Navigating the world of life insurance can feel overwhelming, particularly when confronted with the various premium structures available. This exploration delves into the intricacies of life insurance premiums, examining the different payment options, policy types, and factors influencing costs. Understanding these nuances empowers you to make informed decisions aligned with your financial goals and risk tolerance.

From the simplicity of level premiums to the flexibility of adjustable options, we will unravel the complexities of premium calculations and payment methods. We will also consider how factors like age, health, and the chosen policy type significantly impact the overall cost. By the end, you will possess a clearer understanding of how premiums are structured and how to choose the option that best suits your individual needs.

Defining Premium Types in Life Insurance

Life insurance premiums are the payments you make to maintain your policy’s coverage. Understanding the different premium structures available is crucial for choosing a plan that aligns with your financial capabilities and long-term goals. The frequency of your premium payments can significantly impact your budget and the overall cost of your insurance.

Life insurance premiums are structured in various ways, primarily differing in how frequently payments are made. The core difference lies in the payment schedule and its associated administrative costs. Policies with more frequent payments often incur higher administrative fees, resulting in a slightly higher overall cost compared to less frequent payment options. Conversely, less frequent payment options may require larger lump sum payments, which might not be suitable for everyone.

Premium Payment Options and Their Comparison

Several common premium payment options exist, each with its own advantages and disadvantages. These options allow for flexibility in managing your insurance costs and aligning them with your cash flow.

| Payment Frequency | Advantages | Disadvantages | Impact on Overall Cost |

|---|---|---|---|

| Annual | Lowest overall cost due to fewer administrative fees; potential for discounts. | Requires a large lump sum payment annually; may be difficult for some budgets. | Lowest |

| Semi-Annual | Lower overall cost than more frequent payments; manageable payment amounts. | Higher cost than annual payments; requires two larger payments per year. | Moderate |

| Quarterly | More frequent payments than semi-annual, making budgeting easier for some. | Higher cost than semi-annual and annual payments; requires four payments per year. | Moderate-High |

| Monthly | Most convenient; easily integrated into monthly budgets. | Highest overall cost due to increased administrative fees; smallest payment amounts. | Highest |

Level vs. Adjustable Premiums

Choosing between level and adjustable premium life insurance involves understanding the trade-offs between predictable costs and flexibility. Both options offer valuable coverage, but their suitability depends heavily on individual financial circumstances and long-term goals.

Level premium life insurance policies offer a fixed, unchanging premium throughout the policy’s duration. This predictability is a significant advantage for long-term financial planning, allowing for easier budgeting and reducing the risk of unexpected increases in insurance costs. The stability of level premiums provides peace of mind, knowing that your monthly or annual payments will remain constant, regardless of age or changes in your health. However, this stability often comes at the cost of potentially higher premiums compared to adjustable options, especially in the early years of the policy.

Level Premium Policy Characteristics

Level premium life insurance policies are characterized by their consistent premium payments. This consistency simplifies financial planning, allowing policyholders to incorporate the predictable cost into their budgets. The premium amount is determined at the outset of the policy and remains unchanged for the policy’s lifetime. This predictability makes it easier to manage personal finances and ensures consistent coverage without the worry of increasing premiums. The insurer assumes the risk of future increases in mortality costs, offering a stable and reliable insurance solution. This makes level premium policies particularly attractive to individuals who value financial stability and predictability.

Adjustable Premium Policy Features

Adjustable premium life insurance policies provide flexibility in premium payments. Policyholders can adjust their premiums periodically, usually within defined limits, to suit their changing financial circumstances. This flexibility can be beneficial during periods of financial hardship, allowing for lower payments temporarily. However, this flexibility comes with inherent risks. Lowering premiums may reduce the death benefit or shorten the policy’s coverage period. Conversely, increasing premiums might be necessary if the policy’s cash value falls below a certain level. The potential for unpredictable premium changes makes long-term financial planning more challenging.

