Understanding your W-2 form is crucial for accurate tax filing, and Box 14, specifically concerning health insurance premiums, often presents questions. This guide unravels the complexities of W-2 Box 14, explaining how employer and employee contributions to health insurance are reported, the resulting tax implications, and how to reconcile this information with your tax return. We’ll explore various health insurance plan types and their impact on Box 14 entries, ensuring you have a clear understanding of this often-misunderstood aspect of your tax documentation.

We’ll cover the legal responsibilities of employers in accurately reporting these premiums, common errors to avoid, and provide practical advice for both employees and employers to navigate this process smoothly. Visual representations will further clarify the relationships between employer contributions, employee contributions, total premiums, and their tax consequences. By the end, you’ll possess the knowledge to confidently handle the information presented in W-2 Box 14.

Understanding W-2 Box 14

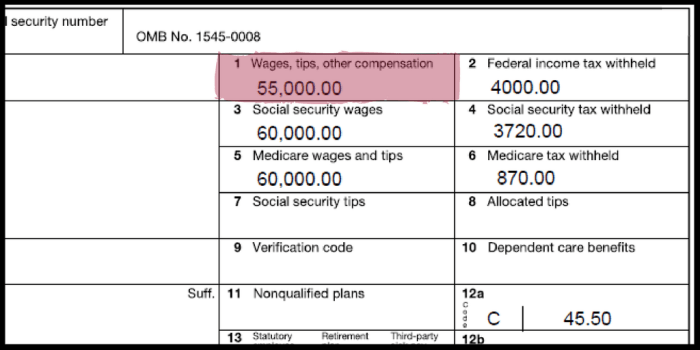

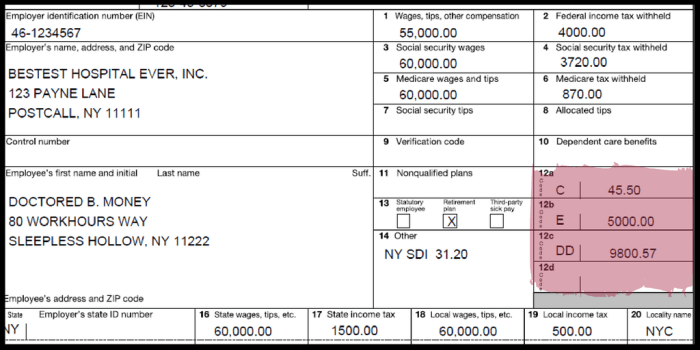

Box 14 of your W-2 form is a catch-all section for various supplemental wage information. While it can contain a variety of entries, one common item reported here is the total amount of health insurance premiums paid during the tax year. This information is crucial for both employees and the IRS, as it can affect tax calculations and potential deductions.

Health Insurance Premiums Reported in Box 14

Box 14 reports the total amount of health insurance premiums paid, whether contributed by the employer, the employee, or a combination of both. It doesn’t differentiate between employer and employee contributions; instead, it presents the total sum. This total figure is used for tax purposes, particularly when considering the employee’s potential eligibility for tax deductions or credits related to health insurance. The specific tax implications depend on the type of health insurance plan and other factors.

Examples of Health Insurance Premium Reporting in Box 14

Several scenarios illustrate how health insurance premiums are reflected in Box 14. Understanding these scenarios provides clarity on how the total premium amount is calculated and reported. It’s important to remember that the employer’s contribution is not a taxable benefit to the employee. However, the total premiums paid (employer and employee portions combined) are reported in Box 14 for record-keeping and potential tax purposes.

| Scenario | Employer Contribution | Employee Contribution | Total Premiums Reported in Box 14 |

|---|---|---|---|

| Employer pays the full premium | $6000 | $0 | $6000 |

| Employee pays the full premium | $0 | $6000 | $6000 |

| Employer and employee share the premium equally | $3000 | $3000 | $6000 |

| Employer pays a larger portion of the premium | $4500 | $1500 | $6000 |

Tax Implications of Premiums Reported in Box 14

The amount your employer contributes towards your health insurance premiums is often reported in Box 14 of your W-2 form. Understanding how this impacts your taxes is crucial for accurate tax filing and potentially maximizing your tax benefits. This section will clarify the tax implications of these premiums, focusing on the distinctions between pre-tax and after-tax deductions and comparing employer-sponsored plans with individually purchased insurance.

Pre-tax versus After-tax Deductions for Health Insurance

The method of paying your health insurance premiums significantly affects your taxable income. With pre-tax deductions, your premiums are deducted from your gross pay *before* taxes are calculated. This reduces your taxable income, leading to lower tax liability. Conversely, after-tax deductions are subtracted from your net pay (after taxes). This means you pay taxes on the full amount of your earnings before the premium is deducted, resulting in a higher tax burden. The difference can be substantial, especially for those in higher tax brackets. For example, if your premium is $500 per month, a pre-tax deduction saves you the amount of tax you would have paid on that $500, whereas with an after-tax deduction, you’ve already paid taxes on the full amount of your salary before the deduction is applied.

