Navigating the world of healthcare can feel like deciphering a complex code, and understanding medical insurance premiums is often the first hurdle. These premiums, essentially the monthly payments for your health insurance coverage, are influenced by a multitude of factors, from your age and health history to the type of plan you choose and even where you live. This guide will unravel the mysteries surrounding medical insurance premiums, empowering you to make informed decisions about your healthcare finances.

Understanding your premiums is crucial for budgeting and ensuring you have the appropriate level of coverage. This guide will break down the components of premiums, explore the factors influencing their cost, and offer strategies for managing expenses. We’ll examine different insurance plan types, interpret premium statements, and provide practical tips for finding affordable yet comprehensive health insurance.

Defining Medical Insurance Premiums

Medical insurance premiums are essentially the recurring payments you make to your insurance company in exchange for coverage of healthcare costs. Think of it as a monthly fee for a safety net – a financial buffer against unexpected medical expenses. The more comprehensive the coverage, and the lower your out-of-pocket costs, the higher your premium will typically be.

Components of Medical Insurance Premiums

Several factors contribute to the final cost of your medical insurance premium. Understanding these components helps you make informed decisions when choosing a plan. These factors are often intertwined and difficult to isolate completely, but a general breakdown provides a useful framework.

Factors Influencing Premium Costs

Several factors influence the cost of your medical insurance premium. These factors often interact in complex ways, but understanding them can help you choose a plan that fits your needs and budget. For example, a younger, healthier individual will generally pay less than an older person with pre-existing conditions.

| Factor | Impact on Premium | Example |

|---|---|---|

| Age | Generally increases with age | A 60-year-old will typically pay more than a 30-year-old. |

| Location | Varies based on geographic location and healthcare costs in that area | Premiums in a high-cost area like New York City will likely be higher than in a rural area. |

| Health Status | Pre-existing conditions can significantly increase premiums | Someone with diabetes may pay more than someone without any health issues. |

| Plan Type | Different plans offer different levels of coverage and cost | A high-deductible plan will generally have a lower premium than a low-deductible plan. |

Comparison of Premiums Across Different Insurance Plans

The following table provides a simplified comparison of monthly premiums for different types of health insurance plans. Note that these are illustrative examples and actual premiums vary significantly based on location, age, health status, and the specific insurer.

| Plan Type | Monthly Premium (Example) | Deductible (Example) | Out-of-Pocket Maximum (Example) |

|---|---|---|---|

| Bronze Plan | $200 | $7,000 | $7,900 |

| Silver Plan | $350 | $4,000 | $7,900 |

| Gold Plan | $500 | $2,000 | $7,900 |

| Platinum Plan | $700 | $1,000 | $7,900 |

Factors Affecting Premium Costs

Several key factors influence the cost of medical insurance premiums. Understanding these factors can help individuals make informed decisions about their health insurance coverage and budget accordingly. These factors interact in complex ways, and the relative importance of each can vary depending on the specific insurance plan and the individual’s circumstances.

Age and Premium Amounts

Age is a significant determinant of premium costs. Generally, premiums increase with age. This is because older individuals statistically have a higher likelihood of requiring more extensive medical care, leading to higher claims costs for the insurance provider. Younger, healthier individuals tend to have lower premiums because they represent a lower risk to the insurance company. This age-related increase is a common practice across most insurance markets, reflecting actuarial assessments of risk.

Health History’s Impact on Premiums

An individual’s health history plays a crucial role in premium calculations. Pre-existing conditions, such as diabetes, heart disease, or cancer, can significantly increase premium costs. Insurance companies assess the potential risk associated with these conditions, factoring in the likelihood of future medical expenses. Individuals with a history of significant medical issues may face higher premiums to compensate for the increased risk the insurer assumes. Conversely, individuals with a clean bill of health and a history of preventative care may qualify for lower premiums.

