Securing your family’s financial future is a paramount concern, and life insurance plays a crucial role in achieving this. While traditional term life insurance offers a valuable safety net, term life insurance with Return of Premium (ROP) presents a unique twist. This comprehensive guide delves into the intricacies of ROP, examining its mechanics, advantages, and disadvantages to help you determine if it aligns with your financial objectives.

We will explore how ROP works, comparing it to standard term life insurance, analyzing its cost structure, and providing illustrative examples to clarify its financial implications. Furthermore, we’ll consider alternative options and address frequently asked questions to ensure you have a thorough understanding before making an informed decision.

Defining Term Life Insurance with Return of Premium (ROP)

Term life insurance with a return of premium (ROP) rider offers a unique blend of life insurance protection and a savings component. It provides a death benefit to your beneficiaries if you pass away during the policy term, but it also guarantees the return of all premiums paid if you outlive the policy. This makes it a potentially attractive option for individuals who want both life insurance coverage and a way to potentially recoup their investment.

Core Features of Term Life Insurance with a Return of Premium Rider

A term life insurance policy with an ROP rider combines the affordability and simplicity of a standard term life insurance policy with the added benefit of premium repayment. The core feature is the return of all premiums paid at the end of the policy term, provided you are still alive. This contrasts with standard term life insurance, where premiums are paid for coverage but there is no monetary return if the policyholder survives the term. The death benefit remains the same as a standard term policy, providing a payout to beneficiaries in the event of the policyholder’s death within the policy term. The ROP rider essentially acts as a savings plan integrated with the life insurance.

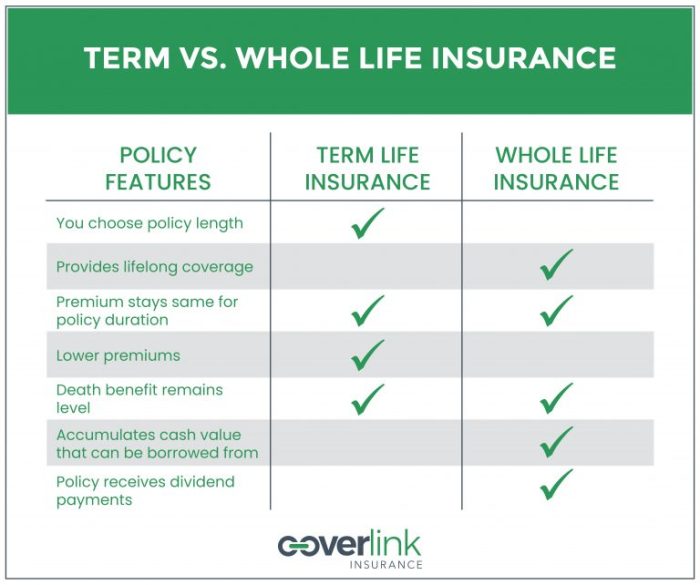

Differences Between Standard Term Life Insurance and Term Life Insurance with ROP

The key difference lies in the return of premiums. Standard term life insurance provides a death benefit only; if the insured survives the policy term, no money is returned. ROP policies, however, refund all premiums paid at the end of the policy term, assuming the policyholder is still living. This means that while premiums for ROP policies will be higher than those for standard term policies, the potential for a full premium refund offsets the increased cost for some individuals. The death benefit remains consistent in both types of policies, focusing solely on providing financial support to beneficiaries upon the insured’s death.

Cost Structure Comparison

ROP policies inherently cost more than standard term life insurance policies with identical coverage amounts and terms. This is because the insurer is obligated to return all premiums paid if the policyholder survives the policy term. The increased cost reflects the added financial risk the insurer assumes. The actual premium difference will vary depending on factors such as age, health, policy term, and the insurer. For example, a 35-year-old male might find a 20-year, $500,000 standard term policy costing $500 annually, while a comparable ROP policy could cost $800 annually. The higher premium for the ROP policy reflects the guaranteed return of $16,000 ($800 x 20 years) at the end of the term.