Cost Predictability and Long-Term Financial Planning

Level premiums offer superior cost predictability, making long-term financial planning significantly easier. The fixed payment simplifies budgeting and reduces the risk of unexpected financial strain. In contrast, adjustable premiums introduce uncertainty into long-term financial planning. While offering flexibility, the potential for fluctuating premiums requires careful financial management and a willingness to adapt to changing circumstances. The unpredictability can make it difficult to incorporate the insurance cost accurately into long-term financial models. For example, a sudden job loss might necessitate a reduction in premium payments, potentially impacting the policy’s coverage.

Scenarios for Suitable Premium Types

The choice between level and adjustable premiums depends heavily on individual circumstances. Below are scenarios where each premium type might be most suitable:

- Level Premiums: Suitable for individuals prioritizing long-term cost predictability and stable budgeting, those with consistent income streams, and those seeking peace of mind regarding their insurance costs throughout their lives. For example, a person with a stable government job might prefer the predictability of a level premium policy.

- Adjustable Premiums: Suitable for individuals anticipating fluctuating income, those needing flexibility in premium payments, and those comfortable with managing the risk of potential premium changes. For instance, a self-employed entrepreneur with variable income might find adjustable premiums more suitable.

Premiums Based on Policy Type

Life insurance premiums are significantly influenced by the type of policy chosen. Understanding these variations is crucial for selecting a plan that aligns with individual financial goals and risk tolerance. Different policy types offer different levels of coverage, cash value accumulation, and, consequently, premium structures.

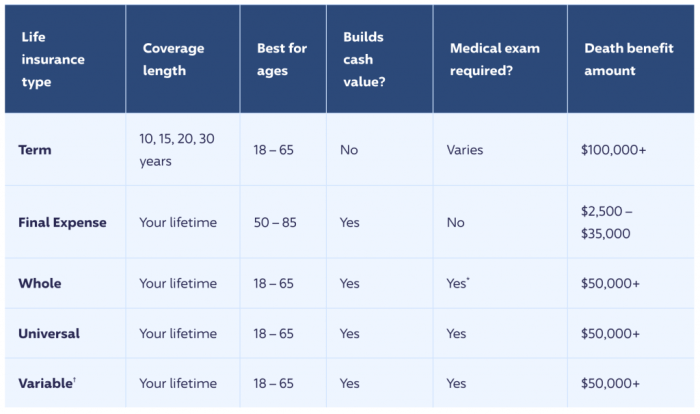

Term Life Insurance Premiums

Term life insurance provides coverage for a specified period (the term), after which the policy expires. Premiums for term life insurance are generally straightforward and relatively low, especially for younger, healthier individuals. The cost is primarily determined by factors like age, health, the length of the term, and the death benefit amount. Premiums remain level throughout the policy term, offering predictability in budgeting. For example, a 30-year-old healthy male might secure a 20-year term life insurance policy with a $500,000 death benefit for a significantly lower annual premium compared to a whole life policy with the same death benefit. This is because term life insurance only covers mortality risk during the specified term, without the added cost of cash value accumulation.

Whole Life Insurance Premium Calculation

Whole life insurance premiums are calculated using a more complex methodology. These policies offer lifelong coverage and build cash value that grows tax-deferred. The premium calculation considers factors such as the insured’s age, health, death benefit, and the insurer’s projected mortality and investment returns. A significant portion of the premium contributes to the cash value component, which grows over time at a rate determined by the insurance company. Unlike term insurance, whole life premiums are typically level throughout the policyholder’s life, though some policies may offer options for flexible premium payments. The calculation incorporates assumptions about the policy’s longevity and the insurer’s investment performance to ensure sufficient funds are available to pay death benefits and maintain the cash value.

