Navigating the world of W2 health insurance premiums can feel like deciphering a complex code. This guide aims to illuminate the often-opaque process, providing clarity on the components, calculations, and implications of these crucial employment benefits. From understanding employer contributions and employee costs to exploring the tax advantages and industry variations, we’ll unravel the intricacies of W2 health insurance premiums, empowering you to make informed decisions about your healthcare coverage.

We’ll delve into the various types of plans available, the factors influencing premium costs, and the long-term financial considerations involved. This exploration will equip you with the knowledge to compare options effectively, negotiate benefits, and ultimately, secure the best possible healthcare coverage for yourself and your family.

Understanding W2 Health Insurance Premiums

Securing health insurance is a crucial aspect of financial planning, and understanding the intricacies of W2 health insurance premiums is vital for employees. This section will break down the key components, types of plans, and premium calculation methods to provide a clear picture of this important employee benefit.

Components of W2 Health Insurance Premiums

W2 health insurance premiums are typically comprised of several key elements. The employer often contributes a portion, while the employee pays the remaining amount through payroll deductions. The employee’s share is determined by factors such as the chosen plan, family size, and the employer’s contribution strategy. These components can include administrative fees, provider network costs, and the insurer’s profit margin. The final premium reflects the overall cost of providing healthcare coverage.

Types of Health Insurance Plans Offered Through W2 Employment

Employers often offer a selection of health insurance plans, each with varying levels of coverage and cost. Common types include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Health Savings Accounts (HSAs). HMOs generally offer lower premiums but restrict access to specialists and require referrals from primary care physicians. PPOs provide greater flexibility in choosing doctors and specialists, but premiums are typically higher. HSAs allow pre-tax contributions to be used for medical expenses, often paired with high-deductible plans. The specific plans available will vary depending on the employer’s benefit package.

Premium Calculation

The calculation of health insurance premiums is a complex process involving actuarial analysis and risk assessment. Insurers consider several factors, including the age and health status of the insured individuals, the type of plan chosen, the geographic location, and the utilization of healthcare services within the plan’s network. In essence, insurers estimate the likely healthcare costs for the covered individuals and set premiums accordingly to cover those costs plus administrative expenses and profit.

A simplified representation might be: Premium = (Estimated Healthcare Costs + Administrative Costs + Profit Margin) / Number of Insured Individuals

This is a high-level overview; actual calculations are far more intricate.

Premium Comparison for Different Family Sizes

The following table illustrates a hypothetical example of how premiums might vary based on family size for a specific PPO plan. Actual premiums will vary significantly based on the factors mentioned above.

| Family Size | Employee Only | Employee + Spouse | Employee + Children | Employee + Spouse + Children |

|---|---|---|---|---|

| Premium | $300 | $600 | $450 | $800 |

Employer Contributions and Employee Costs

Understanding the breakdown of W2 health insurance premiums involves examining both the employer’s contribution and the employee’s share. This understanding is crucial for both employees, who need to budget effectively, and employers, who need to manage their healthcare costs. This section details the different aspects of these contributions and their impact.

Employer contributions to W2 health insurance premiums vary widely depending on factors such as company size, industry, and the specific health plan offered. Some employers cover a significant portion, even 100%, of the premium costs for their employees. Others may contribute a fixed dollar amount or a percentage of the premium, leaving the remaining balance for the employee to pay. For example, a company might contribute $500 per month towards an employee’s premium, while the employee pays the difference. Another company might contribute 80% of the premium cost, while the employee pays the remaining 20%.

Impact of Employee Contribution Levels on Net Income

Employee contributions directly affect their net income, or take-home pay. Higher employee contributions mean less money in their paycheck after taxes and other deductions. This reduction in net income can significantly impact an individual’s budget, especially if the employee is already facing financial constraints. For instance, an employee contributing $200 monthly towards their health insurance premium will have $200 less disposable income each month compared to an employee with a fully employer-sponsored plan. This reduction in disposable income could influence decisions about saving, spending, and overall financial well-being.

