The cost of auto insurance is a significant expense for most drivers, and understanding the factors that influence premiums is crucial for making informed decisions. This guide delves into the complexities of typical auto insurance premiums, exploring the various elements that contribute to the final cost. From age and driving experience to vehicle type and location, we’ll uncover the key variables that determine how much you pay for coverage. We’ll also examine ways to potentially reduce your premiums through discounts and smart choices.

This exploration will cover average premium costs across different demographics, highlighting regional variations and the impact of various coverage levels. We aim to provide a clear and comprehensive understanding of the auto insurance pricing landscape, empowering you to navigate the process with greater confidence and potentially save money.

Factors Influencing Auto Insurance Premiums

Several key factors contribute to the cost of your auto insurance premiums. Understanding these factors can help you make informed decisions about your coverage and potentially save money. These factors are often interconnected, meaning a change in one can influence others.

Age and Driving Experience

Younger drivers, particularly those with less than three years of driving experience, generally pay higher premiums than older, more experienced drivers. This is because statistically, younger drivers are involved in more accidents. Insurance companies assess risk based on this data, resulting in higher premiums for those deemed higher risk. As drivers gain experience and a clean driving record, their premiums typically decrease. For example, a 16-year-old new driver can expect significantly higher premiums than a 40-year-old with a 20-year accident-free driving record.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance costs. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and increased risk of theft. Conversely, smaller, less expensive vehicles typically have lower insurance premiums. For instance, insuring a high-performance sports car will cost considerably more than insuring a compact economy car, reflecting the higher repair costs and greater potential for damage.

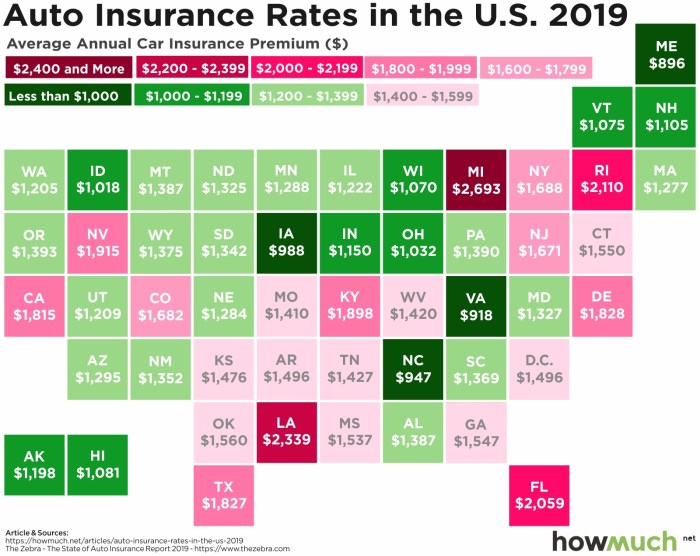

Location

Your location plays a crucial role in determining your insurance rates. Areas with high crime rates, frequent accidents, or higher rates of vehicle theft tend to have higher insurance premiums. This is because insurance companies consider the likelihood of claims in a given area. Living in a densely populated urban area with a high accident rate will likely result in higher premiums compared to living in a rural area with fewer accidents.

Driving History

Your driving history is a major factor in determining your insurance premiums. Accidents and traffic violations significantly increase your premiums. The severity of the accident or violation also impacts the increase. Multiple accidents or serious offenses will result in substantially higher premiums than a single minor traffic violation. Maintaining a clean driving record is crucial for keeping your insurance costs low.

Credit Score

In many states, your credit score is a factor in determining your auto insurance premiums. A lower credit score often correlates with a higher risk of insurance claims, leading to higher premiums. This is a controversial practice, but it’s a reality in many areas. Improving your credit score can potentially lead to lower insurance premiums. For example, someone with a credit score of 750 might receive a lower rate than someone with a score of 550.

Coverage Levels

Different levels of coverage come with different premiums. Liability coverage, which covers damages to others, is generally the most basic and least expensive. Collision coverage, which covers damage to your vehicle in an accident regardless of fault, and comprehensive coverage, which covers damage from non-accident events like theft or vandalism, are additional coverages that increase premiums. Choosing higher coverage limits will also increase your premiums. A policy with only liability coverage will be cheaper than one with liability, collision, and comprehensive coverage.

Average Premium Costs by Demographic

Auto insurance premiums aren’t a one-size-fits-all proposition. Several demographic factors significantly influence the cost, reflecting the statistical likelihood of claims based on these groups. Understanding these variations can help individuals better understand their own premium costs.

Average Premiums by Age Group

Age is a strong predictor of risk in auto insurance. Younger drivers, particularly those in their late teens and early twenties, generally pay higher premiums due to higher accident rates. As drivers age and gain experience, their premiums tend to decrease, often reaching their lowest point in middle age before gradually increasing again in later years. This reflects the statistical reality of increased accident risk at both ends of the age spectrum.

| Age Group | Average Annual Premium (USD) |

|---|---|

| 16-25 | $2000 – $3500 |

| 26-35 | $1500 – $2500 |

| 36-55 | $1200 – $2000 |

| 56-65 | $1500 – $2200 |

| 65+ | $1800 – $2800 |

*Note: These are illustrative ranges and actual premiums vary widely based on other factors.*

