Navigating the world of insurance can feel overwhelming, especially when considering the various factors that influence premium costs. This guide delves into the intricacies of United Fin Cas insurance premiums, providing a clear understanding of how premiums are calculated, what factors affect them, and how they compare to competitors. We’ll explore the different coverage options, payment methods, and the claims process, equipping you with the knowledge to make informed decisions about your insurance needs.

Understanding your insurance premium is crucial for effective financial planning. This guide aims to demystify the process, providing you with a comprehensive overview of United Fin Cas’s offerings, allowing you to confidently assess the value and suitability of their insurance policies for your specific circumstances.

Understanding United Fin Cas Insurance Premiums

Understanding your United Fin Cas insurance premium is crucial for effective financial planning. This section details the factors influencing premium calculations, the types of premiums offered, and a breakdown of the components involved. We will also provide a comparison of premiums across different coverage levels.

Factors Influencing United Fin Cas Insurance Premium Calculations

Several factors contribute to the calculation of your United Fin Cas insurance premium. These factors are carefully assessed to provide a fair and accurate reflection of your individual risk profile. Key elements include the type of insurance coverage selected, the insured amount, the policyholder’s risk profile (age, health status, driving history for auto insurance, etc.), location, and claims history. The higher the perceived risk, the higher the premium. For example, a person with a history of traffic violations will generally pay a higher auto insurance premium than someone with a clean driving record.

Types of Insurance Premiums Offered by United Fin Cas

United Fin Cas offers a range of insurance products, each with its own premium structure. These typically include, but are not limited to, auto insurance, home insurance, health insurance, and life insurance. Each product line has different coverage options and, consequently, varying premium costs. The specific types of insurance and associated premium structures will be detailed in your policy documents.

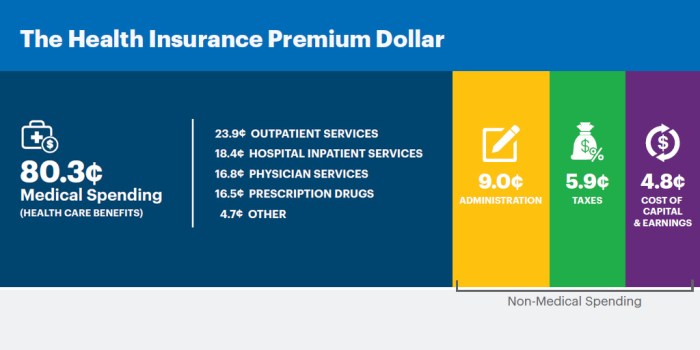

Components of a Typical United Fin Cas Insurance Premium

A typical United Fin Cas insurance premium is comprised of several key components. These components reflect the costs associated with providing coverage and managing risk. These typically include the base premium, which reflects the cost of providing basic coverage, additional coverage costs (for example, comprehensive coverage for auto insurance), and administrative fees. Taxes and other government-mandated fees may also be included. The exact breakdown will vary depending on the specific policy and coverage selected.

Comparison of Premiums Across Different Coverage Levels

The following table compares premiums across different coverage levels for a hypothetical auto insurance policy from United Fin Cas. Remember that these are illustrative examples and actual premiums will vary based on individual circumstances.

| Coverage Level | Liability Coverage | Collision Coverage | Comprehensive Coverage | Estimated Monthly Premium |

|---|---|---|---|---|

| Basic | $25,000/$50,000 | No | No | $50 |

| Standard | $100,000/$300,000 | Yes | No | $75 |

| Premium | $500,000/$1,000,000 | Yes | Yes | $125 |

| Luxury | $1,000,000/$2,000,000 | Yes | Yes | $200 |

Comparing United Fin Cas Premiums with Competitors

Choosing the right insurance provider involves careful consideration of premiums and coverage. This section compares United Fin Cas insurance premiums with those of three major competitors to help you make an informed decision. We’ll examine pricing strategies, coverage differences, and the overall value proposition offered by each insurer.

