The cost of car insurance can feel like a mystery, a fluctuating number influenced by countless factors. This guide unravels the complexities of typical car insurance premiums, providing a clear understanding of what shapes your monthly payments and how you can potentially lower them. From the impact of your driving record to the type of car you drive, we’ll explore the key elements that determine your insurance costs and empower you to make informed decisions.

We’ll delve into the various types of coverage, the influence of location and driving history, and the strategies you can employ to secure the best possible rates. This comprehensive overview will equip you with the knowledge to navigate the world of car insurance with confidence and find a policy that suits your needs and budget.

Factors Influencing Car Insurance Premiums

Several key factors contribute to the final cost of your car insurance premium. Understanding these factors can help you make informed decisions and potentially save money. These factors are often interconnected, meaning a change in one area can influence others.

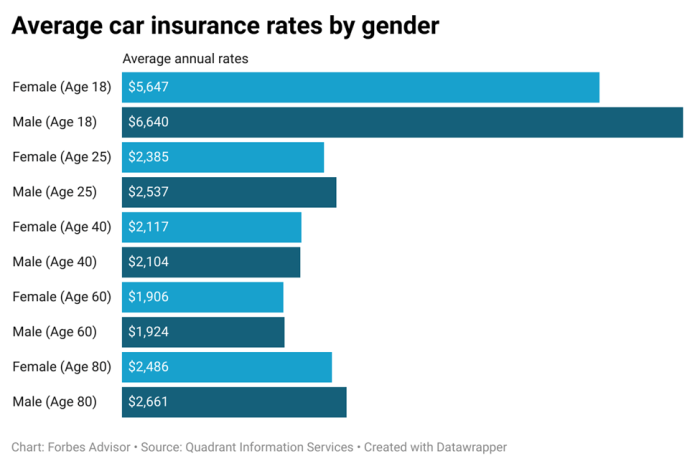

Age and Driving Experience

Your age and driving experience significantly impact your insurance premium. Younger drivers, particularly those with less than three years of driving experience, are statistically more likely to be involved in accidents. Insurance companies reflect this higher risk with higher premiums. As you gain more experience and reach a certain age (typically around 25), your premiums generally decrease, reflecting a lower perceived risk. This is because insurance companies use actuarial data to assess risk profiles. The longer your clean driving record, the lower your premiums are likely to be.

Car Model

The make, model, and year of your vehicle are major factors determining your insurance premium. Cars with a history of higher theft rates, more expensive repairs, or a tendency towards more severe accidents will typically have higher insurance premiums. Conversely, vehicles with safety features, good safety ratings, and lower repair costs will often result in lower premiums.

| Car Model | Make | Year | Estimated Premium Range |

|---|---|---|---|

| Honda Civic | Honda | 2020 | $800 – $1200 |

| Toyota Camry | Toyota | 2022 | $900 – $1400 |

| Ford Mustang GT | Ford | 2023 | $1500 – $2500 |

| Tesla Model 3 | Tesla | 2021 | $1200 – $1800 |

*Note: These are estimated ranges and actual premiums can vary based on other factors.*

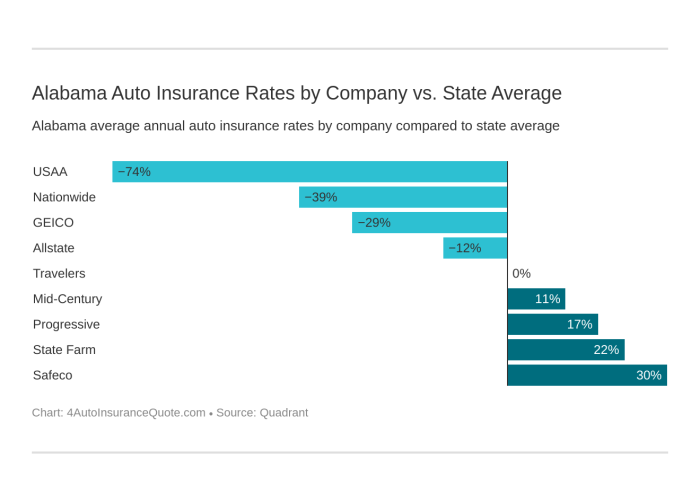

Location

Your location plays a crucial role in determining your insurance rates. Urban areas generally have higher premiums due to increased traffic congestion, higher accident rates, and a greater likelihood of theft. Rural areas tend to have lower premiums because of lower traffic density and fewer accidents. The specific location within a city or state also matters; areas with high crime rates or frequent accidents will usually have higher premiums.