Factors Influencing Employer Decisions Regarding Premium Contributions

Several factors influence an employer’s decision on the level of premium contributions they offer. These include the company’s overall financial health, the competitive landscape within their industry (offering competitive benefits attracts and retains talent), the health plan options available, and the employer’s overall benefits strategy. A profitable company might be able to offer more generous contributions, while a smaller company with tighter budgets might offer less. The type of health plan also plays a role; employer contributions might be higher for plans with lower employee out-of-pocket costs. Finally, the overall benefits package offered (including paid time off, retirement plans, etc.) influences the overall attractiveness of the job, indirectly impacting how much the employer invests in health insurance.

Relationship Between Employee Salary and Premium Contributions

The following table illustrates a hypothetical relationship between employee salary and premium contributions. It’s important to remember that these are examples and actual contributions will vary greatly based on the factors mentioned above.

| Employee Salary | Employer Contribution | Employee Contribution | Total Premium Cost |

|---|---|---|---|

| $40,000 | $400/month | $200/month | $600/month |

| $60,000 | $600/month | $300/month | $900/month |

| $80,000 | $800/month | $400/month | $1200/month |

| $100,000 | $1000/month | $500/month | $1500/month |

Tax Implications of W2 Health Insurance Premiums

Understanding the tax implications of employer-sponsored health insurance is crucial for both employees and employers. The way your health insurance premiums are handled significantly impacts your taxable income and, consequently, your tax liability. This section will clarify the tax advantages and reporting procedures associated with these premiums.

Employer-sponsored health insurance offers significant tax advantages.

Tax Advantages of Employer-Sponsored Health Insurance

The premiums your employer pays towards your health insurance are considered a non-taxable benefit for you. This means that the money your employer contributes isn’t included in your gross income, reducing your overall taxable income. This results in lower taxes owed compared to a scenario where you paid the full premium yourself. Furthermore, the employee’s portion of the premium, when paid through pre-tax deductions from their paycheck, also reduces their taxable income. This pre-tax deduction lowers the amount of income subject to federal and, in many cases, state income taxes.

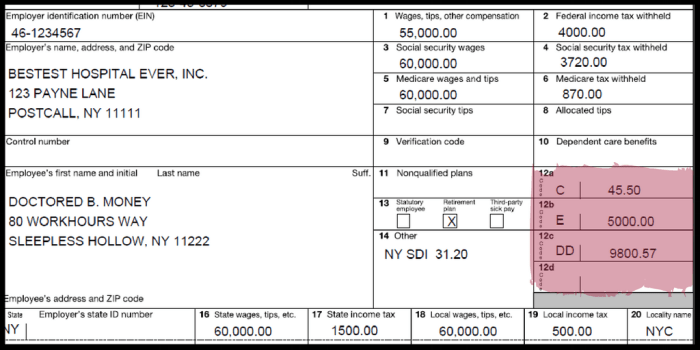

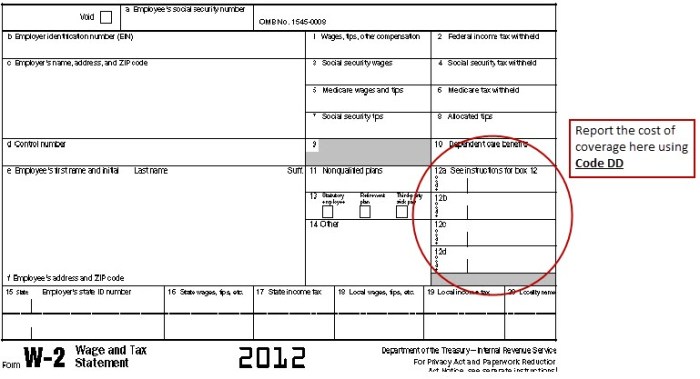

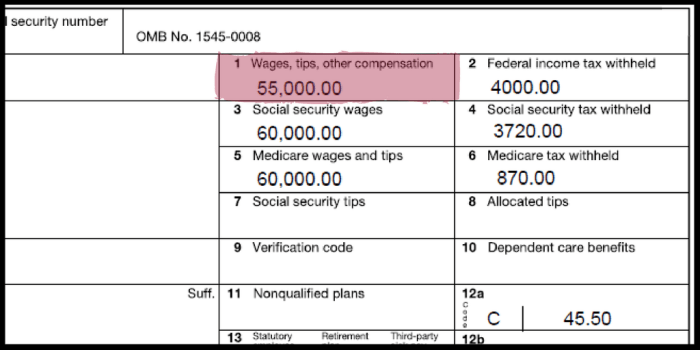

Reporting of Premiums on W2 Forms

Your W-2 form, which you receive from your employer annually, reports the total wages paid to you during the tax year. Crucially, it also shows the amount your employer contributed towards your health insurance premiums. This amount is reported in Box 12, using code DD. This code specifically indicates employer-provided health insurance premiums. Your W-2 will *not* include the amount you personally contributed towards your premiums through pre-tax deductions. That deduction is reflected in your lower taxable income.