Universal Life and Variable Universal Life Insurance Premiums

Universal life (UL) and variable universal life (VUL) insurance offer flexible premium payment options and adjustable death benefits. UL premiums are typically lower initially compared to whole life insurance, but they can be increased or decreased within certain limits, offering flexibility in managing cash flow. The cash value growth in UL policies is generally linked to a fixed or guaranteed interest rate, offering a degree of predictability. VUL insurance, however, provides the option to invest the cash value component in various sub-accounts, similar to mutual funds. Therefore, premiums remain flexible, but the cash value growth is subject to market fluctuations. This increased investment risk and flexibility often result in slightly higher initial premiums than UL policies, but the potential for higher returns also exists.

Premium Characteristics Summary

| Policy Type | Premium Structure | Cash Value | Premium Flexibility |

|---|---|---|---|

| Term Life | Level, typically low | None | Generally not flexible |

| Whole Life | Level, typically higher | Guaranteed growth, tax-deferred | Limited flexibility |

| Universal Life | Flexible, adjustable | Growth linked to interest rate | High flexibility |

| Variable Universal Life | Flexible, adjustable | Growth linked to market performance | High flexibility |

Factors Influencing Premium Costs

Life insurance premiums aren’t a one-size-fits-all proposition. Several key factors interact to determine the final cost, making it crucial to understand these influences when choosing a policy. This section details the major elements impacting your premium.

Age’s Influence on Premium Amounts

Age is a significant factor in premium calculations. Statistically, the older you are, the higher your risk of mortality. Insurance companies use actuarial tables, which reflect average lifespan and mortality rates for different age groups, to assess this risk. A 30-year-old will typically pay considerably less than a 60-year-old for the same coverage because the insurer anticipates paying out the death benefit later for the younger individual. This difference is reflected in the premium structure, with premiums generally increasing with age.

Health and Lifestyle’s Impact on Premiums

Your health status plays a crucial role. Applicants undergo a medical underwriting process, which involves providing medical history, undergoing medical examinations (in some cases), and possibly completing questionnaires about lifestyle choices. Conditions like high blood pressure, diabetes, or a history of smoking significantly increase the perceived risk, leading to higher premiums. Conversely, maintaining a healthy lifestyle, including regular exercise and a balanced diet, can positively impact your premium. For example, a non-smoker with a clean bill of health might qualify for a preferred rate, resulting in lower premiums compared to someone with multiple health concerns.

Underwriting Class and Premium Differences

Insurance companies categorize applicants into different underwriting classes based on their risk profile. These classes range from preferred (lowest risk) to standard, substandard, and declined (highest risk). Someone in the preferred class, exhibiting exceptional health and lifestyle, will receive the lowest premiums. Conversely, those in substandard classes, with significant health issues, will face higher premiums to compensate for the increased risk the insurer assumes. A person with a history of heart disease, for example, might be placed in a substandard class and pay a significantly higher premium than someone with no such history.

Policy Benefits and Premium Costs

The type and amount of coverage directly influence premiums. A larger death benefit necessitates a higher premium because the insurer is committing to a larger payout. Similarly, adding riders, such as accidental death benefits or long-term care riders, increases the overall cost. These riders provide additional coverage beyond the basic death benefit, and this added protection comes at an increased premium. For instance, a policy with a $1 million death benefit and a long-term care rider will naturally cost more than a policy with a $500,000 death benefit and no riders.

Interest Rates and Company Profitability

While not directly related to the individual’s risk profile, interest rates and company profitability significantly affect premium calculations. Insurance companies invest a portion of the premiums received to generate returns. Higher interest rates allow for greater investment returns, potentially lowering the premiums required to maintain the policy’s value. Conversely, lower interest rates might necessitate higher premiums. A company’s profitability also influences premiums; a highly profitable company might offer more competitive rates than a less profitable one. These factors are complex and influence the overall pricing strategy of the insurance provider, affecting premiums across the board.

Illustrative Examples of Premium Calculations

Understanding how life insurance premiums are calculated can seem complex, but breaking down the process into simplified examples makes it clearer. The actual calculations used by insurance companies are far more intricate, involving actuarial tables and sophisticated risk assessment models. However, these examples illustrate the key factors involved.