Driving History

Your driving history is a critical factor in insurance premium calculations. Accidents and traffic violations significantly increase your premiums. The severity of the accident and the number of tickets received will impact the increase. A clean driving record with no accidents or tickets will result in the lowest premiums. Insurance companies use a points system to track violations, and each point raises your premium. Maintaining a clean driving record is crucial for keeping your insurance costs down.

Discounts and Ways to Lower Car Insurance Premiums

Reducing your car insurance premiums doesn’t have to be a complex process. Many strategies exist to lower your monthly payments, from leveraging discounts to improving your driving habits. By understanding these options, you can significantly reduce your overall cost of insurance.

Common Insurance Discounts

Numerous discounts are available to reduce your car insurance premiums. These are often based on factors related to your driving record, vehicle, and lifestyle. Taking advantage of these can lead to substantial savings over time.

- Good Student Discount: Insurers often reward students with good grades (typically a B average or higher) with a discount. This reflects the lower risk associated with responsible, academically focused young drivers.

- Safe Driver Discount: Maintaining a clean driving record, free of accidents and traffic violations, is a key factor in obtaining lower premiums. Many insurers offer significant discounts for drivers with several years of accident-free driving.

- Multi-Car Discount: Insuring multiple vehicles under one policy with the same company usually results in a discount. This reflects the reduced administrative costs for the insurer.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course demonstrates a commitment to safe driving practices, often leading to a premium reduction.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can significantly reduce the risk of theft, resulting in lower premiums. The specific discount varies depending on the device and insurer.

- Bundling Discounts: Combining your car insurance with other insurance policies, such as homeowners or renters insurance, from the same provider often results in a bundled discount. This is a very common and often significant way to save money.

Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as homeowners, renters, or life insurance, can significantly reduce your overall costs. Insurance companies often offer substantial discounts for bundling policies, as it simplifies their administration and increases customer loyalty. For example, a family bundling their car, home, and life insurance might see a 15-25% discount compared to purchasing each policy individually. This discount can amount to hundreds of dollars annually.

Improving Driving Habits to Lower Premiums

Your driving record significantly impacts your insurance premiums. Adopting safer driving habits can lead to lower premiums over time.

- Avoid Accidents and Tickets: The most effective way to lower your premiums is to maintain a clean driving record. Accidents and traffic violations significantly increase premiums.

- Reduce Mileage: Some insurers offer discounts for drivers who have lower annual mileage. This reflects the reduced risk of accidents associated with less driving.

- Maintain a Good Driving Record: Consistent safe driving habits, as demonstrated by a clean driving record, are rewarded with lower premiums.

Cost Savings Associated with Safety Features

Modern vehicles often include advanced safety features that can reduce the likelihood of accidents and, consequently, lower insurance premiums.

- Anti-theft Devices: As mentioned earlier, these devices can significantly reduce the risk of theft, leading to lower premiums. Examples include GPS tracking systems, immobilizers, and alarm systems.

- Advanced Driver-Assistance Systems (ADAS): Features like automatic emergency braking, lane departure warning, and adaptive cruise control demonstrate a commitment to safety and can lead to discounts. Insurers recognize the accident-reducing potential of these technologies.

Final Thoughts

Securing affordable and comprehensive car insurance requires careful consideration of various factors, from your driving history and vehicle choice to the type of coverage you select. By understanding the elements that influence your premiums and actively seeking out discounts and comparison quotes, you can effectively manage your insurance costs. Remember, informed decision-making is key to finding the right balance between protection and affordability.

FAQ Guide

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others’ property or injuries you inflict on others in an accident. Collision coverage pays for damage to your own vehicle, regardless of fault.

How does my credit score affect my car insurance premium?

In many states, your credit score is a factor in determining your insurance premium. A higher credit score generally leads to lower premiums.

Can I get car insurance if I have a DUI on my record?

Yes, but it will likely be significantly more expensive. Insurers consider DUI convictions high-risk.

What is a usage-based insurance program?

These programs use telematics devices or smartphone apps to track your driving habits. Safe driving can lead to lower premiums.

How often can I expect my car insurance rates to change?

Rates can change annually or even more frequently depending on your insurer and changes in your risk profile (e.g., moving, new driving infractions).