Key Feature Comparison Table

| Feature | Standard Term Life Insurance | Term Life Insurance with ROP |

|---|---|---|

| Premium | Lower | Higher |

| Death Benefit | Payout upon death during policy term | Payout upon death during policy term |

| Return of Premium | None | Return of all premiums paid if alive at end of term |

| Policy Term | Variable (e.g., 10, 20, 30 years) | Variable (e.g., 10, 20, 30 years) |

How ROP Works

Term life insurance with Return of Premium (ROP) offers a unique benefit: a refund of your premiums if you outlive the policy term. Unlike traditional term life insurance, which only pays out a death benefit, ROP policies return all premiums paid, minus any applicable fees or deductions, provided certain conditions are met. This effectively transforms your life insurance policy into a form of savings vehicle, albeit with a different risk profile than traditional savings accounts.

ROP operates by accumulating your premiums in a separate account within the insurance company. This account grows tax-deferred, meaning you won’t pay taxes on the accumulated interest until you receive the payout. The insurance company invests these premiums, aiming to generate returns that help offset their costs and administrative expenses. However, the ultimate success of the ROP feature hinges on the policyholder surviving the policy term.

Premium Return Trigger

The return of premium is triggered solely upon the successful completion of the policy term without a death claim. If the insured person dies during the policy term, the designated beneficiaries receive the standard death benefit, and the accumulated premiums are not returned. The policy’s terms and conditions clearly Artikel the circumstances under which premium return will occur, including any potential deductions for fees or administrative costs.

ROP Payout Scenarios

Let’s illustrate with a few examples. Suppose a 35-year-old purchases a 20-year ROP term life insurance policy with an annual premium of $1,000.

Scenario 1: The insured lives for the full 20 years. At the end of the term, they receive a lump-sum payment of $20,000 (20 years x $1,000), minus any applicable fees or deductions as stated in the policy.

Scenario 2: The insured dies after 10 years. The beneficiaries receive the death benefit specified in the policy, but no premium return is paid.

Scenario 3: The insured cancels the policy before the term expires. In this case, the return of premium would not apply, and the policyholder may receive a cash value or surrender value, but it will be significantly less than the total premiums paid. The exact amount depends on the specific policy terms and the insurer’s policy.

Premium Return Process Flowchart

A simplified flowchart depicting the ROP process would look like this:

[Start] –> [Policy Purchase] –> [Premium Payments (Annual/Monthly)] –> [Policy Term in Progress] –> [Death of Insured DURING Term? (Yes/No)] –> [Yes: Death Benefit Paid] OR [No: Policy Term Completion] –> [Premium Return (Less Fees)] –> [End]

Benefits and Drawbacks of ROP

Term life insurance with a return of premium (ROP) offers a unique blend of life insurance protection and a savings component. Understanding both the advantages and disadvantages is crucial before making a purchasing decision, as it significantly impacts long-term financial planning. This section will analyze the pros and cons to help you determine if an ROP policy aligns with your needs.

Advantages of ROP Policies

ROP policies offer several key benefits that make them attractive to some consumers. The primary advantage is the return of premiums paid over the policy term, provided the policy remains in force. This essentially acts as a form of forced savings, offering a financial return even if no death benefit is claimed. This feature can be particularly appealing to individuals who struggle with saving or investing independently.

- Guaranteed Return of Premiums: If you outlive the policy term, you receive all your premiums back, providing a financial safety net. This is a significant difference from traditional term life insurance, where premiums are essentially sunk costs.

- Forced Savings Mechanism: ROP policies encourage consistent saving, benefiting individuals who may lack discipline in managing their personal finances. The premiums act as a structured savings plan.

- Life Insurance Coverage: While the primary focus is often the premium return, ROP still provides essential life insurance coverage during the policy term, protecting your beneficiaries in the event of your death.

Disadvantages and Limitations of ROP Policies

While ROP policies offer attractive features, it’s crucial to acknowledge their limitations. The cost of this added benefit is often higher than traditional term life insurance policies. Furthermore, the return is typically not indexed for inflation, meaning its purchasing power may diminish over time.

- Higher Premiums: The cost of ROP policies is significantly higher than comparable traditional term life insurance policies due to the added return of premium feature. This can impact your budget significantly.

- No Inflation Adjustment: The returned premiums are not adjusted for inflation. Therefore, the real value of the returned amount might be considerably less than the total premiums paid, especially over longer policy terms.

