The allure of owning a Tesla is undeniable, but the cost of insuring this technologically advanced vehicle often comes as a surprise. Understanding Tesla insurance premiums requires navigating a complex interplay of factors, from your driving history and location to the vehicle’s advanced safety features and the specific coverage you choose. This guide delves into the intricacies of Tesla insurance, providing insights to help you make informed decisions and potentially save money.

We’ll explore how Tesla’s innovative Autopilot and Full Self-Driving capabilities impact premiums, examine regional variations in cost, and analyze the influence of driver demographics. We’ll also compare Tesla insurance to that of other electric vehicles and offer practical advice on selecting the optimal coverage plan for your needs. By the end, you’ll have a clearer picture of what affects your Tesla insurance premium and how to best manage the costs.

Tesla Insurance Cost Factors

Tesla insurance premiums, like those for other vehicles, are determined by a variety of factors. Understanding these factors can help Tesla owners make informed decisions about their coverage and potentially save money. While Tesla offers its own insurance program in some regions, the principles influencing cost remain consistent across various providers.

Driving History’s Impact on Tesla Insurance Rates

Your driving record significantly influences your Tesla insurance premium. A clean driving history with no accidents or traffic violations will typically result in lower premiums. Conversely, accidents, speeding tickets, and DUI convictions will likely lead to higher premiums, reflecting the increased risk you pose to the insurer. The severity and frequency of incidents are also considered; a single minor accident will have a less significant impact than multiple serious accidents. For instance, a driver with a history of three speeding tickets in the past three years might see a 20-30% increase in their premium compared to a driver with a spotless record.

Tesla Insurance Premiums Compared to Other Electric Vehicles

Comparing Tesla insurance premiums to those of other electric vehicles (EVs) isn’t straightforward due to variations in factors like model, location, and driving history. However, generally, Tesla insurance premiums can be higher than those for some other EVs. This is often attributed to the higher value and advanced technology of Tesla vehicles, potentially leading to higher repair costs in case of an accident. For example, the cost to repair a Tesla Model S after a collision might exceed that of a similarly sized Nissan Leaf due to the complexity of the vehicle’s technology. The higher repair costs translate to higher insurance premiums to cover potential claims.

Impact of Coverage Levels on Tesla Insurance Costs

Different coverage levels directly affect your Tesla insurance costs. Higher coverage limits, such as comprehensive and collision coverage with higher liability limits, will generally result in higher premiums. Conversely, opting for lower coverage limits, such as state-minimum liability, will lead to lower premiums, but leaves you with less financial protection in the event of an accident. For instance, choosing a higher deductible will lower your premium, but you’ll pay more out-of-pocket if you file a claim. Similarly, adding optional coverage like roadside assistance or rental car reimbursement will increase your overall premium.

Tesla Model Premium Comparison

| Model | Average Premium | Factors Affecting Premium | Coverage Level |

|---|---|---|---|

| Model 3 | $1200 – $1800 (Annual) | Driving history, location, coverage level | Comprehensive & Collision |

| Model Y | $1400 – $2100 (Annual) | Driving history, location, coverage level, higher vehicle value | Comprehensive & Collision |

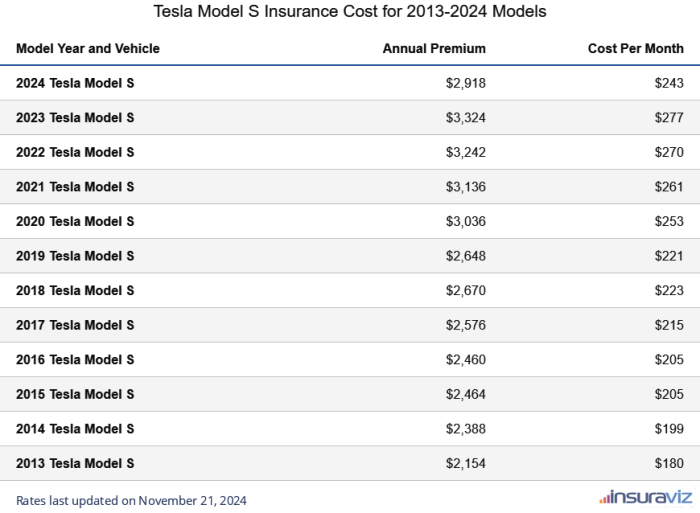

| Model S | $1800 – $2700 (Annual) | Driving history, location, coverage level, higher vehicle value, advanced technology | Comprehensive & Collision |

| Model X | $2000 – $3000 (Annual) | Driving history, location, coverage level, higher vehicle value, advanced technology | Comprehensive & Collision |

Note: These are estimated average annual premiums and can vary significantly based on individual circumstances and location. Actual premiums should be obtained through quotes from insurance providers.

Tesla’s Safety Features and Insurance

Tesla’s advanced safety features significantly influence insurance premiums. Insurers consider the technological advancements built into Tesla vehicles when assessing risk and determining appropriate coverage costs. The interplay between these features and insurance pricing is complex, involving a careful evaluation of both the potential for accident reduction and the potential for increased repair costs.