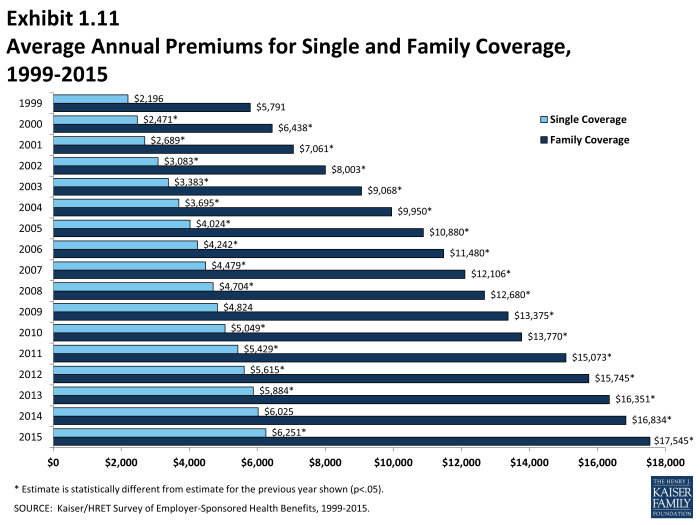

Individual vs. Family Plan Premiums

Family plans typically cost more than individual plans. This is because family plans cover multiple individuals, increasing the potential for claims. While the cost per person may be lower in a family plan compared to separate individual plans, the overall premium is higher due to the increased number of covered individuals and the potential for more extensive medical needs within a family unit. The exact difference will vary depending on the insurer, the plan specifics, and the number of people covered.

Location, Occupation, and Lifestyle Choices

Several other factors influence premium costs. Geographic location affects premiums due to variations in healthcare costs and provider availability. Areas with higher healthcare costs generally result in higher premiums. Occupation also plays a role; some occupations carry higher risk of injury or illness, leading to increased premiums. Finally, lifestyle choices significantly impact premiums. For instance, smokers often pay higher premiums due to increased risks of respiratory illnesses and other health problems.

Lifestyle Choices and Their Effect on Premiums

Lifestyle choices significantly influence the cost of health insurance premiums. Insurers consider these factors because they are strong indicators of long-term health risks.

- Smoking: Smokers typically pay significantly higher premiums due to increased risks of lung cancer, heart disease, and other smoking-related illnesses.

- Obesity: Individuals with a high body mass index (BMI) often face higher premiums because obesity is linked to various health problems, such as diabetes and heart disease.

- Diet and Exercise: A healthy diet and regular exercise can lead to lower premiums. These habits reduce the risk of developing chronic diseases.

- Substance Abuse: Substance abuse (alcohol or drug use) significantly increases the risk of health complications and, consequently, higher premiums.

- Driving Record: While not directly related to health, a poor driving record might reflect higher risk-taking behavior, potentially influencing premium calculations in some cases.

Types of Medical Insurance Plans and Their Premiums

Understanding the different types of medical insurance plans is crucial for making informed decisions about your healthcare coverage. The cost of premiums varies significantly depending on the type of plan you choose, as well as factors like your age, location, and health status. This section will explore the common plan types, their features, and associated premium ranges to help you navigate this complex landscape.

Choosing the right plan involves balancing the cost of premiums with the level of coverage offered. Higher premiums often mean lower out-of-pocket costs, while lower premiums might require you to pay more when you need care. It’s essential to consider your individual needs and healthcare utilization patterns when making your selection.

HMO, PPO, and EPO Plans: Premium Cost Variations

Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs) represent the most common types of medical insurance plans. Each offers a different balance between cost and flexibility. Generally, HMOs tend to have the lowest premiums, followed by EPOs, with PPOs typically having the highest premiums. This difference reflects the varying levels of access and flexibility offered by each plan type.

Premium Costs and Coverage Levels Compared

The premium cost reflects the level of coverage and the structure of the plan. For example, HMOs usually require you to choose a primary care physician (PCP) within the network who then refers you to specialists. This gatekeeping system helps control costs, resulting in lower premiums. However, seeing out-of-network providers generally isn’t covered. PPOs, on the other hand, offer greater flexibility, allowing you to see any doctor, in-network or out-of-network, although out-of-network care usually comes with significantly higher costs. EPOs fall somewhere in between, offering a wider network than HMOs but less flexibility than PPOs. They typically don’t cover out-of-network care at all.

Medical Insurance Plan Comparison

| Plan Type | Features | Premium Range (Example) | Suitability |

|---|---|---|---|

| HMO | Lower premiums, requires PCP referral, limited out-of-network coverage | $300 – $600 per month | Best for healthy individuals who prefer lower premiums and don’t mind limited provider choices. |

| PPO | Higher premiums, greater flexibility, in-network and out-of-network coverage (with higher cost-sharing for out-of-network) | $600 – $1200 per month | Suitable for individuals who value flexibility and prefer to choose their doctors without restrictions, even if it means higher premiums. |

| EPO | Moderate premiums, wider network than HMO but no out-of-network coverage | $400 – $800 per month | A good compromise between cost and flexibility for individuals who want a wider network than an HMO but don’t need the complete freedom of a PPO. |

Note: The premium ranges provided are examples only and will vary widely based on factors such as age, location, the specific insurance company, and the chosen plan details.