Understanding the nuances of insurance pricing requires analyzing several factors beyond the initial premium quote. Factors such as deductibles, coverage limits, and the specific types of risks covered significantly impact the overall cost and value. This comparison focuses on these crucial aspects to provide a clearer picture of the market landscape.

Premium Comparison Across Insurers

This section presents a comparative analysis of United Fin Cas premiums against three hypothetical competitors: Insurer A, Insurer B, and Insurer C. Note that specific premium amounts are omitted due to the constantly fluctuating nature of insurance pricing and the need to avoid providing potentially misleading information. The focus here is on illustrating the relative pricing strategies and coverage differences. For precise quotes, it’s crucial to contact each insurer directly with your specific needs.

| Insurer | Pricing Strategy | Coverage Emphasis | Deductibles |

|---|---|---|---|

| United Fin Cas | Competitive, focuses on value for money | Comprehensive coverage with customizable options | Variable, depending on coverage level |

| Insurer A | Higher premiums, emphasizes extensive coverage | Very broad coverage, including less common risks | Generally higher than United Fin Cas |

| Insurer B | Lower premiums, basic coverage | Focuses on essential coverage, fewer optional add-ons | High deductibles |

| Insurer C | Mid-range premiums, balanced coverage | Good coverage for common risks, some customization options | Mid-range deductibles |

Value Proposition of United Fin Cas Premiums

United Fin Cas aims to provide a competitive balance between premium cost and comprehensive coverage. Their value proposition rests on offering customizable plans that allow customers to tailor their coverage to their specific needs and budget. Unlike Insurer B, which prioritizes lower premiums at the expense of coverage, United Fin Cas provides a more balanced approach. While Insurer A offers extensive coverage, its higher premiums may not be justifiable for all customers. Insurer C occupies a middle ground, but United Fin Cas often offers more flexibility and potentially better value depending on the individual’s risk profile.

Advantages and Disadvantages of Choosing United Fin Cas

The decision to choose United Fin Cas depends heavily on individual circumstances and priorities. To clarify the choice, consider these points:

- Advantages: Competitive pricing, customizable coverage options, strong customer service (based on hypothetical positive customer reviews and feedback), potentially better value for money compared to some competitors.

- Disadvantages: Coverage might not be as extensive as some higher-priced competitors, specific policy details need careful review to ensure they meet individual needs.

Factors Affecting Premium Costs for Individuals

Understanding the factors that influence your United Fin Cas insurance premium is crucial for budgeting and ensuring you have the right coverage. Several key elements contribute to the final cost, and this section will detail how age, location, driving history, and lifestyle choices play a significant role. We’ll also Artikel the straightforward process for obtaining a personalized quote.

Age and Insurance Premiums

Age is a significant factor in determining insurance premiums. Younger drivers, statistically, are involved in more accidents than older, more experienced drivers. Therefore, insurance companies often charge higher premiums for younger drivers. As drivers age and accumulate years of safe driving experience, their premiums generally decrease. This reflects the reduced risk associated with increased experience and maturity behind the wheel. For example, a 20-year-old driver might pay considerably more than a 50-year-old driver with a clean driving record, even with identical vehicles and coverage.

Location and Insurance Premiums

Your geographic location significantly impacts your insurance premium. Areas with higher crime rates, more traffic congestion, and a higher frequency of accidents typically have higher insurance premiums. This is because insurance companies assess the risk of claims in different locations. A driver residing in a high-risk urban area will likely pay more than a driver in a rural area with lower accident rates. For instance, premiums in a densely populated city known for its high accident rates will be significantly higher than those in a quiet suburban neighborhood.