Tax Implications for Employees with Different Income Levels

The tax benefits of employer-sponsored health insurance are generally more pronounced for higher-income individuals. This is because higher-income individuals typically fall into higher tax brackets. A larger pre-tax deduction from their paycheck will reduce their taxable income in a more substantial way, resulting in greater tax savings. For example, an individual in the 22% tax bracket who deducts $5,000 in premiums will save $1,100 in federal income taxes ($5,000 x 0.22). Conversely, an individual in a lower tax bracket will see a proportionally smaller tax savings. However, even for lower-income individuals, the pre-tax deduction still provides a tangible tax benefit.

Examples of Pre-Tax Deductions Affecting Taxable Income

Let’s illustrate the impact of pre-tax deductions on taxable income with two examples:

Example 1: An individual earns $70,000 annually and contributes $5,000 pre-tax towards their health insurance premiums. Their taxable income is reduced to $65,000. The tax savings will depend on their overall tax bracket.

Example 2: Another individual earns $100,000 annually and contributes $7,000 pre-tax towards their health insurance premiums. Their taxable income is reduced to $93,000. The tax savings will be higher than in Example 1 due to their higher income and therefore higher tax bracket. The exact tax savings would need to be calculated based on the applicable tax rates for their specific tax bracket.

Comparing W2 Health Insurance Premiums Across Industries

Understanding the variations in W2 health insurance premiums across different industries is crucial for both employees and employers. Premiums aren’t uniform; they fluctuate significantly depending on the industry, reflecting factors like employee demographics, the nature of the work, and the risk profiles associated with specific jobs. This disparity impacts employee compensation and overall workforce costs.

The cost of health insurance is a significant component of total compensation. While employers often contribute a substantial portion, the employee’s share varies considerably based on industry. This section will explore these differences and their implications.

Industry Variations in W2 Health Insurance Premiums

The following table presents a simplified comparison of average monthly premiums for family coverage across several industries. Note that these figures are illustrative and can vary significantly based on factors such as plan type, location, and the specific employer’s contribution. Actual premiums can be higher or lower depending on these factors. These figures are estimations based on industry-wide trends and publicly available data.

| Industry | Average Monthly Employee Premium (Estimate) | Average Monthly Employer Contribution (Estimate) | Notes |

|---|---|---|---|

| Technology | $700 | $1200 | High-paying jobs often attract employees with higher healthcare needs. |

| Finance | $650 | $1100 | Similar to technology, this sector often has higher-earning employees. |

| Healthcare | $550 | $900 | Employees may have access to employer-sponsored plans with lower premiums, though this varies greatly. |

| Retail | $400 | $600 | Lower-paying jobs often correlate with lower premiums and employer contributions. |

Factors Contributing to Premium Differences

Several factors influence the variation in W2 health insurance premiums across industries. These factors interact in complex ways to determine the final cost.

Firstly, the average employee age and health status within an industry significantly impact premiums. Industries with older workforces or those involving physically demanding jobs might experience higher claims and therefore higher premiums. Secondly, the prevalence of hazardous work environments can also contribute to higher premiums, as these jobs increase the likelihood of workplace injuries and illnesses. Thirdly, the bargaining power of the industry’s labor unions also plays a significant role; strong unions can often negotiate for better health insurance benefits, leading to lower employee contributions. Finally, the size and financial health of the employing company are also major factors; larger, more financially stable companies can often afford to offer more generous health insurance plans.

Implications for Employees

The variations in W2 health insurance premiums across industries have significant implications for employees. Employees in industries with higher premiums face a greater financial burden, potentially reducing their disposable income. This can lead to difficult choices between health insurance coverage and other essential expenses. Conversely, employees in industries with lower premiums enjoy a greater financial advantage, freeing up more resources for other needs. This disparity highlights the importance of understanding the total compensation package, including health insurance costs, when considering job offers across different industries. A seemingly higher salary in one industry might be offset by significantly higher health insurance premiums, resulting in a lower net income compared to a job with a lower salary but lower health insurance costs.

