Renters insurance premiums, like many aspects of life, are subject to fluctuation. This exploration delves into the intricacies of USAA renters insurance premium increases, examining the underlying causes and offering practical strategies for managing costs. We’ll unpack the factors influencing premium calculations, compare USAA to competitors, and provide actionable steps to potentially mitigate increases.

From understanding the impact of claims history and location to exploring the benefits of bundling insurance products and negotiating premiums, this comprehensive guide equips renters with the knowledge needed to navigate the complexities of renters insurance pricing. We will also analyze the role of inflation, underwriting practices, and risk assessment models in shaping individual premiums.

Understanding USAA Renters Insurance Premium Increases

Renters insurance premiums, like many other costs, are subject to fluctuation. Understanding the factors influencing USAA’s adjustments to your premium is key to managing your budget and ensuring adequate coverage. Several interconnected elements contribute to these changes, ranging from broader economic trends to individual risk assessments.

Common Reasons for USAA Renters Insurance Premium Increases

Several factors can lead to an increase in your USAA renters insurance premium. These factors often interact, creating a complex picture that impacts the final cost. For example, a rise in the cost of replacing stolen electronics directly impacts claim payouts, potentially leading to a premium increase for all policyholders. Similarly, an increase in the frequency of burglaries in your specific area could lead to a higher premium for you, reflecting the increased risk.

The Role of Inflation and Increased Claim Costs

Inflation significantly impacts the cost of replacing stolen or damaged belongings. If the price of furniture, electronics, or other household items increases, so too does the potential payout on a renters insurance claim. USAA, like other insurers, must adjust premiums to account for these rising costs to maintain financial solvency and ensure they can meet their obligations to policyholders. Similarly, an increase in the number or severity of claims filed, perhaps due to a rise in natural disasters or theft in a specific region, directly contributes to higher premium costs. For example, a series of severe weather events in a particular city might lead to a rise in claims related to water damage, resulting in higher premiums for renters in that area.

Potential Changes in Underwriting Practices

USAA, like all insurance companies, periodically reviews and refines its underwriting practices. These changes can impact premiums. For instance, a shift in risk assessment models, incorporating more granular data or utilizing new predictive analytics, could lead to adjustments in individual premiums. A stricter underwriting policy, perhaps due to increased losses in a specific area or demographic, might also result in higher premiums for some policyholders. This could involve a more thorough assessment of individual risk factors, potentially leading to a higher premium for those deemed higher risk.

How Risk Assessment Models Influence Premium Adjustments

USAA uses sophisticated risk assessment models to determine individual premiums. These models consider a variety of factors, including your location, credit score (in some states), the value of your belongings, and your claim history. A higher risk profile, as determined by these models, will typically result in a higher premium. For example, a renter living in a high-crime area might see a higher premium than someone in a safer neighborhood, even if they have identical possessions and claim history. Similarly, a renter with a history of filing claims may experience a premium increase, reflecting their increased risk profile.

Steps to Potentially Reduce Your Renters Insurance Premium

Understanding how premiums are calculated can empower you to make choices that might reduce your costs. Here are some steps you can take:

- Increase your deductible: A higher deductible means you pay more out-of-pocket in the event of a claim, but it can lower your premium.

- Bundle your insurance: Combining your renters insurance with other USAA policies, such as auto insurance, may offer discounts.

- Improve home security: Installing security systems and taking other preventative measures can reduce your risk and potentially lower your premium. This could include things like adding deadbolt locks or a security system.

