Universal life insurance offers a unique blend of life insurance coverage and a cash value component, creating a financial instrument with considerable flexibility. Understanding the intricacies of universal life insurance premiums is crucial for making informed decisions about your financial future. This guide delves into the factors influencing premium costs, payment flexibility, and the long-term implications of various strategies, equipping you with the knowledge to navigate this complex landscape.

From the basic structure of premiums and their constituent parts to the significant impact of factors like age, health, and interest rates, we will explore the multifaceted nature of universal life insurance premiums. We will also analyze how different premium payment strategies can influence cash value accumulation and overall policy performance over time. The goal is to provide a clear and comprehensive understanding, empowering you to choose the best plan for your specific needs and financial goals.

Understanding Universal Life Insurance Premiums

Universal life (UL) insurance offers flexibility in premium payments and death benefit adjustments, making it a more complex product than term life insurance. Understanding the structure of its premiums is crucial for making informed decisions.

Universal life insurance premiums are not fixed like those of term life insurance. Instead, they are comprised of several key components that can fluctuate over time. This flexibility allows policyholders to adjust their payments based on their financial circumstances, but it also requires a deeper understanding of how these premiums work.

Universal Life Premium Components

A universal life insurance premium is typically composed of two main parts: the cost of insurance (COI) and the premium allocated to the cash value component. The cost of insurance covers the risk the insurance company takes on by insuring your life. This amount increases with age and health factors. The portion allocated to cash value builds up tax-deferred within the policy, potentially providing future benefits. The total premium paid is the sum of these two components, plus any applicable fees or charges. The policyholder generally has the option to pay premiums above the minimum required, accelerating cash value growth.

Factors Influencing Universal Life Premium Amounts

Several factors significantly influence the amount of your universal life insurance premiums. Your age is a primary determinant, as older individuals generally pay higher premiums due to increased mortality risk. Your health status also plays a crucial role; those with pre-existing conditions or poor health typically face higher premiums. The death benefit amount selected directly impacts premiums; a larger death benefit necessitates a higher premium. The cash value accumulation option within the policy also affects premiums. Choosing a higher cash value accumulation rate means higher premiums, but also potentially faster cash value growth. Finally, the insurance company itself can influence premium amounts through their pricing strategies and risk assessments. For example, a company with a higher risk tolerance might offer lower premiums, but this may come with trade-offs.

Comparison of Universal Life and Term Life Insurance Premiums

The following table compares the premium structures of universal life and term life insurance:

| Feature | Universal Life | Term Life |

|---|---|---|

| Premium Structure | Flexible; adjustable premiums; minimum premiums may apply | Fixed; level premiums for a specified term |

| Premium Amount | Varies based on age, health, death benefit, and cash value choices. | Determined by age, health, and term length. |

| Coverage Duration | Potentially lifelong, provided premiums are maintained. | Limited to the specified term length. |

| Cash Value | Builds tax-deferred cash value. | No cash value accumulation. |

Factors Affecting Universal Life Insurance Premium Costs

Understanding the cost of universal life insurance requires examining several key factors that influence premium calculations. These factors interact in complex ways, and a seemingly small change in one area can significantly impact your overall premium. This section will detail these key influences.

Age

Age is a significant determinant of universal life insurance premiums. Older applicants generally pay higher premiums because their life expectancy is shorter, increasing the insurer’s risk of paying out a death benefit sooner. For example, a 30-year-old applying for the same policy as a 50-year-old will typically pay considerably less. This is due to actuarial tables used by insurance companies to assess risk and calculate premiums based on statistical probabilities of mortality.

Health and Lifestyle

An applicant’s health and lifestyle choices play a crucial role in premium determination. Individuals with pre-existing health conditions, such as heart disease or diabetes, or those engaging in high-risk activities like skydiving or smoking, are considered higher-risk. Insurers will typically charge higher premiums to compensate for the increased probability of an early claim. Conversely, maintaining a healthy lifestyle, including regular exercise and a balanced diet, can lead to lower premiums, reflecting a reduced risk profile.

Death Benefit Amount

The amount of death benefit chosen directly impacts premium costs. A larger death benefit means a higher premium because the insurer is assuming greater financial responsibility. This is a simple relationship: the more money the insurer promises to pay out, the more they need to charge in premiums to cover that risk. Choosing a smaller death benefit can significantly reduce the premium cost, allowing for more affordable coverage.