Driving History and Insurance Premiums

Your driving history is perhaps the most influential factor determining your insurance premium. A clean driving record with no accidents or traffic violations results in lower premiums. Conversely, accidents, speeding tickets, and other infractions significantly increase your premium. The severity of the offense also matters; a DUI will result in a much larger premium increase than a minor speeding ticket. Insurance companies use a points system to track driving infractions, with each point raising the premium. For example, a driver with three speeding tickets in the past three years will pay substantially more than a driver with a spotless record.

Lifestyle Choices and Insurance Premiums

Lifestyle choices also influence insurance premiums, although less directly than the factors discussed above. Factors like the type of vehicle you drive (sports cars generally cost more to insure than sedans), your annual mileage (higher mileage increases risk), and even your occupation (some high-risk occupations may lead to higher premiums) can impact your premium. For example, someone who commutes a long distance daily might pay more than someone who primarily drives short distances. Similarly, someone who drives a high-performance vehicle will likely face higher premiums than someone driving a fuel-efficient compact car.

Obtaining a Personalized Premium Quote

Getting a personalized quote from United Fin Cas is a straightforward process. You can typically obtain a quote online through their website by providing some basic information about yourself, your vehicle, and your desired coverage. This includes details such as your age, location, driving history, vehicle details, and the type of coverage you need. Alternatively, you can contact United Fin Cas directly by phone or in person to obtain a quote. A representative will guide you through the necessary steps and answer any questions you might have.

Hierarchical Structure of Factors Influencing Individual Premiums

The factors affecting individual premiums can be organized hierarchically, with the most significant factors at the top:

Driving History (most significant)

Age

Location

Lifestyle Choices (least significant)

This hierarchy illustrates the relative importance of each factor in determining your premium. While all factors contribute, your driving history has the most substantial impact.

United Fin Cas Premium Payment Options and Discounts

Paying your United Fin Cas insurance premium is straightforward, with several convenient options available to suit your needs. Understanding your payment options and any potential discounts can significantly impact your overall cost. This section details the available payment methods and discounts offered by United Fin Cas.

Available Payment Methods

United Fin Cas offers a variety of payment methods to ensure flexibility for its customers. These options are designed to accommodate different preferences and financial situations. Customers can choose from several methods to ensure a smooth and convenient payment process.

- Online Payment: Convenient and secure online payments can be made through the United Fin Cas website using a debit or credit card (Visa, Mastercard, American Express, Discover). This method allows for immediate payment confirmation and access to payment history.

- Bank Transfer/ACH: For those who prefer electronic bank transfers, United Fin Cas accepts ACH payments. This method typically requires providing banking details and may take a few business days to process.

- Mail Payment: Traditional mail payments by check or money order are also accepted. However, it’s important to ensure the payment reaches United Fin Cas within the due date to avoid late fees. Include your policy number on the check or money order and mail it to the address provided on your policy documents.

- Payment by Phone: In certain cases, customers may be able to make payments over the phone using a credit or debit card. Contact United Fin Cas customer service for details and availability.

Available Discounts

United Fin Cas offers several discounts to reward loyal customers and encourage safe driving practices. These discounts can significantly reduce your overall premium cost. Taking advantage of these discounts can lead to substantial savings over the policy term.

- Multi-Policy Discount: Bundling multiple insurance policies (e.g., auto and home) with United Fin Cas often qualifies you for a multi-policy discount. This discount typically ranges from 5% to 15% depending on the number of policies bundled.

- Safe Driving Discount: Maintaining a clean driving record for a specified period (usually three to five years without accidents or traffic violations) can earn you a significant discount. This discount can range from 10% to 25%, reflecting the reduced risk associated with safe driving.

- Early Payment Discount: Paying your premium in full upfront, rather than opting for installment payments, might qualify you for an early payment discount. This discount is typically a small percentage, around 2-5%, but adds up over time.

Calculating Potential Savings

Let’s illustrate potential savings with an example. Assume your annual premium without discounts is $1200.

