity on their purpose, calculation, and implications for your financial future.

We’ll explore the various types of mortgage insurance, who needs it, how premiums are calculated, and the methods for payment and potential cancellation. By understanding the nuances of MIPs, you can make informed decisions, minimizing unexpected costs and maximizing your chances of successful homeownership.

What are Mortgage Insurance Premiums?

Mortgage insurance premiums (MIPs) are essentially insurance payments made by borrowers to protect lenders against potential losses if the borrower defaults on their mortgage loan. They’re a crucial part of the mortgage process, especially for borrowers who put down less than 20% of the home’s purchase price. These premiums help mitigate the risk for the lender, ensuring they can recoup their investment even if the homeowner fails to make their payments.

Purpose of Mortgage Insurance Premiums

The primary purpose of MIPs is to protect lenders from financial losses arising from mortgage defaults. When a borrower defaults, the lender can file a claim with the mortgage insurer, who then steps in to cover a portion or all of the remaining loan balance. This safeguards the lender’s financial stability and allows them to continue lending. This protection encourages lenders to offer mortgages to a wider range of borrowers, including those with lower down payments.

Types of Mortgage Insurance

There are two primary types of mortgage insurance: Private Mortgage Insurance (PMI) and Federal Housing Administration (FHA) insurance. PMI is typically required for conventional loans (loans not backed by government agencies) where the down payment is less than 20%. FHA insurance, on the other hand, is required for loans insured by the FHA, even with a lower down payment. Both serve the same fundamental purpose – protecting the lender – but differ in their administration and premium structures. A third type, VA-insured loans, does not require mortgage insurance premiums in the traditional sense, but has a funding fee.

Situations Requiring Mortgage Insurance

Mortgage insurance is most commonly required when a borrower makes a down payment of less than 20% of the home’s purchase price. This is because a smaller down payment represents a higher risk for the lender. However, there are other scenarios where mortgage insurance might be necessary. For instance, even with a down payment exceeding 20%, some lenders may still require it based on the borrower’s credit score or other financial factors. Similarly, loans insured by the FHA or other government agencies always require specific types of mortgage insurance.

Comparison of Mortgage Insurance Premiums Across Different Lenders

Comparing MIPs across different lenders can be complex, as premiums vary based on several factors including the loan amount, the borrower’s credit score, the type of mortgage insurance, and the loan-to-value ratio (LTV). Generally, borrowers with higher credit scores and larger down payments will pay lower premiums. It’s essential to obtain quotes from multiple lenders to compare the total cost of the mortgage, including the MIPs, before making a decision. While a precise comparison requires individual loan quotes, it’s generally understood that the rates can fluctuate between lenders, sometimes by a significant margin, highlighting the importance of shopping around. For example, Lender A might offer a slightly higher interest rate but a lower MIP, while Lender B offers a lower interest rate but a higher MIP. The best option depends on the individual borrower’s circumstances and financial priorities.

Who Needs Mortgage Insurance?

Mortgage insurance protects lenders against losses if a borrower defaults on their mortgage loan. It’s a crucial component of the mortgage process, impacting both the borrower’s eligibility and the overall cost of borrowing. Understanding who needs it and why is essential for prospective homebuyers.

Mortgage insurance is typically required when a borrower makes a down payment that is less than 20% of the home’s purchase price. This is because a smaller down payment increases the lender’s risk. The loan-to-value ratio (LTV), calculated by dividing the loan amount by the home’s appraised value, directly determines the need for mortgage insurance. A higher LTV ratio indicates a greater risk for the lender, necessitating mortgage insurance to mitigate potential losses.

Loan-to-Value Ratio and Mortgage Insurance

The loan-to-value (LTV) ratio is the key factor determining whether mortgage insurance is required. Lenders use this ratio to assess the risk associated with a mortgage loan. A lower LTV ratio (meaning a larger down payment) signifies less risk, while a higher LTV ratio (smaller down payment) indicates greater risk. This risk is transferred to the mortgage insurance provider, protecting the lender. For example, a borrower with a 10% down payment (90% LTV) will likely need mortgage insurance, whereas a borrower with a 20% down payment (80% LTV) may not.