Level Term Life Insurance Premium Calculation

Let’s consider a simplified calculation for a level term life insurance policy. Assume a healthy 30-year-old male wants a $250,000 10-year term life insurance policy. The insurer uses a mortality rate table indicating a statistically low chance of death within that timeframe for this demographic. They also factor in their administrative costs and desired profit margin. For simplicity, let’s assume the insurer estimates their total cost per $1,000 of coverage over the 10-year period to be $15. Therefore, the annual premium would be calculated as follows:

Total Coverage / $1000 * Cost per $1000 = Annual Premium

$250,000 / $1000 * $15 = $375

This means the annual premium for this hypothetical policy would be $375. It’s crucial to remember this is a drastically simplified example; real-world calculations are far more complex.

Adjustable Life Insurance Premium Adjustments

Imagine the same 30-year-old male, but this time he opts for an adjustable life insurance policy with an initial death benefit of $250,000 and an initial annual premium of $400. Five years later, he experiences a significant increase in income and decides to increase his death benefit to $500,000. This will necessitate a premium increase. The insurer will recalculate the premium based on his new age (35), increased death benefit, and the remaining policy term. The new premium might be, for example, $700 annually. Conversely, if his financial situation changes, and he chooses to decrease his death benefit to $200,000, his premium will likely decrease as well, perhaps to $300 annually. The exact adjustment will depend on the insurer’s specific policies and the individual’s circumstances.

Factors Influencing Whole Life Insurance Premium Costs Over Time

Whole life insurance premiums remain level throughout the policy’s duration. However, several factors influence the initial premium cost and how that cost compares to the death benefit over time. These include the insured’s age, health status, and the policy’s cash value component. Younger, healthier individuals generally receive lower premiums. As the policyholder ages, the death benefit remains constant, but the cash value component grows, potentially offsetting some of the premium paid over time. The insurer’s expense ratio and profit margin also contribute to the overall premium. Over time, the cash value accumulation might become a significant portion of the policy’s overall value, reflecting the cumulative premiums paid.

Premium Differences Between Insurance Providers

Let’s say a 40-year-old woman seeks a $500,000 20-year term life insurance policy. Three different insurers offer this coverage, but their premium quotes vary significantly. Insurer A quotes an annual premium of $800, Insurer B offers $700, and Insurer C charges $950. These differences stem from various factors including each insurer’s risk assessment methodologies, administrative costs, profit margins, and the specific features included in their policies. This highlights the importance of comparing quotes from multiple providers before selecting a policy.

Conclusion

Choosing the right life insurance policy and premium structure is a crucial financial decision. By carefully considering the various payment options, policy types, and influencing factors discussed, you can select a plan that offers adequate coverage while aligning with your budget and long-term financial strategy. Remember, seeking professional advice from a qualified insurance agent can provide personalized guidance to ensure you make the most informed choice for your specific circumstances.

FAQ Insights

What happens if I miss a premium payment?

Missing a premium payment can result in your policy lapsing, meaning your coverage ends. The consequences vary depending on the policy type and the insurer, but generally include a grace period before lapse, after which reinstatement may be possible, though often with penalties.

Can I change my premium payment frequency later?

The ability to change your premium payment frequency depends on your policy and insurance provider. Some policies allow for adjustments, while others may have restrictions. It’s best to check your policy documents or contact your insurer to confirm your options.

Are there tax advantages to certain premium payment methods?

Tax implications related to life insurance premiums can be complex and vary by jurisdiction. Consult a tax professional for advice tailored to your specific situation. Generally, premiums are not tax-deductible, but the death benefit may be tax-free to beneficiaries under certain conditions.

How do insurers determine my premium rate?

Insurers use a complex actuarial process to determine premiums. Factors considered include your age, health, lifestyle, policy type, death benefit amount, and the insurer’s own risk assessment and profit margins. The underwriting process evaluates your risk profile to determine your premium.