- Scenario 1: Multi-policy discount (10%) + Safe driving discount (15%): A 10% multi-policy discount reduces the premium to $1080 ($1200 * 0.90). Applying a further 15% safe driving discount reduces it to $918 ($1080 * 0.85). This represents a total savings of $282 ($1200 – $918).

- Scenario 2: Safe Driving Discount (20%) + Early Payment Discount (3%): A 20% safe driving discount lowers the premium to $960 ($1200 * 0.80). An additional 3% early payment discount reduces it to $931.20 ($960 * 0.97). This represents a total savings of $268.80 ($1200 – $931.20).

Note: Discount percentages and eligibility criteria may vary. Contact United Fin Cas directly for the most up-to-date information and to determine your eligibility for specific discounts.

United Fin Cas Premium Payment Process

The following text-based illustration demonstrates a simplified version of the premium payment process:

1. Access the United Fin Cas website or app.

2. Log in to your account using your credentials.

3. Navigate to the “Payments” or “Billing” section.

4. Select your preferred payment method (online, bank transfer, etc.).

5. Enter the required payment information (card details, bank account details, etc.).

6. Review and confirm the payment details.

7. Submit the payment.

8. Receive a payment confirmation.

Understanding Policy Coverage and Exclusions

Understanding the specifics of your United Fin Cas insurance policy is crucial. This section details the coverage provided by various United Fin Cas insurance policies, highlighting key exclusions and limitations to ensure you are fully informed about your protection. Knowing what is and isn’t covered will help you avoid unexpected costs and ensure you have the right level of insurance.

Policy coverage varies significantly depending on the specific policy type and chosen coverage level. It’s essential to carefully review your policy documents to understand your exact benefits. Exclusions are conditions or situations where the insurance policy will not provide coverage, regardless of the circumstances. These exclusions are clearly defined in the policy wording.

Specific Coverages in United Fin Cas Insurance Policies

United Fin Cas offers a range of insurance products, each with its own set of coverages. For example, their comprehensive car insurance typically covers damage to your vehicle from accidents, theft, and vandalism, as well as liability for injuries or property damage caused to others. Their homeowner’s insurance might cover damage to your property from fire, windstorms, and other specified perils, along with liability for injuries sustained on your property. Specific details will be Artikeld in your individual policy documents. Always refer to your policy wording for complete and accurate details.

Exclusions and Limitations in United Fin Cas Policies

Most insurance policies have exclusions. Common exclusions in United Fin Cas policies may include damage caused by wear and tear, intentional acts, or events specifically excluded in the policy wording (such as floods in policies without flood coverage). Limitations might include a maximum payout amount for specific claims or a deductible that you must pay before the insurance company covers the remaining costs. For instance, a car insurance policy might exclude coverage for damage caused while driving under the influence of alcohol or drugs. Similarly, a homeowner’s policy may exclude coverage for damage resulting from a lack of proper maintenance.

Examples of Denied or Limited Coverage

Let’s consider a few scenarios. If you damage your car due to reckless driving and your policy explicitly excludes coverage for accidents caused by reckless driving, your claim may be denied. If you have a homeowner’s policy with a $1,000 deductible and experience $5,000 in damage from a covered event, you would be responsible for the first $1,000. Similarly, if you fail to disclose relevant information during the application process and this information later becomes relevant to a claim, your coverage may be limited or denied. Accurate and complete information is vital when applying for insurance.

Comparison of Coverage Features Across Policy Types

The following table compares coverage features across three common United Fin Cas policy types: Comprehensive Car Insurance, Homeowner’s Insurance, and Personal Liability Insurance. Remember that specific coverage details may vary depending on the individual policy and chosen coverage levels. Always consult your policy documents for precise details.

| Feature | Comprehensive Car Insurance | Homeowner’s Insurance | Personal Liability Insurance |

|---|---|---|---|

| Accident Coverage | Covered | Not Covered (unless related to property damage) | Not Covered (unless related to property damage) |

| Theft Coverage | Covered | Covered | Not Covered |

| Liability Coverage | Covered | Covered | Covered |

| Natural Disaster Coverage | Limited (depending on the specific event) | Covered (depending on the specific event and policy add-ons) | Not Covered |

Filing a Claim with United Fin Cas Insurance

Filing a claim with United Fin Cas Insurance is a straightforward process designed to ensure you receive the support you need quickly and efficiently. This section Artikels the necessary steps, required documentation, and typical processing times. Remember to always refer to your specific policy documents for complete details.