Tax Benefits of Employer-Sponsored versus Individually Purchased Health Insurance

Employer-sponsored health insurance often offers significant tax advantages. The employer’s contribution towards your premiums is generally not included in your taxable income. This is a substantial benefit not available with individually purchased plans, where the entire premium is paid after tax, reducing your disposable income. Furthermore, some employer-sponsored plans allow for pre-tax deductions of employee contributions, further minimizing taxable income. Individually purchased plans, however, often qualify for tax credits or deductions depending on income and the Affordable Care Act (ACA) guidelines, offering some tax relief, though typically less than employer-sponsored plans.

Tax Calculation Process Flowchart

The following flowchart illustrates the tax calculation process when considering Box 14 premiums:

[Diagram Description: The flowchart would begin with “Gross Income.” An arrow would point to a box labeled “Subtract Pre-tax Health Insurance Premiums (Box 14).” An arrow from this box would lead to a box labeled “Taxable Income.” From “Taxable Income,” an arrow points to a box labeled “Calculate Taxes Based on Taxable Income.” An arrow from this box leads to a box labeled “Net Income (after taxes).” A separate branch from “Gross Income” could show the “After-tax Health Insurance Premiums” calculation, where taxes are calculated on the full gross income before the premium deduction, resulting in a higher tax liability. Finally, both branches would converge at a box showing the final “Net Income” comparison, highlighting the difference in take-home pay between pre-tax and after-tax premium deductions.]

Types of Health Insurance Premiums Reported

Box 14 of your W-2 form reports the amount your employer paid toward your health insurance premiums. Understanding what types of premiums are included is crucial for accurate tax filing. This section details the various types of health insurance premiums that might appear in Box 14 and how they’re reported.

The types of premiums reported in Box 14 depend on the specific health insurance plan offered by your employer and the details of your coverage. Generally, any premiums paid by your employer on your behalf are reported, regardless of whether you also contribute. However, the exact amount reported will vary depending on the specifics of your plan.

Examples of Health Insurance Plans and Premium Reporting

Several factors influence the premium amount reported in Box 14. The type of plan (e.g., HMO, PPO, HSA), the level of coverage (e.g., single, family), and any employer contributions all play a role.

For instance, an employee enrolled in a single PPO plan might have a lower premium than an employee with family coverage under the same plan. Both premiums would be reported in Box 14, but the family coverage premium would be significantly higher, reflecting the increased cost of covering dependents. Similarly, an employee contributing to a Health Savings Account (HSA) might see a lower premium reflected in Box 14, as the HSA contributions reduce the overall cost of coverage.

Common Health Insurance Plan Types and Box 14 Entries

The following list details common health insurance plan types and how their premiums are typically reflected in Box 14. Note that the actual amount reported will depend on your specific plan and employer contributions.

- HMO (Health Maintenance Organization): Premiums for HMO plans, whether single or family coverage, are reported in Box 14. The amount reported reflects the employer’s contribution toward the premium.

- PPO (Preferred Provider Organization): Similar to HMOs, PPO premiums (single or family) are reported in Box 14. The employer’s contribution to the premium is the reported amount.

- EPO (Exclusive Provider Organization): EPO premiums, like those for HMOs and PPOs, are reported in Box 14. The reported amount is the employer’s contribution.

- HSA (Health Savings Account) Compatible Plans: If your employer contributes to your HSA, this contribution is typically *not* reported in Box 14. Instead, the HSA contribution is reported separately on a Form 1099-SA. The premium paid by the employer for the HSA-compatible plan itself *is* reported in Box 14.

- COBRA Continuation Coverage: Premiums paid by an employer during a COBRA continuation period may be reported in Box 14, but this is less common. The specifics depend on the employer’s policy.

Single vs. Family Coverage in Box 14

The difference between single and family coverage is primarily reflected in the *amount* reported in Box 14. Family coverage premiums are generally substantially higher than single coverage premiums due to the inclusion of dependents. For example, an employer might contribute $5,000 annually towards a single employee’s premium, but $15,000 annually for an employee with family coverage under the same plan. Both amounts would be reported separately in Box 14 for each employee. This reflects the increased cost associated with insuring multiple individuals.