Scenarios Where Mortgage Insurance Might Be Optional

While a 20% down payment generally eliminates the requirement for mortgage insurance, there are exceptions. Some lenders might offer loans with reduced or no mortgage insurance requirements even with less than a 20% down payment, particularly for borrowers with excellent credit scores and stable financial histories. Government-backed loans, such as FHA loans, often have their own mortgage insurance requirements that differ from conventional loans. These requirements can be less stringent in some cases, depending on the specific program. Additionally, some lenders may offer private mortgage insurance (PMI) options with lower premiums for borrowers who meet specific criteria.

LTV Ratios and Mortgage Insurance Requirements

| Loan-to-Value Ratio (LTV) | Mortgage Insurance Requirement (Conventional Loan) | Potential Exceptions | Example Down Payment on a $300,000 Home |

|---|---|---|---|

| 80% or less | Typically not required | May vary by lender | $60,000 or more |

| 80.01% – 90% | Typically required | Possible with excellent credit and certain lender programs | $30,000 – $59,999 |

| 90.01% – 95% | Typically required, higher premiums | Less common; very strong credit and financial history needed | $15,000 – $29,999 |

| 95% or more | Almost always required, significantly higher premiums | Highly unlikely without government assistance programs | Less than $15,000 |

Cancelling Mortgage Insurance

Cancelling mortgage insurance is a significant financial event that can lead to considerable savings. However, the ability to cancel depends entirely on your specific mortgage and the terms agreed upon with your lender. Understanding the conditions and process is crucial for homeowners seeking to eliminate this ongoing expense.

Mortgage insurance cancellation is typically contingent upon reaching a certain loan-to-value (LTV) ratio. This ratio compares the amount you owe on your mortgage to the current market value of your home. Once your equity (the difference between your home’s value and your mortgage balance) reaches a predetermined threshold, usually 20%, the lender may allow you to cancel the insurance. This threshold can vary depending on the type of mortgage insurance and the lender’s policies. The process itself involves submitting a formal request to your lender, providing documentation proving your home’s current market value (usually through a recent appraisal), and ensuring your mortgage is current and in good standing. Failure to meet any of these conditions may delay or prevent cancellation.

Conditions for Cancelling Mortgage Insurance

The primary condition for cancelling mortgage insurance is achieving a sufficiently low loan-to-value (LTV) ratio. This usually means building up enough equity in your home so that the outstanding mortgage balance is 80% or less of the home’s appraised value. Other conditions may include maintaining a consistent history of on-time mortgage payments, having no late payments or defaults on the mortgage account, and providing proof of your home’s current market value via a professional appraisal. The lender will specify their exact requirements.

Process for Cancelling Mortgage Insurance

The process generally involves these steps: First, you need to request cancellation in writing to your mortgage lender. Next, you’ll need to provide documentation such as a recent appraisal to prove your home’s current market value. Then, the lender will review your request and documentation to verify that you meet all the necessary conditions for cancellation. Finally, upon approval, the lender will remove the mortgage insurance from your monthly payments. This often involves a formal amendment to your mortgage agreement. Note that the process can take several weeks or even months to complete, depending on the lender’s processing times and the volume of requests they handle.

Examples of Situations Where Cancellation is Possible

Several scenarios could allow for mortgage insurance cancellation. For example, if a homeowner has consistently made on-time payments for several years and their home has appreciated significantly in value, increasing their equity, they may qualify for cancellation. Another example is if a homeowner makes a substantial principal payment on their mortgage, reducing their loan balance and lowering their LTV ratio. Finally, a refinance to a lower loan amount could also lead to an LTV ratio below the cancellation threshold. It is important to remember that these scenarios are dependent on specific lender requirements and the current market conditions.

The Impact of Mortgage Insurance on Homeownership

Mortgage insurance, while often a necessary hurdle for securing a home loan, significantly impacts the overall cost and long-term financial picture of homeownership. Understanding its advantages and disadvantages is crucial for making informed decisions about financing your property. This section will explore the long-term financial implications of mortgage insurance, comparing the overall cost of homeownership with and without it, and illustrating these impacts with a realistic scenario.