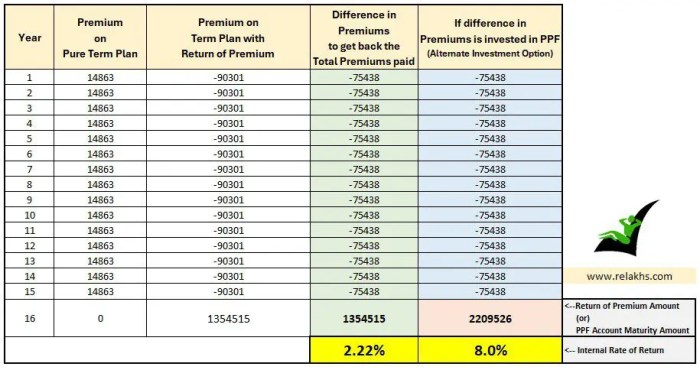

- Potential for Lower Returns Compared to Other Investments: The return on investment from an ROP policy may be lower compared to other investment options, such as mutual funds or index funds, particularly if the market performs well during the policy term. For example, a 30-year ROP policy might return the total premium paid, but if invested in a high-performing index fund, the return could be substantially greater.

- Complexity: Understanding the policy details and fine print can be more complex than traditional term life insurance, requiring careful review before purchase.

Long-Term Financial Implications: ROP vs. Traditional Term Life Insurance

The long-term financial implications of choosing ROP versus traditional term life insurance depend heavily on individual circumstances and risk tolerance. If you prioritize guaranteed return of premiums and forced savings, ROP might be suitable. However, if maximizing investment returns and minimizing costs are paramount, traditional term life insurance with separate savings or investment strategies might be more beneficial.

For instance, a person with a high risk tolerance and strong investment knowledge might prefer a traditional term life insurance policy and invest the premium difference in a higher-yielding investment vehicle. Conversely, someone seeking financial security and a guaranteed return, even at a potentially lower overall return, might prefer an ROP policy. The decision hinges on personal financial goals and risk appetite.

Considerations for Purchasing ROP

Choosing a term life insurance policy with a return of premium (ROP) is a significant financial decision. It requires careful consideration of your individual circumstances, financial goals, and risk tolerance. Understanding the nuances of ROP policies and comparing offerings from different providers is crucial to making an informed choice.

ROP policies offer the security of life insurance coverage combined with a potential return of premiums paid, but this comes at a higher cost than traditional term life insurance. Therefore, a thorough evaluation of your needs and a comparison of various policies are essential steps before committing to a purchase.

Factors Influencing ROP Suitability

Several factors should be carefully weighed when determining if an ROP policy aligns with your needs. These include your age, health, financial situation, risk tolerance, and long-term financial goals. For example, a younger, healthy individual with a strong aversion to risk might find ROP appealing, as the guaranteed return of premiums offers a degree of security. Conversely, an older individual with pre-existing health conditions might find the higher premiums less attractive compared to a traditional term life policy. The policy’s length should also align with your anticipated need for life insurance coverage.

Situations Where ROP Might Be Beneficial or Less Advantageous

ROP can be particularly beneficial for individuals who want life insurance coverage and a guaranteed return of their premiums if they outlive the policy term. This is a good option for those prioritizing financial security and risk aversion. However, ROP might be less advantageous for individuals who prioritize lower premiums and are comfortable with the possibility of not receiving a return on their investment if they live beyond the policy term. Someone who anticipates needing life insurance coverage only for a short period, such as during a specific financial obligation, might find a traditional term policy more cost-effective. The high premium costs associated with ROP should be carefully considered against the potential for return.

Comparing Different ROP Policies

Comparing ROP policies requires a meticulous approach. Focus on key factors such as the premium cost, the guaranteed return amount, the policy length, and any limitations or exclusions. Obtain quotes from multiple insurers to compare their offerings. Pay close attention to the fine print, ensuring you understand all terms and conditions before making a decision. Don’t hesitate to seek professional advice from a financial advisor to help you navigate the complexities of comparing different policies and determine the best fit for your specific needs.