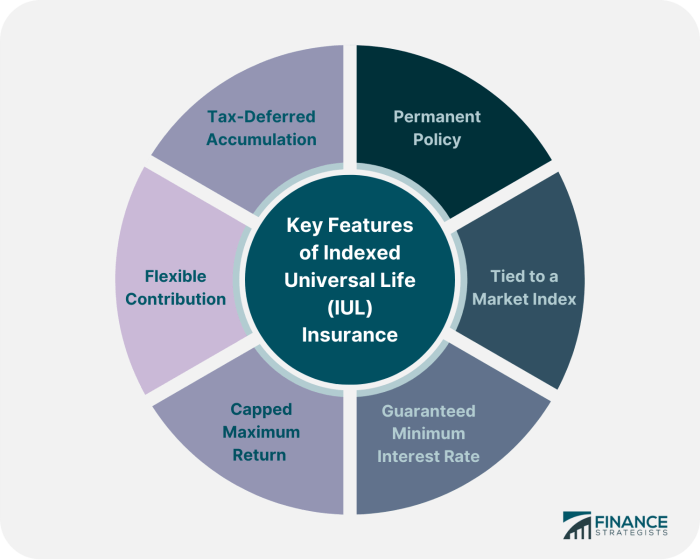

Cash Value Accumulation Options

Universal life insurance policies offer various cash value accumulation options. These options influence premium costs. Policies with higher cash value growth potential, often associated with higher-risk investment strategies within the policy, might have slightly higher premiums. Conversely, more conservative cash value accumulation options, prioritizing safety over growth, typically result in lower premiums. The choice reflects a trade-off between potential future value and current cost. For example, a policy invested in a fixed-interest account will generally have lower premiums than one invested in a more volatile stock market index fund.

Premium Payment Flexibility in Universal Life Insurance

Universal life (UL) insurance offers a significant advantage over many other life insurance types: flexibility in premium payments. This flexibility allows policyholders to adjust their payments to better suit their changing financial circumstances, providing a degree of control not often found in traditional whole life or term life policies. However, this flexibility comes with important considerations regarding the policy’s performance and long-term value.

Understanding the implications of premium payment choices is crucial for maximizing the benefits of a universal life policy. The policy’s cash value growth, death benefit, and overall cost are all directly impacted by the premiums paid. Consistent, strategic premium payments are generally recommended for optimal results, but the ability to adjust payments offers a valuable safety net during periods of financial hardship.

Consequences of Varying Premium Payments

The minimum premium payment for a universal life policy is designed to cover the policy’s cost of insurance (COI) and administrative fees. Paying only the minimum premium ensures the policy remains in force, but it limits the potential for cash value growth. Conversely, paying premiums above the minimum amount accelerates cash value accumulation and can significantly increase the policy’s death benefit, depending on the policy’s features. Failing to pay at least the minimum premium can lead to policy lapse, meaning the coverage terminates, and the accumulated cash value is forfeited.

Examples of Premium Payment Impacts on Cash Value

Let’s consider two scenarios:

Scenario 1: A policyholder pays only the minimum premium of $1,000 annually. Over 10 years, assuming a modest 4% annual interest rate credited to the cash value, the accumulated cash value might reach approximately $11,000, after accounting for COI and fees.

Scenario 2: Another policyholder pays a higher premium of $2,000 annually. With the same interest rate and time frame, their accumulated cash value could reach approximately $24,000. This illustrates how increased premiums directly translate to accelerated cash value growth. Note that these are simplified examples and actual results will vary depending on the specific policy terms, interest rates, and fees.

Long-Term Effects of Different Premium Payment Strategies

Imagine two individuals, both aged 35, purchasing a $500,000 universal life policy.

Individual A consistently pays the minimum premium throughout their life. While the policy remains in force, the cash value grows slowly, and the death benefit remains relatively static at $500,000. At retirement, they may have a modest cash value accumulation, but it might not be substantial.

Individual B initially pays a higher premium, exceeding the minimum, for the first 20 years of the policy. This allows for significant cash value accumulation. After 20 years, they reduce their premium payments to the minimum, allowing the accumulated cash value to continue to grow, albeit more slowly. At retirement, they have a substantially larger cash value that can be used for supplemental income or other needs. The death benefit may also increase due to the earlier higher premium payments, depending on the policy structure. This scenario demonstrates the long-term benefits of a strategic premium payment approach. It’s important to note that unforeseen circumstances, like job loss or unexpected medical expenses, might require adjusting premium payments. The flexibility of UL insurance allows for this adaptability, making it a potentially suitable choice for individuals who anticipate fluctuating income levels.

Illustrating Premium Changes Over Time

Universal life insurance premiums aren’t static; they can fluctuate throughout the policy’s duration, influenced by several factors. Understanding these potential changes is crucial for effective financial planning. This section illustrates how premiums might evolve over a policyholder’s lifetime through hypothetical scenarios and a visual representation.

Premium adjustments in universal life insurance policies are primarily driven by the policy’s cash value growth (or lack thereof), the policyholder’s chosen death benefit, and the underlying interest rates used in calculating the cost of insurance. External economic factors can also play a significant role.

Hypothetical Premium Scenarios

The following scenarios illustrate how different factors can affect universal life insurance premiums over time. These are simplified examples and actual results will vary depending on the specific policy details and market conditions.