Autopilot and Full Self-Driving Features’ Impact on Premiums

The presence of Autopilot and Full Self-Driving (FSD) capabilities impacts insurance premiums in a nuanced way. While these systems are designed to enhance safety, their influence on rates isn’t uniformly positive. Insurers analyze accident data involving Teslas equipped with these features to assess their real-world effectiveness in preventing accidents. Furthermore, the potential for increased repair costs associated with the complex technology in these systems is a factor. Some insurers may offer discounts for drivers who demonstrate responsible use of these features through telematics data, while others might levy higher premiums due to perceived higher repair costs or uncertainty surrounding the systems’ overall safety impact.

Tesla Safety Ratings and Insurance Costs

Tesla’s safety ratings, derived from independent organizations like the NHTSA and IIHS, directly influence insurance premiums. Higher safety ratings generally correlate with lower insurance costs. Insurers use these ratings as a key indicator of a vehicle’s inherent safety, leading to reduced premiums for models with superior crash test performance and safety features. For example, a Tesla model receiving a Top Safety Pick+ designation from the IIHS might qualify for substantial premium discounts compared to a vehicle with lower ratings.

Specific Safety Technologies Affecting Premiums

Several specific Tesla safety technologies impact insurance premiums. These include features like automatic emergency braking (AEB), lane departure warning (LDW), lane keeping assist (LKA), adaptive cruise control (ACC), and blind-spot monitoring (BSM). The presence and effectiveness of these systems are factored into risk assessment models used by insurance companies. The more advanced and comprehensive the suite of safety features, the greater the potential for premium reductions.

Examples of Advanced Driver-Assistance Systems (ADAS) Affecting Rates

Consider a Tesla Model 3 equipped with Autopilot. An insurer might offer a 5-10% discount compared to a similarly equipped vehicle without Autopilot, reflecting the potential accident reduction associated with features like AEB and ACC. However, a Tesla with FSD might see a smaller discount or even a slight premium increase due to the higher repair costs associated with the more complex system and the ongoing data analysis needed to assess its overall safety impact. This illustrates the complex interplay between technological advancements and insurance pricing.

Correlation Between Tesla Safety Features and Premium Discounts

| Tesla Safety Feature | Potential Premium Discount (%) | Notes |

|---|---|---|

| Automatic Emergency Braking (AEB) | 3-5 | Reduces rear-end collisions |

| Lane Keeping Assist (LKA) | 2-4 | Minimizes lane departure accidents |

| Adaptive Cruise Control (ACC) | 2-4 | Improves driver awareness and reduces speed-related accidents |

| Autopilot (Basic) | 5-10 | Combines multiple ADAS features for enhanced safety |

| Full Self-Driving (FSD) | Variable (potential discount or slight increase) | Complex system; impact on premiums varies by insurer and data analysis |

Driver Demographics and Tesla Insurance

Tesla insurance premiums, like those for other vehicles, are significantly influenced by the driver’s profile. Understanding how demographic factors impact your rate is crucial for budgeting and finding the best coverage. Several key aspects of your personal profile play a significant role in determining your final premium.

Age and Driving Experience

Younger drivers, particularly those with limited driving experience, generally face higher insurance premiums. This is because statistically, they are involved in more accidents than older, more experienced drivers. Insurance companies assess risk based on historical data, and this data shows a higher likelihood of accidents and claims for newer drivers. Conversely, drivers with extensive, accident-free driving histories often qualify for lower rates due to their demonstrated responsible driving behavior. The accumulation of years of safe driving significantly reduces perceived risk. For example, a 20-year-old with a learner’s permit will likely pay considerably more than a 50-year-old with a 30-year clean driving record.

Credit Score Impact on Tesla Insurance Rates

Your credit score can surprisingly impact your Tesla insurance premium. Many insurers use credit-based insurance scores to assess risk. The rationale is that individuals with good credit often demonstrate better financial responsibility, which is correlated with responsible driving behavior. A higher credit score typically translates to lower premiums, while a lower credit score might lead to higher rates. This is because a lower credit score may suggest a higher risk of non-payment of insurance premiums or a higher likelihood of filing fraudulent claims. For instance, a driver with an excellent credit score (750 or above) might receive a significant discount compared to someone with a poor credit score (below 600).

Other Demographic Factors Influencing Tesla Insurance Costs

Beyond age, driving experience, and credit score, other factors can influence your Tesla insurance premium. These include your location (urban areas often have higher rates due to increased accident frequency), your driving history (accidents and traffic violations increase premiums), and your chosen coverage level (higher coverage limits naturally result in higher premiums). Additionally, your profession can sometimes be a factor, as certain occupations might involve higher levels of risk or travel. The type of Tesla model you own also plays a role, with higher-priced models potentially attracting higher premiums due to their higher repair costs.