Examples of Plan Suitability

Consider a young, healthy individual with limited healthcare needs. An HMO might be the most cost-effective option, as the lower premiums outweigh the limitations on provider choice. Conversely, a family with a history of complex health conditions and a preference for specific specialists might find a PPO more suitable, despite the higher premiums, to ensure access to the necessary care. An individual who values a broader network than an HMO but doesn’t want to pay the high premiums of a PPO might find an EPO a good fit. These are just examples; the ideal plan depends on individual circumstances.

Understanding Your Premium Statement

Your medical insurance premium statement is a crucial document that details the costs associated with your health insurance coverage. Understanding its components allows you to accurately track your expenses and ensure you are receiving the services you’re paying for. This section will guide you through deciphering the information presented on a typical statement.

Premium Statement Sections

A standard medical insurance premium statement typically includes several key sections. These sections provide a comprehensive overview of your coverage costs, payment history, and outstanding balances. Familiarizing yourself with these sections will enable you to effectively manage your health insurance finances.

Interpreting Premium Statement Information

Each section of your premium statement contains specific information that requires careful interpretation. For example, the “Premium Due” section clearly indicates the amount you owe for the current billing cycle. The “Payment History” section shows your past payments, allowing you to verify that your payments have been correctly processed and applied to your account. Understanding these details helps ensure accurate account management and prevents potential billing discrepancies.

Calculating Total Insurance Costs

Calculating the total cost of your insurance coverage involves adding up several components. This typically includes the monthly or annual premium, any co-pays or deductibles you’ve paid, and any outstanding balances. Consider, for example, a scenario where your monthly premium is $200, your deductible is $1000 (which you’ve already met), and you’ve had a $50 co-pay for a doctor’s visit. Your total cost for the year (assuming no other expenses) would be ($200/month * 12 months) + $1000 + $50 = $3,450. This calculation provides a clear picture of your overall healthcare expenses for the period.

Sample Premium Statement

Let’s examine a sample premium statement to illustrate these concepts.

| Section | Description | Example |

|---|---|---|

| Policy Number | Your unique insurance policy identifier. | 1234567890 |

| Policy Holder Name | The name of the individual or family covered under the policy. | John Doe |

| Billing Period | The timeframe covered by the statement. | January 1, 2024 – January 31, 2024 |

| Premium Due | The amount owed for the billing period. | $200.00 |

| Payment History | A record of your previous payments. | Payment Date: 1/15/2024, Amount: $200.00 |

| Outstanding Balance | Any unpaid amounts. | $0.00 |

| Claims | Details of any claims submitted and processed during the billing period. | Claim #12345, Date of Service: 1/10/2024, Amount Paid: $100.00 |

“The Premium Due section indicates the amount you owe for the current billing cycle. Carefully review the Payment History section to ensure all payments are accurately recorded.”

“To calculate your total insurance costs, sum your premiums, co-pays, deductibles, and any outstanding balances.”

Strategies for Managing Premium Costs

Managing the cost of medical insurance premiums is a significant concern for many individuals and families. Fortunately, several strategies can help individuals find more affordable plans and reduce their overall expenses. Understanding these options and their implications is crucial for making informed decisions about healthcare coverage.

Finding Affordable Medical Insurance Plans

Locating affordable medical insurance involves a multi-faceted approach. First, explore options available through your employer. Group plans often offer lower premiums than individual plans due to economies of scale. If your employer doesn’t offer a plan, or if the offered plan is too expensive, investigate plans available through the Health Insurance Marketplace (if applicable in your region). The Marketplace offers a range of plans with varying levels of coverage and costs, allowing you to compare options and select the one that best suits your needs and budget. Consider utilizing a health insurance broker or advisor; these professionals can help navigate the complexities of plan selection and find suitable options. Finally, remember to check for eligibility for government subsidies or assistance programs, which may significantly reduce your premium costs.

Reducing Premium Expenses Through Deductibles and Co-pays

Increasing your deductible or co-pay can lower your monthly premiums. A higher deductible means you pay more out-of-pocket before your insurance coverage kicks in. Similarly, a higher co-pay increases your cost per doctor’s visit or prescription. For example, choosing a plan with a $5,000 deductible instead of a $2,000 deductible might result in lower monthly premiums, but you’ll have to pay more before your insurance covers expenses. Conversely, a lower deductible and co-pay usually result in higher premiums. The key is to find a balance between affordability and the amount you’re comfortable paying out-of-pocket.