Health Insurance Premium Trends and Predictions

Understanding the trajectory of W2 health insurance premium costs is crucial for both employers and employees. Current trends reveal a consistent upward pressure on premiums, impacting budgeting and financial planning. Predicting future costs allows for proactive strategies to mitigate the financial burden.

Current Trends in W2 Health Insurance Premium Costs

W2 health insurance premiums have been steadily increasing for several years. This rise is not uniform across all plans or demographics, but the overall trend is undeniable. Factors such as increased healthcare utilization, advancements in medical technology, and the rising cost of prescription drugs all contribute to this upward pressure. For example, the Kaiser Family Foundation’s annual Employer Health Benefits Survey consistently shows significant year-over-year increases in average premiums for employer-sponsored health insurance. These increases often outpace inflation, placing a greater strain on both employers and employees.

Projection of Future Premium Costs

Projecting future premium costs requires careful consideration of several factors. Continuing the current trend of annual increases seen in recent years, we can reasonably expect premiums to continue rising. However, the rate of increase may fluctuate based on economic conditions, legislative changes, and innovations in healthcare delivery. For instance, if the economy experiences a significant downturn, we might see a slight moderation in the rate of premium growth, although premiums would likely still increase. Conversely, major legislative changes or breakthroughs in healthcare technology could impact the rate of increase in either direction. A reasonable, though not guaranteed, projection could be a continued annual increase in the low to mid single-digit percentages, but this remains highly dependent on the previously mentioned factors.

Factors Driving Premium Increases

Several interconnected factors contribute to the rising cost of health insurance premiums. Increased healthcare utilization, driven partly by an aging population and advances in medical technology leading to more expensive treatments, is a significant driver. The high cost of prescription drugs, particularly specialty medications, also plays a substantial role. Administrative costs associated with insurance processing and healthcare delivery further inflate premiums. Finally, inflation itself, impacting the cost of labor and medical supplies, contributes to the overall increase. For example, the rising cost of cancer treatments, driven by innovative but expensive therapies, directly impacts insurance premiums.

Strategies for Managing Rising Premium Costs

Managing rising premium costs requires a multi-pronged approach. Employers can explore strategies such as offering high-deductible health plans (HDHPs) coupled with health savings accounts (HSAs) to share cost burdens. Negotiating better rates with insurance providers through group purchasing power is another viable option. Promoting wellness programs and preventative care can help reduce healthcare utilization and ultimately lower costs. Employees can actively participate in cost-sharing programs, utilize generic medications when possible, and shop around for the best healthcare options within their employer’s plan offerings. For example, a company offering a wellness program with incentives for preventative checkups and healthy lifestyle choices can see a reduction in employee healthcare claims over time.

Final Summary

Understanding W2 health insurance premiums is paramount for both employees and employers. This guide has explored the multifaceted nature of these premiums, from the intricacies of calculation and employer contributions to the tax implications and industry-specific variations. By grasping these key aspects, individuals can make informed choices regarding their healthcare coverage, ensuring financial stability and peace of mind. Ultimately, informed decision-making in this area is crucial for both personal financial well-being and overall employee satisfaction.

Popular Questions

What happens if I change jobs mid-year?

Your coverage will depend on your new employer’s plan. There may be a waiting period before coverage begins. COBRA may be an option to maintain your previous coverage temporarily, but at your own expense.

Can I deduct health insurance premiums even if my employer contributes?

Generally, you cannot deduct premiums paid by your employer. However, you may be able to deduct premiums you pay above and beyond what your employer contributes if you are self-employed or have a qualifying health savings account (HSA).

How do I know if I’m getting a good deal on my health insurance?

Compare your plan’s premium costs, deductible, co-pays, and out-of-pocket maximum to similar plans offered by other providers. Consider your healthcare needs and usage when making your comparison.

What if I can’t afford my health insurance premiums?

Explore options like applying for a subsidy through the Affordable Care Act (ACA) marketplace or discussing payment plans with your insurer. Your employer’s HR department may also be able to offer assistance or resources.