Examples of Varying Premium Costs Based on Driver Profiles

Consider two drivers: Driver A is a 22-year-old with a recent speeding ticket and a fair credit score (650). Driver B is a 45-year-old with a clean driving record for 20 years and an excellent credit score (800). Driver A will likely pay a significantly higher premium than Driver B, reflecting the higher perceived risk associated with their profile. The difference could be substantial, potentially hundreds of dollars per year. Another example: a driver living in a rural area with a low crime rate might receive lower rates compared to a driver in a densely populated city with high accident rates, even if their other demographic factors are identical.

Impact of Driver Demographics on Tesla Insurance Premiums

| Demographic Factor | Impact on Premium | Example |

|---|---|---|

| Age (Younger Drivers) | Higher Premiums | 20-year-old with limited driving experience |

| Age (Older Drivers) | Lower Premiums | 55-year-old with 30 years of safe driving |

| Driving Experience | Higher Premiums with less experience, Lower with more experience | New driver vs. Driver with 10+ years accident-free driving |

| Credit Score (High) | Lower Premiums | Credit score above 750 |

| Credit Score (Low) | Higher Premiums | Credit score below 600 |

| Location (Urban) | Higher Premiums | Driver residing in a major metropolitan area |

| Location (Rural) | Lower Premiums | Driver residing in a sparsely populated rural area |

| Driving History (Accidents/Violations) | Higher Premiums | Driver with multiple speeding tickets and one accident |

| Driving History (Clean Record) | Lower Premiums | Driver with a clean driving record for 10+ years |

Illustrative Examples of Tesla Insurance Premiums

Understanding the factors influencing Tesla insurance premiums allows for a clearer picture of what to expect. Premiums are highly individualized, varying significantly based on driver profile, vehicle model, and location. The following examples illustrate the range of potential costs.

Tesla Model S Insurance for a High-Risk Driver

This scenario involves a 22-year-old driver with multiple speeding tickets and a prior at-fault accident insuring a Tesla Model S Plaid in a major metropolitan area with a high crime rate. The high-performance nature of the vehicle, combined with the driver’s risk profile and location, significantly increases the premium. We can expect a monthly premium potentially exceeding $300, possibly even reaching $400 or more. This elevated cost reflects the higher likelihood of accidents and claims associated with this combination of factors. The insurer considers the vehicle’s repair costs, the driver’s history, and the increased risk of theft in the chosen location.

Tesla Model 3 Insurance for a Low-Risk Driver

Conversely, consider a 45-year-old driver with a clean driving record, living in a suburban area with a lower crime rate, and insuring a Tesla Model 3 Standard Range Plus. This driver’s low-risk profile, coupled with the less expensive vehicle model and safer location, results in a substantially lower premium. A monthly premium in the range of $100 to $150 would be reasonable in this scenario. This lower cost is a direct reflection of the reduced risk assessed by the insurance company. Factors like the driver’s years of experience, lack of accidents, and the lower cost of repairs for the Model 3 all contribute to this lower premium.

Tesla Insurance Cost Comparison: With and Without Advanced Driver Assistance Features

Let’s examine two identical drivers insuring the same Tesla Model Y, one equipped with the Full Self-Driving Capability (FSD) package and the other without. While FSD aims to enhance safety, insurers often view it as a double-edged sword. The presence of FSD might initially result in a slightly lower premium, reflecting the potential for reduced accident frequency due to advanced safety features. However, the complex technology and potential for malfunctions could offset this benefit. The repair costs associated with FSD components might also be higher. Therefore, the premium difference might be minimal, potentially only a few dollars more or less per month, or even negligible depending on the insurer’s risk assessment. This highlights the nuanced approach insurers take when considering advanced driver assistance systems. The ultimate impact on the premium depends on the insurer’s specific algorithm and data analysis.

Closing Notes

Securing affordable and comprehensive insurance for your Tesla requires careful consideration of various factors. This guide has illuminated the key elements influencing your premium, from your driving record and location to your Tesla’s advanced safety features and the specific coverage you select. By understanding these factors and actively comparing quotes from different providers, you can find a policy that offers the right balance of protection and cost-effectiveness, ensuring peace of mind on the road.

Essential FAQs

What is the average Tesla insurance premium?

The average Tesla insurance premium varies significantly based on factors like model, location, driver profile, and coverage level. There’s no single answer, but expect premiums to be higher than for comparable gasoline-powered vehicles due to the vehicle’s higher value and repair costs.

Does Tesla offer its own insurance?

Yes, Tesla offers its own insurance program in select regions. This program often leverages data from the vehicle’s sensors and driving patterns to potentially offer customized and potentially lower premiums for safe drivers.

Can I bundle my Tesla insurance with other policies?

Many insurance providers offer bundling options, allowing you to combine your Tesla insurance with other policies (home, renters, etc.) for potential discounts.

How does my credit score affect my Tesla insurance premium?

In many states, your credit score is a factor in determining your insurance premium. A higher credit score generally leads to lower premiums.