Navigating the world of life insurance can be complex, and understanding the nuances of return-of-premium (ROP) riders is crucial for making informed decisions. This guide delves into Washington National Insurance’s return-of-premium offerings, providing a clear and concise explanation of their policies, terms, and conditions. We’ll explore the financial implications, compare them to competitors, and illustrate various scenarios to help you understand how this feature can impact your financial planning.

Understanding whether a return-of-premium policy aligns with your individual needs and risk tolerance is paramount. This guide aims to equip you with the knowledge necessary to assess the value proposition of Washington National’s ROP policies and determine if they are the right fit for your financial security.

Understanding Washington National Insurance Return of Premium Policies

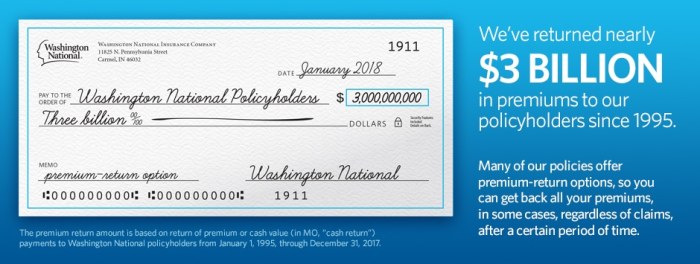

Return of Premium (ROP) riders offered by Washington National Insurance are valuable additions to life insurance policies, offering the potential to recoup a portion or all of your premiums paid if certain conditions are met. Understanding the nuances of these riders is crucial for making informed decisions about your financial protection.

Types of Washington National Return of Premium Riders

Washington National offers various ROP riders, each with its own specific terms and conditions. The exact types and features available may vary depending on the specific policy and the time of purchase. Generally, these riders fall into categories based on the percentage of premiums returned and the duration of the policy. Some may offer a return of a percentage of premiums paid if the insured survives the policy term, while others may have different conditions for premium return. It’s important to review the policy documents carefully to understand the specifics of the ROP rider attached to your policy.

Conditions and Requirements for Return of Premium Qualification

Qualifying for a return of premium typically hinges on the insured surviving the policy’s term. However, specific conditions, such as the policy remaining in force and free from any lapse, are generally required. The policy documents will clearly Artikel these conditions. Failure to meet these conditions could result in forfeiture of the return of premium benefit. Furthermore, the specific terms of the return – whether it’s a percentage or a full return – are detailed within the policy’s ROP rider.

Examples of Return of Premium Applicability and Inapplicability

Consider two scenarios. Scenario one: Mr. Jones purchased a 20-year term life insurance policy with an ROP rider. He survives the full 20 years, maintaining the policy in good standing. He’s entitled to receive the return of premium as Artikeld in his policy documents. Scenario two: Mrs. Smith also had a similar policy but allowed her policy to lapse after 10 years. She will not receive a return of premium because she did not fulfill the condition of maintaining the policy in force for the full term.

Comparison of Washington National Return of Premium Options

The following table provides a simplified comparison. Note that actual options and features may vary, and this is not an exhaustive list. Always refer to your policy documents for the most accurate and up-to-date information.

| Rider Name (Example) | Return Percentage | Term Length | Conditions |

|---|---|---|---|

| ROP Rider A | 100% | 20 years | Policy in force for full term, no lapses |

| ROP Rider B | 80% | 10 years | Policy in force for full term, no lapses |

| ROP Rider C | 50% | 15 years | Policy in force for full term, no lapses, health conditions met |

| ROP Rider D | Variable | Variable | Specific conditions as Artikeld in the policy document |

Policy Terms and Conditions Related to Return of Premium

Understanding the specific terms and conditions governing the return of premium is crucial for policyholders of Washington National Insurance. This section details key aspects of the return of premium benefit, clarifying what constitutes a “premium,” outlining limitations, and explaining the claims process.

Definition of “Premium” in Return of Premium Policies

The term “premium” in the context of Washington National’s return of premium policies refers to the total amount of money paid by the policyholder for the insurance coverage during the policy term. This excludes any additional fees, charges, or taxes associated with the policy. It is specifically the amount directly contributing to the insurance coverage itself. For instance, if your annual premium is $1,200, that’s the figure relevant to the return of premium calculation.