Benefits and Drawbacks of Cost-Saving Strategies

Choosing a high-deductible health plan (HDHP) coupled with a health savings account (HSA) offers tax advantages. Contributions to an HSA are tax-deductible, and the funds grow tax-free. However, this strategy requires careful financial planning, as you’ll need to save enough to cover potential high out-of-pocket medical expenses. On the other hand, lowering your deductible or co-pay provides greater short-term protection, meaning less out-of-pocket expenses for routine care, but at the cost of higher monthly premiums. The best strategy depends on your individual financial situation, health status, and risk tolerance.

Choosing a Cost-Effective Insurance Plan: A Flowchart

The process of choosing a cost-effective insurance plan can be visualized using a flowchart.

[Flowchart Description: The flowchart would begin with a “Start” box. It would then branch into two options: “Employer-Sponsored Plan Available?” A “Yes” branch would lead to a box: “Review Employer Plan Options and Costs.” A “No” branch would lead to a box: “Explore Marketplace Plans and Government Subsidies.” Both branches would then converge into a box: “Compare Plans Based on Premiums, Deductibles, Co-pays, and Coverage.” This would then branch into two options: “Plan Meets Needs and Budget?” A “Yes” branch would lead to a box: “Enroll in Chosen Plan.” A “No” branch would lead back to the “Compare Plans…” box. Finally, the flowchart would end with an “End” box.]

Illustrative Examples of Premium Costs

Understanding the cost of medical insurance premiums requires looking at various factors. The examples below illustrate how age, family size, and pre-existing conditions can significantly impact premium costs. These are illustrative examples and actual costs will vary based on location, insurer, and plan specifics.

Premium Costs by Age and Family Size

The following table provides hypothetical examples of monthly premiums for a standard health insurance plan. Remember that these are simplified examples and real-world premiums can vary greatly. Factors like the specific plan chosen (e.g., bronze, silver, gold, platinum), deductible, and copay will also influence the final cost.

| Age Group | Individual | Family (2 Adults, 2 Children) |

|---|---|---|

| 25-34 | $300 | $900 |

| 35-44 | $450 | $1350 |

| 45-54 | $600 | $1800 |

| 55-64 | $800 | $2400 |

Impact of Health Conditions on Premium Costs

Pre-existing conditions significantly influence premium costs. Individuals with chronic illnesses, such as diabetes or heart disease, generally face higher premiums. For instance, a 30-year-old individual with well-controlled type 2 diabetes might pay $450 per month, while a similar individual without any pre-existing conditions might pay $300. The increased cost reflects the higher likelihood of needing expensive medical care. This is not to say that having a pre-existing condition prevents someone from getting insurance; it simply means the premium will likely be higher.

Visual Representation of Premium Cost Differences

Imagine a bar graph. The horizontal axis represents the different factors influencing premium costs: age, family size, pre-existing conditions (present or absent), and plan type (bronze, silver, gold, platinum). The vertical axis represents the monthly premium cost, ranging from a low of $200 to a high of $2500. Each bar represents a specific scenario. For example, a short bar would represent a young, healthy individual with a bronze plan, while a very tall bar would represent an older individual with a family and pre-existing conditions on a platinum plan. The graph visually demonstrates how each factor contributes to a higher or lower premium cost. The bars would be color-coded to easily distinguish the different factors influencing the cost. For instance, age could be represented by shades of blue, family size by shades of green, and pre-existing conditions by shades of red, with plan type using a pattern within each bar. This would create a clear visual representation of the complex interplay of factors that determine the final premium cost.

Last Recap

Ultimately, understanding what are medical insurance premiums is key to responsible healthcare planning. By carefully considering the factors influencing premium costs, comparing different plan options, and employing cost-saving strategies, you can secure the healthcare coverage you need without undue financial strain. Remember to regularly review your policy and explore available options to ensure your plan continues to meet your evolving needs and budget.

Helpful Answers

What happens if I miss a premium payment?

Missing a premium payment can lead to your coverage being canceled or suspended. Contact your insurance provider immediately if you anticipate difficulty making a payment; they may offer payment plans or other options.

Can I change my health insurance plan during the year?

You may be able to change plans during a special enrollment period, such as if you experience a qualifying life event (e.g., marriage, job loss). Otherwise, you typically must wait until the annual open enrollment period.

How are premiums taxed?

The tax treatment of premiums depends on how you obtain your insurance. Premiums paid through an employer-sponsored plan are often pre-tax, while those purchased individually may be tax-deductible depending on your income and other factors. Consult a tax professional for personalized advice.

What is a deductible and how does it relate to my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage begins. Higher deductibles often correlate with lower premiums, and vice-versa. You need to weigh the trade-off between a lower premium and a higher out-of-pocket cost if you need medical care.