Advantages and Disadvantages of Mortgage Insurance

Mortgage insurance primarily benefits lenders by mitigating their risk in the event of a borrower’s default. However, it also offers some advantages to borrowers, particularly those with lower down payments. Conversely, the premiums represent a significant added expense.

- Advantage: Easier Homeownership Access: Mortgage insurance allows borrowers with less than 20% down payment to qualify for a mortgage, opening the door to homeownership for a broader range of individuals.

- Advantage: Lower Interest Rates (Potentially): In some cases, lenders may offer slightly lower interest rates to borrowers who opt for mortgage insurance, offsetting some of the premium costs.

- Disadvantage: Added Monthly Expense: Mortgage insurance premiums are an ongoing cost, adding to the monthly mortgage payment and increasing the overall cost of homeownership.

- Disadvantage: Potential for Wasted Money: If a borrower pays off their mortgage without ever defaulting, the premiums paid are essentially a sunk cost.

Long-Term Financial Implications of Mortgage Insurance

The long-term financial impact of mortgage insurance depends heavily on the loan term, interest rate, premium amounts, and the borrower’s ability to maintain consistent payments. The cumulative cost of premiums over the life of a loan can be substantial. It’s essential to consider this added expense when budgeting for homeownership. For example, a $300,000 mortgage with a 10% down payment might require mortgage insurance premiums of $100-$200 per month, adding thousands of dollars to the total cost over a 30-year period. This increases the overall cost of the home significantly.

Comparison of Homeownership Costs With and Without Mortgage Insurance

A direct comparison highlights the financial differences. Consider two identical mortgages, one with and one without mortgage insurance. The mortgage without insurance requires a 20% down payment, while the one with insurance requires only 10%. The initial investment is lower with the mortgage requiring insurance, but the monthly payments will be higher due to the added premiums. Over the life of the loan, the total cost (including principal, interest, and insurance premiums) will likely be significantly higher for the mortgage with insurance.

Illustrative Scenario: The Long-Term Financial Impact

Let’s consider Sarah and John. They are purchasing a $300,000 home. Sarah and John secure a 30-year fixed-rate mortgage with a 10% down payment ($30,000). They are required to pay for mortgage insurance, adding approximately $150 per month to their mortgage payment. Over 30 years, this adds up to approximately $54,000 in premiums. If they had saved enough for a 20% down payment ($60,000), they would have avoided this additional expense, reducing their overall cost of homeownership by a substantial amount. This scenario clearly demonstrates how mortgage insurance, while facilitating homeownership, can lead to significantly higher long-term costs.

Understanding Mortgage Insurance Policies

Mortgage insurance policies are contracts designed to protect lenders against financial losses if a borrower defaults on their mortgage loan. These policies function as a safety net, ensuring the lender can recoup their investment even if the property value falls below the outstanding loan amount. Understanding the specifics of these policies is crucial for borrowers to make informed decisions.

A typical mortgage insurance policy Artikels the terms and conditions under which the insurer will compensate the lender in the event of a default. It details the coverage amount, the duration of coverage, the premiums payable, and the circumstances under which the policy may be cancelled or terminated. The policy will also specify the procedures for filing a claim and the process for resolving disputes.

Key Clauses and Terms in a Standard Mortgage Insurance Policy

Standard mortgage insurance policies include several key clauses and terms. These typically involve definitions of default (e.g., missed payments exceeding a specified threshold), the process for claim submission, the insurer’s right to pursue recovery from the borrower, and provisions for policy cancellation. Specific clauses will vary depending on the insurer and the type of policy. For example, some policies may include clauses relating to the borrower’s responsibility to maintain the property’s condition, while others may address specific events like natural disasters. Careful review of the policy document is crucial to understanding these specific details.