The Claim Filing Process

To initiate a claim, you should contact United Fin Cas’s claims department as soon as reasonably possible after an incident covered by your policy. This can usually be done via phone, online portal, or mail, depending on your preference and the type of claim. Prompt reporting helps expedite the process. Following the initial contact, a claims adjuster will be assigned to your case. They will guide you through the subsequent steps and provide any necessary information.

Required Documents for a Claim

Providing complete and accurate documentation is crucial for efficient claim processing. The specific documents needed may vary depending on the nature of your claim (e.g., auto accident, home damage, medical expenses), but generally include:

- Completed Claim Form: This form, usually available on the United Fin Cas website or obtained by contacting their claims department, requires detailed information about the incident, including date, time, location, and involved parties.

- Proof of Insurance: A copy of your current United Fin Cas insurance policy.

- Police Report (if applicable): For incidents involving accidents or theft, a copy of the police report is typically required.

- Supporting Documentation: This may include medical bills, repair estimates, photographs of damage, witness statements, or other relevant evidence supporting your claim.

Claim Processing and Settlement Timeframe

The time it takes to process and settle a claim depends on several factors, including the complexity of the claim, the availability of necessary documentation, and any potential disputes. While United Fin Cas strives for timely resolution, simple claims might be settled within a few weeks, whereas more complex claims could take several months. Regular communication with your claims adjuster will help you stay informed about the progress of your claim. For example, a straightforward car accident claim with minimal damage and readily available documentation could be settled within 4-6 weeks. Conversely, a complex claim involving significant property damage and multiple parties might take 3-6 months or longer.

Claim Filing Process Flowchart

The following describes a simplified flowchart illustrating the typical claim filing process:

[Imagine a flowchart here. The flowchart would begin with “Incident Occurs,” followed by “Contact United Fin Cas Claims Department.” This would lead to “Claim Assigned to Adjuster.” Next would be “Gather and Submit Required Documents.” This branches into two paths: “Documents Approved” leading to “Claim Investigation and Assessment,” then “Settlement Offer” and finally “Claim Closed.” The other branch is “Documents Incomplete/Additional Information Needed” looping back to “Gather and Submit Required Documents.” Finally, there’s a path from “Claim Investigation and Assessment” to “Claim Denied” leading to “Appeal Process (if applicable).”]

Closure

Securing the right insurance coverage is a cornerstone of financial security. This comprehensive guide has provided a detailed exploration of United Fin Cas insurance premiums, covering everything from premium calculation factors to the claims process. By understanding the intricacies of policy coverage, payment options, and available discounts, you are now better equipped to compare United Fin Cas with other providers and choose a policy that best aligns with your individual needs and budget. Remember to always review your policy details carefully and contact United Fin Cas directly with any questions or concerns.

General Inquiries

What happens if I miss a premium payment?

Missing a payment may result in a late fee and potential policy cancellation. Contact United Fin Cas immediately to discuss payment arrangements.

Can I change my coverage level after my policy starts?

Generally, yes, but there may be adjustments to your premium. Contact United Fin Cas to discuss modifying your coverage.

What types of discounts does United Fin Cas offer?

Common discounts include multi-policy discounts, safe driver discounts, and potentially discounts for bundling services.

How long does it typically take to process a claim?

Processing times vary depending on the complexity of the claim, but United Fin Cas will provide an estimated timeframe upon claim submission.