Factors to Consider Before Purchasing ROP

| Premium Cost | Return Amount | Policy Length | Health Conditions |

|---|---|---|---|

| Compare premiums from multiple providers. Consider the total cost over the policy term. | Understand the percentage or total amount of premium returned. Note any conditions for return. | Choose a policy length that aligns with your life insurance needs. Longer terms generally mean higher premiums. | Your health status significantly impacts premium costs. Pre-existing conditions may lead to higher premiums or policy denial. |

Alternatives to ROP

Return of Premium (ROP) term life insurance offers a unique combination of death benefit and premium refund. However, it’s not the only option for securing financial protection for your loved ones and potentially recovering your premiums. Several alternatives provide similar benefits, each with its own set of advantages and disadvantages. Understanding these alternatives allows for a more informed decision based on individual circumstances and financial goals.

Choosing the right life insurance policy depends heavily on your specific needs and risk tolerance. While ROP offers the appeal of a premium refund, other options may be more cost-effective or better suited to long-term financial planning. This section explores some key alternatives and compares them to ROP.

Traditional Term Life Insurance

Traditional term life insurance provides a death benefit for a specified period (the term), without the premium refund feature of ROP. This simplicity often translates to lower premiums compared to ROP policies. The lower cost is a significant advantage for individuals prioritizing affordability over the potential premium return. For example, a 20-year, $500,000 term life policy might cost significantly less as a traditional term policy than an equivalent ROP policy. This makes it a strong option for those focused on maximizing coverage within a budget.

Whole Life Insurance

Unlike term life insurance, whole life insurance offers lifelong coverage, building cash value over time. While premiums are typically higher than term life insurance, including ROP, the cash value component can be borrowed against or withdrawn, providing a source of funds during retirement or emergencies. The long-term cost is significantly greater than ROP, but the permanent coverage and cash value accumulation offer different benefits that appeal to individuals with different long-term financial objectives. For instance, someone aiming for a legacy for their heirs might find whole life insurance more attractive despite the higher cost.

Universal Life Insurance

Universal life insurance also provides lifelong coverage with a cash value component, but it offers more flexibility in premium payments and death benefit adjustments compared to whole life insurance. Premiums can be adjusted based on changing financial circumstances, providing a degree of adaptability that neither ROP nor traditional term life insurance offers. However, the complexity and potential for higher costs compared to ROP necessitate careful consideration of long-term financial planning. A person anticipating significant changes in income or expenses might find the flexibility of universal life appealing, even if the initial premiums are higher.

Comparison of Alternatives

The following table summarizes the key differences between ROP and its alternatives. The best choice depends on individual priorities and circumstances.

| Feature | ROP | Traditional Term Life | Whole Life | Universal Life |

|---|---|---|---|---|

| Coverage Period | Specified Term | Specified Term | Lifetime | Lifetime |

| Premium Refund | Yes | No | No (Cash Value Accumulation) | No (Cash Value Accumulation) |

| Cost | Higher | Lower | Highest | Variable, Potentially High |

| Cash Value | No | No | Yes | Yes |

| Flexibility | Low | Low | Low | High |

Final Thoughts

Term life insurance with Return of Premium offers a compelling alternative to traditional term life insurance, providing both death benefit protection and the potential for premium repayment. While the added cost is a significant factor, the prospect of receiving your premiums back after the policy term can be highly attractive for those seeking a combination of protection and long-term financial security. Careful consideration of your individual circumstances, financial goals, and risk tolerance is paramount in determining whether ROP is the right choice for you. We encourage thorough research and consultation with a financial advisor before making a final decision.

General Inquiries

What happens if I die during the policy term?

Your beneficiaries will receive the death benefit, as with standard term life insurance. The return of premium feature is not applicable in this scenario.

Are there any tax implications with the returned premiums?

Yes, the returned premiums may be subject to income tax. Consult a tax professional for specific guidance based on your individual circumstances.

Can I cancel my ROP policy early?

Generally, you can cancel, but you will likely not receive any of your premiums back unless specified otherwise in your policy. Check your policy’s terms and conditions for details.

How does the cost of ROP compare to traditional term life insurance?

ROP policies typically have higher premiums than standard term life insurance policies due to the added return of premium feature.