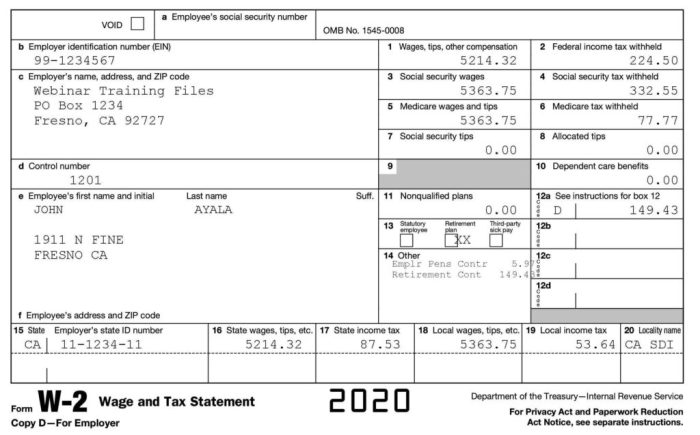

Reconciling W-2 Box 14 with Tax Returns

The information reported in Box 14 of your W-2 form plays a crucial role in accurately filing your tax return. Understanding how this information integrates with your overall tax filing process is essential to ensure you correctly report your income and claim any applicable deductions or credits. This section will guide you through the process of reconciling Box 14 data with your tax forms.

Using Box 14 Information on Tax Returns

The amount shown in Box 14 of your W-2 represents the total value of health insurance premiums your employer paid on your behalf. This amount is generally not included in your taxable wages (Box 1) but may affect other aspects of your tax return. For example, if you itemize deductions, you may be able to deduct the portion of the premiums that exceed a certain limit, depending on your income and other factors. If you received a Form 1099-SA for a Health Savings Account (HSA), the contributions made by your employer may also be reported on that form. Accurate reporting ensures you don’t overpay or underpay your taxes.

Step-by-Step Guide to Reporting Box 14 Information

Accurately reporting Box 14 information requires careful attention to detail. Here’s a step-by-step guide:

- Gather Necessary Documents: Collect your W-2 form, any 1099-SA forms (if applicable), and any other relevant tax documents.

- Determine Your Deduction Method: Decide whether you will itemize deductions or take the standard deduction. The Box 14 amount is only relevant if you itemize.

- Review the Premiums Reported: Carefully review the amount reported in Box 14 to ensure accuracy. If there’s a discrepancy, contact your employer’s payroll department immediately.

- Itemized Deductions: If itemizing, you may be able to deduct medical expenses, including premiums, that exceed 7.5% of your adjusted gross income (AGI). This threshold is adjusted annually for inflation. Use Schedule A (Form 1040) to report these expenses.

- HSA Contributions: If your employer contributed to your HSA, this may be reported separately on Form 1099-SA. The amount should not be double-counted on your tax return.

- File Your Return: Enter the relevant information from your W-2 and other tax documents onto your tax return, ensuring accuracy and consistency.

Potential Discrepancies and Resolutions

Discrepancies between Box 14 and other tax documents can arise. For example, the amount in Box 14 might not match the total premiums you paid if you made additional contributions or if there were errors in payroll processing. If you find a discrepancy, first verify the information with your employer’s payroll department. If the error is confirmed, request a corrected W-2. If the discrepancy remains unresolved, consult a tax professional.

Comparison of Box 14 Reporting on Different Tax Forms

| Tax Form | Relevance of Box 14 Information | How Information is Used |

|---|---|---|

| Form 1040 | Indirectly relevant if itemizing deductions | Information from Box 14 is used to calculate medical expense deductions on Schedule A (Form 1040). |

| Schedule A (Form 1040) | Directly relevant if itemizing deductions | The amount exceeding 7.5% of AGI is reported as a medical expense deduction. |

| Form 1099-SA | Relevant if employer contributions are made to an HSA | Employer HSA contributions are reported separately. |

Final Review

Mastering the intricacies of W-2 Box 14 and its impact on your taxes empowers you to ensure accuracy and potentially maximize tax benefits. While the details can seem complex, understanding the interplay between employer contributions, employee contributions, and the resulting tax implications is achievable. By carefully reviewing your W-2 and following the guidelines provided, you can confidently navigate the tax season and ensure accurate reporting of your health insurance premiums. Remember to consult a tax professional if you encounter any significant complexities or uncertainties.

FAQ Compilation

What if my W-2 Box 14 amount doesn’t match my health insurance statements?

Contact your employer’s payroll department immediately to reconcile the discrepancy. Inaccurate reporting can lead to tax issues.

Are all health insurance premiums reported in Box 14?

No, only premiums paid by or on behalf of the employee through a pre-tax payroll deduction are typically reported in Box 14. After-tax contributions are generally not included.

Can I deduct health insurance premiums if they aren’t reported in Box 14?

If you paid health insurance premiums after-tax, you might be able to deduct them, depending on your circumstances and whether you itemize deductions. Consult a tax professional for personalized guidance.

What happens if my employer fails to report my health insurance premiums correctly in Box 14?

This can lead to errors in your tax return. You should contact your employer to correct the information and potentially amend your tax return if necessary.