Comparison of Different Mortgage Insurance Policy Options

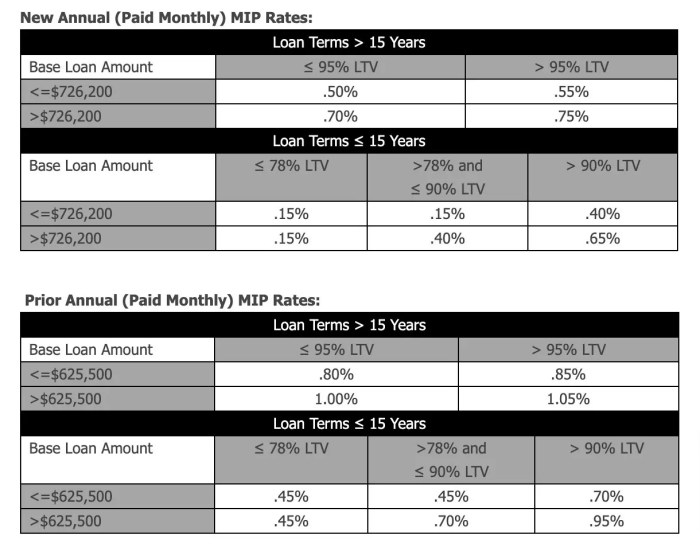

Borrowers may encounter several types of mortgage insurance, each with varying premiums and coverage. For example, Private Mortgage Insurance (PMI) is commonly used for conventional loans with down payments below 20%, while Mortgage Insurance Premiums (MIP) are required for Federal Housing Administration (FHA) loans. PMI is typically cancelled once the borrower reaches a certain level of equity (usually 20%), while MIP may remain in place for the entire loan term, depending on the loan type and terms. The cost of these policies differs significantly based on factors such as the borrower’s credit score, the loan-to-value ratio (LTV), and the type of loan. A borrower with a higher credit score and a lower LTV will typically pay lower premiums.

Frequently Asked Questions Regarding Mortgage Insurance Policies

Understanding the answers to common questions is vital for navigating the mortgage insurance landscape.

This section addresses common concerns:

- How are mortgage insurance premiums calculated? Premiums are typically calculated based on several factors, including the loan amount, the borrower’s credit score, the loan-to-value ratio (LTV), and the type of mortgage insurance policy. The higher the risk, the higher the premium.

- When can I cancel my mortgage insurance? For PMI, cancellation typically occurs once the borrower reaches 20% equity in the home. For MIP, cancellation depends on the specific FHA loan program and may not be possible until the loan is paid off.

- What happens if I default on my mortgage and my lender makes a claim? If a default occurs, the lender will file a claim with the mortgage insurer. The insurer will then assess the situation, potentially covering the lender’s losses. The borrower may still be liable for any remaining debt after the insurer’s payment.

- Are there any tax implications associated with mortgage insurance premiums? In some cases, mortgage insurance premiums may be tax-deductible, depending on individual circumstances and tax laws. Consult a tax professional for personalized advice.

Ultimate Conclusion

Navigating the world of mortgage insurance premiums requires careful consideration of several factors. From understanding your loan-to-value ratio and the different types of insurance available to exploring payment options and cancellation possibilities, a thorough understanding of MIPs is paramount for responsible homeownership. By weighing the advantages and disadvantages, and proactively managing your premiums, you can confidently embark on your homeownership journey with a clear understanding of the financial landscape.

FAQ Section

What happens if I pay off my mortgage early? Does that affect my MIP?

Paying off your mortgage early might impact your MIP depending on the type of insurance and your lender’s policies. Some policies allow for a refund of a portion of the upfront premium, while others may not offer any refund. It’s crucial to check your specific policy details.

Can I refinance to get rid of my mortgage insurance?

Refinancing your mortgage can be a way to eliminate MIP if you achieve a lower loan-to-value ratio (LTV) through increased equity. However, this depends on your lender and the terms of your new loan. Consult with a mortgage professional to assess your options.

Is mortgage insurance tax deductible?

The deductibility of mortgage insurance premiums varies depending on your specific circumstances and tax laws. In some cases, portions of the premiums might be deductible, but it’s best to consult a tax advisor for personalized guidance.

What are the differences between PMI and MIP?

PMI (Private Mortgage Insurance) is typically required for conventional loans with a down payment below 20%, while MIP (Mortgage Insurance Premium) is required for FHA-insured loans. The key difference lies in the insurer: private companies for PMI and the government (through the FHA) for MIP. Both protect lenders from losses due to default.