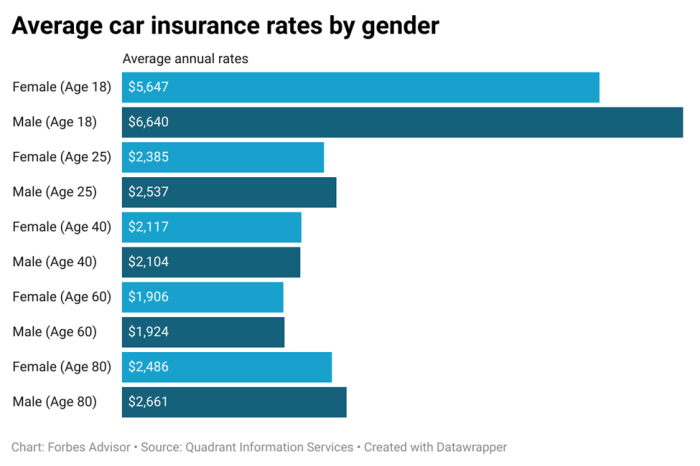

Average Premiums by Gender

Historically, studies have shown a difference in average premiums between genders, with males often paying more than females. This difference is primarily attributed to higher accident and claim rates among male drivers, particularly in younger age groups. However, this gap is narrowing in many regions as insurance companies increasingly focus on individual driving behavior rather than solely relying on broad demographic categories.

| Gender | Average Annual Premium (USD) |

|---|---|

| Male | $1600 |

| Female | $1400 |

*Note: These are illustrative averages and actual premiums vary widely based on other factors. The difference may vary significantly by region and age group.*

Average Premiums by Profession

While not as direct an influence as age or driving history, profession can indirectly affect insurance premiums. High-risk professions, such as those involving long-distance driving or demanding physical labor that might lead to fatigue, could potentially result in higher premiums due to an increased likelihood of accidents. However, this factor is often secondary to other, more significant variables.

| Profession | Average Annual Premium (USD) |

|---|---|

| Office Worker | $1500 |

| Truck Driver | $2000 |

| Construction Worker | $1700 |

| Doctor | $1400 |

*Note: These are illustrative examples and actual premiums vary widely based on other factors. The impact of profession is often less significant than other factors.*

Marital Status and Average Premium Costs

Married individuals often receive lower insurance premiums than single individuals. This is often attributed to the perceived greater responsibility and stability associated with marriage, leading to a statistically lower risk of accidents. Insurance companies may view married individuals as less likely to engage in risky driving behaviors. For example, a married individual with a family might be more cautious on the road than a single young adult.

Illustrative Examples of Premium Calculations

Understanding how auto insurance premiums are calculated can seem complex, but breaking down the process into its key components makes it more manageable. This section provides illustrative examples to clarify the factors involved in determining your final premium.

Premium calculations involve a base rate adjusted by various factors reflecting your individual risk profile. These factors can increase or decrease your premium, resulting in a final cost that reflects your unique circumstances.

Example Premium Calculation: Driver A

Let’s consider Driver A, a 30-year-old with a clean driving record residing in a suburban area. They drive a 2018 Honda Civic and opt for liability coverage with a $500 deductible.

The insurer’s base rate for this profile is $800 annually. Driver A qualifies for a 10% safe driver discount ($80), a 5% multi-car discount ($40) because they insure another vehicle with the same company, and a 2% good student discount ($16) for their child. However, they incur a $50 surcharge due to a recent speeding ticket.

Therefore, the final premium for Driver A is calculated as follows:

Base Rate: $800

Discounts: -$80 (safe driver) – $40 (multi-car) – $16 (good student) = -$136

Surcharge: +$50

Final Premium: $800 – $136 + $50 = $714

Scenario: Impact of Choices on Premium

To demonstrate the influence of various choices, let’s compare Driver A’s premium with a hypothetical scenario involving Driver B. Driver B is the same age and lives in the same area but drives a high-performance sports car and chooses comprehensive coverage with a $1000 deductible. Their driving record is also clean.

Assuming the base rate for the sports car and comprehensive coverage is $1200, and they receive the same discounts as Driver A (totaling $136), their final premium would be:

Base Rate: $1200

Discounts: -$136

Final Premium: $1200 – $136 = $1064

This illustrates how choosing a higher-risk vehicle and a more comprehensive coverage level significantly impacts the final premium.

Visual Representation of Premium Breakdown

A visual representation of a typical auto insurance premium could take the form of a pie chart. The largest segment would represent the base rate, reflecting the insurer’s assessment of inherent risk based on factors like location and vehicle type. Smaller segments would then depict the impact of various discounts (safe driving, good student, multi-car, etc.) and surcharges (speeding tickets, accidents, etc.). This would clearly show the relative contribution of each component to the final premium cost, providing a clear and concise understanding of the price breakdown.

Closing Notes

Ultimately, understanding typical auto insurance premiums involves recognizing the interplay of numerous factors, from personal characteristics to geographical location and the type of coverage selected. By carefully considering these elements and exploring available discounts, drivers can gain a clearer picture of their insurance costs and make choices that best suit their needs and budget. This knowledge empowers consumers to negotiate effectively and secure the most advantageous insurance policies.

FAQ

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others in an accident. Collision coverage pays for damage to your own vehicle, regardless of fault.

How often are auto insurance premiums reviewed?

Premiums are typically reviewed annually, sometimes more frequently depending on your insurer and driving record changes.

Can I get my insurance premiums lowered if I switch to a more fuel-efficient car?

Some insurers offer discounts for fuel-efficient vehicles, but it’s not universally applied. It’s best to check with your insurer directly.

What happens if I let my insurance lapse?

Letting your insurance lapse can result in higher premiums when you reinstate coverage and may lead to legal consequences if you’re involved in an accident while uninsured.