Exclusions and Limitations on Return of Premium

Several factors can limit or exclude the return of premium benefit. These limitations are typically clearly defined within the policy document. Common exclusions might include situations where the policy is terminated due to non-payment of premiums, fraud, or misrepresentation of material facts during the application process. Furthermore, the policy may specify a waiting period before the return of premium benefit becomes effective. Certain policy riders or endorsements might also alter the terms related to the return of premium.

Situations that Void or Reduce Return of Premium

Several scenarios can result in a reduced or voided return of premium. For example, if a policyholder makes a claim that is subsequently deemed fraudulent, the return of premium may be significantly reduced or completely forfeited. Similarly, if the policy is cancelled due to a breach of contract by the policyholder (such as failing to disclose a pre-existing condition), the return of premium benefit may be lost. A death claim before the policy’s return of premium period expires would also prevent the return of premiums. Specific examples would need to be reviewed based on the individual policy wording.

Process for Claiming a Return of Premium

The process for claiming a return of premium typically involves submitting a formal request to Washington National Insurance. This request should be accompanied by specific documentation, which might include a copy of the policy, proof of payment of premiums, and any other supporting documents as required by the company. The policy document itself usually Artikels the exact documentation needed and the specific steps to initiate a claim. Contacting Washington National’s customer service directly is also recommended to clarify any questions about the claim process or required documentation for your specific policy.

Illustrative Examples of Return of Premium Scenarios

Understanding how return of premium works in practice is crucial. The following scenarios illustrate different outcomes based on policy terms and the insured’s circumstances. Remember that specific policy details will always determine the final return.

Full Return of Premium Scenario

This scenario describes a situation where a policyholder receives the entire amount of premiums paid back. Let’s imagine Sarah purchased a 10-year, $100,000 term life insurance policy with a return of premium rider. The annual premium was $500, totaling $5000 over the 10 years. Sarah maintained the policy in good standing for the entire 10-year term and did not file any claims. At the end of the 10 years, since she did not experience a covered event resulting in a death benefit payout, Washington National Insurance returned the full $5000 in premiums to her as stipulated in her policy.

Partial Return of Premium Scenario

A partial return occurs when a policyholder receives a portion of their premiums back. Consider John, who also purchased a similar 10-year, $100,000 term life insurance policy with a return of premium rider. However, John’s policy had a clause stating that only premiums paid after the fifth year would be returned if no claim was made. John paid $2500 in premiums during the first five years and $2500 in the subsequent five years. Assuming no claims, Washington National Insurance would only return the $2500 paid after the fifth year. The initial premiums are not refundable according to the policy’s terms.

No Return of Premium Scenario

In this scenario, the policyholder receives no return of premiums. Suppose Maria purchased a 10-year term life insurance policy with a return of premium rider. However, during the policy term, Maria unfortunately passed away due to an illness covered under the policy. In this case, Washington National Insurance would pay out the death benefit of $100,000 to her beneficiaries. Because the death benefit was paid, the return of premium clause in her policy would be void; no premium refund would be issued as the primary purpose of the insurance – providing a death benefit – was fulfilled.

Final Wrap-Up

Ultimately, the decision of whether to invest in a Washington National Insurance policy with a return-of-premium rider depends on your individual financial circumstances, risk tolerance, and long-term goals. By carefully weighing the costs and potential benefits, and understanding the policy’s specific terms and conditions, you can make an informed choice that best protects your financial future. This guide provides a foundation for that crucial decision-making process. Remember to consult directly with a financial advisor for personalized guidance.

FAQs

What happens if I die before the return of premium period ends?

Your beneficiaries will receive the death benefit, as Artikeld in your policy, regardless of the return-of-premium feature.

Are there any health requirements to qualify for a return-of-premium rider?

Specific health requirements vary depending on the policy and the amount of coverage. Underwriting will assess your application.

Can I cancel my policy and still receive a return of premium?

The conditions for receiving a return of premium are usually specified in the policy document. Cancellation may impact the amount or eligibility for the return.

How is the return of premium calculated?

The calculation method is detailed in the policy documents and usually factors in premiums paid, policy duration, and any applicable fees or deductions.

What if my policy lapses before the return of premium period?

Typically, you would not receive a return of premium if the policy lapses before the specified return period. Consult your policy documents for precise details.