Scenario 1: A 35-year-old purchases a universal life policy with a level death benefit and consistently makes the minimum premium payments. Initially, the cash value grows steadily, allowing the minimum premium to remain relatively stable for the first 10 years. However, during years 11-15, lower-than-anticipated investment returns result in slower cash value growth, necessitating a slight premium increase to maintain the death benefit. In years 16-20, the market recovers, and the cash value growth resumes, potentially allowing for a slight decrease in the premium or the option to increase the death benefit without a premium increase.

Scenario 2: A 45-year-old purchases a universal life policy with a death benefit that increases annually. This policy requires consistently higher premiums compared to a level death benefit policy. However, the premium increases are generally predictable and are factored into the policy’s design. This scenario highlights that choosing a higher death benefit generally leads to higher premiums, but provides greater coverage over time.

Scenario 3: A 55-year-old purchases a universal life policy and chooses to make higher-than-minimum premium payments early in the policy’s life. This builds a substantial cash value cushion. Consequently, even if market returns are lower in later years, the accumulated cash value helps offset the cost of insurance, potentially resulting in stable or even slightly decreasing premiums over the 20-year period.

Visual Representation of Premium Changes Over 20 Years

The following describes a line graph illustrating hypothetical premium changes over a 20-year period. The horizontal axis represents the year (1 through 20), and the vertical axis represents the annual premium amount (in dollars).

The graph would show three distinct lines, each representing one of the scenarios described above. Scenario 1’s line would start relatively flat, then show a slight upward curve between years 11 and 15, before leveling off and potentially slightly declining in the final years. Scenario 2’s line would show a consistently upward trend, reflecting the increasing death benefit. Scenario 3’s line would start relatively high due to the higher initial premium payments, but would remain relatively flat or even show a slight downward trend throughout the 20 years, demonstrating the benefit of early premium payments. The graph would use different colors or line styles to distinguish between the three scenarios, and include a clear legend explaining each line. The overall visual would effectively demonstrate the variability of universal life insurance premiums based on different choices and market conditions.

Concluding Remarks

Navigating the world of universal life insurance premiums requires a careful consideration of numerous factors, from initial cost and payment flexibility to the long-term impact of interest rate fluctuations. By understanding the interplay between these elements and tailoring your premium payments to your financial objectives, you can harness the power of this versatile insurance product to secure your family’s future and build lasting wealth. This guide has provided a foundational understanding; however, consulting a qualified financial advisor is always recommended for personalized guidance.

FAQs

What happens if I miss a universal life insurance premium payment?

Missing a premium payment can result in your policy lapsing, meaning your coverage ends. However, grace periods are often offered, and there might be options to reinstate the policy, though this might involve paying back missed premiums with interest.

Can I change my premium payments later on?

Yes, many universal life policies allow for adjustments to your premium payments within certain limits. Increasing or decreasing premiums can impact your cash value accumulation and death benefit. Consult your policy documents or your insurance provider for specific details.

How are universal life insurance premiums taxed?

The tax implications of universal life insurance premiums are complex and depend on several factors, including the policy type and how it is structured. Consult a tax professional for specific advice on your situation. Generally, premiums are not tax-deductible, but the death benefit is typically tax-free to beneficiaries.

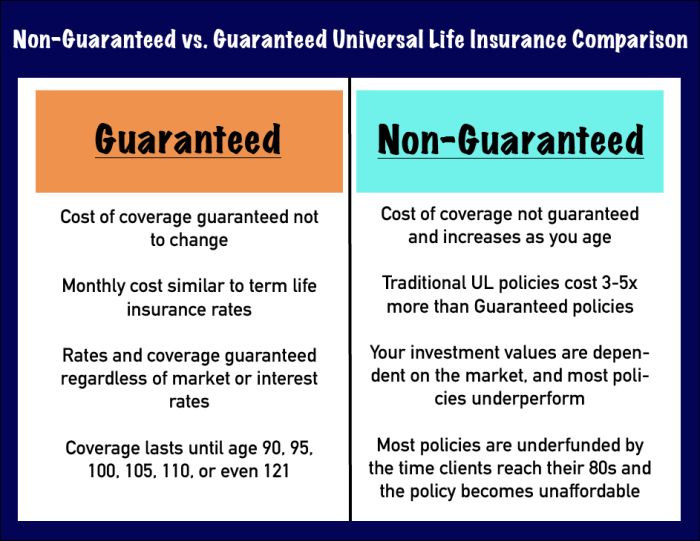

What is the difference between guaranteed and non-guaranteed elements in universal life premiums?

Guaranteed elements, such as the minimum death benefit, are fixed and promised by the insurer. Non-guaranteed elements, such as cash value growth, depend on factors like interest rates and investment performance, and are not guaranteed.