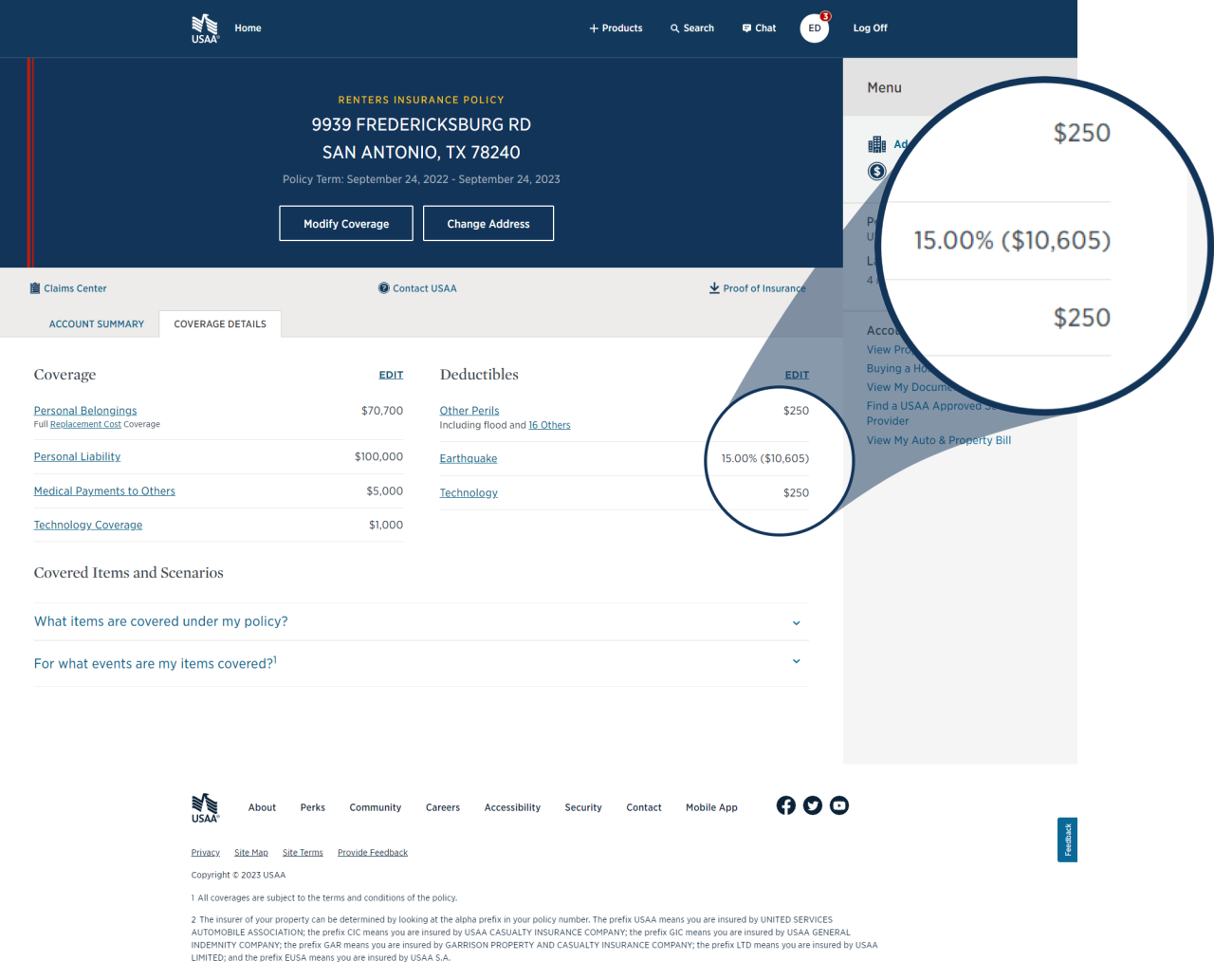

- Review your coverage: Ensure you only have the coverage you need. Overinsuring can lead to unnecessary expenses.

- Shop around: While loyalty is important, periodically comparing rates from other insurers can help you find the best value.

Strategies for Managing Renters Insurance Costs

Managing the cost of renters insurance can feel like a juggling act, but with a proactive approach and understanding of your options, you can find ways to keep premiums manageable without sacrificing essential coverage. This section Artikels several effective strategies to help you control your USAA renters insurance expenses.

Negotiating Lower Renters Insurance Premiums with USAA

Contacting USAA directly to discuss your premium is a worthwhile first step. Explain your financial situation and inquire about potential discounts or payment plans. Highlighting your long-standing loyalty as a customer or a consistently clean claims history can strengthen your negotiation position. Be prepared to discuss alternative coverage options or higher deductibles to potentially lower your premium. Remember to be polite and professional throughout the conversation.

Bundling Renters Insurance with Other USAA Products

USAA often offers discounts for bundling insurance products. Combining your renters insurance with auto insurance, or other eligible policies, can lead to significant savings. The exact discount will vary depending on your specific policies and location, but the potential cost savings are often substantial enough to make bundling a financially attractive option. Check your USAA account or contact them directly to explore the available bundling options and their associated discounts.

Impact of Home Security Measures on Premiums

Improving your home security can demonstrably reduce your renters insurance premium. Installing security systems, including monitored alarm systems, smart locks, and security cameras, can signal a lower risk to USAA, leading to a potential reduction in your premium. Document your security upgrades and contact USAA to inquire about potential discounts; some insurers offer specific discounts for enhanced security measures. For example, a renter who installs a monitored alarm system might see a 5-10% reduction in their premium compared to a renter without one.

Reducing Premium Costs by Increasing Deductibles

A higher deductible means you pay more out-of-pocket in the event of a claim, but in return, your premium will generally be lower. Carefully consider your financial situation and risk tolerance when choosing a deductible. A higher deductible will result in lower monthly payments, but it’s crucial to ensure you can comfortably afford the deductible amount should you need to file a claim. For instance, increasing your deductible from $500 to $1000 might result in a noticeable decrease in your monthly premium.

Filing a Claim with USAA: A Step-by-Step Guide

Filing a claim with USAA typically involves these steps: 1) Report the incident immediately. 2) Gather all necessary documentation, including photos and police reports if applicable. 3) Contact USAA via phone or their app to initiate the claims process. 4) Cooperate fully with the adjuster assigned to your case. 5) Follow USAA’s instructions for providing additional information or completing any required forms. While filing a claim might not directly increase your premium immediately, multiple claims within a short period can affect your future rates, as it signals a higher risk to the insurer. Therefore, it’s crucial to only file legitimate claims and avoid making unnecessary claims.

Concluding Remarks

Navigating the landscape of renters insurance premiums requires a proactive approach. By understanding the factors that influence costs, comparing options, and implementing effective management strategies, renters can effectively control their expenses and secure the appropriate coverage. This analysis of USAA renters insurance premium increases provides a framework for making informed decisions and maintaining affordable protection for personal belongings and liability.

FAQ

What happens if I file a claim with USAA? Will my premiums increase?

Filing a claim may impact your future premiums, as it indicates a higher risk profile. However, the extent of the increase depends on several factors, including the claim’s severity and frequency of past claims.

Can I pay my USAA renters insurance premium monthly?

USAA likely offers various payment options, including monthly installments. Check your policy documents or contact USAA customer service to confirm available payment plans.

Does USAA offer discounts for renters insurance?

USAA may offer discounts for bundling renters insurance with other products, having a good claims history, or implementing home security measures. Contact USAA directly to inquire about available discounts.

How often does USAA review and adjust renters insurance premiums?

Premium reviews vary depending on the policy and individual circumstances. It’s advisable to review your policy periodically and contact USAA for clarification on the review schedule for your specific policy.